|

Alan J. Auerbach

Alan Jeffrey Auerbach (born 1951) is an American economist, public policy scholar, and author. Auerbach is known for his contributions to public finance and taxation policy. He serves as the Robert D. Burch Professor of Economics and Law and Director of the Burch Center for Tax Policy and Public Finance at the University of California, Berkeley. Auerbach is a Distinguished Fellow of the American Economic Association. In 2021, he was awarded the Order of the Rising Sun.https://www.mofa.go.jp/files/100254456.pdf Early life and education Auerbach attended Yale University, where he graduated ''summa cum laude'' with a Bachelor of Arts in Economics and Mathematics in 1974. He was elected to Phi Beta Kappa. He continued his studies at Harvard University, where he earned a Ph.D. in economics in 1978. At Harvard, he received the David A. Wells Prize for his dissertation. Career Auerbach began his academic career at Harvard University as an assistant professor and later associate prof ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Americans

Americans are the Citizenship of the United States, citizens and United States nationality law, nationals of the United States, United States of America.; ; Law of the United States, U.S. federal law does not equate nationality with Race (human categorization), race or ethnicity but rather with citizenship.* * * * * * * The U.S. has 37 American ancestries, ancestry groups with more than one million individuals. White Americans form the largest race (human classification), racial and ethnic group at 61.6% of the U.S. population, with Non-Hispanic whites, non-Hispanic Whites making up 57.8% of the population. Hispanic and Latino Americans form the second-largest group and are 18.7% of the American population. African Americans, Black Americans constitute the country's third-largest ancestry group and are 12.4% of the total U.S. population. Asian Americans are the country's fourth-largest group, composing 6% of the American population. The country's 3.7 million Native Americans i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Daishiro Yamagiwa

is a Japanese politician of the Liberal Democratic Party, serving as a member of the House of Representatives in the Diet (national legislature). He served as Minister in charge of Economic Revitalization under the cabinet of Prime Minister Fumio Kishida from October 2021 to October 2022. Career A native of Kamakura, Kanagawa, Yamagiwa graduated from Yamaguchi University and received a Ph.D. in veterinary medicine from the University of Tokyo. After working as a veterinarian, he was elected to the House of Representatives for the first time in 2003. Within the LDP, Yamagiwa has served as Parliamentary Secretary of Cabinet Office, and as a member of the Committee on Cabinet. In his early years in parliament, much of his work related to trade relations with other countries, notably in Africa, East Asia, and Islands in the Southern Ocean. On 10 August 2022, seven ministers were purged because of ties to the Unification Church following the assassination of Shinzo Abe and increasin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Republican Party (United States)

The Republican Party, also known as the Grand Old Party (GOP), is a Right-wing politics, right-wing political parties in the United States, political party in the United States. One of the Two-party system, two major parties, it emerged as the main rival of the then-dominant Democratic Party (United States), Democratic Party in the 1850s, and the two parties have dominated American politics since then. The Republican Party was founded in 1854 by anti-slavery activists opposing the Kansas–Nebraska Act and the expansion of slavery in the United States, slavery into U.S. territories. It rapidly gained support in the Northern United States, North, drawing in former Whig Party (United States), Whigs and Free Soil Party, Free Soilers. Abraham Lincoln's 1860 United States presidential election, election in 1860 led to the secession of Southern states and the outbreak of the American Civil War. Under Lincoln and a Republican-controlled Congress, the party led efforts to preserve th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

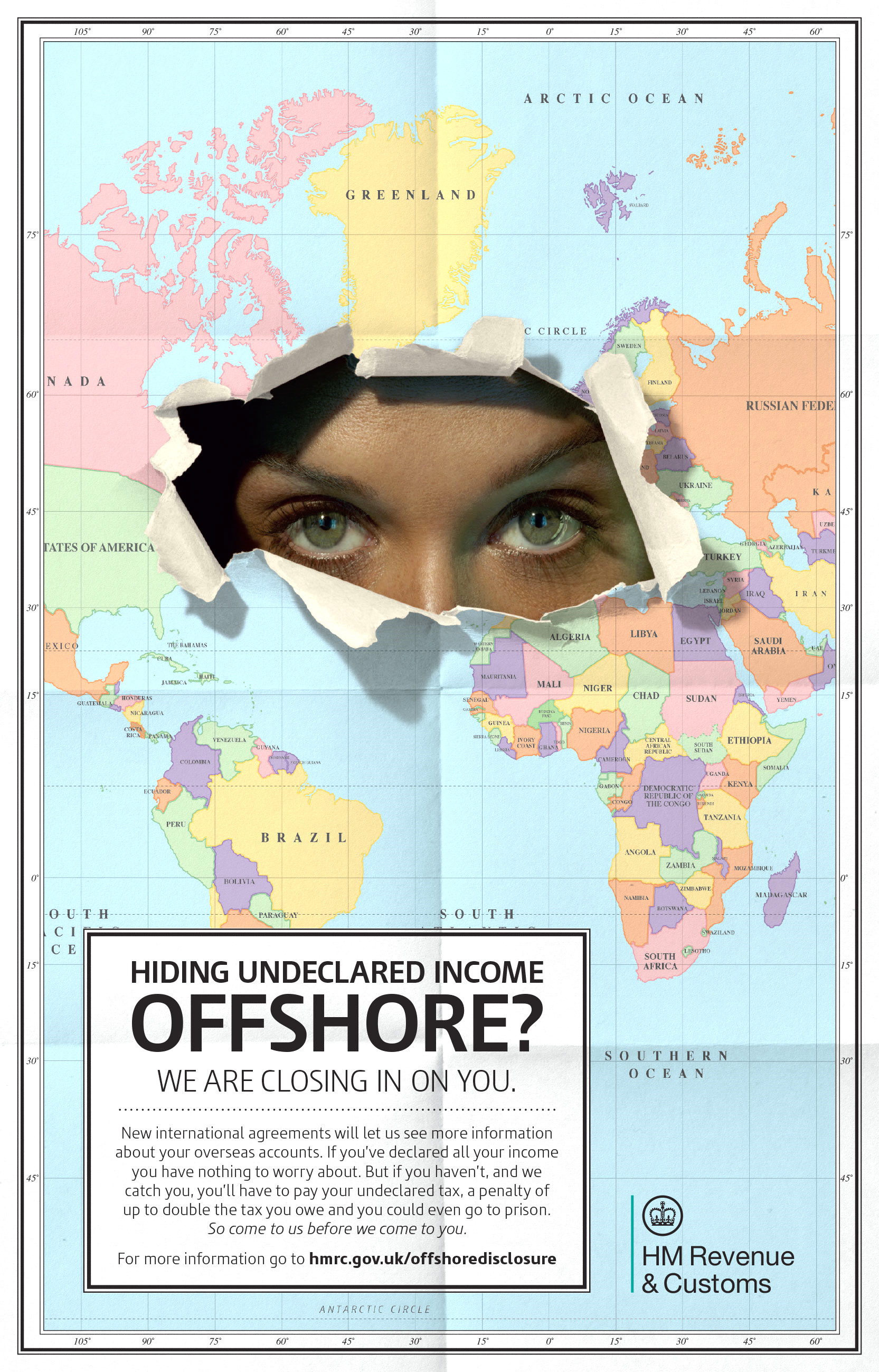

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company. In United States federal legislation, US federal legislation a company which has been restructured in this manner is referred to as an inverted domestic corporation, and the term "corporate expatriate" is also used, for example in the Homeland Security Act of 2002. The majority of the less than 100 material tax inversions recorded since 1993 have been of US corporations (85 inversions), seeking to pay less to the US corporate tax system. The only other jurisdiction to experience a material outflow of tax inv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Pricing

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorities in many countries can adjust intragroup transfer prices that differ from what would have been charged by unrelated enterprises dealing at arm’s length (the arm’s-length principle). The OECD and World Bank recommend intragroup pricing rules based on the arm’s-length principle, and 19 of the 20 members of the G20 have adopted similar measures through bilateral treaties and domestic legislation, regulations, or administrative practice.World Bank pp. 35-51 Countries with transfer pricing legislation generally follow th''OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations''in most respects, although their rules can differ on some important details. Where adopted, transfer pricing rules allow tax au ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Rent

In economics, economic rent is any payment to the owner of a factor of production in excess of the costs needed to bring that factor into production. In classical economics, economic rent is any payment made (including imputed value) or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities (e.g., patents). In the moral economy of neoclassical economics, assuming the market is natural, and does not come about by state and social contrivance, economic rent includes income gained by labor or state beneficiaries or other "contrived" exclusivity, such as labor guilds and unofficial corruption. Overview In the moral economy of the economics tradition broadly, economic rent is distinct from producer surplus, or normal profit, both of which are theorized to involve productive human action. Economic rent is also independent of opportunity cost, unlike economic profit, where opportunity c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Destination-based Cash Flow Tax

A destination-based cash flow tax (DBCFT) is a cash flow tax with a destination-based border-adjustment. Unlike traditional corporate income tax, firms are able to immediately expense all capital investment (called "full expensing"). This ensures that normal profit is out of the tax base and only supernormal profits are taxed. Additionally, the destination-based border-adjustment is the same as how the value-added tax treat cross-border transactions—by exempting exports but taxing imports. It was proposed in the United States by the Republican Party in their 2016 policy paper "''A Better Way — Our Vision for a Confident America''", which promoted a move to the tax. It has been described by some sources as simply a form of import tariff, while others have argued that it has different consequences than those of a simple tariff because the exchange rates would fully adjust. According to economist Alan J. Auerbach at the University of California, Berkeley, who is the "pri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Tax Journal

The National Tax Association – Tax Institute of America (NTA) is a US non-profit, non-partisan organization committed to the study and discussion of public taxation, spending, and borrowing decisions by governments around the world. Since its founding in 1907, the NTA has remained the leading association of tax professionals and public finance scholars devoted to advancing the theory and practice of public finance. Its focus remains on education rather than political debate. The organization educates government officials, tax professionals, and the general public. It hosts events and publishes the ''National Tax Journal''. The National Tax Association was founded in Ohio in 1907 by a group of "nearly 100 lawyers, university professors, business leaders, and government administrators". The organization's initial goal was to advocate for tax reform with the goal of creating alternate taxation models which could then be adopted by municipalities. However, due to a long-term lack ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Economic Review

The ''American Economic Review'' is a monthly peer-reviewed academic journal first published by the American Economic Association in 1911. The current editor-in-chief is Erzo FP Luttmer, a professor of economics at Dartmouth College. The journal is based in Pittsburgh. It is one of the " top five" journals in economics. In 2004, the ''American Economic Review'' began requiring "data and code sufficient to permit replication" of a paper's results, which is then posted on the journal's website. Exceptions are made for proprietary data. Until 2017, the May issue of the ''American Economic Review'', titled the ''Papers and Proceedings'' issue, featured the papers presented at the American Economic Association's annual meeting that January. After being selected for presentation, the papers in the ''Papers and Proceedings'' issue did not undergo a formal process of peer review. Starting in 2018, papers presented at the annual meetings have been published in a separate journal, '' AEA Pap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Economic Literature

The ''Journal of Economic Literature'' is a peer-reviewed academic journal, published by the American Economic Association, that surveys the academic literature in economics. It was established by Arthur Smithies in 1963 as the ''Journal of Economic Abstracts'',Journal of Economic Literature: About JEL , retrieved 6 May 2011. and is currently one of the highest ranked journals in economics. /ref> As a , it mainly features essays and reviews of recent economic theories (as opposed to the latest research). The |