|

İspençe

İspençe was a land tax levied on non-Muslims in the Ottoman Empire. İspençe was a land-tax on non-Muslims in parts of the Ottoman Empire; its counterpart, for Muslim taxpayers, was the resm-i çift - which was set at slightly lower rate. The treasury was well aware of the difference in tax takes, and the incentive to convert; the legal reforms of Bayezid II halved some criminal penalties on non-Muslim taxpayers "''so that the taxpayers shall not vanish''"; this rule was reconfirmed a century later, in 1587. In other cases, local taxes were imposed on non-Muslims specifically to encourage conversion. İspençe had existed in the Balkans before the Ottoman conquest; the Ottoman Empire typically adapted local taxes and institutions in each conquered area, leading to a patchwork of different taxes and rates. The concept of İspençe, theoretically a payment in lieu of corvee labour, was derived from the Byzantine Empire, Byzantine "zeugaratikion", a land tax based on the zeugarion ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

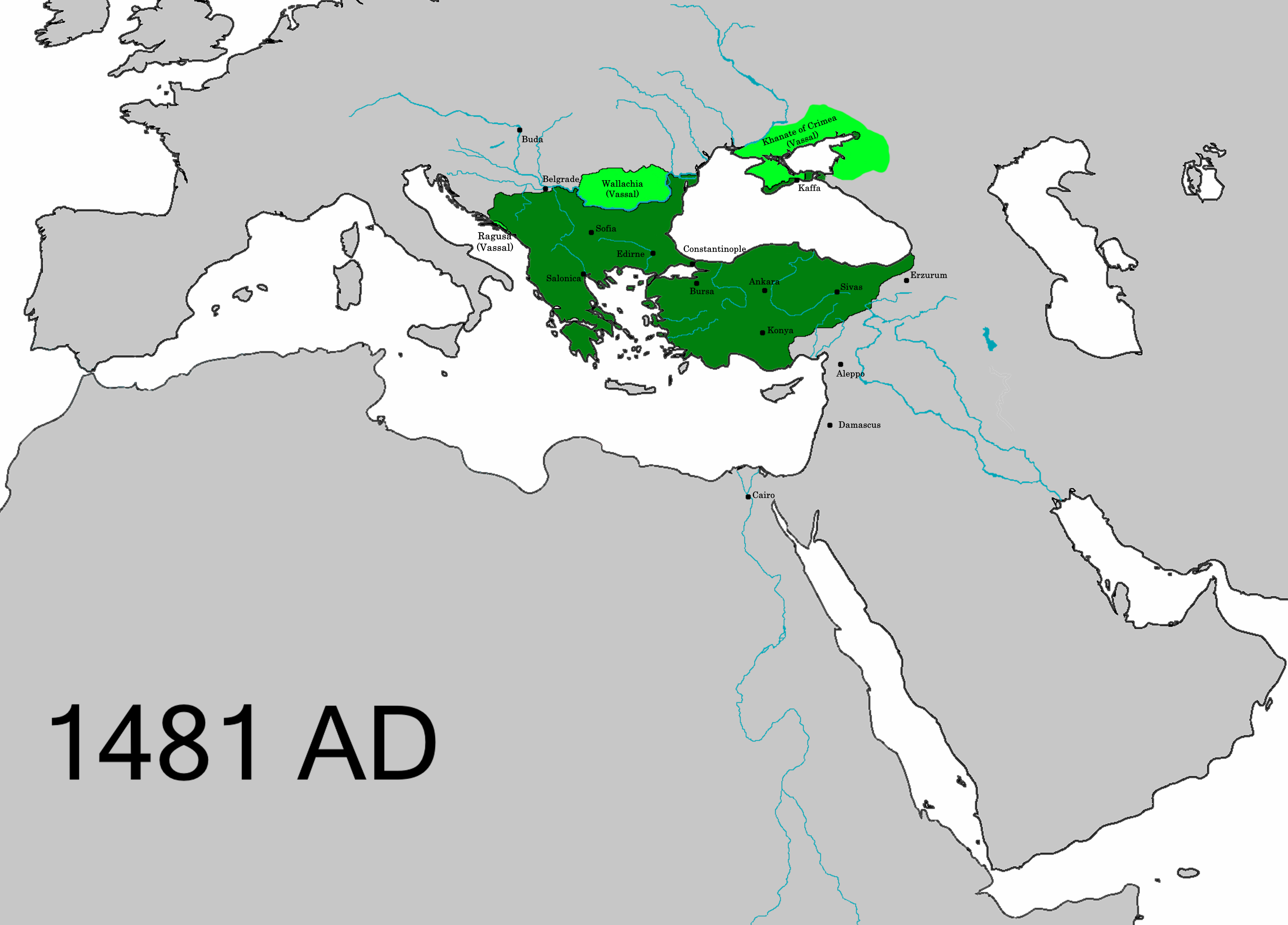

Ottoman Empire

The Ottoman Empire (), also called the Turkish Empire, was an empire, imperial realm that controlled much of Southeast Europe, West Asia, and North Africa from the 14th to early 20th centuries; it also controlled parts of southeastern Central Europe, between the early 16th and early 18th centuries. The empire emerged from a Anatolian beyliks, ''beylik'', or principality, founded in northwestern Anatolia in by the Turkoman (ethnonym), Turkoman tribal leader Osman I. His successors Ottoman wars in Europe, conquered much of Anatolia and expanded into the Balkans by the mid-14th century, transforming their petty kingdom into a transcontinental empire. The Ottomans ended the Byzantine Empire with the Fall of Constantinople, conquest of Constantinople in 1453 by Mehmed II. With its capital at History of Istanbul#Ottoman Empire, Constantinople (modern-day Istanbul) and control over a significant portion of the Mediterranean Basin, the Ottoman Empire was at the centre of interacti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disabilities (Jewish)

Jewish disabilities were legal restrictions, limitations and obligations placed on European Jews in the Middle Ages. In Europe, the disabilities imposed on Jews included provisions requiring Jews to wear specific and identifying clothing such as the Jewish hat and the yellow badge, paying special taxes, swearing special oaths, living in certain neighbourhoods, and forbidding Jews to enter certain trades. In Sweden, for example, Jews were forbidden to sell new pieces of clothing. Disabilities also included special taxes levied on Jews, exclusion from public life, restraints on the performance of religious ceremonies, and linguistic censorship. Some countries went even further and outright expelled Jews, for example England in 1290 (Jews were readmitted in 1655) and Spain in 1492 (readmitted in 1868). The disabilities began to be lifted with Jewish emancipation in the late 18th and 19th centuries. In 1791, Revolutionary France was the first country to abolish disabilities alto ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Taxation

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000â2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zakat

Zakat (or ZakÄh ØēŲاØĐ) is one of the Five Pillars of Islam. Zakat is the Arabic word for "Giving to Charity" or "Giving to the Needy". Zakat is a form of almsgiving, often collected by the Muslim Ummah. It is considered in Islam a religious obligation, and by Quranic ranking, is next after prayer (''salat'') in importance. Eight heads of zakat are mentioned in the Quran. As one of the Five Pillars of Islam, zakat is a religious duty for all Muslims who meet the necessary criteria of wealth to help the needy. It is a mandatory charitable contribution, often considered to be a tax.MuáļĨammad ibn al-áļĪasan áđŽÅŦsÄŦ (2010), ''Concise Description of Islamic Law and Legal Opinions'', , pp. 131â135. The payment and disputes on zakat have played a major role in the history of Islam, notably during the Ridda wars. Zakat on wealth is based on the value of all of one's possessions. It is customarily 2.5% (or ) of a Muslim's total savings and wealth above a minimum amount known ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Haraç

Haraç (, , , sh-Cyrl-Latn, Ņ аŅаŅ, haraÄ) was a land tax levied on non-Muslim subjects in the Ottoman Empire. ''Haraç'' was developed from an earlier form of land taxation, ''kharaj'' (''harac''), and was, in principle, only payable by non-Muslims; it was seen as a counterpart to zakat paid by Muslims.Hunter, Malik and Senturk, p. 77 The ''haraç'' system later merged into the cizye taxation system. While the taxes collected from non Muslims were higher than those collected from Muslims, the rights and opportunities provided to non Muslims were much more limited. It often incentivised people to convert to Islam. Haraç collection was reformed by a firman of 1834, which abolished the old levying system, and required that ''haraç'' be raised by a commission composed of the kadÄą and the ''ayans'', or municipal chiefs of '' rayas'' in each district. The firman made several other changes to taxation as part of the wider Tanzimat The (, , lit. 'Reorganization') was a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jizya

Jizya (), or jizyah, is a type of taxation levied on non-Muslim subjects of a state governed by Sharia, Islamic law. The Quran and hadiths mention jizya without specifying its rate or amount,Sabet, Amr (2006), ''The American Journal of Islamic Social Sciences'' 24:4, Oxford; pp. 99â100. and the application of jizya varied in the course of Islamic history. However, scholars largely agree that early Muslim rulers adapted some of the existing systems of taxation and modified them according to Islamic religious law.online Historically, the jizya tax has been understood in Islam as a fee for protection provided by the Muslim ruler to non-Muslims, for the exemption from military service for non-Muslims, for the permission to practice a non-Muslim faith with some communal autonomy in a Muslim state, and as material proof of the non-Muslims' allegiance to the Muslim state and its laws. The majority of Muslim jurists required adult, free, sane men, males among the dhimma community to pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tahrir Defterleri

A ''defter'' was a type of tax register and land cadastre in the Ottoman Empire. Etymology The term is derived from Greek , literally 'processed animal skin, leather, fur', meaning a book, having pages of goat parchment used along with papyrus as paper in Ancient Greece, borrowed into Arabic as '':'' , meaning a register or a notebook. Description The information collected could vary, but ''tahrir defterleri'' typically included details of villages, dwellings, household heads (adult males and widows), ethnicity/religion (because these could affect tax liabilities/exemptions), and land use. The defter-i hakÃĒni was a land registry, also used for tax purposes. Each town had a defter and typically an officiator or someone in an administrative role to determine whether the information should be recorded. The officiator was usually some kind of learned man who had knowledge of state regulations. The defter was used to record family interactions such as marriage and inheritance. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morea

Morea ( or ) was the name of the Peloponnese peninsula in southern Greece during the Middle Ages and the early modern period. The name was used by the Principality of Achaea, the Byzantine province known as the Despotate of the Morea, by the Ottoman Empire for the Morea Eyalet, and later by the Republic of Venice for the short-lived Kingdom of the Morea. Etymology There is some uncertainty over the origin of the medieval name "Morea", which is first recorded in the 10th century in the Byzantine chronicles. Traditionally, scholars thought the name to have originated from the word ''morea'' (ΞÎŋÏÎÎą), meaning morus or mulberry, a tree which, though known in the region from the ancient times, gained value after the 6th century, when mulberry-eating silkworms were smuggled from China to Byzantium. The British Byzantinist Steven Runciman suggested that the name comes "from the likeness of its shape to that of a mulberry leaf". History After the conquest of Constantinople by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Akçe

The ''akçe'' or ''akça'' (anglicized as ''akche'', ''akcheh'' or ''aqcha''; ; , , in Europe known as '' asper'') was a silver coin mainly known for being the chief monetary unit of the Ottoman Empire. It was also used in other states including the Anatolian Beyliks, the Aq Qoyunlu, and the Crimean Khanate. The basic meaning of the word is "silver" or "silver money", deriving from the Turkish word () and the diminutive suffix . Three s were equal to one . One-hundred and twenty 's equalled one . Later after 1687 the ' became the main unit of account, replacing the . In 1843, the silver ' was joined by the gold lira in a bimetallic system. Its weight fluctuated; one source estimates it between 1.15 and 1.18 grams. The name ' originally referred to a silver coin but later the meaning changed and it became a synonym for money. The mint in Novo Brdo, a fortified mining town in the Serbian Despotate rich with gold and silver mines, began to strike ' in 1441 when it was captur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Resm-i çift

The Resm-i Ãift (''Ãift Akçesi'' or ''Ãift resmi'') was a tax in the Ottoman Empire. It was a tax on farmland, assessed at a fixed annual rate per çift, and paid by land-owning Muslims. Some Imams and some civil servants were exempted from the resm-i çift. The tax was collected annually, on 1 March, from the holder of the timar or their tax-farmer. Some exemptions from resm-i çift were granted, but this was less common than exemptions from extraordinary taxes. Some of the '' sadat'' were initially considered exempt from taxes such as the resm-i çift, but this exemption ended in the 17th century; there were various exemptions for those involved in salt-making and mining. The Ãift is a measure of land area, derived from the word for "pair"; it is an area of farmland which can be ploughed by a pair of oxen - the equivalent of the Byzantine Zeugarion. It has been argued that the basic land tax in Asia Minor and the Balkans was directly copied from earlier Byzantine tax metho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Janjevo

Janjevo () or JanjevÃŦ (in Albanian) is a village or small town in the Lipjan municipality in eastern Kosovo. The settlement has a long history, having been mentioned for the first time in 1303 as a Catholic parish. The town was prior to the Kosovo War (1998â99) inhabited by a majority of Croats, known by their demonym as '' Janjevci'', who since have left massively for Croatia. Geography Janjevo is described as a village or small town, located in Lipjan municipality, by Gornja GuÅĄterica and TeÄe. History Middle Ages Janjevo was first mentioned in 1303. Although only a Catholic parish is mentioned, and no information on mining activity, it is assumed that the Catholic community in fact drew from miners, gathered in such numbers to constitute a parish. Whether these Catholics were Ragusans or Saxons is unknown; with the opening of mines in medieval Serbia, Saxons (''Sasi'') are mentioned as mining specialists; although they are not mentioned as inhabiting Janjevo, they m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |