|

American Family Business Institute

The American Family Business Institute (AFBI) is a trade association of business owners, farmers, and entrepreneurs working for permanent repeal of the United States federal estate tax. The organization was founded in 1994. AFBI has been the leader of the Washington, D.C. estate tax repeal coalition since 2004. During the 2005 estate tax fight the organization worked closely with Senate and House leadership and the White House to build Congressional support for the H.R. 8 repeal bill. Since then, the Institute has continued to be active on the issue, educating Congress, the media and the public about the costs of the estate tax and building Congressional pressure for permanent repeal. The organization's mission, as stated on its 990 tax filings, is to “Promote public policies that lead to the abolition of the Death Tax; to protect the fundamental relationship of personal property to liberty; and to preserve family businesses and entrepreneurship as a foundation of the America ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax In The United States

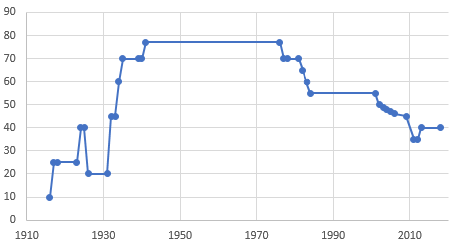

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to the federal government, 12 states tax the estate of the deceased. Six states have " inheritance taxes" levied on the person who receives money or property from the estate of the deceased. The estate tax is periodically the subject of political debate. Some opponents have called it the "death tax" [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IRS Tax Forms

The United States Internal Revenue Service (IRS) uses Form (document), forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate Taxation in the United States, taxes to be paid to the federal government of the United States, federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other Tax return (United States), tax forms in the United States are filed with state and local governments. The IRS numbered the forms sequentially as they were introduced. Individual forms 1040 As of the 2018 tax year, Form 1040, U.S. Individual Income Tax Return, is the only form used for personal (individual) federal income tax returns filed with the IRS. In prior years, it had been one of three forms (1040 [the "Long Form"], 1040A [the "Short Form"] and 1040EZ – see below for explanations of each) used for such returns. The first Form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax In The United States

A gift tax, known originally as inheritance tax, is a tax imposed on the transfer of ownership of property during the giver's life. The United States Internal Revenue Service says that a gift is "Any transfer to an individual, either directly or indirectly, where full compensation (measured in money or money's worth) is not received in return." When a taxable gift in the form of cash, stocks, real estate, gift cards, or other tangible or intangible property is made, the tax is usually imposed on the donor (the giver) unless there is a retention of an interest which delays completion of the gift. A transfer is "completely gratuitous" when the donor receives nothing of value in exchange for the given property. A transfer is "gratuitous in part" when the donor receives some value, but the value of the property received by the donor is substantially less than the value of the property given by the donor. In this case, the amount of the gift is the difference. In the United States, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Washington (state)

Washington, officially the State of Washington, is a U.S. state, state in the Pacific Northwest region of the United States. It is often referred to as Washington State to distinguish it from Washington, D.C., the national capital, both named after George Washington (the first President of the United States, U.S. president). Washington borders the Pacific Ocean to the west, Oregon to the south, Idaho to the east, and shares Canada–United States border, an international border with the Provinces and territories of Canada, Canadian province of British Columbia to the north. Olympia, Washington, Olympia is the List of capitals in the United States, state capital, and the most populous city is Seattle. Washington is the List of U.S. states and territories by area, 18th-largest state, with an area of , and the List of U.S. states and territories by population, 13th-most populous state, with a population of just less than 8 million. The majority of Washington's residents live ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Concentration

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or economic heterogeneity. The distribution of wealth differs from the income distribution in that it looks at the economic distribution of ownership of the assets in a society, rather than the current income of members of that society. According to the International Association for Research in Income and Wealth, "the world distribution of wealth is much more unequal than that of income." For rankings regarding wealth, see list of countries by wealth equality or list of countries by wealth per adult. Definition of wealth Wealth of an individual is defined as net worth, expressed as: wealth = assets − liabilities A broader definition of wealth, which is rarely used in the measurement of wealth inequality, also includes human capital. For example, the United Nations definition of ''inclusive wealth'' is a monetary measure which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Associations Based In The United States

Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. Economists refer to a system or network that allows trade as a market (economics), market. Traders generally negotiate through a medium of credit or exchange, such as money. Though some economists characterize barter (i.e. trading things without the use of money) as an early form of trade, History of money#Emergence of money, money was invented before written history began. Consequently, any story of how money first developed is mostly based on conjecture and logical inference. Letters of credit (finance), credit, paper money, and digital currency, non-physical money have greatly simplified and promoted trade as buying can be separated from selling, or Earnings, earning. Trade between two traders is called bilateral trade, while trade involving more than two traders is called Multilateral treaty, multilateral trade. In one modern view, trade exists due to spe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Organizations Established In 1994

An organization or organisation (Commonwealth English; see spelling differences) is an entity—such as a company, or corporation or an institution (formal organization), or an association—comprising one or more people and having a particular purpose. Organizations may also operate secretly or illegally in the case of secret societies, criminal organizations, and resistance movements. And in some cases may have obstacles from other organizations (e.g.: MLK's organization). What makes an organization recognized by the government is either filling out incorporation or recognition in the form of either societal pressure (e.g.: Advocacy group), causing concerns (e.g.: Resistance movement) or being considered the spokesperson of a group of people subject to negotiation (e.g.: the Polisario Front being recognized as the sole representative of the Sahrawi people and forming a partially recognized state.) Compare the concept of social groups, which may include non-organi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |