History of taxation in the United States on:

[Wikipedia]

[Google]

[Amazon]

The history of taxation in the United States begins with the colonial protest against British taxation policy in the 1760s, leading to the

Federal

Federal

In response to the Supreme Court decision in the ''Pollock'' case, Congress proposed the Sixteenth Amendment, which was ratified in 1913, and which states:

In response to the Supreme Court decision in the ''Pollock'' case, Congress proposed the Sixteenth Amendment, which was ratified in 1913, and which states:

Congress re-adopted the income tax in 1913, levying a 1% tax on net personal incomes above $3,000, with a 6%

Congress re-adopted the income tax in 1913, levying a 1% tax on net personal incomes above $3,000, with a 6%

Before the

Before the

online

* Buenker, John D. "The ratification of the federal income tax amendment." ''Cato Journal''. 1 (1981): 183-223. * Buenker, John D. ''The Income Tax and the Progressive Era'' (Routledge, 2018

excerpt

* Burg, David F. ''A World History of Tax Rebellions: An Encyclopedia of Tax Rebels, Revolts, and Riots from Antiquity to the Present'' (2003

excerpt and text search

* * Ellis, Elmer. "Public Opinion and the Income Tax, 1860-1900." ''Mississippi Valley Historical Review'' 27.2 (1940): 225-24

online

* Mehrotra, Ajay K. " ‘More mighty than the waves of the sea’: toilers, tariffs, and the income tax movement, 1880–1913," ''Labor History'' (2004), 45:2, 165-198, DOI: 10.1080/0023656042000217246 * * Ratner, Sidney. ''American Taxation: Its History as a Social Force in Democracy'' (1942

online

* Shepard, Christopher. ''The Civil War Income Tax and the Republican Party, 1861–1872''. (New York: Algora Publishing, 2010

excerpt

* Stabile, Donald. ''The Origins of American Public Finance: Debates over Money, Debt, and Taxes in the Constitutional Era, 1776–1836'' (1998

excerpt and text search

* Thorndike, Joseph J. ''Their Fair Share: Taxing the Rich in the Age of FDR.'' Washington, DC: Urban Institute, 2013. * {{cite book , last1=Weisman , first1=Steven R. , title=The Great Tax Wars: Lincoln to Wilson-The Fierce Battles over Money That Transformed the Nation , date=2002 , publisher=Simon & Schuster , isbn=0-684-85068-0 , url=https://archive.org/details/greattaxwars00weis Economic history of the United States

American Revolution

The American Revolution (1765–1783) was a colonial rebellion and war of independence in which the Thirteen Colonies broke from British America, British rule to form the United States of America. The revolution culminated in the American ...

. The independent nation collected taxes on imports ( "tariffs"), whiskey

Whisky or whiskey is a type of liquor made from Fermentation in food processing, fermented grain mashing, mash. Various grains (which may be Malting, malted) are used for different varieties, including barley, Maize, corn, rye, and wheat. Whisky ...

, and (for a while) on glass windows. States and localities collected poll taxes

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources. ''Poll'' is an archaic term for "head" or "top of the head". The sen ...

on voters and property taxes on land and commercial buildings. In addition, there were the state and federal excise taxes. State and federal inheritance taxes began after 1900, while the states (but not the federal government) began collecting sales taxes in the 1930s. The United States imposed income taxes

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

briefly during the Civil War and the 1890s. In 1913, the Sixteenth Amendment was ratified, allowing Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

to levy an income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

on individuals and entities.

Colonial taxation

Taxes were low at the local, colonial, and imperial levels throughout the colonial era. The issue that led to the Revolution was whether Parliament had the right to impose taxes on the Americans when they were not represented in Parliament.Influential colonial taxation policies

Stamp Act 1765

TheStamp Act 1765

The Stamp Act 1765, also known as the Duties in American Colonies Act 1765 (5 Geo. 3. c. 12), was an Act of Parliament (United Kingdom), act of the Parliament of Great Britain which imposed a direct tax on the British America, British coloni ...

was the fourth Stamp Act to be passed by the Parliament of Great Britain and required all legal documents, permits, commercial contracts, newspapers, wills, pamphlets, and playing cards in the American colonies to carry a tax stamp. It was enacted on November 1, 1765, at the end of the Seven Years' War between the French and the British, a war that started with the young officer George Washington attacking a French outpost. The stamp tax had the scope of defraying the cost of maintaining the military presence protecting the colonies. Americans rose in strong protest, arguing in terms of " No Taxation without Representation". Boycotts forced Britain to repeal the stamp tax, while convincing many British leaders it was essential to tax the colonists on something to demonstrate the sovereignty of Parliament.

Townshend Revenue Act

The Townshend Revenue Act were two tax laws passed by Parliament in 1767; they were proposed byCharles Townshend

Charles Townshend (27 August 1725 – 4 September 1767) was a British politician who held various titles in the Parliament of Great Britain. His establishment of the controversial Townshend Acts is considered one of the key causes of the Amer ...

, Chancellor of the Exchequer

The chancellor of the exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and the head of HM Treasury, His Majesty's Treasury. As one of the four Great Offices of State, t ...

. They placed a tax on common products imported into the American Colonies, such as lead, paper, paint, glass, and tea. In contrast to the Stamp Act 1765

The Stamp Act 1765, also known as the Duties in American Colonies Act 1765 (5 Geo. 3. c. 12), was an Act of Parliament (United Kingdom), act of the Parliament of Great Britain which imposed a direct tax on the British America, British coloni ...

, the laws were not a direct tax that people paid daily, but a tax on imports that was collected from the ship's captain when he unloaded the cargo. The Townshend Acts also created three new admiralty court

Admiralty courts, also known as maritime courts, are courts exercising jurisdiction over all admiralty law, maritime contracts, torts, injuries, and offenses.

United Kingdom England and Wales

Scotland

The Scottish court's earliest records, ...

s to try Americans who ignored the laws.

Sugar Act 1764

The tax on sugar, cloth, and coffee. These were non-British exports.Boston Tea Party

The Boston Tea Party was an act ofprotest

A protest (also called a demonstration, remonstration, or remonstrance) is a public act of objection, disapproval or dissent against political advantage. Protests can be thought of as acts of cooperation in which numerous people cooperate ...

by the American colonists against Great Britain

Great Britain is an island in the North Atlantic Ocean off the north-west coast of continental Europe, consisting of the countries England, Scotland, and Wales. With an area of , it is the largest of the British Isles, the List of European ...

for the Tea Act in which they dumped many chests of tea into Boston Harbor. The cuts to taxation on tea undermined American smugglers, who destroyed the tea in retaliation for its exemption from taxes. Britain reacted harshly, and the conflict escalated to war in 1775.

Capitation tax

Capitation taxes, also known aspoll taxes

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources. ''Poll'' is an archaic term for "head" or "top of the head". The sen ...

, were initially created in the 1890s. Poll taxes are a fixed tax on individuals, regardless of income; voters must pay the tax before they are permitted to cast a ballot. These taxes were occasionally paired with literacy tests to prove qualification to vote.

Revenue from poll taxes acted as a major source of funding for state governments. To increase this revenue, poll taxes were also frequently extended to the process of obtaining hunting, fishing, and driving licenses.

Poll taxes were a prerequisite to voting registration in many states. Often, legislatures required the tax to be paid on a day separate from the polls. Voters were then required to bring proof of payment on election day. This caused issues for various workers that had to move frequently and were unable to maintain proper bookkeeping.

These taxes were widely utilized as a form of voter prevention in southern states after the abolition of slavery. They were introduced as part of the Jim Crow laws

The Jim Crow laws were U.S. state, state and local laws introduced in the Southern United States in the late 19th and early 20th centuries that enforced Racial segregation in the United States, racial segregation, "Jim Crow (character), Ji ...

to deter black Americans from voting. However, capitation tax laws did not directly state a specific group of people and the tax requirements applied to all races and both sexes. Therefore, poll taxes were also often used to discriminate against women who attempted to vote. Some poor white male voters were deemed exempt from poll taxes via grandfather clause if they had an ancestor who could vote prior to the Civil War.

The Twenty-Fourth Amendment terminated the use of poll taxes in federal elections in 1964. Alabama, Arkansas, Mississippi, Texas, and Virginia continued to utilize poll taxes for state elections until '' Harper v. Virginia Board of Elections'', a U.S. Supreme Court case held in 1966. The court ruled that capitation taxes enforced in state elections are also unconstitutional.

Tariffs

Income for federal government

Tariffs have played different parts intrade policy

A commercial policy (also referred to as a trade policy or international trade policy) is a government's policy governing international trade. Commercial policy is an all encompassing term that is used to cover topics which involve international ...

and the economic history of the United States. Tariffs were the largest source of federal revenue from the 1790s to the eve of World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

until it was surpassed by income taxes. Since the revenue from the tariff was considered essential and easy to collect at the major port

A port is a maritime facility comprising one or more wharves or loading areas, where ships load and discharge cargo and passengers. Although usually situated on a sea coast or estuary, ports can also be found far inland, such as Hamburg, Manch ...

s, it was agreed the nation should have a tariff for revenue purposes.

Protectionism

Another role the tariff played was in the protection of local industry; it was the political dimension of the tariff. From the 1790s to the present day, the tariff (and closely related issues such as import quotas andtrade

Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. Economists refer to a system or network that allows trade as a market.

Traders generally negotiate through a medium of cr ...

treaties) generated enormous political stresses. These stresses lead to the Nullification crisis during the 19th century, and the creation of the World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization headquartered in Geneva, Switzerland that regulates and facilitates international trade. Governments use the organization to establish, revise, and enforce the rules that g ...

.

Origins of protectionism

WhenAlexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

was the United States Secretary of the Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal a ...

he issued the Report on Manufactures, which reasoned that applying tariffs in moderation, in addition to raising revenue to fund the federal government, would also encourage domestic manufacturing and growth of the economy by applying the funds raised in part towards subsidies (called bounties in his time) to manufacturers. The main purposes sought by Hamilton through the tariff were to: (1) protect American infant industry for a short term until it could compete; (2) raise revenue to pay the expenses of government; (3) raise revenue to directly support manufacturing through bounties (subsidies). This resulted in the passage of three tariffs by Congress, the Tariff of 1789, the Tariff of 1790, and the Tariff of 1792 which progressively increased tariffs.

Sectionalism

Tariffs contributed to sectionalism between the North and the South. The Tariff of 1824 increased tariffs to protect the American industry in the face of cheaper imported commodities such as iron products, wool, and cotton textiles, and agricultural goods from England. This tariff was the first in which the sectional interests of the North and the South truly came into conflict because the South advocated lower tariffs to take advantage of tariff reciprocity from England and other countries that purchased raw agricultural materials from the South. The Tariff of 1828, also known as the Tariff of Abominations, and the Tariff of 1832 accelerated sectionalism between the North and the South. For a brief moment in 1832, South Carolina made vague threats to leave the Union over the tariff issue. Tariff of 1832 In 1833, to ease North-South relations, Congress lowered the tariffs. In the 1850s, the South gained greater influence over tariff policy and made subsequent reductions. In 1861, just before the Civil War, Congress enacted the Morrill Tariff, which applied high rates and inaugurated a period of relatively continuous trade protection in the United States that lasted until theUnderwood Tariff

The Revenue Act of 1913, also known as the Tariff Act of 1913, Underwood Tariff or the Underwood–Simmons Act (ch. 16, ), re-established a federal income tax in the United States and substantially lowered tariffs in United States history, tariff ...

of 1913. The schedule of the Morrill Tariff and its two successor bills were retained long after the end of the Civil War.

Early 20th century protectionism

In 1921, Congress sought to protect local agriculture as opposed to the industry bypassing the Emergency Tariff, which increased rates onwheat

Wheat is a group of wild and crop domestication, domesticated Poaceae, grasses of the genus ''Triticum'' (). They are Agriculture, cultivated for their cereal grains, which are staple foods around the world. Well-known Taxonomy of wheat, whe ...

, sugar

Sugar is the generic name for sweet-tasting, soluble carbohydrates, many of which are used in food. Simple sugars, also called monosaccharides, include glucose

Glucose is a sugar with the Chemical formula#Molecular formula, molecul ...

, meat

Meat is animal Tissue (biology), tissue, often muscle, that is eaten as food. Humans have hunted and farmed other animals for meat since prehistory. The Neolithic Revolution allowed the domestication of vertebrates, including chickens, sheep, ...

, wool

Wool is the textile fiber obtained from sheep and other mammals, especially goats, rabbits, and camelids. The term may also refer to inorganic materials, such as mineral wool and glass wool, that have some properties similar to animal w ...

and other agricultural products brought into the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

from foreign nations, which protected domestic producers of those items.

However, one year later Congress passed another tariff, the Fordney–McCumber Tariff

The Fordney–McCumber Tariff of 1922 was a law that raised American tariffs on many imported goods to protect factories and farms. The US Congress displayed a pro-business attitude in passing the tariff and in promoting foreign trade by providi ...

, which applied the scientific tariff and the American Selling Price. The purpose of the scientific tariff was to equalize production costs among countries so that no country could undercut the prices charged by American companies.Fordney–McCumber Tariff

The Fordney–McCumber Tariff of 1922 was a law that raised American tariffs on many imported goods to protect factories and farms. The US Congress displayed a pro-business attitude in passing the tariff and in promoting foreign trade by providi ...

The difference in production costs was calculated by the Tariff Commission. A second novelty was the American Selling Price. This allowed the president to calculate the duty based on the price of the American price of a good, not the imported good.

During the outbreak of the Great Depression in 1930, Congress raised tariffs via the Smoot–Hawley Tariff Act on over 20,000 imported goods to record levels, and, in the opinion of most economists, worsened the Great Depression by causing other countries to reciprocate, thereby plunging American imports and exports by more than half.

Era of GATT and WTO

In 1948, the US signed theGeneral Agreement on Tariffs and Trade

The General Agreement on Tariffs and Trade (GATT) is a legal agreement between many countries, whose overall purpose was to promote international trade by reducing or eliminating trade barriers such as tariffs or quotas. According to its p ...

(GATT), which reduced tariff barriers and other quantitative restrictions and subsidies on trade through a series of agreements.

In 1993, the GATT was updated (''GATT 1994'') to include new obligations upon its signatories. One of the most significant changes was the creation of the World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization headquartered in Geneva, Switzerland that regulates and facilitates international trade. Governments use the organization to establish, revise, and enforce the rules that g ...

(WTO). Whereas GATT was a set of rules agreed upon by nations, the WTO is an institutional body. The WTO expanded its scope from traded goods to trade within the service sector

The tertiary sector of the economy, generally known as the service sector, is the third of the three economic sectors in the three-sector model (also known as the economic cycle). The others are the primary sector (raw materials) and the ...

and intellectual property rights

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, co ...

. Although it was designed to serve multilateral agreements, during several rounds of GATT negotiations (particularly the Tokyo

Tokyo, officially the Tokyo Metropolis, is the capital of Japan, capital and List of cities in Japan, most populous city in Japan. With a population of over 14 million in the city proper in 2023, it is List of largest cities, one of the most ...

Round) plurilateral A plurilateral agreement is a multi-national legal or trade agreement between countries. In the jargon of global economics, it is an agreement between more than two countries, but not a great many, which would be multilateral agreement.

Use of th ...

agreements created selective trading and caused fragmentation among members. WTO arrangements are generally a multilateral agreement settlement mechanism of GATT.

Excise tax

Federal

Federal excise tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when ...

es are applied to specific items such as motor fuels, tires, telephone usage, tobacco products, and alcoholic beverages

Drinks containing alcohol are typically divided into three classes—beers, wines, and spirits—with alcohol content typically between 3% and 50%. Drinks with less than 0.5% are sometimes considered non-alcoholic.

Many societies have a di ...

. Excise taxes are often, but not always, allocated to special funds related to the object or activity taxed.

During the presidency of George Washington

George Washington's tenure as the inaugural president of the United States began on April 30, 1789, the day of his First inauguration of George Washington, first inauguration, and ended on March 4, 1797. Washington took office after he was Li ...

, Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

proposed a tax on distilled spirits to fund his policy of assuming the war debt of the American Revolution

The American Revolution (1765–1783) was a colonial rebellion and war of independence in which the Thirteen Colonies broke from British America, British rule to form the United States of America. The revolution culminated in the American ...

for those states which had failed to pay. After a vigorous debate, the House decided by a vote of 35–21 to approve legislation imposing a seven-cent-per-gallon excise tax on whiskey. This marks the first time in American history that Congress voted to tax an American product; this led to the Whiskey Rebellion

The Whiskey Rebellion (also known as the Whiskey Insurrection) was a violent tax protest in the United States beginning in 1791 and ending in 1794 during the presidency of George Washington. The so-called "whiskey tax" was the first tax impo ...

.

Income tax

The history of income taxation in the United States began in the 19th century with the imposition of income taxes to fund war efforts. However, the constitutionality of income taxation was widely held in doubt (see '' Pollock v. Farmers' Loan & Trust Co.'') until 1913 with the ratification of the 16th Amendment.Legal foundations

Article I, Section 8, Clause 1 of the United States Constitution assignsCongress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

the power to impose "Taxes, Duties, Imposts, and Excises", but the same clause also requires that "Duties, Imposts, and Excises shall be uniform throughout the United States".

In addition, the Constitution specifically limited Congress' ability to impose direct taxes, by requiring it to distribute direct taxes in proportion to each state's census population. It was thought that head taxes and property tax

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or Wealth t ...

es (slaves could be taxed as either or both) were likely to be abused and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9, therefore, specifies that "No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken".

Taxation was also the subject of Federalist No. 33

Federalist No. 33, written by Alexander Hamilton and first published in '' The Independent Journal'' on January 2, 1788, continues the focus on the issues in creating an efficient taxation system, along with reassuring the people's doubts about ...

penned secretly by the Federalist Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

under the pseudonym

A pseudonym (; ) or alias () is a fictitious name that a person assumes for a particular purpose, which differs from their original or true meaning ( orthonym). This also differs from a new name that entirely or legally replaces an individual's o ...

Publius. In it, he explains that the wording of the "Necessary and Proper" clause should serve as guidelines for the legislation of laws regarding taxation. The legislative branch is to be the judge, but any abuse of those powers of judging can be overturned by the people, whether as states or as a larger group.

What seemed to be a straightforward limitation on the power of the legislature based on the subject of the tax proved inexact and unclear when applied to an income tax, which can be arguably viewed either as a direct or an indirect tax. The courts have generally held that direct taxes are limited to taxes on people (variously called "capitation", "poll tax" or "head tax") and property. All other taxes are commonly referred to as "indirect taxes".

Pre-Sixteenth Amendment

To help pay for its war effort in theAmerican Civil War

The American Civil War (April 12, 1861May 26, 1865; also known by Names of the American Civil War, other names) was a civil war in the United States between the Union (American Civil War), Union ("the North") and the Confederate States of A ...

, Congress imposed its first personal income tax in 1861. It was part of the Revenue Act of 1861

The Revenue Act of 1861, formally cited as Act of August 5, 1861, Chap. XLV, 12 Stat. 292', included the first U.S. Federal income tax statute (seSec. 49. The Act, motivated by the need to fund the Civil War, imposed an income tax to be "levied, c ...

(3% of all incomes over US$800; rescinded in 1872). Congress also enacted the Revenue Act of 1862

The Revenue Act of 1862 (July 1, 1862, Ch. 119, ), was a bill the United States Congress passed to help fund the American Civil War. President Abraham Lincoln signed the act into law on July 1, 1862. The act established the office of the Commiss ...

, which levied a 3% tax on incomes above $600, rising to 5% for incomes above $10,000. Rates were raised in 1864. This income tax was repealed in 1872.

A new income tax statute was enacted as part of the 1894 Tariff Act. At that time, the United States Constitution

The Constitution of the United States is the Supremacy Clause, supreme law of the United States, United States of America. It superseded the Articles of Confederation, the nation's first constitution, on March 4, 1789. Originally includi ...

specified that Congress could impose a "direct" tax only if the law apportioned that tax among the states according to each state's census

A census (from Latin ''censere'', 'to assess') is the procedure of systematically acquiring, recording, and calculating population information about the members of a given Statistical population, population, usually displayed in the form of stati ...

population.

In 1895, the United States Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

ruled, in '' Pollock v. Farmers' Loan & Trust Co.,'' that taxes on rents from real estate, on interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

income from personal property and other income from personal property (which includes dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

income) were direct taxes on property and therefore had to be apportioned. Since the apportionment of income taxes is impractical, the ''Pollock'' rulings had the effect of prohibiting a federal tax on income from the property. Due to the political difficulties of taxing individual wages without taxing income from property, a federal income tax was impractical from the time of the ''Pollock'' decision until the time of ratification of the Sixteenth Amendment (below).

Sixteenth Amendment

In response to the Supreme Court decision in the ''Pollock'' case, Congress proposed the Sixteenth Amendment, which was ratified in 1913, and which states:

In response to the Supreme Court decision in the ''Pollock'' case, Congress proposed the Sixteenth Amendment, which was ratified in 1913, and which states:

The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.The

Supreme Court

In most legal jurisdictions, a supreme court, also known as a court of last resort, apex court, high (or final) court of appeal, and court of final appeal, is the highest court within the hierarchy of courts. Broadly speaking, the decisions of ...

in '' Brushaber v. Union Pacific Railroad,'' , indicated that the Sixteenth Amendment did not expand the federal government's existing power to tax income (meaning profit or gain from any source) but rather removed the possibility of classifying an income tax as a direct tax based on the source of the income. The Amendment removed the need for the income tax on interest, dividends, and rents to be apportioned among the states based on population. Income taxes are required, however, to abide by the law of geographical uniformity.

Congress enacted an income tax in October 1913 as part of the Revenue Act of 1913

The Revenue Act of 1913, also known as the Tariff Act of 1913, Underwood Tariff or the Underwood–Simmons Act (ch. 16, ), re-established a federal income tax in the United States and substantially lowered tariff rates. The act was sponsored by R ...

, levying a 1% tax on net personal incomes above $3,000, with a 6% surtax on incomes above $500,000. By 1918, the top rate of the income tax was increased to 77% (on income over $1,000,000, equivalent of $16,717,815 in 2018 dollars). The average rate for the (unspecified) "very rich" however, was 15%. The rate was increased in 1917 during World War I. The top marginal tax rate was reduced to 58% in 1922, to 25% in 1925 and finally to 24% in 1929. In 1932 the top marginal tax rate was increased to 63% during the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

and steadily increased, reaching 94% in 1944 (on income over $200,000, equivalent of $2,868,625 in 2018 dollars). During World War II, Congress introduced payroll withholding and quarterly tax payments.

Tax rate reductions

Following World War II tax increases, top marginal individual tax rates stayed near or above 90%, and the effective tax rate at 70% for the highest incomes (few paid the top rate), until 1964 when the top marginal tax rate was lowered to 70%. Kennedy explicitly called for a top rate of 65 percent, but added that it should be set at 70 percent if certain deductions were not phased out at the top of the income scale. The top marginal tax rate was lowered to 50% in 1982 and eventually to 28% in 1988. It slowly increased to 39.6% in 2000, then was reduced to 35% for the period 2003 through 2012. Corporate tax rates were lowered from 48% to 46% in 1981 ( PL 97-34), then to 34% in 1986 ( PL 99-514), and increased to 35% in 1993, subsequently lowered to 21% in 2018. Timothy Noah, the senior editor of the ''New Republic'', argues that while Ronald Reagan made massive reductions in the nominal marginal income tax rates with his Tax Reform Act of 1986, this reform did not make a similarly massive reduction in the effective tax rate on the higher marginal incomes. Noah writes in his ten-part series entitled "The Great Divergence," that in 1979, the effective tax rate on the top 0.01 percent of taxpayers was 42.9 percent, according to the Congressional Budget Office, but that by Reagan's last year in office it was 32.2%. This effective rate on high incomes held steadily until the first few years of the Clinton presidency when it increased to a peak high of 41%. However, it fell back down to the low 30s by his second term in the White House. This percentage reduction in the effective marginal income tax rate for the wealthiest Americans, 9%, is not a very large decrease in their tax burden, according to Noah, especially in comparison to the 20% drop in nominal rates from 1980 to 1981 and the 15% drop in nominal rates from 1986 to 1987. In addition to this small reduction in the income taxes of the wealthiest taxpayers in America, Noah discovered that the effective income tax burden for the bottom 20% of wage earners was 8% in 1979 and dropped to 6.4% under the Clinton Administration. This effective rate further dropped under the George W. Bush Administration. Under Bush, the rate decreased from 6.4% to 4.3%. These figures also correspond to an analysis of effective tax rates from 1979–2005 by theCongressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

.

Development of the modern income tax

Congress re-adopted the income tax in 1913, levying a 1% tax on net personal incomes above $3,000, with a 6%

Congress re-adopted the income tax in 1913, levying a 1% tax on net personal incomes above $3,000, with a 6% surtax

A surtax is a tax levied upon another tax, also known as tax surcharge.

Canada

The provincial portion of the value-added tax on goods and services in two Canadian jurisdictions, Quebec and Prince Edward Island, was formerly calculated as a sur ...

on incomes above $500,000. By 1918, the top rate of the income tax was increased to 77% (on income over $1,000,000) to finance World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

. The top marginal tax rate was reduced to 58% in 1922, to 25% in 1925, and finally to 24% in 1929. In 1932 the top marginal tax rate was increased to 63% during the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

and steadily increased.

During World War II, Congress introduced payroll withholding and quarterly tax payments. President Franklin D. Roosevelt

Franklin Delano Roosevelt (January 30, 1882April 12, 1945), also known as FDR, was the 32nd president of the United States, serving from 1933 until his death in 1945. He is the longest-serving U.S. president, and the only one to have served ...

proposed a 100% tax on all incomes over $25,000, stating that the success of the war effort required both revenue and public income equity. When Congress did not enact that proposal, Roosevelt issued an executive order attempting to achieve a similar result through a salary cap on certain salaries in connection with contracts between the private sector and the federal government. For tax years 1944 through 1951, the highest marginal tax rate for individuals was 91%, increasing to 92% for 1952 and 1953, and reverting to 91% 1954 through 1963.

For the 1964 tax year, the top marginal tax rate for individuals was lowered to 77%, and then to 70% for tax years 1965 through 1981. In 1978 income brackets were adjusted for inflation, so fewer people were taxed at high rates. The top marginal tax rate was lowered to 50% for tax years 1982 through 1986. Reagan undid 40% of his 1981 tax cut, in 1983 he hiked gas and payroll taxes, and in 1984 he raised tax revenue by closing loopholes for businesses. According to historian and domestic policy adviser Bruce Bartlett, Reagan's 12 tax increases over the course of his presidency took back half of the 1981 tax cut.

For tax year 1987, the highest marginal tax rate was 38.5% for individuals. It was lowered to 28% in revenue neutral fashion, eliminating many loopholes and shelters, along with in corporate taxes, (with a 33% "bubble rate") for tax years 1988 through 1990. Ultimately, the combination of base broadening and rate reduction raised revenue equal to about 4% of existing tax revenue

For the 1991 and 1992 tax years, the top marginal rate was increased to 31% in a budget deal President George H. W. Bush

George Herbert Walker BushBefore the outcome of the 2000 United States presidential election, he was usually referred to simply as "George Bush" but became more commonly known as "George H. W. Bush", "Bush Senior," "Bush 41," and even "Bush th ...

made with the Congress.

In 1993 the Clinton administration proposed and the Congress accepted (with no Republican support) an increase in the top marginal rate to 39.6% for the 1993 tax year, where it remained through the tax year 2000.

In 2001, President George W. Bush

George Walker Bush (born July 6, 1946) is an American politician and businessman who was the 43rd president of the United States from 2001 to 2009. A member of the Bush family and the Republican Party (United States), Republican Party, he i ...

proposed and Congress accepted an eventual lowering of the top marginal rate to 35%. However, this was done in stages: with the highest marginal rate of 39.1% for 2001, then 38.6% for 2002 and finally 35% for years 2003 through 2010. This measure had a sunset provision

In public policy, a sunset provision or sunset clause is a measure within a statute, regulation, or other law that provides for the law to cease to be effective after a specified date, unless further legislative action is taken to extend it. Unli ...

and was scheduled to expire for the 2011 tax year when rates would have returned to those adopted during the Clinton years unless Congress changed the law; Congress did so bypassing the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010, signed by President Barack Obama on December 17, 2010.

At first, the income tax was incrementally expanded by the Congress of the United States

The United States Congress is the legislative branch of the federal government of the United States. It is a bicameral legislature, including a lower body, the U.S. House of Representatives, and an upper body, the U.S. Senate. They both ...

, and then inflation automatically raised most persons into tax bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain poin ...

s formerly reserved for the wealthy until income tax brackets were adjusted for inflation. Income tax now applies to almost two-thirds of the population. The lowest-earning workers, especially those with dependents, pay no income taxes as a group and get a small subsidy from the federal government because of child credits and the Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

.

While the government was originally funded via tariff

A tariff or import tax is a duty (tax), duty imposed by a national Government, government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods ...

s upon imported goods, tariffs now represent only a minor portion of federal revenues. Non-tax fees are generated to recompense agencies for services or to fill specific trust fund

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a designated person. In the English common law, the party who entrusts the property is k ...

s such as the fee placed upon airline ticket

An airline ticket is a document or electronic record, issued by an airline or a travel agency, that confirms that an individual is entitled to a seat on a flight on an aircraft. The airline ticket may be one of two types: a ''paper ticket'', whic ...

s for airport expansion and air traffic control

Air traffic control (ATC) is a service provided by ground-based air traffic controllers who direct aircraft on the ground and through a given section of controlled airspace, and can provide advisory services to aircraft in non-controlled air ...

. Often the receipts intended to be placed in "trust" funds are used for other purposes, with the government posting an IOU

An IOU (Abbreviation, abbreviated from the phrase "I owe you") is usually an informal document acknowledging debt. An IOU differs from a promissory note in that an IOU is not a negotiable instrument and does not specify repayment terms such as th ...

('I owe you) in the form of a federal bond or other accounting

Accounting, also known as accountancy, is the process of recording and processing information about economic entity, economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activit ...

instrument, then spending the money on unrelated current expenditures.

Net long-term capital gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

...

s as well as certain types of qualified dividend

Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordina ...

income are taxed preferentially. The federal government collects several specific taxes in addition to the general income tax. Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

and Medicare are large social support programs which are funded by taxes on personal earned income (see below).

Treatment of "income"

Tax statutes passed after the ratification of the Sixteenth Amendment in 1913 are sometimes referred to as the "modern" tax statutes. Hundreds of Congressional acts have been passed since 1913, as well as several codifications (i.e., topical reorganizations) of the statutes (see Codification). The modern interpretation of the Sixteenth Amendment taxation power can be found in '' Commissioner v. Glenshaw Glass Co.'' . In that case, a taxpayer had received an award of punitive damages from a competitor and sought to avoid paying taxes on that award. The U.S. Supreme Court observed that Congress, in imposing the income tax, had defined income to include:gains, profits, and the income derived from salaries, wages, or compensation for personal service ... of whatever kind and in whatever form paid, or from professions, vocations, trades, businesses, commerce, or sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property; also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, or gains or profits and the income derived from any source whatever.The Court held that "this language was used by Congress to exert in this field the full measure of its taxing power", id., and that "the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted." The Court then enunciated what is now understood by Congress and the Courts to be the definition of taxable income, "instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Id. at 431. The defendant, in that case, suggested that a 1954 rewording of the tax code had limited the income that could be taxed, a position which the Court rejected, stating:

The definition of gross income has been simplified, but no effect upon its present broad scope was intended. Certainly, punitive damages cannot reasonably be classified as gifts, nor do they come under any other exemption provision in the Code. We would do violence to the plain meaning of the statute and restrict a clear legislative attempt to bring the taxing power to bear upon all receipts constitutionally taxable were we to say that the payments in question here are not gross income.In ''Conner v. The United States'', a couple had lost their home to a fire and had received compensation for their loss from the insurance company, partly in the form of hotel costs reimbursed. The U.S. District Court acknowledged the authority of the IRS to assess taxes on all forms of payment but did not permit taxation on the compensation provided by the insurance company, because unlike a wage or a sale of goods at a profit, this was not a gain. As the court noted, "Congress has taxed income, not compensation". By contrast, at least two federal courts of appeals have indicated that Congress may constitutionally tax an item as "income," regardless of whether that item is in fact income. See ''Penn Mutual Indemnity Co. v. Commissioner'' and ''Murphy v. Internal Revenue Serv.''

Estate and gift tax

The origins of the estate and gift tax occurred during the rise of the state inheritance tax in the late 19th century and theProgressive Era

The Progressive Era (1890s–1920s) was a period in the United States characterized by multiple social and political reform efforts. Reformers during this era, known as progressivism in the United States, Progressives, sought to address iss ...

.

In the 1880s and 1890s, many states passed inheritance taxes, which taxed the donees on the receipt of their inheritance. While many objected to the application of an inheritance tax, some including Andrew Carnegie

Andrew Carnegie ( , ; November 25, 1835August 11, 1919) was a Scottish-American industrialist and philanthropist. Carnegie led the expansion of the History of the iron and steel industry in the United States, American steel industry in the late ...

and John D. Rockefeller

John Davison Rockefeller Sr. (July 8, 1839 – May 23, 1937) was an American businessman and philanthropist. He was one of the List of richest Americans in history, wealthiest Americans of all time and one of the richest people in modern hist ...

supported increases in the taxation of inheritance.

At the beginning of the 20th century, President Theodore Roosevelt

Theodore Roosevelt Jr. (October 27, 1858 – January 6, 1919), also known as Teddy or T.R., was the 26th president of the United States, serving from 1901 to 1909. Roosevelt previously was involved in New York (state), New York politics, incl ...

advocated the application of a progressive inheritance tax on the federal level.

In 1916, Congress adopted the present federal estate tax, which instead of taxing the wealth that a donee inherited as occurred in the state inheritance taxes it taxed the wealth of a donor's estate upon transfer.

Later, Congress passed the Revenue Act of 1924

The United States Revenue Act of 1924 () (June 2, 1924), also known as the Mellon tax bill (after U.S. Secretary of the Treasury Andrew Mellon) cut federal tax rates for 1924 income. The bottom rate, on income under $4,000, fell from 1.5% to 1.1 ...

, which imposed the gift tax, a tax on gifts given by the donor.

In 1948 Congress allowed marital deductions for the estate and the gift tax. In 1981, Congress expanded this deduction to an unlimited amount for gifts between spouses.

Today, the estate tax is a tax imposed on the transfer of the "taxable estate" of a deceased person, whether such property is transferred via a will

Will may refer to:

Common meanings

* Will and testament, instructions for the disposition of one's property after death

* Will (philosophy), or willpower

* Will (sociology)

* Will, volition (psychology)

* Will, a modal verb - see Shall and will

...

or according to the state laws of intestacy

Intestacy is the condition of the estate of a person who dies without a legally valid will, resulting in the distribution of their estate under statutory intestacy laws rather than by their expressed wishes. Alternatively this may also apply ...

. The estate tax is one part of the ''Unified Gift and Estate Tax'' system in the United States. The other part of the system, the gift tax, imposes a tax on transfers of property during a person's life; the gift tax prevents avoidance of the estate tax should a person want to give away his/her estate just before dying.

In addition to the federal government, many states also impose an estate tax, with the state version called either an estate tax or an inheritance tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and pro ...

. Since the 1990s, the term " death tax" has been widely used by those who want to eliminate the estate tax, because the terminology used in discussing a political issue affects popular opinion.

If an asset is left to a spouse or a charitable organization, the tax usually does not apply. The tax is imposed on other transfers of property made as an incident of the death of the owner, such as a transfer of property from an intestate

Intestacy is the condition of the estate of a person who dies without a legally valid will, resulting in the distribution of their estate under statutory intestacy laws rather than by their expressed wishes. Alternatively this may also apply ...

estate or trust, or the payment of certain life insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typical ...

benefits or financial account sums to beneficiaries.

Payroll tax

Before the

Before the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, the following economic problems were considered great hazards to working-class Americans:

* The U.S. had no federal-government-mandated retirement savings; consequently, for many workers (those who could not afford both to save for retirement and to pay for living expenses), the end of their work careers was the end of all income.

* Similarly, the U.S. had no federal-government-mandated disability income insurance to provide for citizens disabled by injuries (of any kind—work-related or non-work-related); consequently, for most people, a disabling injury meant no more income if they had not saved enough money to prepare for such an event (since most people have little to no income except earned income from work).

* In addition, there was no federal-government-mandated disability income insurance to provide for people unable to ever work during their lives, such as anyone born with severe mental retardation

Intellectual disability (ID), also known as general learning disability (in the United Kingdom), and formerly mental retardation (in the United States), Rosa's Law, Pub. L. 111-256124 Stat. 2643(2010).Archive is a generalized neurodevelopmental ...

.

* Finally, the U.S. had no federal-government-mandated health insurance for the elderly; consequently, for many workers (those who could not afford both to save for retirement and to pay for living expenses), the end of their work careers was the end of their ability to pay for medical care.

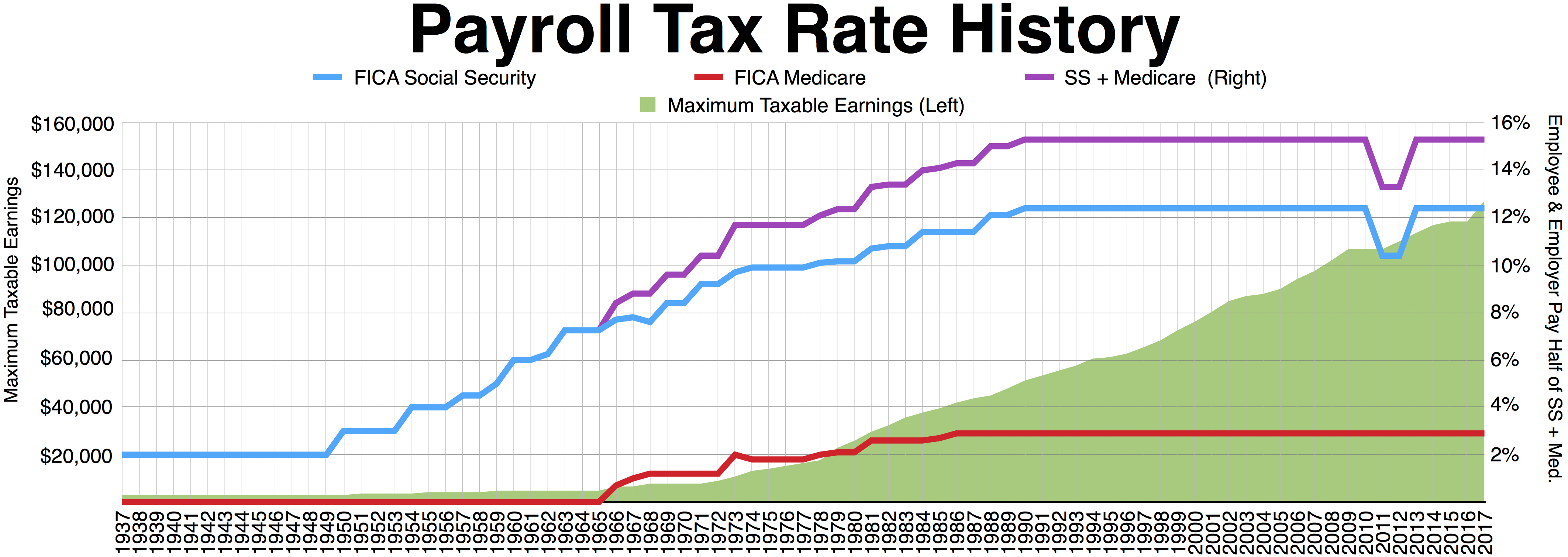

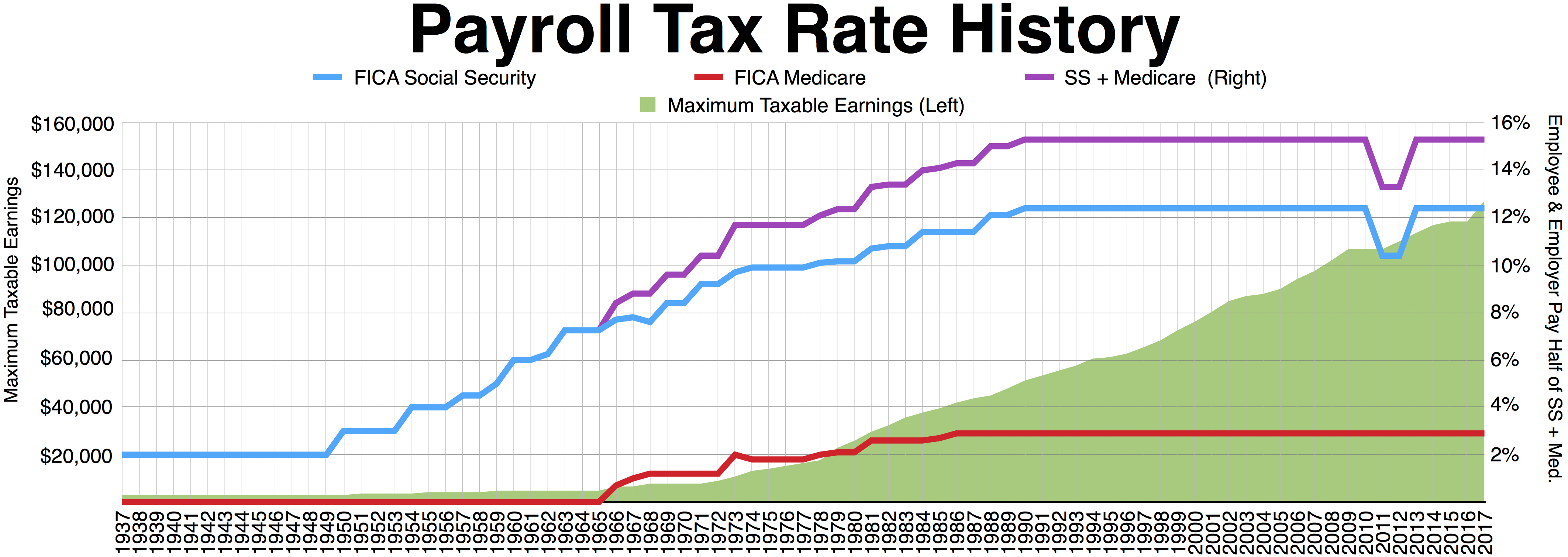

Creation

In the 1930s, theNew Deal

The New Deal was a series of wide-reaching economic, social, and political reforms enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938, in response to the Great Depression in the United States, Great Depressi ...

introduced Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

to rectify the first three problems (retirement, injury-induced disability, or congenital disability). It introduced the FICA tax as the means to pay for Social Security.

In the 1960s, Medicare was introduced to rectify the fourth problem (health care for the elderly). The FICA tax was increased to pay for this expense.

Development

PresidentFranklin D. Roosevelt

Franklin Delano Roosevelt (January 30, 1882April 12, 1945), also known as FDR, was the 32nd president of the United States, serving from 1933 until his death in 1945. He is the longest-serving U.S. president, and the only one to have served ...

introduced the Social Security (FICA) Program. FICA began with voluntary participation, participants would have to pay 1% of the first $1,400 of their annual incomes into the Program, the money the participants elected to put into the Program would be deductible from their income for tax purposes each year, the money the participants put into the independent "Trust Fund" rather than into the General operating fund, and therefore, would only be used to fund the Social Security Retirement Program, and no other Government program, and, the annuity payments to the retirees would never be taxed as income.

During the Lyndon B. Johnson

Lyndon Baines Johnson (; August 27, 1908January 22, 1973), also known as LBJ, was the 36th president of the United States, serving from 1963 to 1969. He became president after the assassination of John F. Kennedy, under whom he had served a ...

administration Social Security moved from the trust fund to the general fund. Participants may not have an income tax deduction for Social Security withholding. Immigrants became eligible for Social Security benefits during the Carter administration. During the Reagan administration Social Security annuities became taxable.

Alternative minimum tax

The alternative minimum tax (AMT) was introduced by theTax Reform Act of 1969

The Tax Reform Act of 1969 () was a United States federal tax law signed by President Richard Nixon oDecember 30, 1969 Its largest impact was creating the Alternative Minimum Tax, which was intended to tax high-income earners who had previously a ...

, and became operative in 1970. It was intended to target 155 high-income households that had been eligible for so many tax benefits that they owed little or no income tax under the tax code of the time.

In recent years, the AMT has been under increased attention. With the Tax Reform Act of 1986

The Tax Reform Act of 1986 (TRA) was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22, 1986.

The Tax Reform Act of 1986 was the top domestic priority of President Reagan's second term. The ...

, the AMT was broadened and refocused on homeowners in high tax states. Because the AMT is not indexed to inflation and recent tax cuts, an increasing number of middle-income taxpayers have been finding themselves subject to this tax.

In 2006, the IRS's National Taxpayer Advocate's report highlighted the AMT as the single most serious problem with the tax code. The advocate noted that the AMT punishes taxpayers for having children or living in a high-tax state and that the complexity of the AMT leads to most taxpayers who owe AMT not realizing it until preparing their returns or being notified by the IRS.

Capital gains tax

The origins of the income tax on gains from capital assets did not distinguish capital gains from ordinary income. From 1913 to 1921, income from capital gains was taxed at ordinary rates, initially up to a maximum rate of 7 percent. Congress began to distinguish the taxation of capital gains from the taxation of ordinary income according to the holding period of the asset with the Revenue Act of 1921, which allowed a tax rate of 12.5 percent gain for assets held at least two years. In addition to different tax rates depending on the holding period, Congress began excluding certain percentages of capital gains depending on the holding period. From 1934 to 1941, taxpayers could exclude percentages of gains that varied with the holding period: 20, 40, 60, and 70 percent of gains were excluded on assets held 1, 2, 5, and 10 years, respectively. Beginning in 1942, taxpayers could exclude 50 percent of capital gains from income on assets held at least six months or elect a 25 percent alternative tax rate if their ordinary tax rate exceeded 50 percent. Capital gains tax rates were significantly increased in the1969

1969 ( MCMLXIX) was a common year starting on Wednesday of the Gregorian calendar, the 1969th year of the Common Era (CE) and ''Anno Domini'' (AD) designations, the 969th year of the 2nd millennium, the 69th year of the 20th century, and the ...

and 1976

Events January

* January 2 – The International Covenant on Economic, Social and Cultural Rights enters into force.

* January 5 – The Pol Pot regime proclaims a new constitution for Democratic Kampuchea.

* January 18 – Full diplomatic ...

Tax Reform Acts.

The 1970s and 1980s saw a period of oscillating capital gains tax rates. In 1978, Congress reduced capital gains tax rates by eliminating the minimum tax on excluded gains and increasing the exclusion to 60 percent, thereby reducing the maximum rate to 28 percent. The 1981 tax rate reductions further reduced capital gains rates to a maximum of 20 percent.

Later in the 1980s, Congress began increasing the capital gains tax rate and repealing the exclusion of capital gains. The Tax Reform Act of 1986

The Tax Reform Act of 1986 (TRA) was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22, 1986.

The Tax Reform Act of 1986 was the top domestic priority of President Reagan's second term. The ...

repealed the exclusion from income that provided for tax-exemption of long-term capital gains, raising the maximum rate to 28 percent (33 percent for taxpayers subject to phaseouts). When the top ordinary tax rates were increased by the 1990 and 1993 budget acts, an alternative tax rate of 28 percent was provided. Effective tax rates exceeded 28 percent for many high-income taxpayers, however, because of interactions with other tax provisions.

The end of the 1990s and the beginning of the present century heralded major reductions in taxing the income from gains on capital assets. Lower rates for 18-month and five-year assets were adopted in 1997 with the Taxpayer Relief Act of 1997

The Taxpayer Relief Act of 1997 () was enacted by the 105th United States Congress and signed into law by President Bill Clinton. The legislation reduced several federal taxes in the United States and notably created the Roth IRA.

Provisions ...

. In 2001, President George W. Bush

George Walker Bush (born July 6, 1946) is an American politician and businessman who was the 43rd president of the United States from 2001 to 2009. A member of the Bush family and the Republican Party (United States), Republican Party, he i ...

signed the Economic Growth and Tax Relief Reconciliation Act of 2001

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated wit ...

, into law as part of a $1.35 trillion tax cut program.

Corporate tax

The United States' corporate tax rate was at its highest, 52.8 percent, in 1968 and 1969. The top rate was hiked last in 1993 to 35 percent. Under the Tax Cuts and Jobs Act of 2017, the rate adjusted to 21 percent.See also

*Income tax in the United States

The United States federal government and most State governments in the United States, state governments impose an income tax. They are determined by applying a tax rate, which Progressive tax, may increase as income increases, to taxable incom ...

* Starve the beast (policy)

* Taxation in the United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, ...

* Tax resistance in the United States

Tax resistance in the United States has been practiced at least since colonial times, and has played important parts in American history.

Tax resistance is the refusal to pay a tax, usually by means that bypass established legal norms, as a mean ...

* List of United States Supreme Court taxation and revenue case law

* History of taxation in the United Kingdom

300px, ''The Friend of the People; & his Petty New Tax Gatherer paying John Bull a visit'' (1806), James Gillray , alt=A satirical cartoon by James Gilroy. John Bull, speaking from a first floor window, says "TAXES? TAXES? TAXES? why how an I t ...

References

Further reading

* * Buenker, John D. "Urban Liberalism and the Federal Income Tax Amendment" ''Pennsylvania History'' (1969) 36#2 pp. 192-21online

* Buenker, John D. "The ratification of the federal income tax amendment." ''Cato Journal''. 1 (1981): 183-223. * Buenker, John D. ''The Income Tax and the Progressive Era'' (Routledge, 2018

excerpt

* Burg, David F. ''A World History of Tax Rebellions: An Encyclopedia of Tax Rebels, Revolts, and Riots from Antiquity to the Present'' (2003

excerpt and text search

* * Ellis, Elmer. "Public Opinion and the Income Tax, 1860-1900." ''Mississippi Valley Historical Review'' 27.2 (1940): 225-24

online

* Mehrotra, Ajay K. " ‘More mighty than the waves of the sea’: toilers, tariffs, and the income tax movement, 1880–1913," ''Labor History'' (2004), 45:2, 165-198, DOI: 10.1080/0023656042000217246 * * Ratner, Sidney. ''American Taxation: Its History as a Social Force in Democracy'' (1942

online

* Shepard, Christopher. ''The Civil War Income Tax and the Republican Party, 1861–1872''. (New York: Algora Publishing, 2010

excerpt

* Stabile, Donald. ''The Origins of American Public Finance: Debates over Money, Debt, and Taxes in the Constitutional Era, 1776–1836'' (1998

excerpt and text search

* Thorndike, Joseph J. ''Their Fair Share: Taxing the Rich in the Age of FDR.'' Washington, DC: Urban Institute, 2013. * {{cite book , last1=Weisman , first1=Steven R. , title=The Great Tax Wars: Lincoln to Wilson-The Fierce Battles over Money That Transformed the Nation , date=2002 , publisher=Simon & Schuster , isbn=0-684-85068-0 , url=https://archive.org/details/greattaxwars00weis Economic history of the United States