Basics

Sources of U.S. income tax laws

United States income tax law comes from a number of sources. These sources have been divided by one author into three tiers as follows: *''Tier 1'' **Basic concepts

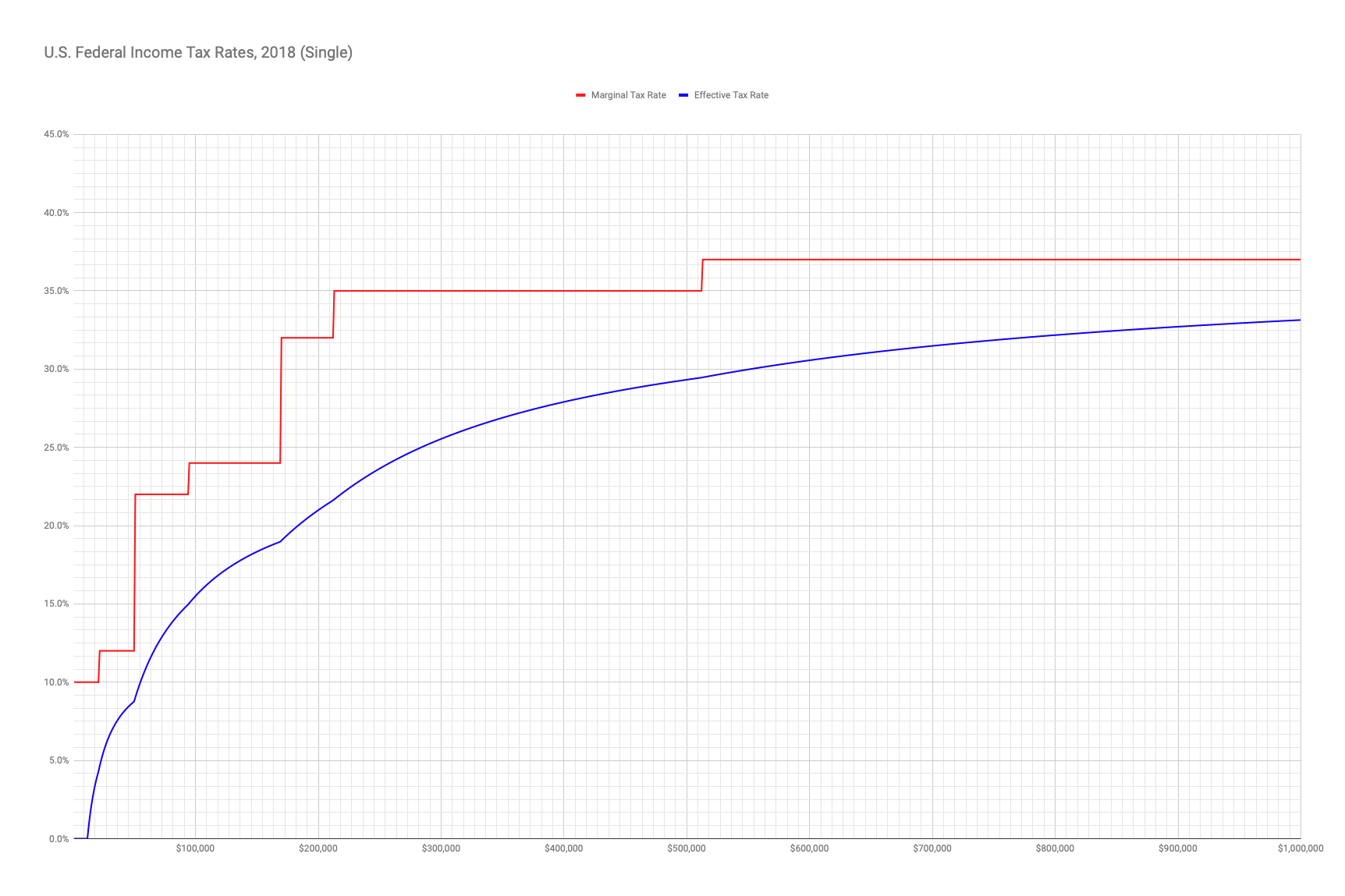

A tax is imposed on net taxable income in the United States by the federal, most state, and some local governments. Income tax is imposed on individuals, corporations, estates, and trusts. The definition of net taxable income for most sub-federal jurisdictions mostly follows the federal definition.CCH ''State Tax Handbook'' 2018, page 617, ''et seq''. The rate of tax at the federal level is graduated; that is, the tax rates on higher amounts of income are higher than on lower amounts. Federal individual tax rates vary from 10% to 37%. Some states and localities impose an income tax at a graduated rate, and some at a flat rate on all taxable income. Individuals are eligible for a reduced rate of federal income tax on capital gains and qualifying dividends. The tax rate and some deductions are different for individuals depending ofiling status

Married individuals may compute tax as a couple or separately. Single individuals may be eligible for reduced tax rates if they are head of a household in which they live with a dependent. Taxable income is defined in a comprehensive manner in the

all income earned or received from whatever source

This includes salaries and wages, tips, pensions, fees earned for services, price of goods sold, other business income, gains on sale of other property, rents received, interest and

Adjustments (usually reductions) to gross income

of individuals are made for contributions to many types of retirement or health savings plans, certain student loan interest, half of self-employment tax, and a few other items. The

may result in a loss

Generally, such loss can reduce other taxable income, subject to some limits. Personal deductions: The former deduction for personal exemptions wa

repealed for 2018 through 2025

Standard deduction: Individuals get a deduction from taxable income for certain personal expenses. An individual may claim a standard deduction

For 2021, the basic standard deduction

was $12,550 for single individuals or married persons filing separately, $25,100 for a joint return or surviving spouse, and $18,800 for a head of household. Itemized deductions: Those who choose to claim actua

itemized deductions

may deduct the following, subject to many conditions and limitations: *Medical expenses in excess of 10% of adjusted gross income, *Certain taxe

limited to $10,000 or $5,000 in 2018 through 2025

*Home mortgage interest, *Contributions to charities, *Losses on nonbusiness property due to casualty, and *Deductions for expenses incurred in the production of income in excess of 2% of adjusted gross income. Capital gains: Capital gains include gains on selling stocks and bonds, real estate, and other capital assets. The gain is the excess of the proceeds over the adjusted tax basis (cost less depreciation deductions allowed) of the property. This lower rate of tax also applies to qualified dividends from U.S. corporations and many foreign corporations. There are limits on how much net capital loss may reduce other taxable income.

Tax credits: All taxpayers are allowed a credit for foreign taxes and for a percentage o

Tax credits: All taxpayers are allowed a credit for foreign taxes and for a percentage ocertain types of business expenses

Individuals are also allowe

credits

related to education expenses, retirement savings, and child care expenses. Each of the credits is subject to specific rules and limitations. Some credits are treated as refundable payments. Alternative minimum tax: All taxpayers are also subject to the Alternative Minimum Tax if their income exceeds certain exclusion amounts. This tax applies only if it exceeds regular income tax and is reduced by some credits. Additional Medicare tax: High-income earners may also have to pay an additional 0.9% tax on wages, compensation, and self-employment income. Net investment income tax: Net investment income is subject to a

additional 3.8% tax

for individuals with income in excess of certain thresholds. Tax returns: U.S. corporations and most resident individuals must file income tax returns to self assess income tax if any tax is due or to claim a tax refund. Some people must file an income tax return because they satisfy one of several other conditions. Tax returns may be filed electronically with Free File or Direct File. Generally, an individual'

tax return covers the calendar year. Corporations may elect a different tax year

Most states and localities follow the federal tax year and require separate returns. Tax payment: Taxpayers mus

pay income tax

due without waiting for an assessment. Many taxpayers are subject to

estimated tax payments

or face penalties. Tax penalties: Failing to make payments on time, or failing to file returns, can result in substantial penalties. Certain intentional failures may result in criminal penalties, including monetary fines and/or imprisonment. Tax returns may b

examined and adjusted

by tax authorities. Taxpayers hav

rights to appeal

any change to tax, and these rights vary by jurisdiction. Taxpayers may also go to court to contest tax changes. Tax authorities may not make changes after a certain period of time (generally three or four years from the tax return due date).

Federal income tax rates for individuals

Federal income brackets and tax rates for individuals are adjusted annually for inflation. TheMarginal tax rates

Example of a tax computation

Income tax for year 2017: Single taxpayer making $40,000 gross income, no children, under 65 and not blind, taking standard deduction; * $40,000 gross income – $6,350 standard deduction – $4,050 personal exemption = $29,600 taxable income ** amount in the first income bracket = $9,325; taxation of the amount in the first income bracket = $9,325 × 10% = $932.50 ** amount in the second income bracket = $29,600 – $9,325 = $20,275.00; taxation of the amount in the second income bracket = $20,275.00 × 15% = $3,041.25 * Total income tax is $932.50 + $3,041.25 = $3,973.75 (~9.93% effective tax) Note, however, that taxpayers with taxable income of less than $100,000 must use IRS provided tax tables. Under that table for 2016, the income tax in the above example would be $3,980.00. In addition to income tax, a wage earner would also have to pay Federal Insurance Contributions Act tax (FICA) (and an equal amount of FICA tax must be paid by the employer): * $40,000 (adjusted gross income) ** $40,000 × 6.2% = $2,480 (Social Security portion) ** $40,000 × 1.45% = $580 (Medicare portion) * Total FICA tax paid by employee = $3,060 (7.65% of income) * Total federal tax of individual = $3,973.75 + $3,060.00 = $7,033.75 (~17.58% of income) Total federal tax including employer's contribution: * Total FICA tax contributed by employer = $3,060 (7.65% of income) * Total federal tax of individual including employer's contribution = $3,973.75 + $3,060.00 + $3,060.00 = $10,093.75 (~25.23% of income)Effective income tax rates

Effective tax rates are typically lower than marginal rates due to various deductions, with some people actually having a negative liability. The individual income tax rates in the following chart include capital gains taxes, which have different marginal rates than regular income. Only the first $118,500 of someone's income is subject to social insurance (Social Security) taxes in 2016. The table below also does not reflect changes, effective with 2013 law, which increased the average tax paid by the top 1% to the highest levels since 1979, at an effective rate of 33%, while most other taxpayers have remained near the lowest levels since 1979.Taxable income

Income tax is imposed as a tax rate times taxable income. Taxable income is defined asGross income

TheGross income is not limited to cash received, but "includes income realized in any form, whether money, property, or services." Gross income includes wages and tips, fees for performing services, gain from sale of inventory or other property, interest, dividends, rents, royalties, pensions, alimony, and many other types of income. Items must be included in income when received or accrued. The amount included is the amount the taxpayer is entitled to receive. Gains on property are the gross proceeds less amounts returned,

Business deductions

Most business deductions are allowed regardless of the form in which the business is conducted. Therefore, an individual small business owner is allowed most of the same business deductions as a publicly traded corporation. A business is an activity conducted regularly to make a profit. Only a few business-related deductions are unique to a particular form of business-doing. The deduction of investment expenses by individuals, however, has several limitations, along with other itemized (personal) deductions. The amount and timing of deductions for income tax purposes is determined under tax accounting rules, not financial accounting ones. Tax rules are based on principles similar in many ways to accounting rules, but there are significant differences. Federal deductions for most meals and entertainment costs are limited to 50% of the costs (with an exception for tax year 2021, allowing a 100% deduction for meals purchased in a restaurant). Costs of starting a business (sometimes called pre-operating costs) are deductible ratably over 60 months. Deductions for lobbying and political expenses are limited. Some other limitations apply. Expenses likely to produce future benefits must be capitalized. The capitalized costs are then deductible as depreciation (see MACRS) or amortization over the period future benefits are expected. Examples include costs of machinery and equipment and costs of making or building property. IRS tables specify lives of assets by class of asset or industry in which used. When an asset the cost of which was capitalized is sold, exchanged, or abandoned, the proceeds (if any) are reduced by the remaining unrecovered cost to determine gain or loss. That gain or loss may be ordinary (as in the case of inventory) or capital (as in the case of stocks and bonds), or a combination (for some buildings and equipment). Most personal, living, and family expenses are not deductible. Business deductions allowed for federal income tax are almost always allowed in determining state income tax. Only some states, however, allow itemized deductions for individuals. Some states also limit deductions by corporations for investment related expenses. Many states allow different amounts for depreciation deductions. State limitations on deductions may differ significantly from federal limitations. Business deductions in excess of business income result in losses that may offset other income. However, deductions for losses from passive activities may be deferred to the extent they exceed income from other passive activities. Passive activities include most rental activities (except for real estate professionals) and business activities in which the taxpayer does not materially participate. In addition, losses may not, in most cases, be deducted in excess of the taxpayer's amount at risk (generally tax basis in the entity plus share of debt).Personal deductions

Prior to 2018, individuals were allowed a special deduction called a personal exemption. This wanot allowed after 2017 but will be allowed again in 2026

This was a fixed amount allowed each taxpayer, plus an additional fixed amount for each child or other dependents the taxpayer supports. The amount of this deduction was $4,000 for 2015. The amount is indexed annually for inflation. The amount of exemption was phased out at higher incomes through 2009 and after 2012 (no phase out in 2010–2012).

Retirement savings and fringe benefit plans

Employers get a deduction for amounts contributed to a qualified employee retirement plan or benefit plan. The employee does not recognize income with respect to the plan until he or she receives a distribution from the plan. The plan itself is organized as a trust and is considered a separate entity. For the plan to qualify forCapital gains

Taxable income includes capital gains. However, individuals are taxed at a lower rate on long term capital gains and qualified dividends (see below). A capital gain is the excess of the sales price over the tax basis (usually, the cost) of capital assets, generally those assets not held for sale to customers in the ordinary course of business. Capital losses (where basis is more than sales price) are deductible, but deduction for long term capital losses is limited to the total capital gains for the year, plus for individuals up to $3,000 of ordinary income ($1,500 if married filing separately). An individual may exclude $250,000 ($500,000 for a married couple filing jointly) of capital gains on the sale of the individual's primary residence, subject to certain conditions and limitations. Gains on depreciable property used in a business are treated as ordinary income to the extent of depreciation previously claimed. In determining gain, it is necessary to determine which property is sold and the amount of basis of that property. This may require identification conventions, such as first-in-first-out, for identical properties like shares of stock. Further, tax basis must be allocated among properties purchased together unless they are sold together. Original basis, usually cost paid for the asset, is reduced by deductions forlike-kind

property are not recognized, and the tax basis of the new property is based on the tax basis of the old property. Before 1986 and from 2004 onward, individuals were subject to a reduced rate of federal tax on capital gains (called long-term capital gains) on certain property held more than 12 months. The reduced rate of 15% applied for regular tax and the Alternative Minimum Tax through 2011. The reduced rate also applies to dividends from corporations organized in the United States or a country with which the United States has an income tax treaty. This 15% rate was increased to 20% in 2012. Beginning in 2013, capital gains above certain thresholds is included in net investment income subject to an additional 3.8% tax. :

on real estate used as primary residence are exempt

Accounting periods and methods

The US tax system allows individuals and entities to choose theirOther taxable and tax exempt entities

Partnerships and LLCs

Business entities treated asnot subject to income tax

at the entity level. Instead, their member

include their share

of income, deductions, and credits in computing their own tax. The character of the partner's share of income (such as capital gains) is determined at the partnership level. Many types of business entities, including limited liability companies (LLCs), may elect to be treated as a corporation or as a partnership. Distributions from partnerships are not taxed as dividends.

Corporations

Corporate tax is imposed in the U.S. at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. A corporation wholly owned by U.S. citizens and resident individuals may elect for the corporation to be taxed similarly to partnerships as an S Corporation. Corporate income tax is based on taxable income, which is defined similarly to individual taxable income.

Shareholders (including other corporations) of corporations (other than S Corporations) are taxed on

Corporate tax is imposed in the U.S. at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. A corporation wholly owned by U.S. citizens and resident individuals may elect for the corporation to be taxed similarly to partnerships as an S Corporation. Corporate income tax is based on taxable income, which is defined similarly to individual taxable income.

Shareholders (including other corporations) of corporations (other than S Corporations) are taxed on Corporate tax rates

Federal corporate income tax is imposed a21%

from 2018. Dividend exclusions and certain corporation-only deductions may significantly lower the effective rate.

Deductions for corporations

Most expenses of corporations are deductible, subject to limitations also applicable to other taxpayers. (See relevant deductions for details.) In addition, regular U.S. corporations are allowed a deduction o100% of dividends received

from 10% or more foreign subsidiaries

50% of amounts included in income

unde

section 951A

an

37.5% of foreign branch income

Some deductions of corporations are limited at federal or state levels. Limitations apply to items due t

related parties

including interest and royalty expenses.

Estates and trusts

Estates and trusts may bsubject to income tax

at the estate or trust level, or th

beneficiaries may be subject to income tax

on their share of income. Where income must be distributed, the beneficiaries are taxed similarly to partners in a partnership. Where income may be retained, the estate or trust is taxed. It may get a deduction for later distributions of income. Estates and trusts are allowed only those deductions related to producing income, plus $1,000. They are taxed at graduated rates that increase rapidly to the maximum rate for individuals. The tax rate for trust and estate income in excess of $11,500 was 35% for 2009. Estates and trusts are eligible for the reduced rate of tax on dividends and capital gains through 2011.

Tax-exempt entities

U.S. tax law exempts certain types of entities from income and some other taxes. These provisions arose during the late 19th century. Charitable organizations and cooperatives may apply to the IRS forSocial insurance taxes (Social Security tax and Medicare tax, or FICA)

The United States social insurance system is funded by a tax similar to an income tax. Social Security tax of 6.2% is imposed on wages paid to employees. The tax is imposed on both the employer and the employee. The maximum amount of wages subject to the tax for 2020 was $137,700. This amount is indexed for inflation. A companion Medicare Tax of 1.45% of wages is imposed on employers and employees with no limitation. A self-employment tax composed of both the employer and employee amounts (totaling 15.3%) is imposed on self-employed persons.Other tax items

Credits

The federal and state systems offer numerous tax credits for individuals and businesses. Among the key federal credits for individuals are: * Child credit: For 2017, a credit up to $1,000 per qualifying child. For 2018 to 2025, the credit rose to $2,000 per qualifying child but made having aAlternative minimum tax

Taxpayers must pay the higher of the regular income tax or the alternative minimum tax (AMT). Taxpayers who have paid AMT in prior years may claim a credit against regular tax for the prior AMT. The credit is limited so that regular tax is not reduced below current year AMT. AMT is imposed at a nearly flat rate (20% for corporations, 26% or 28% for individuals, estates, and trusts) on taxable income as modified for AMT. Key differences between regular taxable income and AMT taxable income include: *The standard deduction and personal exemptions are replaced by a single deduction, which is phased out at higher income levels, *No deduction is allowed for individuals for state taxes, *Most miscellaneous itemized deductions are not allowed for individuals, *Depreciation deductions are computed differently, and *Corporations must make a complex adjustment to more closely reflect economic income.Special taxes

There are many federal tax rules designed to prevent people from abusing the tax system. Provisions related to these taxes are often complex. Such rules include: *Accumulated earnings tax on corporation accumulations in excess of business needs, * Personal holding company taxes, * Passive foreign investment company rules, and * Controlled foreign corporation provisions.Special industries

Tax rules recognize that some types of businesses do not earn income in the traditional manner and thus require special provisions. For example, insurance companies must ultimately pay claims to some policy holders from the amounts received as premiums. These claims may happen years after the premium payment. Computing the future amount of claims requires actuarial estimates until claims are actually paid. Thus, recognizing premium income as received and claims expenses as paid would seriously distort an insurance company's income. Special rules apply to some or all items in the following industries:Insurance companies

(rules related to recognition of income and expense; different rules apply to life insurance and to property and casualty insurance) *Shipping (rules related to the revenue recognition cycle)

(rules related to expenses for exploration and development and for recovery of capitalized costs) In addition, mutual funds

are subject to special rules allowing them to be taxed only at the owner level. The company must report to each owner his/her share of ordinary income, capital gains, and creditable foreign taxes. The owners then include these items in their own tax calculation. The fund itself is not taxed, and distributions are treated as a

real estate investment trusts

an

State, local and territorial income taxes

Dept of the Interior, Office of Insular Affairs. DOI.gov)

, import/export taxes (Se

Stanford.wellsphere.com)

, federal commodity taxes (Se

Stanford.wellsphere.com)

social security taxes (Se

etc. Residents pay federal

IRS.gov

and Medicare (Se

Reuters.com)

as well as Commonwealth of Puerto Rico income taxes (Se

and ). All federal employees (See , those who do business with the federal government (Se

MCVPR.com)

, Puerto Rico-based corporations that intend to send funds to the U.S. (Se

p. 9, line 1.)

, and some others (For example, Puerto Rican residents that are members of the U.S. military, See ; and Puerto Rico residents who earned income from sources outside Puerto Rico, Se

pp 14–15.)

also pay federal income taxes. In addition, because the cutoff point for income taxation is lower than that of the U.S. IRS code, and because the per-capita income in Puerto Rico is much lower than the average per-capita income on the mainland, more Puerto Rico residents pay income taxes to the local taxation authority than if the IRS code were applied to the island. This occurs because "the Commonwealth of Puerto Rico government has a wider set of responsibilities than do U.S. State and local governments" (Se

GAO.gov

. As residents of Puerto Rico pay into Social Security, Puerto Ricans are eligible for Social Security benefits upon retirement, but are excluded from the Supplemental Security Income (SSI) (Commonwealth of Puerto Rico residents, unlike residents of the Commonwealth of the Northern Mariana Islands and residents of the 50 States, do not receive the SSI. Se

Socialsecurity.gov)

and the island actually receives less than 15% of the

p 252).

In general, "many federal social welfare programs have been extended to Puerto Rican (''sic'') residents, although usually with caps inferior to those allocated to the states." (The Louisiana Purchase and American Expansion: 1803–1898. By Sanford Levinson and Bartholomew H. Sparrow. New York: Rowman and Littlefield Publishers. 2005. Page 167. For a comprehensive coverage of federal programs made extensive to Puerto Rico see Richard Cappalli's Federal Aid to Puerto Rico (1970)). It has also been estimated (Se

that, because the population of the Island is greater than that of 50% of the States, if it were a state, Puerto Rico would have six to eight seats in the House, in addition to the two seats in the Senate.(Se

an

Thomas.gov

Puerto Rico Democracy Act of 2007." These are the steps to follow

THOMAS.gov

> Committee Reports > 110 > drop down "Word/Phrase" and pick "Report Number" > type "597" next to Report Number. This will provide the document "House Report 110-597 - 2007", then from the Table of Contents choose "Background and need for legislation".). Another misconception is that the import/export taxes collected by the U.S. on products manufactured in Puerto Rico are all returned to the Puerto Rico Treasury. This is not the case. Such import/export taxes are returned ''only'' for rum products, and even then the US Treasury keeps a portion of those taxes (See the "House Report 110-597 - Puerto Rico Democracy Act#Puerto Rico Democracy Act of 2007">Puerto Rico Democracy Act of 2007" mentioned above.)

International aspects

The United States imposes tax on all citizens of the United States, including those who are residents of other countries, all individuals who are residents for tax purposes, and domestic corporations, defined as corporations created or organized in the United States or under Federal or state law.

Federal income tax is imposed on citizens, residents, and domestic corporations based on their worldwide income. To mitigate double taxation, a credit is allowed for foreign income taxes. This foreign tax credit is limited to that part of current year tax attributable to foreign source income. Determining such part involves determining the source of income and allocating and apportioning deductions to that income. Many, but not all, tax resident individuals and corporations pay tax on their worldwide income, but few allow a credit for foreign taxes.

In addition, federal income tax may be imposed on non-resident non-citizens as well as foreign corporations on U.S. source income. Federal tax applies to interest, dividends, royalties, and certain other income of nonresident aliens and foreign corporations not effectively connected with a U.S. trade or business at a flat rate of 30%. This rate is often reduced under tax treaties. Foreign persons are taxed on income effectively connected with a U.S. business and gains on U.S. realty similarly to U.S. persons. Nonresident aliens who are present in the United States for a period of 183 days in a given year are subject to U.S. capital gains tax on certain net capital gains realized during that year from sources within the United States. The states tax non-resident individuals only on income earned within the state (wages, etc.), and tax individuals and corporations on business income apportioned to the state.

The United States has income tax treaties wit

The United States imposes tax on all citizens of the United States, including those who are residents of other countries, all individuals who are residents for tax purposes, and domestic corporations, defined as corporations created or organized in the United States or under Federal or state law.

Federal income tax is imposed on citizens, residents, and domestic corporations based on their worldwide income. To mitigate double taxation, a credit is allowed for foreign income taxes. This foreign tax credit is limited to that part of current year tax attributable to foreign source income. Determining such part involves determining the source of income and allocating and apportioning deductions to that income. Many, but not all, tax resident individuals and corporations pay tax on their worldwide income, but few allow a credit for foreign taxes.

In addition, federal income tax may be imposed on non-resident non-citizens as well as foreign corporations on U.S. source income. Federal tax applies to interest, dividends, royalties, and certain other income of nonresident aliens and foreign corporations not effectively connected with a U.S. trade or business at a flat rate of 30%. This rate is often reduced under tax treaties. Foreign persons are taxed on income effectively connected with a U.S. business and gains on U.S. realty similarly to U.S. persons. Nonresident aliens who are present in the United States for a period of 183 days in a given year are subject to U.S. capital gains tax on certain net capital gains realized during that year from sources within the United States. The states tax non-resident individuals only on income earned within the state (wages, etc.), and tax individuals and corporations on business income apportioned to the state.

The United States has income tax treaties witover 65 countries

These treaties reduce the chance of double taxation by allowing each country to fully tax its citizens and residents and reducing the amount the other country can tax them. Generally the treaties provide for reduced rates of tax on investment income and limits as to which business income can be taxed. The treaties each define which taxpayers can benefit from the treaty. U.S. treaties do not apply to income taxes imposed by the states or political subdivisions, except for the non discrimination provisions that appear in almost every treaty. Also, U.S. treaties generally prevent U.S. persons from invoking treaty provisions with respect to U.S. taxes, with certain relatively standard exceptions.

Tax collection and examinations

Tax returns

Individuals (with income above a minimum level), corporations, partnerships, estates, and trusts must file annual reports, called tax returns, with federal and appropriate state tax authorities. These returns vary greatly in complexity level depending on the type of filer and complexity of their affairs. On the return, the taxpayer reports income and deductions, calculates the amount of tax owed, reports payments and credits, and calculates the balance due. Federal individual, estate, and trust income tax returns are due by April 15Publication 509: Tax Calendars for use in 2017U.S. Internal Revenue Service, Cat. No. 15013X for most taxpayers. Corporate and partnership federal returns are due two and one half months following the corporation's year end. Tax exempt entity returns are due four and one half months following the entity's year end. All federal returns may b

with most extensions available by merely filing a single page form. Due dates and extension provisions for state and local income tax returns vary. Income tax returns generally consist of the basic form with attached forms and schedules. Several forms are available for individuals and corporations, depending on the complexity and nature of the taxpayer's affairs. Many individuals are able to use the one pag

Form 1040-EZ

which requires no attachments except wage statements from employers

Forms W-2

. Individuals claiming itemized deductions must complet

Schedule A

Similar schedules apply for interest (Schedule B), dividends (Schedule B), business income (Schedule C), capital gains (Schedule D), farm income (Schedule F), and self-employment tax (Schedule-SE). All taxpayers must file those forms for credits, depreciation, AMT, and other items that apply to them. Electronic filing of tax returns may be done for taxpayers by registered tax preparers. If a taxpayer discovers an error on a return, or determines that tax for a year should be different, the taxpayer should file an amended return. These returns constitute claims for refund if taxes are determined to have been overpaid.

The IRS, state, and local tax authorities may examine a tax return and propose changes. Changes to tax returns may be made with minimal advance involvement by taxpayers, such as changes to wage or dividend income to correct errors. Other examination of returns may require extensive taxpayer involvement, such as an audit by the IRS. These audits often require that taxpayers provide the IRS or other tax authority access to records of income and deductions. Audits of businesses are usually conducted by IRS personnel at the business location.

Changes to returns are subject to appeal by the taxpayer, including going to court. IRS changes are often first issued a

The IRS, state, and local tax authorities may examine a tax return and propose changes. Changes to tax returns may be made with minimal advance involvement by taxpayers, such as changes to wage or dividend income to correct errors. Other examination of returns may require extensive taxpayer involvement, such as an audit by the IRS. These audits often require that taxpayers provide the IRS or other tax authority access to records of income and deductions. Audits of businesses are usually conducted by IRS personnel at the business location.

Changes to returns are subject to appeal by the taxpayer, including going to court. IRS changes are often first issued aproposed adjustments

The taxpayer may agree to the proposal or may advise the IRS why it disagrees. Proposed adjustments are often resolved by the IRS and taxpayer agreeing to what the adjustment should be. For those adjustments to which agreement is not reached, the IRS issues

advising of the adjustment. The taxpayer ma

appeal

this preliminary assessment within 30 days within the IRS. The Appeals Division reviews the IRS field team determination and taxpayer arguments, and often proposes a solution that the IRS team and the taxpayer find acceptable. When an agreement is still not reached, the IRS issues an assessment as a notice of deficiency o

The taxpayer then has three choices: file suit in United States Tax Court without paying the tax, pay the tax and sue for refund in regular court, or simply pay the tax and be done. Recourse to court can be costly and time-consuming but is often successful. IRS computers routinely make adjustments to correct mechanical errors in returns. In addition, the IRS conducts an extensive document matching computer program that compares taxpayer amounts of wages, interest, dividends, and other items to amounts reported by taxpayers. These programs automatically issue 30-day letters advising of proposed changes. Only a very small percentage of tax returns are actually examined. These are selected by a combination of computer analysis of return information and random sampling. The IRS has long maintained

program to identify patterns

on returns most likely to require adjustment. Procedures for examination by state and local authorities vary by jurisdiction.

Tax collection

Taxpayers are required to pay all taxes owed based on the self-assessed tax returns, as adjusted. The IRmay provide time payment plans that include interest and a "penalty" that is merely added interest. Where taxpayers do not pay tax owed, the IRS has strong means to enforce collection. These include the ability to levy bank accounts and seize property. Generally, significant advance notice is given before levy or seizure. However, in certain rarely use

the IRS may immediately seize money and property. The IR

are responsible for most collection activities.

Withholding of tax

Persons paying wages or making certain payments to foreign persons are required to withhold income tax from such payments. Income tax withholding on wages is based odeclarations by employees

an

tables provided by the IRS

Persons paying interest, dividends, royalties, and certain other amounts to foreign persons must also withhold income tax at a flat rate of 30%. This rate may be reduced by a tax treaty. These withholding requirements also apply to non-U.S. financial institutions. Additiona

backup withholding

provisions apply to some payments of interest or dividends to U.S. persons. The amount of income tax withheld is treated as a payment of tax by the person receiving the payment on which tax was withheld. Employers and employees must also pay Social Security tax, the employee portion of which is also to be withheld from wages. Withholding of income and Social Security taxes are often referred to as

Statute of limitations

The IRS is precluded from assessing additional tax after a certain period of time. In the case of federal income tax, this period is generally three years from the later of the due date of the original tax return or the date the original return was filed. The IRS has an additional three more years to make changes if the taxpayer has substantially understated gross income. The period under which the IRS may make changes is unlimited in the case of fraud, or in the case of failure to file a return.Penalties

Taxpayers who fail to file returns, file late, or file returns that are wrong, may be subject to penalties. These penalties vary based on the type of failure. Some penalties are computed as interest, some are fixed amounts, and some are based on other measures. Penalties for filing or paying late are generally based on the amount of tax that should have been paid and the degree of lateness. Penalties for failures related to certain forms are fixed amounts, and vary by form from very small to huge. Intentional failures, including tax fraud, may result in criminal penalties. These penalties may include jail time or forfeiture of property. Criminal penalties are assessed in coordination with theHistory

Constitutional

Article I, Section 8, Clause 1 of the United States Constitution (the " Taxing and Spending Clause"), specifies

Article I, Section 8, Clause 1 of the United States Constitution (the " Taxing and Spending Clause"), specifies Early federal income taxes

The first income tax suggested in the United States was during theProgressive Era

For several years, the issue of an income tax lay unaddressed. In 1906, Presidentp. 18,

There is every reason why, when next our system of taxation is revised, the National Government should impose a graduated inheritance tax, and, if possible, a graduated income tax.During the speech he cited the ''Pollock'' case without naming it specifically. The income tax became an issue again in Roosevelt's later speeches, including the 1907 State of the Union and during the 1912 election campaign. Roosevelt's successor,

Ratification of the Sixteenth Amendment

In response, Congress proposed the Sixteenth Amendment (ratified by the requisite number of states in 1913), which states:

In response, Congress proposed the Sixteenth Amendment (ratified by the requisite number of states in 1913), which states:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.The

Modern interpretation of the power to tax incomes

The modern interpretation of the Sixteenth Amendment taxation power can be found in '' Commissioner v. Glenshaw Glass Co.'' . In that case, a taxpayer had received an award of punitive damages from a competitor for antitrust violations and sought to avoid paying taxes on that award. The Court observed that Congress, in imposing the income tax, had definedgains, profits, and income derived from salaries, wages or compensation for personal service ... of whatever kind and in whatever form paid, or from professions, vocations, trades, businesses, commerce, or sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property; also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, or gains or profits and income derived from any source whatever.348 U.S.(Note: The ''Glenshaw Glass'' case was an interpretation of the definition of "gross income" in section 22 of the Internal Revenue Code of 1939. The successor to section 22 of the 1939 Code is section 61 of the current Internal Revenue Code of 1986, as amended.) The Court held that "this language was used by Congress to exert in this field the full measure of its taxing power", id., and that "the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted." The Court then enunciated what is now understood by Congress and the Courts to be the definition of taxable income, "instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Id. at 431. The defendant in that case suggested that a 1954 rewording of the tax code had limited the income that could be taxed, a position which the Court rejected, stating:

The definition of gross income has been simplified, but no effect upon its present broad scope was intended. Certainly punitive damages cannot reasonably be classified as gifts, nor do they come under any other exemption provision in the Code. We would do violence to the plain meaning of the statute and restrict a clear legislative attempt to bring the taxing power to bear upon all receipts constitutionally taxable were we to say that the payments in question here are not gross income.Tax statutes passed after the ratification of the Sixteenth Amendment in 1913 are sometimes referred to as the "modern" tax statutes. Hundreds of Congressional acts have been passed since 1913, as well as several codifications (i.e., topical reorganizations) of the statutes (see Codification). In ''Central Illinois Public Service Co. v. United States'', , the U.S. Supreme Court confirmed that wages and income are not identical as far as taxes on income are concerned, because income not only ''includes'' wages, but any ''other'' gains as well. The Court in that case noted that in enacting taxation legislation, Congress "chose not to return to the inclusive language of the Tariff Act of 1913, but, specifically, 'in the interest of simplicity and ease of administration,' confined the ''obligation to withhold'' ncome taxesto 'salaries, wages, and other forms of compensation for personal services and that "committee reports ... stated consistently that 'wages' meant remuneration 'if paid for services performed by an employee for his employer. Other courts have noted this distinction in upholding the taxation not only of wages, but also of personal gain derived from ''other'' sources, recognizing some limitation to the reach of income taxation. For example, in ''Conner v. United States'', 303 F. Supp. 1187 (S.D. Tex. 1969), ''aff'd in part and rev'd in part'', 439 F.2d 974 (5th Cir. 1971), a couple had lost their home to a fire, and had received compensation for their loss from the insurance company, partly in the form of hotel costs reimbursed. The court acknowledged the authority of the IRS to assess taxes on all forms of payment, but did not permit taxation on the compensation provided by the insurance company, because unlike a wage or a sale of goods at a profit, this was not a gain. As the Court noted, "Congress has taxed income, not compensation". By contrast, other courts have interpreted the Constitution as providing even broader taxation powers for Congress. In '' Murphy v. IRS'', the United States Court of Appeals for the District of Columbia Circuit upheld the federal income tax imposed on a monetary settlement recovery that the same court had previously indicated was not income, stating: " though the 'Congress cannot make a thing income which is not so in fact,'... it can ''label'' a thing income and tax it, so long as it acts within its constitutional authority, which includes not only the Sixteenth Amendment but also Article I, Sections 8 and 9." Similarly, in ''Penn Mutual Indemnity Co. v. Commissioner'', the United States Court of Appeals for the Third Circuit indicated that Congress could properly impose the federal income tax on a receipt of money, regardless of what that receipt of money is called:

It could well be argued that the tax involved here n income taxis an "excise tax" based upon the receipt of money by the taxpayer. It certainly is not a tax on property and it certainly is not a capitation tax; therefore, it need not be apportioned. ... Congress has the power to impose taxes generally, and if the particular imposition does not run afoul of any constitutional restrictions then the tax is lawful, call it what you will.

Income tax rates in history

History of top rates

* In 1913, the top tax rate was 7% on incomes above $500,000 (equivalent to $ in dollars) and a total of $28.3 million was collected.

* During

* In 1913, the top tax rate was 7% on incomes above $500,000 (equivalent to $ in dollars) and a total of $28.3 million was collected.

* During Federal income tax rates

Federal and state income tax rates have varied widely since 1913. For example, in 1954, the federal income tax was based on layers of 24 income brackets at tax rates ranging from 20% to 91% (for a chart, see Internal Revenue Code of 1954). Below is a table of historical marginal income tax rates for married filing jointly tax payers at stated income levels. These income numbers are not the amounts used in the tax laws at the time.Controversies

The complexity of the U.S. income tax laws

United States tax law attempts to define a comprehensive system of measuring income in a complex economy. Many provisions defining income or granting or removing benefits require significant definition of terms. Further, many state income tax laws do not conform with federal tax law in material respects. These factors and others have resulted in substantial complexity. Even venerable legal scholars like Judge Learned Hand have expressed amazement and frustration with the complexity of the U.S. income tax laws. In the article, ''Thomas Walter Swan'', 57 Yale Law Journal No. 2, 167, 169 (December 1947), Judge Hand wrote:In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession: cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer eno handle to seize hold of nd thatleave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegel: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.Complexity is a separate issue from flatness of rate structures. Also, in the United States, income tax laws are often used by legislatures as policy instruments for encouraging numerous undertakings deemed socially useful — including the buying of life insurance, the funding of employee health care and pensions, the raising of children, home ownership, and the development of alternative energy sources and increased investment in conventional energy. Special tax provisions granted for any purpose increase complexity, irrespective of the system's flatness or lack thereof.

Proposals for changes of income taxation

Proposals have been made frequently to change tax laws, often with the backing of specific interest groups. Organizations making such proposals include Citizens for Tax Justice, Americans for Tax Reform, Americans for Tax Fairness, Citizens for an Alternative Tax System, Americans For Fair Taxation, and FreedomWorks. Various proposals have been put forth for tax simplification in Congress including the '' Fair Tax Act'' and variousAlternatives

Proponents of aTaxation vs. the states

Some economists believe income taxation offers the federal government a technique to diminish the power of the states, because the federal government is then able to distribute funding to states with conditions attached, often giving the states no choice but to submit to federal demands.Tax protestors

Numerous tax protester arguments have been raised asserting that the federal income tax is unconstitutional, including discredited claims that the Sixteenth Amendment was not properly ratified. All such claims have been repeatedly rejected by the federal courts as frivolous.Distribution

In the United States, a progressive tax system is employed which equates to higher income earners paying a larger percentage of their income in taxes. According to the IRS, the top 1% of income earners for 2008 paid 38% of income tax revenue, while earning 20% of the income reported. The top 5% of income earners paid 59% of the total income tax revenue, while earning 35% of the income reported. The top 10% paid 70%, earning 46% and the top 25% paid 86%, earning 67%. The top 50% paid 97%, earning 87% and leaving the bottom 50% paying 3% of the taxes collected and earning 13% of the income reported.

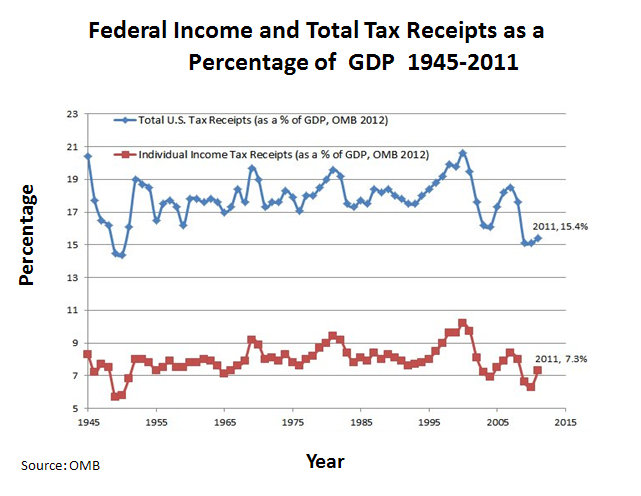

From 1979 to 2007 the average federal income tax rate fell 110% for the second lowest quintile, 56% for the middle quintile, 39% for the fourth quintile, 8% for the highest quintile, and 15% for the top 1%, with the bottom quintile moving from a tax rate of zero to negative liability. Despite this, individual income tax revenue only dropped from 8.7 to 8.5% of GDP over that time, and total federal revenue was 18.5% of GDP in both 1979 and 2007, above the postwar average of 18%. Tax code changes have dropped millions of lower earning people from the federal income tax rolls in recent decades. Those with zero or negative liability who were not claimed as dependents by a payer increased from 14.8% of the population in 1984 to 49.5% in 2009.

While there is consensus that overall federal taxation is progressive, there is dispute over whether progressivity has increased or decreased in recent decades, and by how much. The total effective federal tax rate for the top 0.01% of income earners declined from around 75% to around 35% between 1960 and 2005. Total effective federal tax rates fell from 19.1% to 12.5% for the three middle quintiles between 1979 and 2010, from 27.1% to 24% for the top quintile, from 7.5% to 1.5% for the bottom quintile, and from 35.1% to 29.4% for the top 1%.

A 2008

In the United States, a progressive tax system is employed which equates to higher income earners paying a larger percentage of their income in taxes. According to the IRS, the top 1% of income earners for 2008 paid 38% of income tax revenue, while earning 20% of the income reported. The top 5% of income earners paid 59% of the total income tax revenue, while earning 35% of the income reported. The top 10% paid 70%, earning 46% and the top 25% paid 86%, earning 67%. The top 50% paid 97%, earning 87% and leaving the bottom 50% paying 3% of the taxes collected and earning 13% of the income reported.

From 1979 to 2007 the average federal income tax rate fell 110% for the second lowest quintile, 56% for the middle quintile, 39% for the fourth quintile, 8% for the highest quintile, and 15% for the top 1%, with the bottom quintile moving from a tax rate of zero to negative liability. Despite this, individual income tax revenue only dropped from 8.7 to 8.5% of GDP over that time, and total federal revenue was 18.5% of GDP in both 1979 and 2007, above the postwar average of 18%. Tax code changes have dropped millions of lower earning people from the federal income tax rolls in recent decades. Those with zero or negative liability who were not claimed as dependents by a payer increased from 14.8% of the population in 1984 to 49.5% in 2009.

While there is consensus that overall federal taxation is progressive, there is dispute over whether progressivity has increased or decreased in recent decades, and by how much. The total effective federal tax rate for the top 0.01% of income earners declined from around 75% to around 35% between 1960 and 2005. Total effective federal tax rates fell from 19.1% to 12.5% for the three middle quintiles between 1979 and 2010, from 27.1% to 24% for the top quintile, from 7.5% to 1.5% for the bottom quintile, and from 35.1% to 29.4% for the top 1%.

A 2008 OECD Publishing, , 2008, pgs. 103, 104.

Effects on income inequality

According to the CBO, U.S. federal tax policies substantially reduce income inequality measured after taxes. Taxes became less progressive (i.e., they reduced income inequality relatively less) measured from 1979 to 2011. The tax policies of the mid-1980s were the least progressive period since 1979. Government transfer payments contributed more to reducing inequality than taxes.See also

*Explanatory notes

References

Further reading

Government sources: *IRPublication 17

Your Federal Income Tax *IR

Publication 334

Tax Guide for Small Business *IR

Publication 509

Tax Calendar *IR

Publication 541

Partnerships *IR

Publication 542

Corporations *IR

Publication 544

Sales and Other Dispositions of Assets *IR

Publication 556

Examination of Returns, Appeal Rights, and Claims for Refund *IR

*'

IRS videos on tax topics

'' *IR

links to state websites

Law & regulations:

Texts: *Fox, Stephen C, ''Income Tax in the USA''. 2013 edition , . *Hoffman, William H. Jr.; Willis, Eugene; ''et al.'', ''South-Western Federal Taxation''. 2013 edition , . *Pratt, James W.; Kulsrud, William N.; ''et al.'', ''Federal Taxation''. 2013 edition . *Whittenberg, Gerald; Altus-Buller, Martha; Gill, Stephen, ''Income Tax Fundamentals 2010''. 2013 edition , . History: * Buenker, John D. ''The Income Tax and the Progressive Era'' (Routledge, 2018

excerpt

* Ellis, Elmer. "Public Opinion and the Income Tax, 1860-1900." ''Mississippi Valley Historical Review'' 27.2 (1940): 225-24

online

* Ratner, Sidney. ''American Taxation: Its History as a Social Force in Democracy'' (1942

online

* Thorndike, Joseph J. ''Their Fair Share: Taxing the Rich in the Age of FDR.'' Washington, DC: Urban Institute, 2013. * Reference works (annual): *CCH ''U.S. Master Tax Guide, 2013'' *RIA ''Federal Tax Handbook 2013'' *Dauchy, E. P., & Balding, C. (2013). Federal Income Tax Revenue Volatility Since 1966. Working Papers w0198, Center for Economic and Financial Research (CEFIR). ''Available a

SSRN 2351376

'. Consumer publications (annual): *''J.K. Lasser's Your Income Tax for 2013'' , *''Ernst & Young Tax Guide 2013'' , {{DEFAULTSORT:Income Tax In The United States