|

Excise Tax In The United States

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state, and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such, often remain "hidden" in the price of a product or service rather than being listed separately. Federal excise taxes and revenues Federal excise taxes raised $86.8 billion in fiscal year 2020 or 2.5% of total federal tax revenue. These data come from Tables 2.1 through 2.4. Fuel Federal excise taxes have been stable at 18.4¢ per gallon for gasoline and 24.4¢ per gallon for diesel fuel since 1993. This raised $37.4 billion in fiscal year 2015. These fuel taxes raised 90% of the Highway Trust Fund. The average of state taxes on fuel was 31.02¢ per ga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. It is therefore a fee that must be paid in order to consume certain products. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

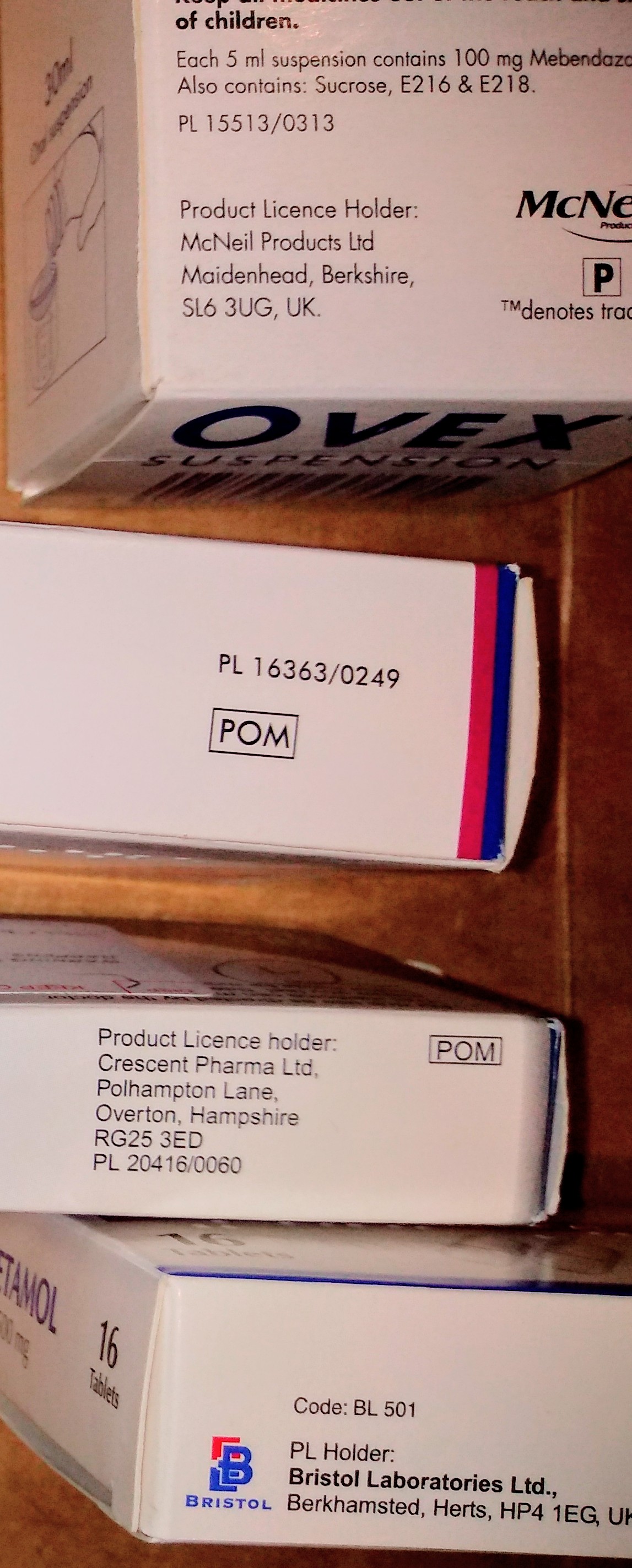

Prescription Drug

A prescription drug (also prescription medication, prescription medicine or prescription-only medication) is a pharmaceutical drug that is permitted to be dispensed only to those with a medical prescription. In contrast, over-the-counter drugs can be obtained without a prescription. The reason for this difference in substance control is the potential scope of misuse, from drug abuse to practising medicine without a license and without sufficient education. Different jurisdictions have different definitions of what constitutes a prescription drug. In North America, , usually printed as "Rx", is used as an abbreviation of the word "prescription". It is a contraction of the Latin word "''recipe''" (an imperative form of "recipere") meaning "take". Prescription drugs are often dispensed together with a monograph (in Europe, a Patient Information Leaflet or PIL) that gives detailed information about the drug. The use of prescription drugs has been increasing since the 1960s. Regul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Roberts

John Glover Roberts Jr. (born January 27, 1955) is an American jurist serving since 2005 as the 17th chief justice of the United States. He has been described as having a Moderate conservatism, moderate conservative judicial philosophy, though he is primarily an Institutionalism in political parties, institutionalist. Regarded as a swing vote in some cases, Roberts has presided over an ideological shift toward conservative jurisprudence on the high court, in which he has authored key opinions. Born in Buffalo, New York, Roberts was raised Catholic Church, Catholic in Northwest Indiana and studied at Harvard University with the initial intent to become a historian, graduating in three years with highest distinction, then attended Harvard Law School, where he was an editor of the ''Harvard Law Review.'' Later, Roberts served as a law clerk for Judge Henry Friendly and Justice William Rehnquist. From 1989 to 1993, he held positions in the Department of Justice during the Reagan a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Protection And Affordable Care Act

A patient is any recipient of health care services that are performed by healthcare professionals. The patient is most often ill or injured and in need of treatment by a physician, nurse, optometrist, dentist, veterinarian, or other health care provider. Etymology The word patient originally meant 'one who suffers'. This English noun comes from the Latin word , the present participle of the deponent verb, , meaning , and akin to the Greek verb ( ) and its cognate noun (). This language has been construed as meaning that the role of patients is to passively accept and tolerate the suffering and treatments prescribed by the healthcare providers, without engaging in shared decision-making about their care. Outpatients and inpatients An outpatient (or out-patient) is a patient who attends an outpatient clinic with no plan to stay beyond the duration of the visit. Even if the patient will not be formally admitted with a note as an outpatient, their attendance is stil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariffs In United States History

Tariffs have historically played a key role in the trade policy of the United States. Economic historian Douglas Irwin classifies U.S. tariff history into three periods: a ''revenue period'' (ca. 1790–1860), a ''restriction period'' (1861–1933) and a ''reciprocity period'' (from 1934 onwards). In the first period, from 1790 to 1860, average tariffs increased from 20 percent to 60 percent before declining again to 20 percent. From 1861 to 1933, which Irwin characterizes as the "restriction period", the average tariffs rose to 50 percent and remained at that level for several decades. From 1934 onwards, in the "reciprocity period", the average tariff declined substantially until it leveled off at 5 percent. Especially after 1942, the U.S. began to promote worldwide free trade. After the 2016 presidential election, the US increased trade protectionism. According to Irwin, tariffs were intended to serve three primary purposes: "to raise revenue for the government, to restr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Government Revenue By Type

Federal or foederal (archaic) may refer to: Politics General *Federal monarchy, a federation of monarchies *Federation, or ''Federal state'' (federal system), a type of government characterized by both a central (federal) government and states or regional governments that are partially self-governing; a union of states *Federal republic, a federation which is a republic *Federalism, a political philosophy *Federalist, a political belief or member of a political grouping * Federalization, implementation of federalism Particular governments *Government of Argentina *Government of Australia *Federal government of Brazil *Government of Canada *Cabinet of Germany *Federal government of Iraq *Government of India *Federal government of Mexico *Federal government of Nigeria *Government of Pakistan *Government of the Philippines *Government of Russia *Government of South Africa *Federal government of the United States **United States federal law **United States federal courts *Federal gove ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxes Revenue By Source Chart History

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Coun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cannabis

''Cannabis'' () is a genus of flowering plants in the family Cannabaceae that is widely accepted as being indigenous to and originating from the continent of Asia. However, the number of species is disputed, with as many as three species being recognized: '' Cannabis sativa'', '' C. indica'', and '' C. ruderalis''. Alternatively, ''C. ruderalis'' may be included within ''C. sativa'', or all three may be treated as subspecies of ''C. sativa'', or ''C. sativa'' may be accepted as a single undivided species. The plant is also known as hemp, although this term is usually used to refer only to varieties cultivated for non-drug use. Hemp has long been used for fibre, seeds and their oils, leaves for use as vegetables, and juice. Industrial hemp textile products are made from cannabis plants selected to produce an abundance of fibre. ''Cannabis'' also has a long history of being used for medicinal purposes, and as a recreational drug known by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alcohol Tax

Excise taxes on alcoholic beverages are per unit taxes levied by governments to raise revenue or used as corrective taxes to control health-related Externality, externalities associated with consumption of alcohol. This page addresses the economics and politics of alcohol excise taxation. Background Excise taxes are specific taxes applied to production, distribution or sale of a commodity or service, such as Alcohol (drug), alcohol, tobacco, Fuel taxes in the United States, gasoline, Sugary drink tax, sugary drinks, marijuana, plastic bags, Tanning tax, indoor tanning, bicycles, firearms, and gambling. Other terms for these taxes are an excise duty, indirect tax, unit tax, user fee, commodity tax, consumption tax, luxury tax, sumptuary tax, and sin tax. Excise tax in the United States, Excise taxes may be used to raise revenue or as corrective taxes to address externalities associated with production or consumption. Taxing producers using specific taxes is believed to reduce admin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Cigarette

An electronic cigarette (e-cigarette), or vape, is a device that simulates smoking. It consists of an atomizer, a power source such as a battery, and a container such as a cartridge or tank. Instead of smoke, the user inhales vapor. As such, using an e-cigarette is often called "vaping". The atomizer is a heating element that vaporizes a liquid solution called e-liquid that cools into an aerosol of tiny droplets, vapor and air. The vapor mainly comprises propylene glycol and/or glycerin, usually with nicotine and flavoring. Its exact composition varies, and depends on matters such as user behavior. E-cigarettes are activated by taking a puff or pressing a button. Some look like traditional cigarettes, and most kinds are reusable. Nicotine is highly addictive. Users become physically and psychologically dependent. Limited evidence indicates that e-cigarettes are less addictive than smoking, with slower nicotine absorption rates. , quote="There is moderate evidence that r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cigarette

A cigarette is a narrow cylinder containing a combustible material, typically tobacco, that is rolled into Rolling paper, thin paper for smoking. The cigarette is ignited at one end, causing it to smolder; the resulting smoke is orally inhaled via the opposite end. Cigarette smoking is the most common method of tobacco consumption. The term ''cigarette'', as commonly used, refers to a tobacco cigarette, but the word is sometimes used to refer to other substances, such as a joint (cannabis), cannabis cigarette or a herbal cigarette. A cigarette is distinguished from a cigar by its usually smaller size, use of processed leaf, different smoking method, and paper wrapping, which is typically white. There are significant negative health effects from smoking cigarettes such as cancer, chronic obstructive pulmonary disease (COPD), cardiovascular disease, heart disease, birth defects, and other Health effects of tobacco, health problems relating to nearly every organ of the body. Most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |