Automatic stabilizer on:

[Wikipedia]

[Google]

[Amazon]

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly

Analysis conducted by the

Analysis conducted by the

income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

es and welfare spending, that act to damp out fluctuations in real GDP

Real gross domestic product (real GDP) is a macroeconomic measure of the value of economic output adjusted for price changes (i.e. inflation or deflation). This adjustment transforms the money-value measure, nominal GDP, into an index for quantit ...

.

The size of the government budget deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''g ...

tends to increase when a country enters a recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier effect

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable.

For example, suppose variable ''x''

changes by ''k'' units, which causes an ...

. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP.

Induced taxes

Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, and governmenttax revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resour ...

s fall as well. This change in tax revenue occurs because of the way modern tax systems are generally constructed.

*Income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

es are generally at least somewhat progressive. This means that as household incomes fall during a recession, households pay lower rates on their incomes as income tax. Therefore, income tax revenue tends to fall faster than the fall in household income.

* Corporate tax is generally based on profits, rather than revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive reven ...

. In a recession profits tend to fall much faster than revenue. Therefore, a company pays much less tax while having slightly less economic activity.

* Sales tax depends on the dollar volume of sales, which tends to fall during recessions.

If national income rises, by contrast, then tax revenues will rise. During an economic boom, tax revenue is higher and in a recession tax revenue is lower, not only in absolute terms but as a proportion of national income.

Some other forms of taxation do not exhibit these effects, if they bear no relation to income (e.g. poll taxes

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources.

Head taxes were important sources of revenue for many governments f ...

, export tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and pol ...

s or property tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inhe ...

es).

Transfer payments

Most governments also payunemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

and welfare benefits

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifical ...

. Generally speaking, the number of unemployed people and those on low incomes who are entitled to other benefits increases in a recession and decreases in a boom. As a result, government expenditure increases automatically in recessions and decreases automatically in booms in absolute terms. Since output increases in booms and decreases in recessions, expenditure is expected to increase as a share of income in recessions and decrease as a share of income in booms.

Incorporated into the expenditure multiplier

This section incorporates automatic stabilization into a broadlyKeynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

multiplier model.

*MPC = Marginal propensity to consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes and ...

(fraction of incremental income spent on domestic consumption)

*T = Marginal (induced) tax rate (fraction of incremental income that is paid in taxes)

*MPI = Marginal Propensity to Import (fraction of incremental income spent on imports)

Holding all other things constant, ceteris paribus, the greater the level of taxes, or the greater the MPI then the value of this multiplier will drop. For example, lets assume that:

:→ ''MPC'' = 0.8

:→ ''T'' = 0

:→ ''MPI'' = 0.2

Here we have an economy with zero marginal taxes and zero transfer payments. If these figures were substituted into the multiplier formula, the resulting figure would be 2.5. This figure would give us the instance where a (for instance) $1 billion change in expenditure would lead to a $2.5 billion change in equilibrium real GDP.

Lets now take an economy where there are positive taxes (an increase from 0 to 0.2), while the MPC and MPI remain the same:

:→ ''MPC'' = 0.8

:→ ''T'' = 0.2

:→ ''MPI'' = 0.2

If these figures were now substituted into the multiplier formula, the resulting figure would be 1.79. This figure would give us the instance where, again, a $1 billion change in expenditure would now lead to only a $1.79 billion change in equilibrium real GDP.

This example shows us how the multiplier is lessened by the existence of an automatic stabilizer and thus helping to lessen the fluctuations in real GDP as a result of changes in expenditure. Not only does this example work with changes in T, it would also work by changing the MPI while holding MPC and T constant as well.

There is broad consensus among economists that automatic stabilizers often exist and function in the short term.

Additionally, imports

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade.

In international trade, the importation and exportation of goods are limited ...

often tend to decrease in a recession, meaning more of the national income is spent at home rather than abroad. This also helps stabilize the economy.

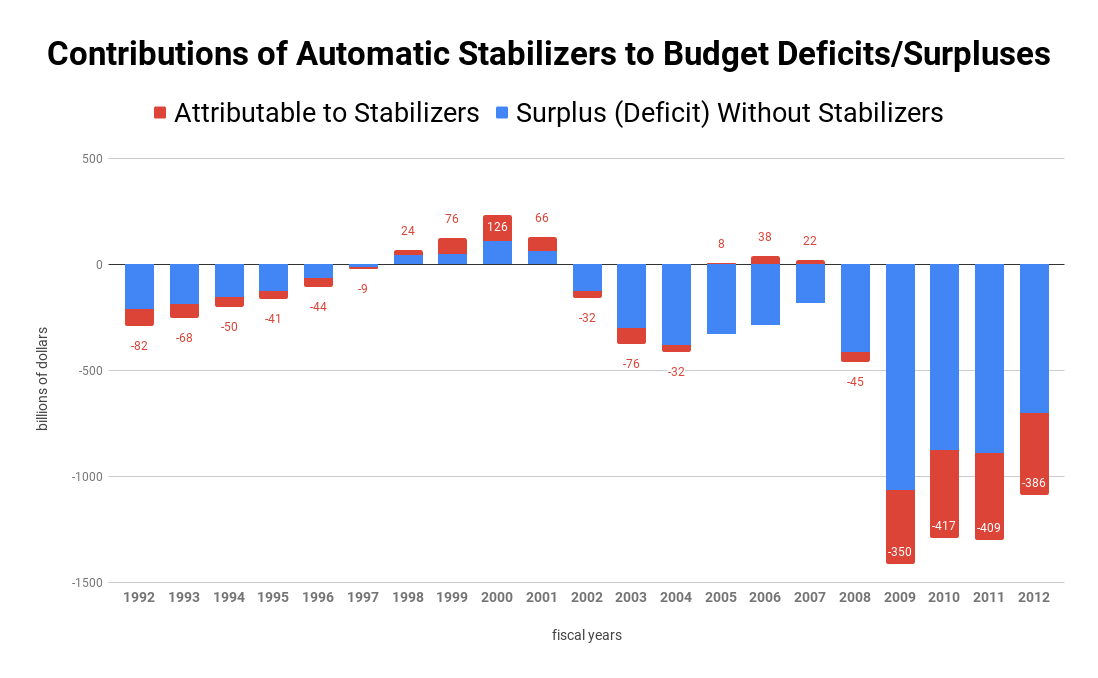

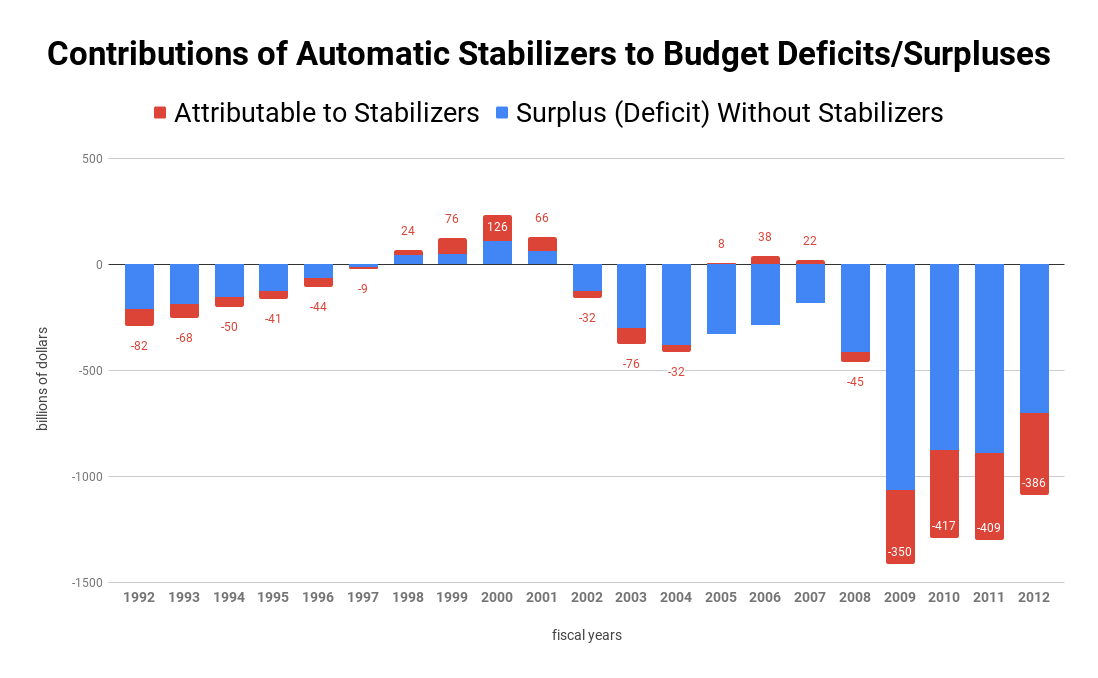

Estimated effects

Analysis conducted by the

Analysis conducted by the Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

in 2013 estimated the effects of automatic stabilizers on budget deficits and surpluses in each fiscal year since 1960. The analysis found, for example, that stabilizers increased the deficit by 32.9% in fiscal 2009, as the deficit soared to $1.4 trillion as a result of the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

, and by 47.6% in fiscal 2010. Stabilizers increased deficits in 30 of the 52 years from 1960 through 2012. In each of the five surplus years during the period, stabilizers contributed to the surplus; the $3 billion surplus in 1969 would have been a $13 billion deficit if not for stabilizers, and 60% of the 1999 $126 billion surplus was attributed to stabilizers.''The Effects of Automatic Stabilizers on the Federal Budget as of 2013'', pp.6-7: https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/reports/43977_AutomaticStablilizers_one-column.pdf

See also

* Negative feedbackReferences

{{Authority control Economics effects Macroeconomic policy