|

Cafeteria Plan

A cafeteria plan or cafeteria system is a type of employee benefit plan offered in the United States pursuant to Section 125 of the Internal Revenue Code. Its name comes from the earliest versions of such plans, which allowed employees to choose between different types of benefits, similar to the ability of a customer to choose among available items in a cafeteria. Qualified cafeteria plans are excluded from gross income. To qualify, a cafeteria plan must allow employees to choose from two or more benefits consisting of cash or qualified benefit plans. The Internal Revenue Code explicitly excludes deferred compensation plans from qualifying as a cafeteria plan subject to a gross income exemption. Section 125 also provides two exceptions. If the cafeteria plan discriminates in favor of highly compensated employees, the highly compensated employees will be required to report their cafeteria plan benefits as income. The second exception is that if "the statutory nontaxable benefi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employee Benefit

Employment is a relationship between two party (law), parties Regulation, regulating the provision of paid Labour (human activity), labour services. Usually based on a employment contract, contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wage, wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuity, gratuities, bonus payments or employee stock option, stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, and disability insurance. Employment is typically governed by Labour law, employment laws, o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cafeteria

A cafeteria, called canteen outside the U.S., is a type of food service location in which there is little or no waiting staff table service, whether in a restaurant or within an institution such as a large office building or school; a school dining location is also referred to as a dining hall or lunchroom (in American English). Cafeterias are different from coffeehouses, although the English term came from the Spanish term ''cafetería'', which carries the same meaning. Instead of table service, there are food-serving counters/stalls or booths, either in a line or allowing arbitrary walking paths. Customers take the food that they desire as they walk along, placing it on a tray. In addition, there are often stations where customers order food, particularly items such as hamburgers or tacos which must be served hot and can be immediately prepared with little waiting. Alternatively, the patron is given a number and the item is brought to their table. For some food items ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Income

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes and other deductions (e.g., mandatory pension contributions). For a business, gross income (also gross profit, sales profit, or credit sales) is the difference between revenue and the cost of making a product or providing a service, before deducting overheads, payroll, taxation, and interest payments. This is different from operating profit (earnings before interest and taxes). Gross margin is often used interchangeably with gross profit, but the terms are different. When speaking about a monetary amount, it is technically correct to use the term "gross profit", but when referring to a percentage or ratio, it is correct to use "gross margin". Relationship with other accounting terms The various deductions (and their corresponding me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deferred Compensation

Deferred compensation is an arrangement in which a portion of an employee's wage is paid out at a later date after which it was earned. Examples of deferred compensation include pensions, retirement plans, and employee stock options. The primary benefit of most deferred compensation is the deferral of tax to the date(s) at which the employee receives the income. United States In the US, Internal Revenue Code section 409A regulates the treatment for federal income tax purposes of "non-qualified deferred compensation", the timing of deferral elections, and of distributions. While technically "deferred compensation" is any arrangement where an employee receives wages after they have earned them, the more common use of the phrase refers to "non-qualified" deferred compensation and a specific part of the tax code that provides a special benefit to corporate executives and other highly compensated corporate employees. Non-qualifying Deferred compensation is a written agreement betw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flexible Spending Account

In the United States, a flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts, resulting in payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are forfeited to the employer, known as the "use it or lose it" rule. Under the terms of the Affordable Care Act however a plan may permit an employee to carry over up to $660 into the following year without losing the funds but this does not apply to all plans and some plans may have lower limits. The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a Health Reimbursement Account, health reimbursement account (HRA). However, while HSAs and HRAs are almost exclusively used as components of a consumer-driven health care plan, medical FSAs are commonly offered with more traditional health plans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Fle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Unemployment Tax Act

The Federal Unemployment Tax Act (or FUTA, ) is a United States federal law that imposes a federal employer tax used to help fund state workforce agencies. Employers report this tax by filing Internal Revenue Service Form 940 annually. In some cases, employers are required to pay the tax in installments during the tax year. FUTA covers a federal share of unemployment insurance (UI) and job service program administration costs in every state. In addition, FUTA pays one-half the cost of extended unemployment benefits during periods of high unemployment. It also provides a fund that states can borrow from when necessary to pay benefits. Legal basis The legality of FUTA has been affirmed in the 1937 Supreme Court case '' Steward Machine Co. v. Davis''. Amount of tax Until June 30, 2011, the Federal Unemployment Tax Act imposed a tax of 6.2%, which was composed of a permanent rate of 6.0% and a temporary rate of 0.2%, which was passed by Congress in 1976. The temporary rate was exten ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acne Vulgaris

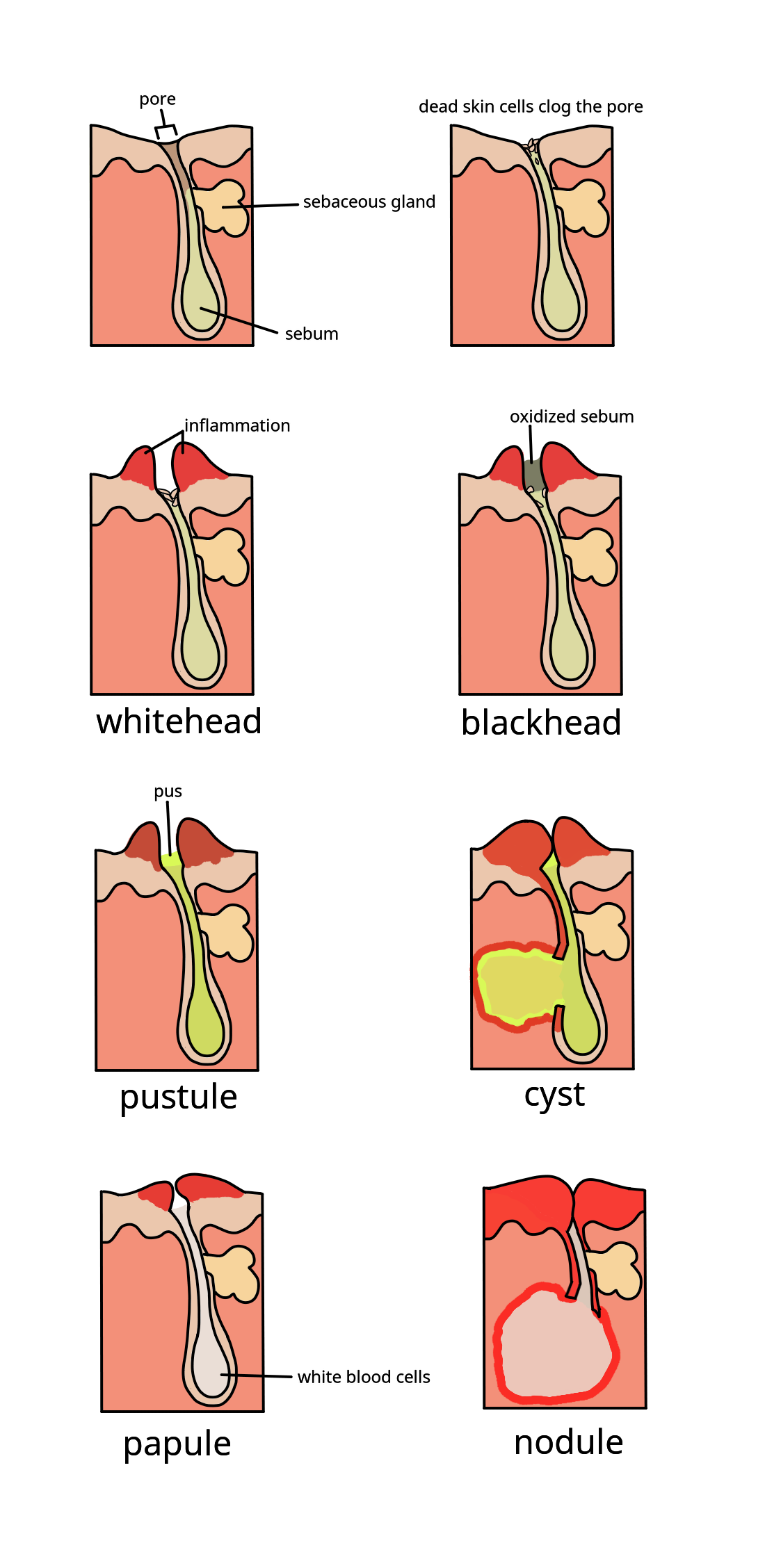

Acne ( ), also known as ''acne vulgaris'', is a long-term Cutaneous condition, skin condition that occurs when Keratinocyte, dead skin cells and Sebum, oil from the skin clog hair follicles. Typical features of the condition include comedo, blackheads or whiteheads, pimples, oily skin, and possible scarring. It primarily affects skin with a relatively high number of sebaceous gland, oil glands, including the face, upper part of the chest, and back. The resulting appearance can lead to lack of confidence, anxiety (mood), anxiety, reduced self-esteem, and, in extreme cases, clinical depression, depression or suicidal ideations, thoughts of suicide. Susceptibility to acne is primarily genetic in 80% of cases. The roles of diet and cigarette smoking in the condition are unclear, and neither hygiene, cleanliness nor exposure to sunlight are associated with acne. In both sexes, hormones called androgens appear to be part of the underlying mechanism, by causing increased production ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lactose Intolerance

Lactose intolerance is caused by a lessened ability or a complete inability to digest lactose, a sugar found in dairy products. Humans vary in the amount of lactose they can tolerate before symptoms develop. Symptoms may include abdominal pain, bloating, diarrhea, flatulence, and nausea. These symptoms typically start thirty minutes to two hours after eating or drinking something containing lactose, with the severity typically depending on the amount consumed. Lactose intolerance does not cause damage to the gastrointestinal tract. Lactose intolerance is due to the lack of the enzyme lactase in the small intestines to break lactose down into glucose and galactose. There are four types: primary, secondary, developmental, and congenital. Primary lactose intolerance occurs as the amount of lactase declines as people grow up. Secondary lactose intolerance is due to injury to the small intestine. Such injury could be the result of infection, celiac disease, inflammatory bowel disea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll Taxes In The United States

Payroll taxes are taxes imposed on employers or employees. They are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true Tax incidence, economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education. National payroll tax systems Australia The Australian federal government (Australian Taxation Office, ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as Pay-as-you-go tax, pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |