|

Approved Vendor List

Supplier evaluation and supplier appraisal are terms used in business and refer to the processes of evaluating and approving potential suppliers by quantitative assessment. The aim of the process is to ensure a portfolio of best-in-class suppliers is available for use. Supplier evaluation can also be applied to current suppliers in order to measure and monitor their performance for the purposes of ensuring contract compliance, reducing costs, mitigating risk and driving continuous improvement. Process Supplier evaluation is a continual process within purchasing departments, and forms part of the pre-qualification step within the purchasing process, although in many organizations, it includes the participation and input of other departments and stakeholders. Most experts or firms experienced in collecting supplier evaluation information prefer doing so using five-step processes for determining which to approve. Their processes often take the form of either a questionnaire or interview ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for profit." A business entity is not necessarily separate from the owner and the creditors can hold the owner liable for debts the business has acquired except for limited liability company. The taxation system for businesses is different from that of the corporates. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. A distinction is made in law and public offices between the term business and a company (such as a corporation or cooperative). Colloquially, the terms are used interchangeably. Corporations are distinct from Sole proprietorship, sole proprietors and partnerships. Corporations are separate and unique Legal person, legal entities from their shareholde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vendor

In a supply chain, a vendor, supplier, provider or a seller, is an enterprise that contributes goods or services. Generally, a supply chain vendor manufactures inventory/stock items and sells them to the next link in the chain. Today, these terms refer to a supplier of any goods or service. In property sales, the vendor is the name given to the seller of the property. Description A vendor is a supply chain management term that means anyone who provides goods or services of experience to another entity. Vendors may sell B2B (business-to-business; i.e., to other companies), B2C (business to consumers or direct-to-consumer), or B2G (business to government). Some vendors manufacture inventory, inventoriable items and then sell those items to customers, while other vendors offer services or experiences. The term vendor and the term supplier are often used indifferently. The difference is that the vendors ''sells'' the goods or services while the supplier ''provides'' the goods or serv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Virgin Money (brand)

Virgin Money is a financial services brand used by two independent brand-licensees worldwide from the Virgin Group. Virgin Money branded services are currently available in Australia and the United Kingdom. The brand formerly operated in South Africa and the United States. Each Virgin Money branded entity acts independently from the others, thus the products vary from country to country. Current brand licensees Virgin Money Australia Virgin Money currently has operations in Australia with 150,000 customers and is owned by Bank of Queensland. Virgin Money UK Virgin Money currently has operations in the United Kingdom. The company was initially established as a personal finance company under the name of Virgin Direct in 1995, and the Virgin Money brand itself was introduced in 2000. Virgin Money vastly increased its size and customer base in 2012 with the purchase of the so-called 'good bank' portion of the nationalised Northern Rock bank. In 2018, the entire UK operation of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clydesdale Bank

Clydesdale Bank () is a trading name used by Clydesdale Bank plc for its retail banking operations in Scotland. In June 2018, it was announced that Clydesdale Bank plc's holding company, CYBG, would acquire Virgin Money for £1.7 billion in an all-stock deal, and that Clydesdale Bank plc's Clydesdale Bank, Yorkshire Bank and B brands would be phased out in favour of Virgin Money's brand, including the renaming of parent company CYBG plc to Virgin Money UK plc. Clydesdale Bank, along with Virgin Money and Yorkshire Bank (B's rebrand to Virgin Money was completed in 2019), currently operate as trading divisions of Clydesdale Bank plc under its banking licence. History Banknotes Following the announcement of the CYBG's takeover of Virgin Money in 2018 and planned phasing-out of the Clydesdale Bank brand by 2021 in favour of Virgin Money, it was announced that Virgin Money would continue to issue banknotes under the Clydesdale brand after 2021. Banknote history Unt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Ireland

Bank of Ireland Group plc () is a commercial bank operation in Ireland and one of the traditional Big Four Irish banks. Historically the premier banking organisation in Ireland, the bank occupies a unique position in Irish banking history. At the core of the modern-day group is the old Governor and Company of the Bank of Ireland, the ancient institution established by royal charter in 1783. Bank of Ireland has been designated as a Significant Institution since the entry into force of European Banking Supervision in late 2014, and as a consequence is directly supervised by the European Central Bank. History Bank of Ireland is the oldest bank in continuous operation (apart from closures due to bank strikes in 1950, 1966, 1970, and 1976) in Ireland. The Bank of Ireland Act 1781 (21 & 22 Geo. 3. c. 16 (I)) was passed by the Parliament of Ireland, establishing the Bank of Ireland. On 25 June 1783, Bank of Ireland opened for business at St Mary's Abbey in a private house previ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one of the bankers for the government of the United Kingdom, it is the world's second oldest central bank. The bank was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. In the 21st century the bank took on increased responsibility for maintaining and monitoring financial stability in the UK, and it increasingly functions as a statutory Financial regulation, regulator. The bank's headquarters have been in London's main financial di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbuthnot Latham

Arbuthnot Latham & Co. Limited is a British private and merchant bank headquartered in London, England. It is the principal subsidiary of Arbuthnot Banking Group plc, which trades on the Alternative Investment Market under the stock symbol ARBB. Founded in 1833, it has the status of one of the 12 accepting houses. History Arbuthnot Latham was founded on 13 May 1833 by Alfred Latham and John A. Arbuthnot at 33 Great St Helen's, Lime Street (near The Gherkin) in the City of London. Originally starting as a general merchant business, it soon began involving itself in finance and lending operations. In 1981 the Arbuthnot family's involvement with the bank ended, with its purchase by Dow Scandia; a consortium majority owned by the Dow Chemical Company. It was at this time that Henry Angest joined the bank. Shortly afterwards, Dow had sold Arbuthnot Latham. By 1990, the business had had four separate ownersCity AM. 14 November 2013 and the Arbuthnot Latham name had been retired. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aldermore

Aldermore Bank plc is a retail bank which provides financial services to small and medium-sized businesses and personal customers. It was founded in 2009 and listed on the London Stock Exchange in March 2015. It was a constituent of the FTSE 250 Index until it was acquired by South African banking conglomerate FirstRand in March 2018. History Aldermore was established with backing from private equity company, AnaCap Financial Partners LLP, in early 2009. The acquisition of Ruffler Bank in May 2009 provided Aldermore with its banking licence and an asset finance business which was combined with the commercial mortgage business of Base Commercial Mortgages, a small mothballed operation. AnaCap purchased Cattles Invoice Finance, a factoring business, from Cattles PLC in 2009, and in 2010 the division became part of Aldermore. It raised £62 million of further investment from a consortium of funds managed by Goldman Sachs Asset Management, Honeywell Capital Management, and th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Company

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Building Society

A building society is a financial institution owned by its members as a mutual organization, which offers banking institution, banking and related financial services, especially savings and mortgage loan, mortgage lending. They exist in the United Kingdom, Australia and New Zealand, and formerly in Ireland and several Commonwealth countries, including South Africa as mutual banks. They are similar to credit unions, but rather than promoting thrift and offering unsecured and business loans, the purpose of a building society is to provide home mortgages to members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. The term "building society" first arose in the 19th century in Kingdom of Great Britain, Great Britain from cooperative banking, cooperative savings groups. In the United Kingdom, bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In The United Kingdom

Banking in the United Kingdom can be considered to have started in the Kingdom of England in the 17th century. The first activity in what later came to be known as banking was by goldsmiths who, after the dissolution of English monasteries by Henry VIII, began to accumulate significant stocks of gold. 17th century Many goldsmiths were associated with the Crown but, following seizure of gold held at the Royal Mint in the Tower of London by Charles I, they extended their services to gentry and aristocracy as the Royal Mint was no longer considered a safe place to keep gold. Goldsmiths came to be known as 'keepers of running cash' and they accepted gold in exchange for a receipt as well as accepting written instructions to pay back, even to third parties. This instruction was the forerunner to the modern banknote or cheque. Around 1650, a cloth merchant, Thomas Smith opened the first provincial bank in Nottingham. During 1694 the Bank of England was founded. The Governor and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Labor

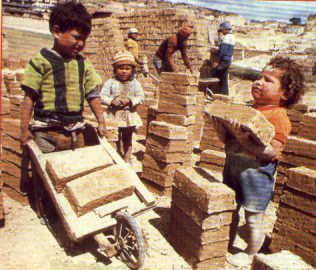

Child labour is the exploitation of children through any form of work that interferes with their ability to attend regular school, or is mentally, physically, socially and morally harmful. Such exploitation is prohibited by legislation worldwide, although these laws do not consider all work by children as child labour; exceptions include work by child artists, family duties, supervised training, and some forms of work undertaken by Amish children, as well as by Indigenous children in the Americas. Child labour has existed to varying extents throughout history. During the 19th and early 20th centuries, many children aged 5–14 from poorer families worked in Western nations and their colonies alike. These children mainly worked in agriculture, home-based assembly operations, factories, mining, and services such as news boys—some worked night shifts lasting 12 hours. With the rise of household income, availability of schools and passage of child labour laws, the inci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |