homeownership in the united states on:

[Wikipedia]

[Google]

[Amazon]

The homeownership rate in the

The homeownership rate in the

The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of

The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of

U.S. Census Bureau's Housing Vacancy Survey

{{North America in topic, Home-ownership in Wealth in the United States Economy of the United States Housing in the United States Ownership

The homeownership rate in the

The homeownership rate in the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

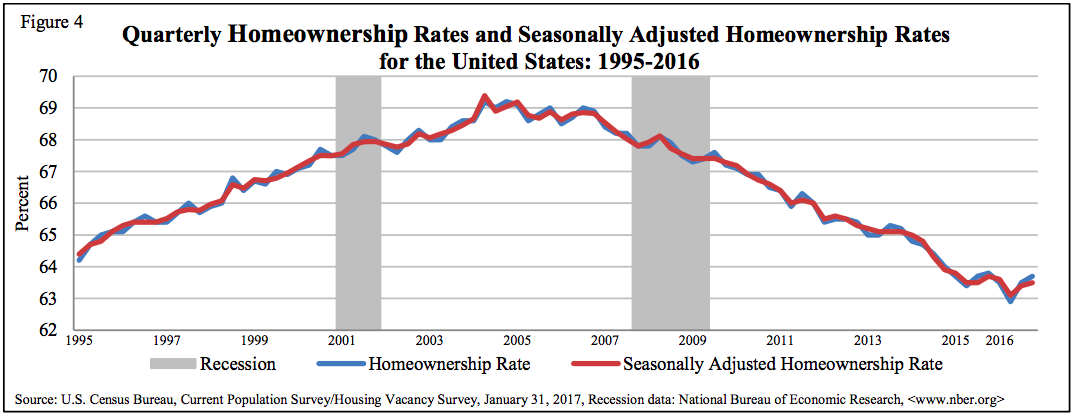

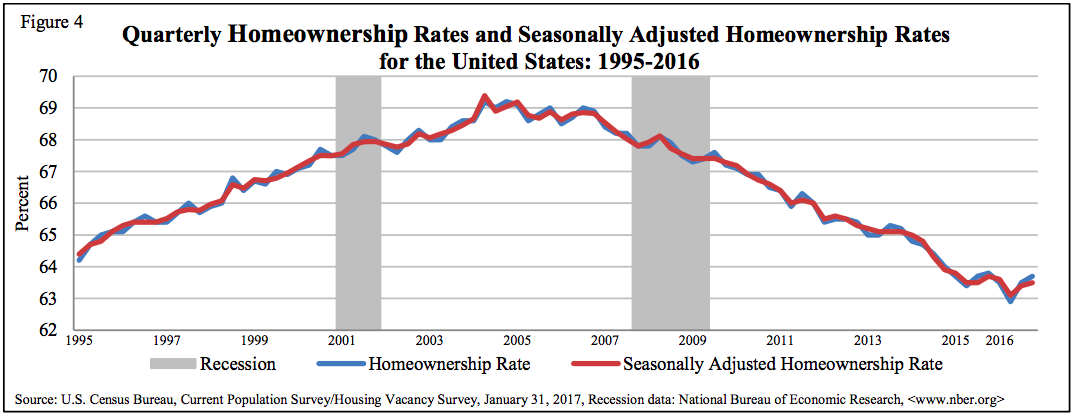

is the percentage of households that are owner-occupied. U.S. homeownership rates vary depending on a household's demographic characteristics, such as ethnicity, race, location, type of household, and type of settlement. At the start of 2025, the seasonally adjusted U.S. homeownership rate was 65.2%, down from 67.1% in 2000. By comparison, the European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The u ...

homeownership rate stood at 69% as of 2022.

In recent decades, the U.S. homeownership rate has remained relatively stable—it was at 62.1% in 1960. However, homeowner equity has fallen steadily since World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

and is now on average less than 50% of the value of the home. The annual U.S. Census Bureau statistics show that homeownership is most common in rural areas and suburbs, with three quarters of suburban households being homeowners. Among the country's regions, the Midwest

The Midwestern United States (also referred to as the Midwest, the Heartland or the American Midwest) is one of the four census regions defined by the United States Census Bureau. It occupies the northern central part of the United States. It ...

has the highest homeownership rate and the Western U.S. has the lowest. The Federal Reserve Bank of Chicago examined the decline in homeownership rates where the "head of household" was 25 to 44 years of age. The rates fell substantially between 1980 and 2000, and recovered only partially during the U.S. housing bubble of the early 2000s. The research indicated that post-1980 trends toward (a) marrying later, and (b) greater instability in household earnings, accounted for a large share of the decline in young homeownership.

U.S. homeowners tend to have higher-than-average incomes. Owner-occupied households were more likely to be families (as opposed to individuals) than were their tenant counterparts. Among racial demographics, White Americans

White Americans (sometimes also called Caucasian Americans) are Americans who identify as white people. In a more official sense, the United States Census Bureau, which collects demographic data on Americans, defines "white" as " person hav ...

had the country's highest homeownership rate, while African Americans

African Americans, also known as Black Americans and formerly also called Afro-Americans, are an American racial and ethnic group that consists of Americans who have total or partial ancestry from any of the Black racial groups of Africa ...

had the lowest rate. One study shows that homeownership rates correlated with higher educational attainment.

The term "homeownership rate" can be misleading. As defined by the U.S. Census Bureau, it is the percentage of homes that are occupied by the owner. It is not the percentage of adults that own their home. This latter percentage will be significantly lower than the homeownership rate. Many owner-occupied households contain adult relatives (often young adult

In medicine and the social sciences, a young adult is generally a person in the years following adolescence, sometimes with some overlap. Definitions and opinions on what qualifies as a young adult vary, with works such as Erik Erikson's stages ...

s, descendants of the owner) who do not own a home. Single building multi-bedroom rental units can house more than one adult, all of whom do not own a home. The term can also be misleading because it includes households that owe on a mortgage

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners t ...

, which means they do not possess full equity in the home they are said to "own". According to ATTOM Data Research, only "34 percent of all American homeowners have 100 percent equity in their propertiesthey’ve either paid off their entire mortgage debt or they never had a mortgage".

In 2017, CNBC

CNBC is an American List of business news channels, business news channel owned by the NBCUniversal News Group, a unit of Comcast's NBCUniversal. The network broadcasts live business news and analysis programming during the morning, Day ...

reported that the median sale price for a U.S. home was US$199,200. In early 2025, Statista forecast that the median sale price would jump to US$426,000 by 2nd quarter 2026. The growing U.S. housing shortage is a major factor in home prices increasing so rapidly.

Measuring method

In the United States, the homeownership rate is created through the ''Housing Vacancy Survey'' by the U.S. Census Bureau. It is created by dividing the owner occupied units by the total number of occupied units. This is an important point to understand changes in the homeownership rate over time. The bust of the housing bubble resulted in many houses becoming foreclosed. However, the decrease in the homeownership rate from 3Q2007 to 4Q2007 was mostly a result of an increase in the renter's population and less due to a decrease in the homeowner population.Government policy

Homeownership has been promoted as government policy using several means involving mortgage debt and the government sponsored entitiesFreddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New ...

, and the Federal Home Loan Banks

The Federal Home Loan Banks (FHLBanks, or FHLBank System) are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

Overview

The FHLBank System was chartered by ...

, which fund or guarantee $6.5 trillion of assets with the purpose of directly or indirectly promoting homeownership. Homeownership has been further promoted through tax policy which allows a tax deduction

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The diff ...

for mortgage interest payments on a primary residence. The Community Reinvestment Act also encourages homeownership for low-income earners. The promotion of homeownership by the government through encouraging mortgage borrowing and lending has given rise to debates regarding government policies and the subprime mortgage crisis.

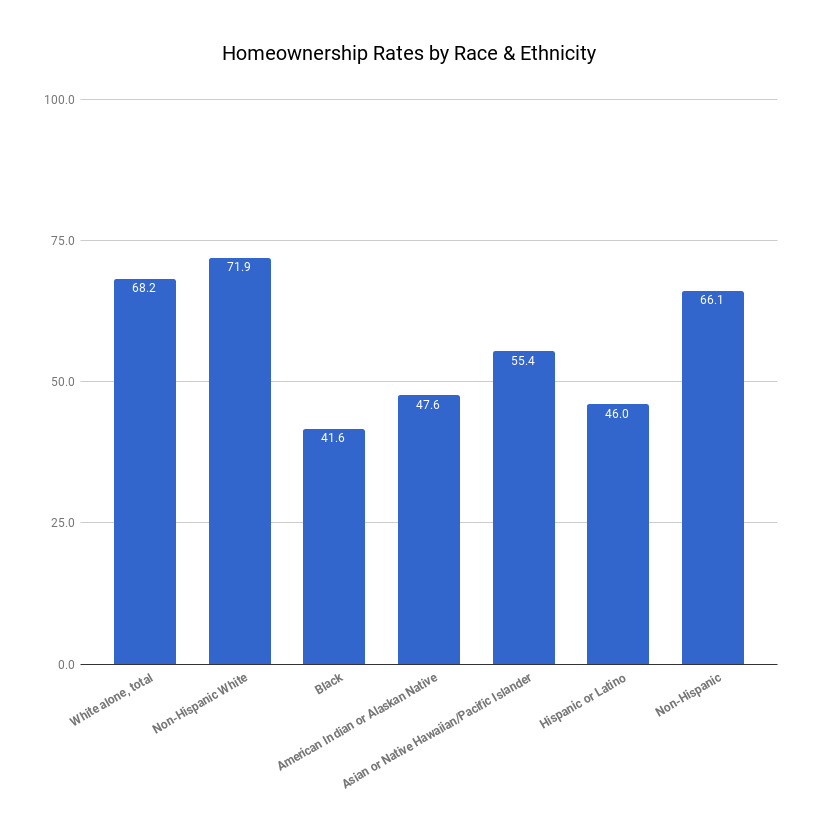

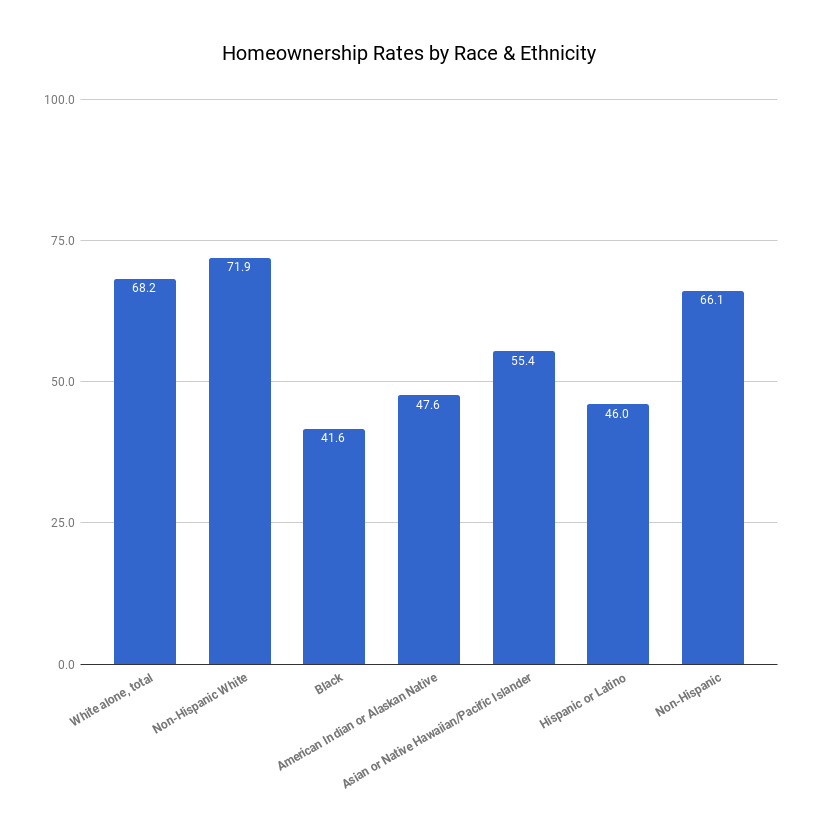

Race

: The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of

The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of white

White is the lightest color and is achromatic (having no chroma). It is the color of objects such as snow, chalk, and milk, and is the opposite of black. White objects fully (or almost fully) reflect and scatter all the visible wa ...

, Asian and Native American households, the homeownership rates for African American

African Americans, also known as Black Americans and formerly also called Afro-Americans, are an Race and ethnicity in the United States, American racial and ethnic group that consists of Americans who have total or partial ancestry from an ...

s and Latinos have typically fallen short of the fifty percent threshold. Whites have had the highest homeownership rate, followed by Asians and Native Americans.

Although a landmark United States Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

ruling '' Shelley v. Kraemer'' , ruled invalid exclusionary racial covenants, which almost always barred black citizens from owning a home but often extended to American Jews

American Jews (; ) or Jewish Americans are American citizens who are Jewish, whether by culture, ethnicity, or religion. According to a 2020 poll conducted by Pew Research, approximately two thirds of American Jews identify as Ashkenazi, 3% id ...

, Asian Americans, Mexican Americans, and non-citizens and other ethnic groups and could be used by white real estate owners to enforce or introduce racial segregation

Racial segregation is the separation of people into race (human classification), racial or other Ethnicity, ethnic groups in daily life. Segregation can involve the spatial separation of the races, and mandatory use of different institutions, ...

, threats of legal action allowed them to remain effective for some time afterwards. Racial steering practices later on also affected patterns of homeownership among non-whites and the cumulative effects of exclusionary covenants, racial steering, and other segregation measures have resulted in lower property values, less capital accumulation

Capital accumulation is the dynamic that motivates the pursuit of profit, involving the investment of money or any financial asset with the goal of increasing the initial monetary value of said asset as a financial return whether in the form ...

, lower municipal tax revenues, and disinvestment in black communities. Despite the fact that the ''Shelley v. Kraemer'' decision found exclusionary covenants to be unconstitutional under the Fourteenth Amendment to the United States Constitution

The Fourteenth Amendment (Amendment XIV) to the United States Constitution was adopted on July 9, 1868, as one of the Reconstruction Amendments. Considered one of the most consequential amendments, it addresses Citizenship of the United States ...

's Equal Protection Clause

The Equal Protection Clause is part of the first section of the Fourteenth Amendment to the United States Constitution. The clause, which took effect in 1868, provides "nor shall any State... deny to any person within its jurisdiction the equal pr ...

ago, and hence unenforceable, the clauses are still present in many deeds well into the twenty-first century.

Hispanics had the lowest homeownership rate in the country in all years, except for 2002, up until 2005. For the last half of the decade of the 2000s the homeownership rate for Hispanics exceeded that of African American

African Americans, also known as Black Americans and formerly also called Afro-Americans, are an Race and ethnicity in the United States, American racial and ethnic group that consists of Americans who have total or partial ancestry from an ...

s. Temporal fluctuations were slight for all races, with rates commonly not changing more than two percentage points per year.

:

The strongest increase in the percentage of homeowners in the first half of the decade of the 2000s was among non-white minorities. The homeownership rate for minorities approached the sixty percent mark in 2006, which was a significant change because less than half of all minority households owned homes as recently as 1994. The ownership rate for minorities increased by 25.6%, from 47.7% in 1993 to 59.9% in 2006. This rate fell after the 2006 peak, consistent with overall homeownership rates.

The increase among white Americans was less substantial. In 2005, 75.8% of white Americans owned their own homes, compared to 70% in 1993, and the rate fell during the last half of the decade of the 2000s, slightly more slowly than for the rest of the population. Thus one can conclude that despite a large remaining discrepancy between the homeownership rates among different racial groups, the gap had been closing up until the peak, with ownership rates increasing more substantially for minorities than for whites, but subsequently began slightly widening.

SOURCE: US Census Bureau, 2016Racism

The data from theUnited States Census Bureau

The United States Census Bureau, officially the Bureau of the Census, is a principal agency of the Federal statistical system, U.S. federal statistical system, responsible for producing data about the American people and American economy, econ ...

shows black Americans have the lowest rate of homeownership in the US. According to the National Association of Realtors

The National Association of Realtors (NAR) is an American trade association for those who work in the real estate industry. it had over 1.5 million members, making it the largest trade association in the United States including NAR's institute ...

, blacks and Hispanic Americans face higher mortgage rates than their white and Asian counterparts, and more illegal discrimination in real estate transactions. The Fair Housing Act

The Civil Rights Act of 1968 () is a Lists of landmark court decisions, landmark law in the United States signed into law by President of the United States, United States President Lyndon B. Johnson during the King assassination riots.

Titles ...

is a law established to help stop illegal discrimination against potential minority homeowners in the U.S. The law is enforced by the United States Department of Housing and Urban Development

The United States Department of Housing and Urban Development (HUD) is one of the executive departments of the U.S. federal government. It administers federal housing and urban development laws. It is headed by the secretary of housing and u ...

. Also, black and Hispanic households usually face more personal challenges such as the likelihood of higher personal debt, lower incomes, lower credit scores, or lower savings than the average buyer for a home purchase.

Type of household

There is a strong correlation between the type and age of a household's family structure and homeownership. As of 2006, married couple families, which also have the highestmedian income

The median income is the income amount that divides a population into two groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean (or average) income. Both of these are ways of unde ...

of any household type, were most likely to own a home. Age played a significant role as well with homeownership increasing with the age of the householder until age 65, when a slight decrease becomes visible. While only 43% of households with a householder under the age of thirty-five owned a home, 81.6% of those with a householder between the ages of 55 and 64 did. According to Zillow's data analysis the median age of renters who are heads of households is age 41 years, up from age 37 in 2000.

This means that households with a middle-aged householder were nearly twice as likely to own a home as those with a young householder. Overall married couple families with a householder age 70 to 74 had the highest homeownership rate with 93.3% being homeowners. The lowest homeownership rate was recorded for single females under the age of twenty-five of whom only 13.6%, were homeowners. Yet, single females had an overall higher homeownership rate than single males and single mothers.

Income

There are considerable correlations betweenincome

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. F ...

, homeownership rate and housing characteristics. As income is closely linked to social status

Social status is the relative level of social value a person is considered to possess. Such social value includes respect, honour, honor, assumed competence, and deference. On one hand, social scientists view status as a "reward" for group members ...

, sociologist Leonard Beeghley has made the hypothesis that "the lower the social class, then the fewer amenities built into housing." According to 2002, US Census Bureau data housing characteristics vary considerably with income. For homeowners with middle-range household incomes, ranging from $40,000 to $60,000, the median home value was $112,000, while the median size was and the median year of construction was 1970. A slight majority, 54% of homes occupied by owners in this group had two or more bathrooms.

According to a 2004 report, among homeowners with household incomes in the top 10%, those earning more than $120,000 a year, home values were considerably higher while houses were larger and newer. The median value for homes in this demographic was $256,000 while median square footage was 2,500 and the median year of construction was 1977. The vast majority, 80%, had two or more bathrooms. Overall, houses of those with higher incomes were larger, newer, more expensive with more amenities.

U.S. home prices are rising significantly faster than incomes. After accounting for inflation, home prices jumped 118% from 1965 to 2021, while income had only increased by 15%. High demand and low supply in most cities will likely continue to keep home prices outpacing income increases. According to a Realtor.com analysis, there was a shortage of about 2.3 million homes by the end of 2022, compared to an increase of about 500,000 since 2012.

Wealth accumulation

Homeownership is the primary asset most Americans use to generate wealth. For a majority of U.S. homeowners, their home equity represents 50-70% of their net wealth. As of January 2025, the average mortgage-holding homeowner had approximately US$311,000 in equity.Political influence

Homeownership influences the political participation of individuals, with homeowners more likely to participate in local elections. Owning a home increases the likelihood of participating in local primaries by 35%. Voter turnout probability increases with the value of the home. Becoming a homeowner influences an individual's political outlook, as they are more likely to vote in ways they perceive as protecting their investment. Being a homeowner increases the likelihood of political participation by 75% when issue ofzoning

In urban planning, zoning is a method in which a municipality or other tier of government divides land into land-use "zones", each of which has a set of regulations for new development that differs from other zones. Zones may be defined for ...

are decided. For national elections, homeowners are more likely than renters to participate in primaries and general elections; their turnout is about 10 points higher than renters for general elections.

For those who use private mortgages to finance homeownership, their party affiliation polarizes towards one of the two major political parties. Individuals who buy homes through Federal Housing Administration

The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a Independent agencies of the United States government, United States government agency founded by Pr ...

-supported mortgages are much more likely to become Democrats.

History of homeownership rate

International comparison (as of 2022)

See also

* Starter home *List of countries by home ownership rate

This is a list of countries, territories and regions by home ownership rate, which is the ratio of owner-occupied units to total residential units in a specified area, based on available data.

See also

* Home-ownership in the United States

* ...

* Household income in the United States

* Real estate pricing

*Economy of the United States

The United States has a highly developed mixed economy. It is the world's largest economy by nominal GDP and second largest by purchasing power parity (PPP). As of 2025, it has the world's seventh highest nominal GDP per capita and ninth ...

* Housing insecurity in the United States

* Eviction in the United States

*Poverty in the United States

In the United States, poverty has both social and political implications. Based on Measuring poverty, poverty measures used by the Census Bureau (which exclude non-cash factors such as food stamps or medical care or public housing), America h ...

* Homelessness in the United States

Footnotes

References

Further reading

* Kwak, Nancy H. ''A World of Homeowners: American Power and the Politics of Housing Aid'' (University of Chicago Press, 2015). 328 pp. * Rothstein, Richard. '' The Color of Law: A Forgotten History of How Our Government Segregated America'' (Liveright Publishing Corporation, 2017). 368 pp. * Thurston, Chloe N. '' At the Boundaries of Homeownership: Credit, Discrimination, and the American State'' (Cambridge University Press, 2018). 268 pp.External links

U.S. Census Bureau's Housing Vacancy Survey

{{North America in topic, Home-ownership in Wealth in the United States Economy of the United States Housing in the United States Ownership