|

Banca Generale

The ''Banca Generale'' () was a major Italian investment bank between its founding in 1871 and its bankruptcy in 1894. History The Banca Generale was founded in 1871 in Milan and started operations in 1872. Its headquarters were located in Rome, and its backers included two interrelated European financial families, the Bischoffsheims and Goldchmidts; Vienna-based Unionbank; and Italian bankers from Milan, Trieste and Turin, such as the Weill-Schott and Morpurgo families. Together with the Credito Mobiliare, the Banca Generale dominated the Italian investment banking market in the 1870s and 1880s, and the two were the dominant financial institutions in Italy other than the country's six banks of issue. The Banca Generale eventually went bankrupt on , in a context of financial fragility following the domestic Banca Romana scandal and international panic of 1893. Former executives at Banca Generale moved to leading positions in other banks, namely at Banca Commerciale Ital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on '' Forbes'' survey of closely held U.S. businesses sold a trillion dollars' worth of goods and services ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credito Mobiliare

The ''Società generale di credito mobiliare italiano'' (), often referred to simply as ''Credito Mobiliare'', was a major Italian bank in the last third of the 19th century. It was established in 1863 in Turin with support from the Pereire brothers, succeeding a previous venture, the ''Cassa del Commercio e dell'Industria di Torino'' (), which had been founded in 1852 and had been supported by the French Rothschilds in the late 1850s. The Credito Mobiliare failed to survive the major Italian financial crisis of the early 1890s and was liquidated in 1893. Some of its operations were re-organized as the Banca Commerciale Italiana, marking the transition from French to German influence in Italian investment banking. History The was established in 1852 and reorganized in 1856 with support from Paris-based financier James Mayer de Rothschild, who wanted to pre-empt efforts by his French competitors the Pereire brothers to expand on the Italian market. That effort, however, did ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defunct Banks Of Italy

Defunct (no longer in use or active) may refer to: * ''Defunct'' (video game), 2014 * Zombie process or defunct process, in Unix-like operating systems See also * * :Former entities * End-of-life product An end-of-life product (EOL product) is a product at the end of the product lifecycle which prevents users from receiving updates, indicating that the product is at the end of its useful life (from the vendor's point of view). At this stage, a ... * Obsolescence {{Disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Di Credito Italiano

The ''Banca di Credito Italiano'' () was a significant investment bank in late 19th-century Italy. It was founded in Turin on as the Italian affiliate of Paris-based Crédit Industriel et Commercial, itself recently established in 1859. As such, it was one of the earliest joint-stock banks established in the new Kingdom of Italy. In 1865 it relocated its head office to Florence, the kingdom's temporary capital, and in 1874 to Milan. In 1892, it was acquired by the Credito Mobiliare, which however went bankrupt the next year. Its shares were quoted on the Milan Stock Exchange from 1863 to 1893. See also * Credito Mobiliare * Banca Generale * Banco di Sconto e Sete The ''Banco di Sconto e Sete'' () was an Italian credit institution based in Turin, created in 1863 by merger of two previous banks, the ''Cassa di Sconto di Torino'' (, est. 1853) and ''Banco Sete'' (, est. 1857). It failed in the severe Italian ... Notes Defunct banks of Italy {{bank-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banco Di Sconto E Sete

The ''Banco di Sconto e Sete'' () was an Italian credit institution based in Turin, created in 1863 by merger of two previous banks, the ''Cassa di Sconto di Torino'' (, est. 1853) and ''Banco Sete'' (, est. 1857). It failed in the severe Italian banking crisis of the early 1890s, was placed into liquidation in 1892, with its remaining assets and liabilities eventually absorbed into the Società Bancaria Italiana in 1904. Overview The ''Casse di Sconto'' were part of a plan outlined by Cavour to complement the role of the money-issuing National Bank of the Sardinian States with specialized discount banks. The ''Cassa di Sconto'' of Turin was established on , with financial support from the National Bank. Its branch in Genoa became an autonomous affiliate in 1856. The ''Cassa di Sconto di Torino'' started activity with initial capital of one million lire and seat in Palazzo Pallavicino Mossi in Turin, today via Santa Teresa 11. It was authorized to discount trade bills, grant ad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monteverde Angel

The Monteverde Angel or Angel of the Resurrection (Italian ''Angelo di Monteverde'' and ''Angelo della Resurrezione'') is a masterpiece of neo-classical religious sculpture, created in marble in 1882 by the Italian artist Giulio Monteverde. The statue of 1882 guards the tomb of the Oneto family in the cemetery of Staglieno in Genoa, Northern Italy. It is one of the most famous works by the neo-classical Italian sculptor Giulio Monteverde Giulio Monteverde (8 October 1837 – 3 October 1917) was an Italian naturalist sculptor and teacher. Biography Monteverde was born in Bistagno, Italy and studied at the Academy of Fine Arts in Rome. He later became a professor there.McKay, ... (1837-1917) and was commissioned by Francesco Oneto, a president of the Banca Generale, in honour of deceased members of his family. Portraying a pensive angel with long, richly detailed wings, it is acknowledged as one of the most beautiful and sensual sculptures in its genre, to which Mont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credito Italiano

Credito Italiano also known as just Credit, was an Italian bank, now part of UniCredit. It was merged with Unicredito in 1998, forming Unicredito Italiano (now UniCredit). Circa 1999 to 2002 UniCredit created a new subsidiary of the same name to run the retail network of Credito Italiano. On 1 July 2002 the subsidiary received the assets of sister banks to become UniCredit Banca. History Founded on 28 April 1870 in Genoa as Banca di Genova, it took part in the establishment of the Bank of Italy ( it, Banca d'Italia) and opened the first trans-Atlantic banking business with Buenos Aires (1872). Local shareholders were local nobility ( Pallavicino and Balbi), bankers (Quartara, Polleri) and merchants (Lagorio, Dodero, Bacigalupo), creating an initial capital of 3 million Italian lira. It acquired "Banca Vonwiller" of Milan. In the 1890s, the international financial crisis led to refinancing by German and Swiss banks and name change to "Credito Italiano" (1895) With a paid-in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Commerciale Italiana

Banca Commerciale Italiana (COMIT), founded in 1894, was once one of the largest banks in Italy. In 1999 it merged with a banking group consisting of Cassa di Risparmio delle Provincie Lombarde (aka Cariplo; est. 1823) and Banco Ambroveneto, which had merged in 1998. The bank group changed the name to Intesa-BCI, which BCI temporary became a sub-holding company. On 1 January 2003, the group's name changed to Banca Intesa. In 2006 Banca Intesa merged with Sanpaolo IMI, based in Turin, Italy, to form Intesa Sanpaolo. History BCI's predecessor was the '' Società Generale di Credito Mobiliare'', founded in 1862. This institution became successful as a lender to the iron and steel industry. However, the Italian banking crisis of 1893–1894, led to Credito Mobiliare's failure. On 10 October 1894 Credito Mobiliare was re-established as a private joint-stock bank under the name Banca Commerciale Italiana with capital from several German and Austrian banks, including S. Bleichröde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1893

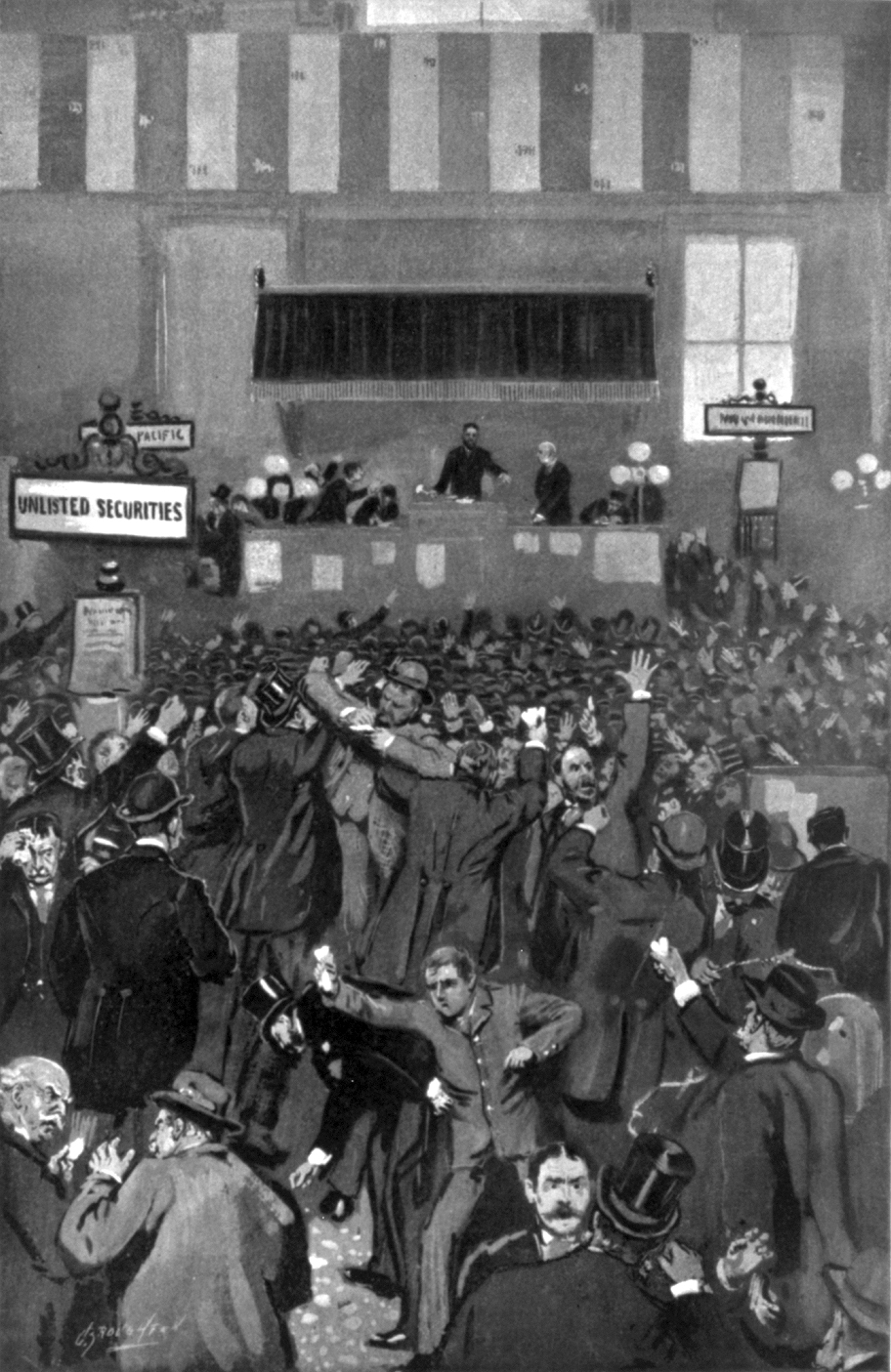

The Panic of 1893 was an economic depression in the United States that began in 1893 and ended in 1897. It deeply affected every sector of the economy, and produced political upheaval that led to the political realignment of 1896 and the presidency of William McKinley. Causes The Panic of 1893 has been traced to many causes, one of those points to Argentina; investment was encouraged by the Argentine agent bank, Baring Brothers. However, the 1890 wheat crop failure and a failed coup in Buenos Aires ended further investments. In addition, speculations in South African and Australian properties also collapsed. Because European investors were concerned that these problems might spread, they started a run on gold in the U.S. Treasury. Specie was considered more valuable than paper money; when people were uncertain about the future, they hoarded specie and rejected paper notes.Nelson, Scott Reynolds. 2012. A Nation of Deadbeats. New York: Alfred Knopf, p. 189. During th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Romana Scandal

The ''Banca Romana'' scandal surfaced in January 1893 in Italy over the bankruptcy of the ''Banca Romana'', one of the six national banks authorised at the time to issue currency. The scandal was the first of many Italian corruption scandals, and discredited both ministers and parliamentarians, in particular those of the Historical Left and was comparable to the Panama Canal Scandal that was shaking France at the time, threatening the constitutional order. Additionally the collapse of a speculative boom based on a substantial urban rebuilding programme gravely damaged Italian banks.Davis, John A., Socialism and the Working Classes in Italy Before 1914'', in Geary, Dick (ed.) (1989), ', Berg, , p. 188 Under the direction of Ludovico Guerrini (1870–81) the bank had been managed prudently and its banknote circulation had remained within the legal limits. However, his successor as governor of the ''Banca Romana'', Bernardo Tanlongo, was a peculiar man, semi-literate but with a geni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Issue

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank ("lender of last resort"); * Reserve management: managing a country's fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morpurgo

Morpurgo ( he, מורפורגו) is an Italian surname of Jewish origin. Originally ''Marpurg'', from the Austrian city Marburg an der Drau (today Maribor in Slovenia). Key ancestor was Moises Jacob, father of Petachia, in Bad Radkersburg, Austria. Petachia (1355–1460) had three sons who died in Maribor. Their subsequent multinational progeny took the surnames Maribor, Marburg, Marpurg, Morpurgo, Marlborough, Murphy. ''Morpurgo'' may refer to: * Anna Morpurgo Davies (1937–2014), Italian linguist at Oxford University. * Clare Morpurgo, wife of Michael Morpurgo. * Elio Morpurgo (1858–1944), Italian politician. * Israel Isserlein (1380–1460) son of Petachia, had two sons, Aaron (1420–1490) and Keshel. * Lisa Morpurgo (Dordoni) (1923–1998), Italian writer and astrologer. * Michael Morpurgo (born 1943), English writer, especially of children's novels. * Rachel Luzzatto Morpurgo (1790–1871), Jewish-Italian poet. * Samson (ben Joshua Moses) Morpurgo (1681–1740), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |