|

Al Bilad Bank

Bank Albilad () is an Islamic Saudi bank established in 2004. History The bank was established in 2004. The brothers Mohammed and Abdullah Ibrahim Al Subeaei are significant stakeholders. In 2009, the bank renewed its entire inventory of ATM machines. Bank Albilad is a Saudi joint stock company, headquartered in Riyadh. In May 2022 its shareholders approved an increase in capitalization to 10 billion Saudi Riyals through a 1-for-3 issue of shares. Enjaz Banking Services is the remittance department of Bank Albilad. In February 2021, Nasser Mohammed Al-Subeaei was appointed chairman of the board of directors and Fahd Abdullah Bindekhayel as Vice Chairman. Services Bank Albilad offers products and services complaint with sharia (Islamic) law. The bank provides retail banking products, business products, investment products through the bank investment arm “Albilad Capital ”, international remittance services through the bank Remittance Arm “Enjaz ”. Board of directors * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Banking

Retail banking, also known as consumer banking or personal banking, is the provision of services by a bank to the general public, rather than to companies, corporations or other banks, which are often described as wholesale banking (corporate banking). Banking services which are regarded as retail include provision of savings and transactional accounts, mortgages, personal loans, debit cards, and credit cards. Retail banking is also distinguished from investment banking or commercial banking. It may also refer to a division or department of a bank which deals with individual customers. In the U.S., the term ''commercial bank'' is used for a ''normal'' bank to distinguish it from an investment bank. After the Great Depression, the Glass–Steagall Act restricted normal banks to banking activities, and investment banks to capital market activities. That distinction was repealed in the 1990s. Commercial bank can also refer to a bank or a division of a bank that deals mostly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Riyadh

A company, abbreviated as co., is a Legal personality, legal entity representing an association of legal people, whether Natural person, natural, Juridical person, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Over time, companies have evolved to have the following features: "separate legal personality, limited liability, transferable shares, investor ownership, and a managerial hierarchy". The company, as an entity, was created by the State (polity), state which granted the privilege of incorporation. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * List of legal entity types by country, business entities, whose aim is to generate sales, revenue, and For-profit, profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Listed On Tadawul

A company, abbreviated as co., is a legal entity representing an association of legal people, whether natural, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Over time, companies have evolved to have the following features: "separate legal personality, limited liability, transferable shares, investor ownership, and a managerial hierarchy". The company, as an entity, was created by the state which granted the privilege of incorporation. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is to generate sales, revenue, and profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duties according to the publicly declared incorporation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Saudi Arabia

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ancien ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 2004

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts of credit and lending that had their roots in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banks In Saudi Arabia

A list is a set of discrete items of information collected and set forth in some format for utility, entertainment, or other purposes. A list may be memorialized in any number of ways, including existing only in the mind of the list-maker, but lists are frequently written down on paper, or maintained electronically. Lists are "most frequently a tool", and "one does not ''read'' but only ''uses'' a list: one looks up the relevant information in it, but usually does not need to deal with it as a whole". Lucie Doležalová,The Potential and Limitations of Studying Lists, in Lucie Doležalová, ed., ''The Charm of a List: From the Sumerians to Computerised Data Processing'' (2009). Purpose It has been observed that, with a few exceptions, "the scholarship on lists remains fragmented". David Wallechinsky, a co-author of '' The Book of Lists'', described the attraction of lists as being "because we live in an era of overstimulation, especially in terms of information, and lists help ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

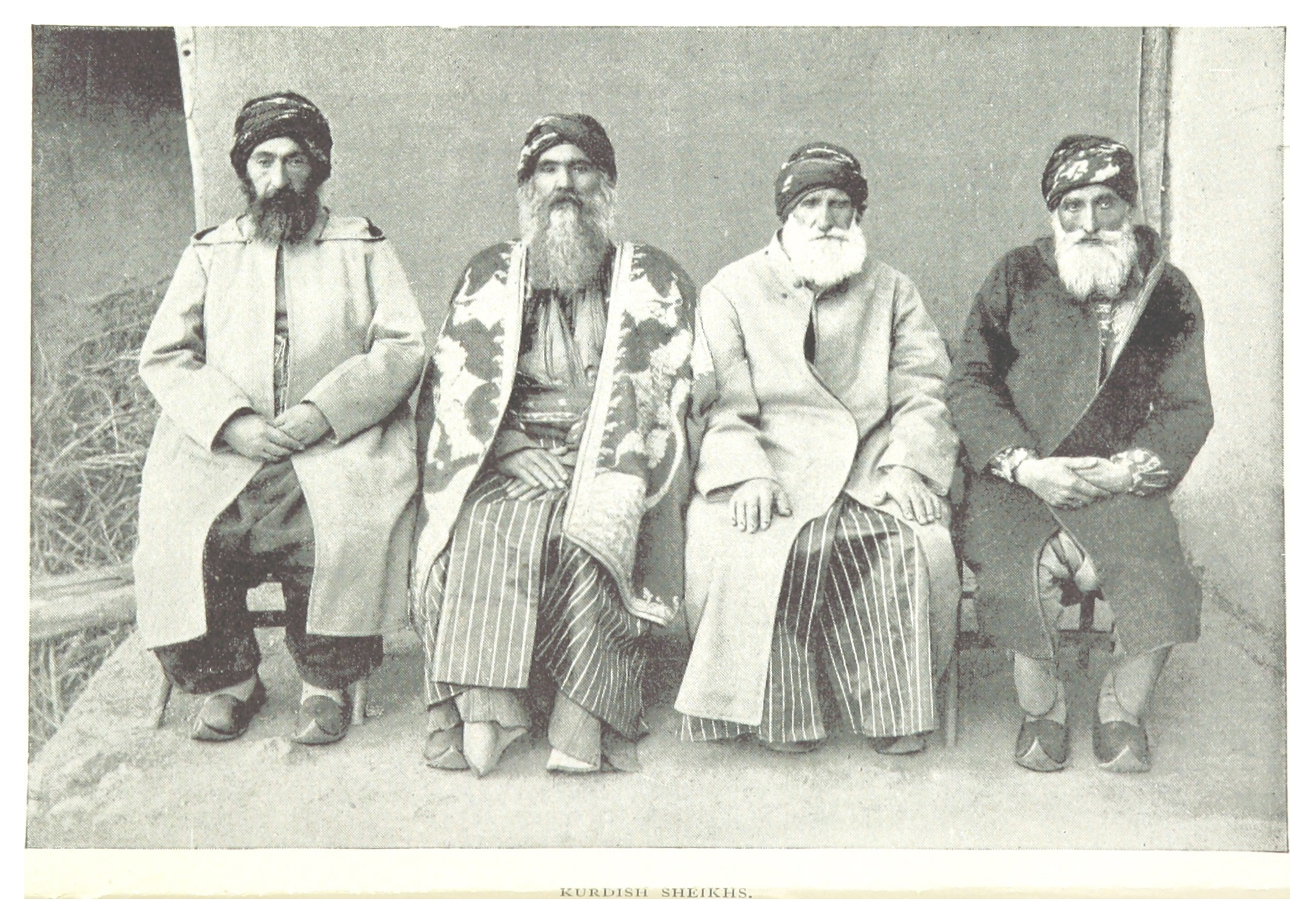

Sheikh

Sheikh ( , , , , ''shuyūkh'' ) is an honorific title in the Arabic language, literally meaning "elder (administrative title), elder". It commonly designates a tribal chief or a Muslim ulama, scholar. Though this title generally refers to men, there are also a small number of female sheikhs in history. The title ''Syeikha'' or ''Sheikha'' generally refers to women. In some countries, it is given as a surname to those of great knowledge in religious affairs, by a prestigious religious leader from a silsila, chain of Sufi scholars. The word is mentioned in the Qur'an in three places: verse 72 of Hud (surah), Hud, 78 of Yusuf (surah), Yusuf, and 23 of al-Qasas. A royal family member of the United Arab Emirates and some other Arab countries, also has this title, since the ruler of each emirate is also the sheikh of their tribe. Etymology and meaning The word in Arabic stems from a Semitic root, triliteral root connected with aging: , ''shīn-yā'-khā. The title carries the me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a Return (finance), return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sharia

Sharia, Sharī'ah, Shari'a, or Shariah () is a body of religious law that forms a part of the Islamic tradition based on Islamic holy books, scriptures of Islam, particularly the Quran, Qur'an and hadith. In Islamic terminology ''sharīʿah'' refers to immutable, intangible divine law; contrary to ''fiqh'', which refers to its interpretations by Ulama, Islamic scholars. Sharia, or fiqh as traditionally known, has always been used alongside urf, customary law from the very beginning in Islamic history; has been elaborated and developed over the centuries by fatwa, legal opinions issued by mufti, qualified jurists – reflecting the tendencies of Schools of Fiqh, different schools – and integrated and with various economic, penal and administrative laws issued by Muslims, Muslim rulers; and implemented for centuries by Qadi, judges in the courts until recent times, when secularism was widely adopted in Islamic societies. Traditional Principles of Islamic jurisprudence, theory o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abdulaziz Bin Mohammed Al-Onaizan

Abdulaziz bin Mohammed Al-Onaizan (born , Ar-Rass, Saudi Arabia) is a Saudi Arabian businessman who is chief executive officer (CEO) of Bank Albilad. Al-Onaizan joined Bank Albilad in 2014, where he was a chief business officer. In 2016, he was appointed as the bank's CEO. Early life Al-Onaizan was born in Saudi Arabia and raised in Ar-Rass. He attended Ar-Rass Secondary School for high school. He then moved to Riyadh for college and attended King Saud University. In 1987, he obtained his bachelor's degree on quantitative methods. Career In 1991, Al-Onaizan joined Samba Financial Group as the head of treasury. He then moved to Arab National Bank in 2004 and Alinma Bank in 2008 serving as the deputy chief executive officer of treasury and the head of treasury respectively. In 2014, Al-Onaizan joined Bank Albilad as the chief business officer (CBO). In 2016, he was appointed as the chief executive officer (CEO). Al-Onaizan additionally serves as the vice-chairman of the board ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arab News

''Arab News'' is an English-language daily newspaper published in Saudi Arabia. It is published from Riyadh. The target audiences of the paper, which is published in broadsheet format, are businesspeople, executives and diplomats. At least as of May 2019, ''Arab News'' was owned by Prince Turki bin Salman Al Saud, the brother of the ruling Crown Prince of Saudi Arabia Muhammad bin Salman. The newspaper promotes the Saudi government. History ''Arab News'' was founded in Jeddah on 20 April 1975 by Hisham Hafiz and his brother Mohammad Hafiz. It was the first English-language daily newspaper published in Saudi Arabia. ''Arab News'' is also the first publication of SRPC. The daily was jointly named by Kamal Adham, Hisham Hafiz and Turki bin Faisal. The paper is one of twenty-nine publications published by Saudi Research and Publishing Company (SRPC), a subsidiary of Saudi Research and Marketing Group (SRMG). The former chairman of SRMG and therefore, ''Arab News'' is Turki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |