|

Homeownership In The United States

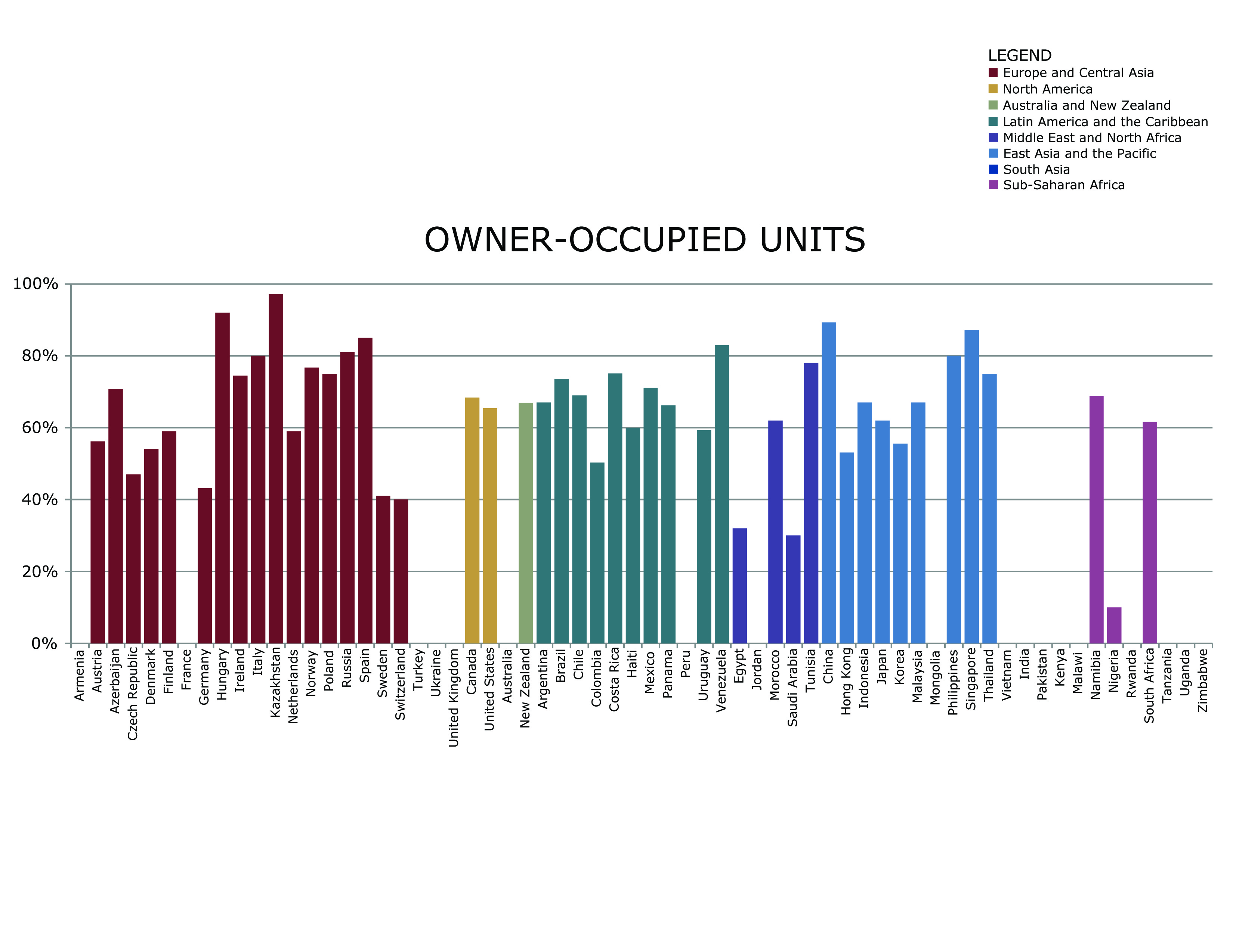

The homeownership rate in the United States is the percentage of households that are owner-occupied. U.S. homeownership rates vary depending on a household's demographic characteristics, such as ethnicity, race, location, type of household, and type of settlement. At the start of 2025, the seasonally adjusted U.S. homeownership rate was 65.2%, down from 67.1% in 2000. By comparison, the European Union homeownership rate stood at 69% as of 2022. In recent decades, the U.S. homeownership rate has remained relatively stable—it was at 62.1% in 1960. However, homeowner equity has fallen steadily since World War II and is now on average less than 50% of the value of the home. The annual U.S. Census Bureau statistics show that homeownership is most common in rural areas and suburbs, with three quarters of suburban households being homeowners. Among the country's regions, the Midwest has the highest homeownership rate and the Western U.S. has the lowest. The Federal Reserve Ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Home Ownership Rate

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the homeowner fail ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Young Adult

In medicine and the social sciences, a young adult is generally a person in the years following adolescence, sometimes with some overlap. Definitions and opinions on what qualifies as a young adult vary, with works such as Erik Erikson's stages of human development significantly influencing the definition of the term; generally, the term is often used to refer to adults in approximately the age range of 18 to 45 years. Some inclusive definitions extend the range into the early to mid 40s, while others end earlier. The United States Census Bureau, for instance, defines young adults as those between the ages of 18 and 32. (As of 2024): Over 65 million Americans born approximately from 1990 to 2006, would likely fall under this category. The young adult stage in human development precedes middle adulthood.Martin BrinerErik Erikson page, 1999, on Briner', Department of Mathematical Sciences, Center for Assessment and Program Evaluation, US Military Academy at West Point. Accessed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Community Reinvestment Act

The Community Reinvestment Act (CRA, P.L. 95-128, 91 Stat. 1147, title VIII of the Housing and Community Development Act of 1977, ''et seq.'') is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods.Text of Housing and Community Development Act of 1977 — Title VIII (Community Reinvestment) Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as |

Primary Residence

A person's primary residence, or main residence is the dwelling where they usually live, typically a house or an apartment. A person can only have one ''primary'' residence at any given time, though they may share the residence with other people. A primary residence is considered to be a legal residence for the purpose of income tax and/or acquiring a mortgage. Criteria for a primary residence consist mostly of guidelines rather than hard rules, and residential status is often determined on a case-by-case basis. Use in urban planning The primary residence is the main dwelling unit on a parcel of land. This term distinguishes this unit from a potential secondary suite. Definition in specific jurisdictions United Kingdom If taxpayers own a property but never lived in it, it cannot be considered their main residence even if it is the only property they own. Furthermore, the court would ask itself, in order to determine whether the property is their main residence, whether a reasona ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tax Deduction

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. Capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Federal Home Loan Banks

The Federal Home Loan Banks (FHLBanks, or FHLBank System) are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment. Overview The FHLBank System was chartered by Congress in 1932, during the Great Depression. It has a primary mission of providing member financial institutions with financial products/services which assist and enhance the financing of housing and community lending. FHLBanks operate exclusively in the secondary market providing loans (advances) to financial institutions, not individuals. The 11 FHLBanks are each structured as cooperatives owned and governed by their member financial institutions, which today include savings and loan associations (thrifts), commercial banks, credit unions, and insurance companies. While FHLBanks are private, the FHLBank System is directly regulated by the Federal Housing Finance Agency (FHFA) and FHLBanks enjoy certain benefits from their government s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitization, securitizing mortgage loans in the form of mortgage-backed security, mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or "thrifts"). Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. In 2024, with over $4.3 trillion in assets, Fannie Mae is the largest company in the United States and the fifth largest company in the world, by assets. Fannie Mae was ranked number 27 on the Fortune 500, ''Fortune'' 50 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.Tysons Corner CDP, Virginia ". United States Census Bureau. Retrieved on May 7, 2009. The FHLMC was created in 1970 to expand the secondary market for Mortgage loan, mortgages in the US. Along with its sister organization, the Federal National Mortgage Association (Fannie Mae), Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purcha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Government Sponsored Entities

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of credit to targeted sectors of the economy, to make those segments of the capital market more efficient and transparent, and to reduce the risk to investors and other suppliers of capital. The desired effect of the GSEs is to enhance the availability and reduce the cost of credit to the targeted borrowing sectors primarily by reducing the risk of capital losses to investors: agriculture, home finance and education. Well known GSEs are the Federal National Mortgage Association, known as Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac. Congress created the first GSE in 1916 with the creation of the Farm Credit System. It initiated GSEs in the home finance segment of the economy with the creation of the Federal Home Loan Banks in 1932; and it targeted education when it chartered Salli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Owner Occupied

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the homeowner fai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

USA Today

''USA Today'' (often stylized in all caps) is an American daily middle-market newspaper and news broadcasting company. Founded by Al Neuharth in 1980 and launched on September 14, 1982, the newspaper operates from Gannett's corporate headquarters in New York City. Its newspaper is printed at 37 sites across the United States and at five additional sites internationally. The paper's dynamic design influenced the style of local, regional, and national newspapers worldwide through its use of concise reports, colorized images, informational graphics, and inclusion of popular culture stories, among other distinct features. As of 2023, ''USA Today'' has the fifth largest print circulation in the United States, with 132,640 print subscribers. It has two million digital subscribers, the fourth-largest online circulation of any U.S. newspaper. ''USA Today'' is distributed in all 50 states, Washington, D.C., and Puerto Rico, and an international edition is distributed in Asia, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Statista

Statista (styled in all lower case) is a German online platform that specializes in data gathering and visualization. In addition to publicly available third-party data, Statista also provides exclusive data via the platform, which is collected through its team's surveys and analysis. According to its own publications, Statista offers more than 1,000,000 statistics on over 80,000 topics from more than 22,500 sources in over 150 countries and is accessed 31 million times a month (as of December 2022). The company claims to cover around 170 industries with its content. In 2024, Statista reported more than four million registered users, with which the company generated around 167 million euros in revenue. Statista has been owned by Ströer Media since 2015, with an 81.3% stake. The company provides statistics and survey results, which are presented in charts and tables. Its main target groups are business customers, lecturers, and researchers. The data provided by the company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |