The

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

has separate

federal,

state

State most commonly refers to:

* State (polity), a centralized political organization that regulates law and society within a territory

**Sovereign state, a sovereign polity in international law, commonly referred to as a country

**Nation state, a ...

, and

local government

Local government is a generic term for the lowest tiers of governance or public administration within a particular sovereign state.

Local governments typically constitute a subdivision of a higher-level political or administrative unit, such a ...

s with

taxes

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

imposed at each of these levels. Taxes are levied on income, payroll, property, sales,

capital gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

A ca ...

, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of

GDP

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performance o ...

, below the

OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

average of 33.5% of GDP.

U.S. tax and transfer policies are

progressive and therefore reduce effective

income inequality

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes ...

, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

).

Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. Taxes are imposed on

net income

In business and Accountancy, accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and Amortization (a ...

of individuals and corporations by the federal, most state, and some local governments. Citizens and residents are taxed on worldwide income and allowed a credit for foreign taxes. Income subject to tax is determined under tax accounting rules, not financial accounting principles, and includes almost all income from whatever source, except that as a result of the enactment of the

Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022 (IRA) is a United States federal law which aims to reduce the federal government budget deficit, lower prescription drug prices, and invest in domestic energy production while promoting clean energy. It was ...

, large corporations are subject to a 15% minimum tax for which the starting point is annual financial statement income.

Most business expenses reduce taxable income, though limits apply to a few expenses. Individuals are permitted to reduce taxable income by personal allowances and certain non-business expenses, including

home mortgage interest,

state and local taxes,

charitable contributions, and medical and certain other expenses incurred above certain percentages of income.

State rules for determining taxable income often differ from federal rules. Federal marginal

tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be in ...

s vary from 10% to 37% of taxable income. State and local tax rates vary widely by jurisdiction, from 0% to 13.30% of income, and many are graduated. State taxes are generally treated as a deductible expense for federal tax computation, although the

2017 tax law imposed a $10,000 limit on the state and local tax ("SALT") deduction, which raised the effective tax rate on medium and high earners in high tax states. Prior to the SALT deduction limit, the average deduction exceeded $10,000 in most of the Midwest, and exceeded $11,000 in most of the Northeastern United States, as well as California and Oregon.

The states impacted the most by the limit were the

tri-state area

Tri-state area is an informal term in the United States which can refer to any of multiple areas that lie across three states. When referring to populated areas, the term implies a shared economy or culture among the area's residents, typically c ...

(NY, NJ, and CT) and California; the average SALT deduction in those states was greater than $17,000 in 2014.

The United States is one of two countries in the world that

taxes its non-resident citizens on worldwide income, in the same manner and rates as residents. The U.S. Supreme Court upheld the constitutionality of imposition of such a tax in the case of ''Cook v. Tait''. Nonetheless, the

foreign earned income exclusion eliminates U.S. taxes on the first $120,000 of annual foreign source earned income of U.S. citizens and certain U.S. residents living and working abroad. (This is the inflation-adjusted amount for 2023.)

Payroll tax

Payroll taxes are taxes imposed on employers or employees. They are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the ...

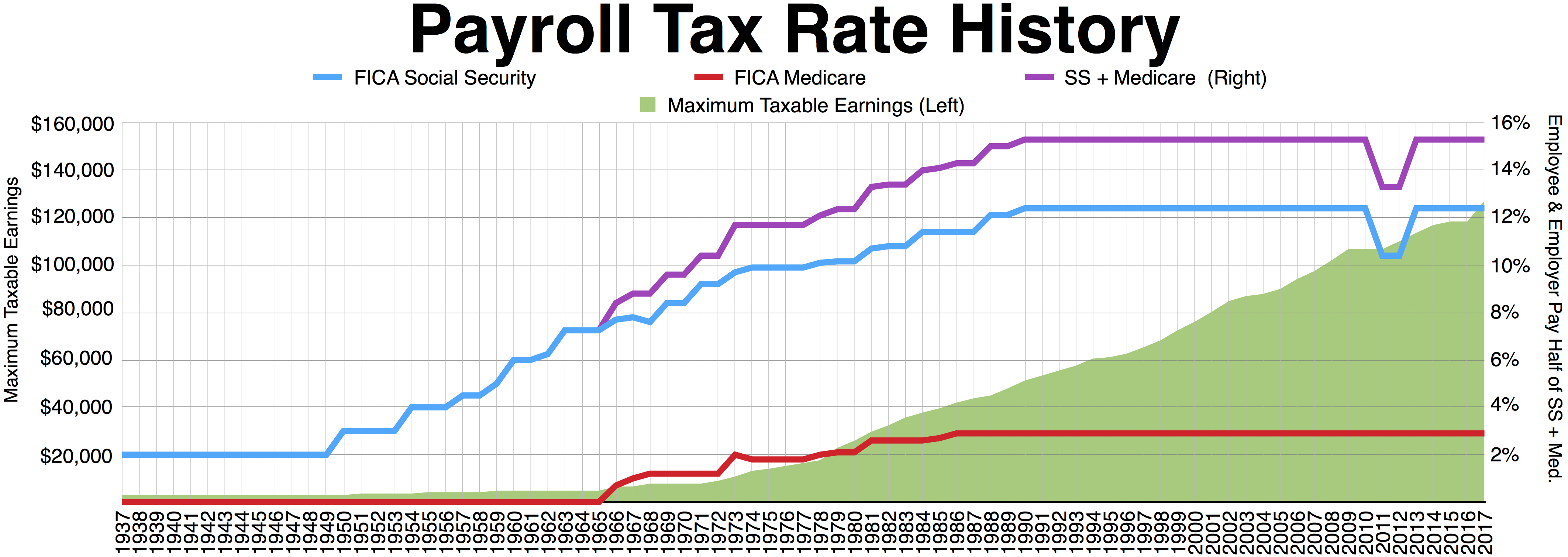

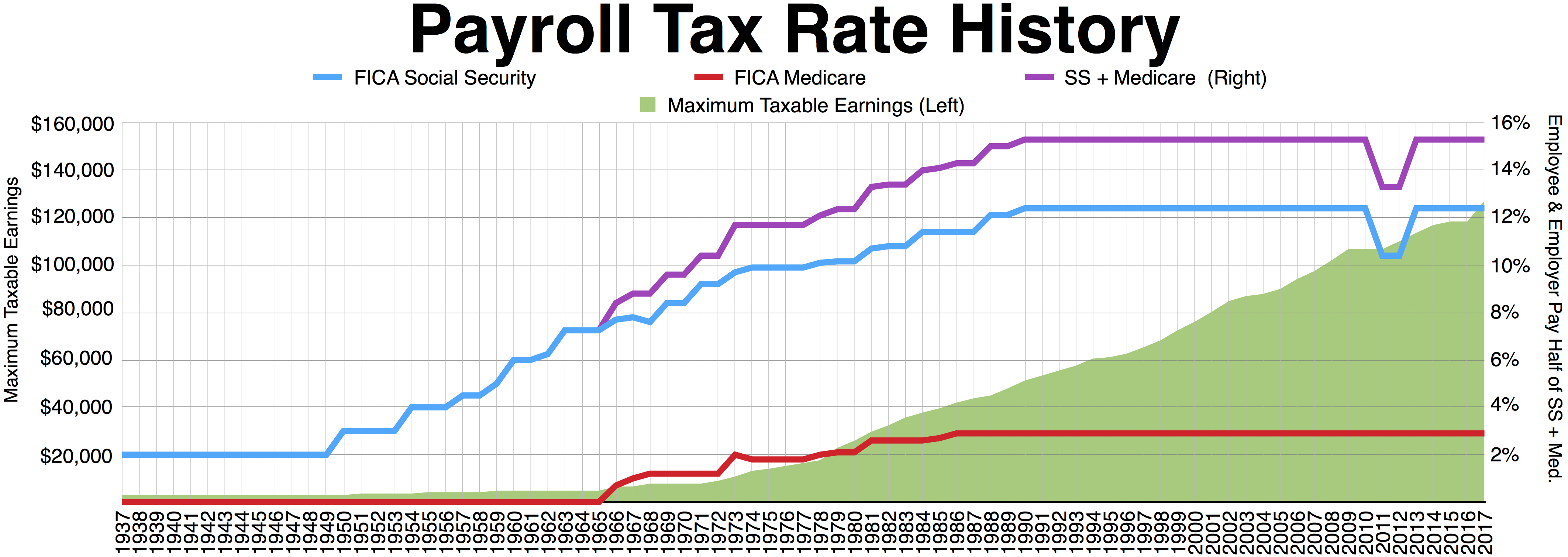

es are imposed by the federal and all state governments. These include Social Security and Medicare taxes imposed on both employers and employees, at a combined rate of 15.3% (13.3% for 2011 and 2012). Social Security tax applies only to the first $132,900 of wages in 2019.

There is an additional Medicare tax of 0.9% on wages above $200,000. Employers must withhold income taxes on wages. An unemployment tax and certain other levies apply to employers. Payroll taxes have dramatically increased as a share of federal revenue since the 1950s, while corporate income taxes have fallen as a share of revenue. (Corporate profits have not fallen as a share of GDP).

Property tax

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or Wealth t ...

es are imposed by most local governments and many special purpose authorities based on the fair market value of property. School and other authorities are often separately governed, and impose separate taxes. Property tax is generally imposed only on realty, though some jurisdictions tax some forms of business property. Property tax rules and rates vary widely with annual median rates ranging from 0.2% to 1.9% of a property's value depending on the state.

Sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

es are imposed by most states and some localities on the price at retail sale of many goods and some services. Sales tax rates vary widely among jurisdictions, from 0% to 16%, and may vary within a jurisdiction based on the particular goods or services taxed. Sales tax is collected by the seller at the time of sale, or remitted as use tax by buyers of taxable items who did not pay sales tax.

The United States imposes tariffs or

customs

Customs is an authority or Government agency, agency in a country responsible for collecting tariffs and for controlling International trade, the flow of goods, including animals, transports, personal effects, and hazardous items, into and out ...

duties on the import of many types of goods from many jurisdictions. These tariffs or duties must be paid before the goods can be legally imported. Rates of duty vary from 0% to more than 20%, based on the particular goods and country of origin.

Estate and

gift tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must ...

es are imposed by the federal and some state governments on the transfer of property inheritance, by will, or by lifetime donation. Similar to federal income taxes, federal estate and gift taxes are imposed on worldwide property of citizens and residents and allow a credit for foreign taxes.

Levels and types of taxation

The U.S. has an assortment of federal, state, local, and special-purpose governmental jurisdictions. Each imposes taxes to fully or partly fund its operations. These taxes may be imposed on the same income, property or activity, often without offset of one tax against another. The types of tax imposed at each level of government vary, in part due to constitutional restrictions. Income taxes are imposed at the federal and most state levels. Taxes on property are typically imposed only at the local level, although there may be multiple local jurisdictions that tax the same property. Other excise taxes are imposed by the federal and some state governments. Sales taxes are imposed by most states and many local governments. Customs duties or tariffs are only imposed by the federal government. A wide variety of user fees or license fees are also imposed.

Types of taxpayers

Taxes may be imposed on individuals (natural persons), business entities, estates, trusts, or other forms of organization. Taxes may be based on property, income, transactions, transfers, importations of goods, business activities, or a variety of factors, and are generally imposed on the type of taxpayer for whom such

tax base

A tax is a mandatory financial charge or levy imposed on an individual or legal person, legal entity by a governmental organization to support government spending and public expenditures collectively or to Pigouvian tax, regulate and reduce nega ...

is relevant. Thus, property taxes tend to be imposed on property owners. In addition, certain taxes, particularly income taxes, may be imposed on the members of a business or other entity based on the income of the entity. For example, a partner is taxed on the partner's allocable share of the income of an entity that is or, under entity classification rules, is classified as a partnership. Another example relates to the grantors or beneficiaries of trusts. Yet another example relates to the United States shareholders of controlled foreign corporations.

With a few exceptions, one level of government does not impose tax on another level of government or its instrumentalities.

Income tax

Taxes based on income are imposed at the federal, most state, and some local levels within the United States. The tax systems within each jurisdiction may define taxable income separately. Many states refer to some extent to federal concepts for determining taxable income.

History of the income tax

The

first income tax in the United States was implemented with the

Revenue Act of 1861

The Revenue Act of 1861, formally cited as Act of August 5, 1861, Chap. XLV, 12 Stat. 292', included the first U.S. Federal income tax statute (seSec. 49. The Act, motivated by the need to fund the Civil War, imposed an income tax to be "levied, c ...

by

Abraham Lincoln

Abraham Lincoln (February 12, 1809 – April 15, 1865) was the 16th president of the United States, serving from 1861 until Assassination of Abraham Lincoln, his assassination in 1865. He led the United States through the American Civil War ...

during the

Civil War

A civil war is a war between organized groups within the same Sovereign state, state (or country). The aim of one side may be to take control of the country or a region, to achieve independence for a region, or to change government policies.J ...

. In 1895 the

Supreme Court

In most legal jurisdictions, a supreme court, also known as a court of last resort, apex court, high (or final) court of appeal, and court of final appeal, is the highest court within the hierarchy of courts. Broadly speaking, the decisions of ...

ruled that the U.S. federal income tax on interest income, dividend income and rental income was

unconstitutional

In constitutional law, constitutionality is said to be the condition of acting in accordance with an applicable constitution; "Webster On Line" the status of a law, a procedure, or an act's accordance with the laws or set forth in the applic ...

in ''

Pollock v. Farmers' Loan & Trust Co.'', because it was a

direct tax

Although the actual definitions vary between jurisdictions, in general, a direct tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a distinction betwee ...

. The ''Pollock'' decision was overruled by the ratification of the

Sixteenth Amendment to the United States Constitution

The Sixteenth Amendment (Amendment XVI) to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 ...

in 1913, and by subsequent U.S. Supreme Court decisions including ''Graves v. New York ex rel. O'Keefe,'' ''

South Carolina v. Baker,'' and ''

Brushaber v. Union Pacific Railroad Co.''

Basic concepts

The U.S. income tax system imposes a tax based on income on individuals, corporations, estates, and trusts. The tax is taxable income, as defined, times a specified tax rate. This tax may be reduced by credits, some of which may be refunded if they exceed the tax calculated. Taxable income may differ from income for other purposes (such as for financial reporting). The definition of taxable income for federal purposes is used by many, but far from all states. Income and deductions are recognized under tax rules, and there are variations within the rules among the states. Book and tax income may differ. Income is divided into "capital gains", which are taxed at a lower rate and only when the taxpayer chooses to "realize" them, and "ordinary income", which is taxed at higher rates and on an annual basis. Because of this distinction, capital is taxed much more lightly than labor.

Under the U.S. system, individuals, corporations, estates, and trusts are subject to income tax. Partnerships are not taxed; rather, their partners are subject to income tax on their shares of income and deductions, and take their shares of credits. Some types of business entities may elect to be treated as corporations or as partnerships.

Taxpayers are required to file tax returns and self assess tax. Tax may be withheld from payments of income (''e.g.'', withholding of tax from wages). To the extent taxes are not covered by withholdings, taxpayers must make estimated tax payments, generally quarterly. Tax returns are subject to review and adjustment by taxing authorities, though far fewer than all returns are reviewed.

Taxable income is

gross income

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes ...

less exemptions, deductions, and personal exemptions. Gross income includes "all income from whatever source". Certain income, however, is subject to

tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

at the federal or state levels. This income is reduced by

tax deduction

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The diff ...

s including most business and some nonbusiness expenses. Individuals are also allowed a deduction for

personal exemptions, a fixed dollar allowance. The allowance of some nonbusiness deductions is phased out at higher income levels.

The U.S. federal and most state income tax systems tax the worldwide income of citizens and residents. A federal

foreign tax credit

A foreign tax credit (FTC) is generally offered by income tax systems that tax residents on worldwide income, to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have b ...

is granted for foreign income taxes. Individuals residing abroad may also claim the

foreign earned income exclusion. Individuals may be a citizen or resident of the United States but not a resident of a state. Many states grant a similar credit for taxes paid to other states. These credits are generally limited to the amount of tax on income from foreign (or other state) sources.

Filing status

Federal and state income tax is calculated, and returns filed, for each taxpayer. Two married individuals may calculate tax and file returns jointly or separately. In addition, unmarried individuals supporting children or certain other relatives may file a return as a head of household. Parent-subsidiary groups of companies may elect to file a

consolidated return.

There are currently five filing statuses for filing federal individual income taxes: single, married filing jointly, married filing separately, head of household, and qualifying widow(er). The filing status used is important for determining which deductions and credits the taxpayer qualifies for. States may have different rules for determining a taxpayer's filing status, especially for people in a

domestic partnership

A domestic partnership is an intimate relationship between people, usually couples, who live together and share a common domestic life but who are not married (to each other or to anyone else). People in domestic partnerships receive legal be ...

.

Graduated tax rates

Income tax rates differ at the federal and state levels for corporations and individuals. Federal and many state income tax rates are higher (graduated) at higher levels of income. In addition, federal and many state individual income tax rate schedules differ based on the individual's filing status. For example, the income level at which each rate starts generally is higher (''i.e.'', tax is lower) for married couples filing a joint return or single individuals filing as head of household.

Individuals are subject to federal graduated tax rates from 10% to 37%. Corporations are subject to a 21% federal rate of tax. Prior to 2018, the effective date of the

Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

, corporations were subject to federal graduated rates of tax from 15% to 35%; a rate of 34% applied to income from $335,000 to $15,000,000.

[; IRS Publication 542.] State income tax rates, in states which have a tax on personal incomes, vary from 1% to 16%, including local income tax where applicable. Nine states do not have a tax on ordinary personal incomes. These include Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

State and local taxes are generally deductible in computing federal taxable income for taxpayers who itemize their deductions; however, the

Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

limited the maximum amount of the deduction to $10,000 for individuals and married couples from 2018 through 2025.

Income

Taxable income is

gross income

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes ...

less adjustments and allowable

tax deduction

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The diff ...

s. Gross income for federal and most states is receipts and gains from all sources less

cost of goods sold

Cost of goods sold (COGS) (also cost of products sold (COPS), or cost of sales) is the carrying value of goods sold during a particular period.

Costs are associated with particular goods using one of the several formulas, including specific iden ...

. Gross income includes "all income from whatever source", and is not limited to cash received. Income from illegal activities is taxable and must be reported to the

IRS

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administerin ...

.

The amount of income recognized is generally the value received or which the taxpayer has a right to receive. Certain types of income are specifically excluded from gross income. The time at which gross income becomes taxable is determined under federal tax rules. This may differ in some cases from accounting rules.

Certain types of income are excluded from gross income (and therefore subject to

tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

). The exclusions differ at federal and state levels. For federal income tax, interest income on state and local bonds is exempt, while few states exempt any interest income except from municipalities within that state. In addition, certain types of receipts, such as gifts and inheritances, and certain types of benefits, such as employer-provided health insurance, are excluded from income.

Foreign non-resident persons are taxed only on income from U.S. sources or from a U.S. business. Tax on foreign non-resident persons on non-business income is at 30% of the gross income, but reduced under many

tax treaties

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance ...

.

These brackets are the taxable income plus the standard deduction for a joint return. That deduction is the first bracket. For example, a couple earning $88,600 by September owes $10,453; $1,865 for 10% of the income from $12,700 to $31,500, plus $8,588 for 15% of the income from $31,500 to $88,600. Now, for every $100 they earn, $25 is taxed until they reach the next bracket.

After making $400 more; going down to the 89,000 row the tax is $100 more. The next column is the tax divided by 89,000. The new law is the next column. This tax equals 10% of their income from $24,000 to $43,050 plus 12% from $43,050 to $89,000. The singles' sets of markers can be set up quickly. The brackets with its tax are cut in half.

Itemizers can figure the tax without moving the scale by taking the difference off the top. The couple above, having receipts for $22,700 in deductions, means that the last $10,000 of their income is tax free. After seven years the papers can be destroyed; if unchallenged.

Source and Method

Deductions and exemptions

The U.S. system allows reduction of taxable income for both business and some nonbusiness expenditures, called deductions. Businesses selling goods reduce gross income directly by the cost of goods sold. In addition, businesses may deduct most types of expenses incurred in the business. Some of these deductions are subject to limitations. For example, only 50% of the amount incurred for any meals or entertainment may be deducted. The amount and timing of deductions for business expenses is determined under the taxpayer's

tax accounting

U.S. tax accounting refers to accounting for tax purposes in the United States. Unlike most countries, the United States has a comprehensive set of accounting principles for tax purposes, prescribed by tax law, which are separate and distinct f ...

method, which may differ from methods used in accounting records.

Some types of business expenses are deductible over a period of years rather than when incurred. These include the cost of long lived assets such as buildings and equipment. The cost of such assets is recovered through deductions for

depreciation

In accountancy, depreciation refers to two aspects of the same concept: first, an actual reduction in the fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wears, and second, the allocation i ...

or

amortization

Amortization or amortisation may refer to:

* The process by which loan principal decreases over the life of an amortizing loan

* Amortization (accounting), the expensing of acquisition cost minus the residual value of intangible assets in a syst ...

.

In addition to business expenses, individuals may reduce income by an allowance for

personal exemptions and either a fixed

standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

or

itemized deduction

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income Tax return (United States), tax returns and which decrease their taxable income, and are claimable in place of a standard ...

s. One personal exemption is allowed per taxpayer, and additional such deductions are allowed for each child or certain other individuals supported by the taxpayer. The standard deduction amount varies by taxpayer filing status. Itemized deductions by individuals include

home mortgage interest,

state and local taxes, certain other taxes,

contributions to recognized charities, medical expenses in excess of 7.5% of

adjusted gross income

In the United States income tax system, adjusted gross income (AGI) is an individual's total gross income minus specific deductions. It is used to calculate taxable income, which is AGI minus allowances for personal exemptions and itemized d ...

, and certain other amounts.

Personal exemptions, the standard deduction, and itemized deductions are limited (phased out) above certain income levels.

Business entities

Corporations must pay tax on their taxable income independently of their shareholders.

Shareholders are also subject to tax on dividends received from corporations. By contrast, partnerships are not subject to income tax, but their partners calculate their taxes by including their shares of partnership items. Corporations owned entirely by U.S. citizens or residents (

S corporation

An S corporation (or S Corp), for United States federal income tax, is a closely held corporation (or, in some cases, a limited liability company (LLC) or a partnership) that makes a valid election to be taxed under Subchapter S of Chapter 1 of t ...

s) may elect to be treated similarly to partnerships. A

limited liability company

A limited liability company (LLC) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of ...

and certain other business entities may elect to be treated as corporations or as partnerships. States generally follow such characterization. Many states also allow corporations to elect S corporation status. Charitable organizations are subject to tax on business income.

Certain transactions of business entities are not subject to tax. These include many types of formation or reorganization.

Credits

A wide variety of tax credits may reduce income tax at the federal and state levels. Some credits are available only to individuals, such as the

child tax credit for each dependent child,

American Opportunity Tax Credit for education expenses, or the

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

for low income wage earners. Some credits, such as the Work Opportunity Tax Credit, are available to businesses, including various special industry incentives. A few credits, such as the

foreign tax credit

A foreign tax credit (FTC) is generally offered by income tax systems that tax residents on worldwide income, to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have b ...

, are available to all types of taxpayers.

Payment or withholding of taxes

The United States federal and state income tax systems are self-assessment systems. Taxpayers must declare and pay tax without assessment by the taxing authority. Quarterly payments of tax estimated to be due are required to the extent taxes are not paid through withholdings. The second and fourth "quarters" are not a quarter of a year in length. The second "quarter" is two months (April and May) and the fourth is four months (September to December). (Estimated taxes used to be paid based on a calendar quarter, but in the 60's the October due date was moved back to September to pull the third quarter cash receipts into the previous federal budget year which begins on October 1 every year, allowing the federal government to begin the year with a current influx of cash.) Employers must withhold income tax, as well as Social Security and Medicare taxes, from wages. Amounts to be withheld are computed by employers based on representations of tax status by employees on

Form W-4

Form W-4 (officially, the "Employee's Withholding Allowance Certificate") is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation (Tax exemption, exemptions, status, etc.) to ...

, with limited government review.

State variations

Forty-three

states

State most commonly refers to:

* State (polity), a centralized political organization that regulates law and society within a territory

**Sovereign state, a sovereign polity in international law, commonly referred to as a country

**Nation state, a ...

and many localities in the U.S. impose an

income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

on individuals. Forty-seven states and many localities impose a tax on the income of corporations. Tax rates vary by state and locality, and may be fixed or graduated. Most rates are the same for all types of income. State and local income taxes are imposed in addition to federal income tax. State income tax is allowed as a

deduction in computing federal income, but is capped at $10,000 per household since the passage of the

2017 tax law. Prior to the change, the average deduction exceeded $10,000 in most of the Midwest, most of the Northeast, as well as California and Oregon.

State and local taxable income is determined under state law, and often is based on federal taxable income. Most states conform to many federal concepts and definitions, including defining income and business deductions and timing thereof. State rules vary widely regarding to individual itemized deductions. Most states do not allow a deduction for state income taxes for individuals or corporations, and impose tax on certain types of income exempt at the federal level.

Some states have alternative measures of taxable income, or alternative taxes, especially for corporations.

States imposing an income tax generally tax all income of corporations organized in the state and individuals residing in the state. Taxpayers from another state are subject to tax only on income earned in the state or apportioned to the state. Businesses are subject to income tax in a state only if they have sufficient nexus in (connection to) the state.

Non-residents

Foreign individuals and corporations not resident in the United States are subject to federal income tax only on income from a U.S. business and certain types of income from

U.S. sources. States tax individuals resident outside the state and corporations organized outside the state only on wages or business income within the state. Payers of some types of income to non-residents must

withhold federal or state income tax on the payment. Federal withholding of 30% on such income may be reduced under a

tax treaty

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritanc ...

. Such treaties do not apply to state taxes.

Alternative tax bases (AMT, states)

An

alternative minimum tax (AMT) is imposed at the federal level on a somewhat modified version of taxable income. The tax applies to individuals and corporations. The tax base is

adjusted gross income

In the United States income tax system, adjusted gross income (AGI) is an individual's total gross income minus specific deductions. It is used to calculate taxable income, which is AGI minus allowances for personal exemptions and itemized d ...

reduced by a fixed deduction that varies by taxpayer filing status. Itemized deductions of individuals are limited to home mortgage interest, charitable contributions, and a portion of medical expenses. AMT is imposed at a rate of 26% or 28% for individuals and 20% for corporations, less the amount of regular tax. A credit against future regular income tax is allowed for such excess, with certain restrictions.

Many states impose minimum income taxes on corporations or a tax computed on an alternative tax base. These include taxes based on the capital of corporations and alternative measures of income for individuals. Details vary widely by state.

Differences between book and taxable income for businesses

In the United States, taxable income is computed under rules that differ materially from

U.S. generally accepted accounting principles. Since only publicly traded companies are required to prepare financial statements, many non-public companies opt to keep their financial records under tax rules. Corporations that present financial statements using other than tax rules must include a detailed reconciliation of their financial statement income to their taxable income as part of their tax returns. Key areas of difference include depreciation and amortization, timing of recognition of income or deductions, assumptions for

cost of goods sold

Cost of goods sold (COGS) (also cost of products sold (COPS), or cost of sales) is the carrying value of goods sold during a particular period.

Costs are associated with particular goods using one of the several formulas, including specific iden ...

, and certain items (such as meals and entertainment) the tax deduction for which is limited.

Reporting under self-assessment system

Income taxes in the United States are self-assessed by taxpayers by filing required tax returns. Taxpayers, as well as certain non-tax-paying entities, like partnerships, must file annual

tax returns

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax.

Tax returns are usually processed by each country's tax authority, known as a ...

at the federal and applicable state levels. These returns disclose a complete computation of taxable income under tax principles. Taxpayers compute all income, deductions, and credits themselves, and determine the amount of tax due after applying required prepayments and taxes withheld. Federal and state tax authorities provide preprinted forms that must be used to file tax returns. IRS

Form 1040 series is required for individuals, Form

1120 series for corporations, Form

1065

Year 1065 ( MLXV) was a common year starting on Saturday of the Julian calendar.

Events

By place

Europe

* December 24 – King Ferdinand I of León ("the Great") dies in León, Spain, after an 11-year reign as Emperor of All ...

for partnerships, and Form

990 series for tax exempt organizations.

The state forms vary widely, and rarely correspond to federal forms. Tax returns vary from the two-page (Form 1040EZ) used by nearly 70% of individual filers to thousands of pages of forms and attachments for large entities. Groups of corporations may elect to file

consolidated returns at the federal level and with a few states. Electronic filing of federal and many state returns is widely encouraged and in some cases required, and many vendors offer computer software for use by taxpayers and paid return preparers to prepare and electronically file returns.

Capital gains tax

Individuals and corporations pay

U.S. federal income tax on the net total of all their

capital gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

...

s. The tax rate depends on both the investor's

tax bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain poin ...

and the amount of time the investment was held. Short-term capital gains are taxed at the investor's

ordinary income

Under the United States Internal Revenue Code, the ''type'' of income is defined by its character. Ordinary income is usually characterized as income other than long-term capital gains. Ordinary income can consist of income from wages, salari ...

tax rate and are defined as investments held for a year or less before being sold. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate.

Payroll taxes

In the United States, payroll taxes are assessed by the federal government, many states, the District of Columbia, and numerous cities. These taxes are imposed on employers and employees and on various compensation bases. They are collected and paid to the taxing jurisdiction by the employers. Most jurisdictions imposing payroll taxes require reporting quarterly and annually in most cases, and electronic reporting is generally required for all but small employers. Because payroll taxes are imposed only on wages and not on income from investments, taxes on labor income are much heavier than taxes on income from capital.

Income tax withholding

Federal, state, and local

withholding tax

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the ...

es are required in those jurisdictions imposing an income tax. Employers having contact with the jurisdiction must withhold the tax from wages paid to their employees in those jurisdictions. Computation of the amount of tax to withhold is performed by the employer based on representations by the employee regarding his/her tax status on IRS

Form W-4

Form W-4 (officially, the "Employee's Withholding Allowance Certificate") is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation (Tax exemption, exemptions, status, etc.) to ...

. Amounts of income tax so withheld must be paid to the taxing jurisdiction, and are available as refundable

tax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "dis ...

s to the employees. Income taxes withheld from payroll are not final taxes, merely prepayments. Employees must still file income tax returns and self assess tax, claiming amounts withheld as payments.

Social Security and Medicare taxes

Federal social insurance taxes are imposed equally on employers and employees, consisting of a tax of 6.2% of wages up to an annual wage maximum ($132,900 in 2019

) for Social Security plus a tax of 1.45% of total wages for Medicare. For 2011, the employee's contribution was reduced to 4.2%, while the employer's portion remained at 6.2%. There is an additional Medicare tax of 0.9% on wages over $200,000, to be paid only by the employee (reported separately on the employee's tax return on Form 8959). To the extent an employee's portion of the 6.2% tax exceeds the maximum by reason of multiple employers (each of whom will collect up to the annual wage maximum), the employee is entitled to a refundable

tax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "dis ...

upon filing an income tax return for the year.

Unemployment taxes

Employers are subject to unemployment taxes by the federal and all state governments. The tax is a percentage of taxable wages with a cap. The tax rate and cap vary by jurisdiction and by employer's industry and experience rating. For 2009, the typical maximum tax per employee was under $1,000. Some states also impose unemployment, disability insurance, or similar taxes on employees.

Reporting and payment

Employers must report payroll taxes to the appropriate taxing jurisdiction in the manner each jurisdiction provides. Quarterly reporting of aggregate income tax withholding and Social Security taxes is required in most jurisdictions. Employers must file reports of aggregate unemployment tax quarterly and annually with each applicable state, and annually at the federal level.

Each employer is required to provide each employee an annual report on IRS Form W-2 of wages paid and federal, state and local taxes withheld, with a copy sent to the IRS and the taxation authority of the state. These are due by January 31 and February 28 (March 31 if filed electronically), respectively, following the calendar year in which wages are paid. The Form W-2 constitutes proof of payment of tax for the employee.

Employers are required to pay payroll taxes to the taxing jurisdiction under varying rules, in many cases within 1 banking day. Payment of federal and many state payroll taxes is required to be made by

electronic funds transfer

Electronic funds transfer (EFT) is the transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems.

The funds transfer process generally consists ...

if certain dollar thresholds are met, or by deposit with a bank for the benefit of the taxing jurisdiction.

Penalties

Failure to timely and properly pay federal payroll taxes results in an automatic penalty of 2% to 10%. Similar state and local penalties apply. Failure to properly file monthly or quarterly returns may result in additional penalties. Failure to file Forms W-2 results in an automatic penalty of up to $50 per form not timely filed. State and local penalties vary by jurisdiction.

A particularly severe penalty applies where federal income tax withholding and Social Security taxes are not paid to the IRS. The penalty of up to 100% of the amount not paid can be assessed against the employer entity as well as any person (such as a corporate officer) having control or custody of the funds from which payment should have been made.

Sales and excise taxes

Sales and use tax

There is no federal sales or use tax in the United States. All but five states impose sales and use taxes on retail sale, lease and rental of many goods, as well as some services. Many cities, counties, transit authorities and special purpose districts impose an additional local sales or use tax. Sales and use tax is calculated as the purchase price times the appropriate tax rate. Tax rates vary widely by jurisdiction from less than 1% to over 10%. Sales tax is collected by the seller at the time of sale. Use tax is self assessed by a buyer who has not paid sales tax on a taxable purchase.

Unlike

value added tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared wi ...

, sales tax is imposed only once, at the retail level, on any particular goods. Nearly all jurisdictions provide numerous categories of goods and services that are exempt from sales tax, or taxed at a reduced rate. Purchase of goods for further manufacture or for resale is uniformly exempt from sales tax. Most jurisdictions exempt food sold in grocery stores, prescription medications, and many agricultural supplies. Generally cash discounts, including coupons, are not included in the price used in computing tax.

Sales taxes, including those imposed by local governments, are generally administered at the state level. States imposing sales tax require retail sellers to register with the state, collect tax from customers, file returns, and remit the tax to the state. Procedural rules vary widely. Sellers generally must collect tax from in-state purchasers unless the purchaser provides an exemption certificate. Most states allow or require electronic remittance of tax to the state. States are prohibited from requiring out of state sellers to collect tax unless the seller has some minimal connection with the state.

Excise taxes

Excise taxes may be imposed on the sales price of goods or on a per unit or other basis, in theory to discourage consumption of the taxed goods or services. Excise tax may be required to be paid by the manufacturer at wholesale sale, or may be collected from the customer at retail sale. Excise taxes are imposed at the federal and state levels on a variety of goods, including

alcohol

Alcohol may refer to:

Common uses

* Alcohol (chemistry), a class of compounds

* Ethanol, one of several alcohols, commonly known as alcohol in everyday life

** Alcohol (drug), intoxicant found in alcoholic beverages

** Alcoholic beverage, an alco ...

, tobacco, tires, gasoline, diesel fuel, coal, firearms, telephone service, air transportation, unregistered bonds, and many other goods and services. Some jurisdictions require that tax stamps be affixed to goods to demonstrate payment of the tax.

Property taxes

Most jurisdictions below the state level in the United States impose a tax on interests in real property (land, buildings, and permanent improvements). Some jurisdictions also tax some types of business personal property. Rules vary widely by jurisdiction. Many overlapping jurisdictions (counties, cities, school districts) may have authority to tax the same property. Few states impose a tax on the value of property.

Property tax is based on

fair market value

The fair market value of property is the price at which it would change hands between a willing and informed buyer and seller. The term is used throughout the Internal Revenue Code, as well as in bankruptcy laws, in many state laws, and by several ...

of the subject property. The amount of tax is determined annually based on the market value of each property on a particular date, and most jurisdictions require redeterminations of value periodically. The tax is computed as the determined market value times an assessment ratio times the tax rate. Assessment ratios and tax rates vary widely among jurisdictions, and may vary by type of property within a jurisdiction. Where a property has recently been sold between unrelated sellers, such sale establishes fair market value. In other (''i.e.'', most) cases, the value must be estimated. Common estimation techniques include comparable sales, depreciated cost, and an income approach. Property owners may also declare a value, which is subject to change by the tax assessor.

Types of property taxed

Property taxes are most commonly applied to real estate and business property. Real property generally includes all interests considered under that state's law to be ownership interests in land, buildings, and improvements. Ownership interests include ownership of title as well as certain other rights to property. Automobile and boat registration fees are a subset of this tax. Other nonbusiness goods are generally not subject to property tax, though

Virginia

Virginia, officially the Commonwealth of Virginia, is a U.S. state, state in the Southeastern United States, Southeastern and Mid-Atlantic (United States), Mid-Atlantic regions of the United States between the East Coast of the United States ...

maintains a unique personal property tax on all motor vehicles, including non-business vehicles.

Assessment and collection

The assessment process varies by state, and sometimes within a state. Each taxing jurisdiction determines values of property within the jurisdiction and then determines the amount of tax to assess based on the value of the property. Tax assessors for taxing jurisdictions are generally responsible for determining property values. The determination of values and calculation of tax is generally performed by an official referred to as a

tax assessor. Property owners have rights in each jurisdiction to declare or contest the value so determined. Property values generally must be coordinated among jurisdictions, and such coordination is often performed by

equalization.

Once value is determined, the assessor typically notifies the last known property owner of the value determination. After values are settled, property tax bills or notices are sent to property owners. Payment times and terms vary widely. If a property owner fails to pay the tax, the taxing jurisdiction has various remedies for collection, in many cases including seizure and sale of the property. Property taxes constitute a lien on the property to which transfers are also subject. Mortgage companies often collect taxes from property owners and remit them on behalf of the owner.

Customs duties

The United States imposes tariffs or

customs

Customs is an authority or Government agency, agency in a country responsible for collecting tariffs and for controlling International trade, the flow of goods, including animals, transports, personal effects, and hazardous items, into and out ...

duties on imports of goods. The duty is levied at the time of import and is paid by the importer of record. Customs duties vary by country of origin and product. Goods from many countries are exempt from duty under various trade agreements. Certain types of goods are exempt from duty regardless of source. Customs rules differ from other import restrictions. Failure to properly comply with customs rules can result in seizure of goods and criminal penalties against involved parties. United States Customs and Border Protection ("CBP") enforces customs rules.

Import of goods

Goods may be imported to the United States subject to import restrictions. Importers of goods may be subject to tax ("customs duty" or "tariff") on the imported value of the goods. "Imported goods are not legally entered until after the shipment has arrived within the port of entry, delivery of the merchandise has been authorized by CBP, and estimated duties have been paid." Importation and declaration and payment of customs duties is done by the importer of record, which may be the owner of the goods, the purchaser, or a licensed customs broker. Goods may be stored in a bonded warehouse or a Foreign-Trade Zone in the United States for up to five years without payment of duties. Goods must be declared for entry into the U.S. within 15 days of arrival or prior to leaving a bonded warehouse or foreign trade zone. Many importers participate in a voluntary self-assessment program with CBP. Special rules apply to goods imported by mail. All goods imported into the United States are subject to inspection by CBP. Some goods may be temporarily imported to the United States under a system similar to the

ATA Carnet

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the Tax exemption, tax-free and Duty-free trade, duty-free temporary export and import of nonperishable goods for up to one year. It ...

system. Examples include laptop computers used by persons traveling in the U.S. and samples used by salesmen.

Origin

Rates of tax on transaction values vary by

country of origin

Country of origin (CO) represents the country or countries of manufacture, production, design, or brand origin where an article or product comes from. For multinational brands, CO may include multiple countries within the value-creation proce ...

. Goods must be individually labeled to indicate country of origin, with exceptions for specific types of goods. Goods are considered to originate in the country with the highest rate of duties for the particular goods unless the goods meet certain minimum content requirements. Extensive modifications to normal duties and classifications apply to goods originating in Canada or Mexico under the

orth American Free Trade Agreement

Classification

All goods that are not exempt are subject to duty computed according to the Harmonized Tariff Schedule published by CBP and the U.S. International Trade Commission. This lengthy schedule provides rates of duty for each class of goods. Most goods are classified based on the nature of the goods, though some classifications are based on use.

Duty rate

Customs duty rates may be expressed as a percentage of value or dollars and cents per unit. Rates based on value vary from zero to 20% in the 2011 schedule. Rates may be based on relevant units for the particular type of goods (per ton, per kilogram, per square meter, etc.). Some duties are based in part on value and in part on quantity.

Where goods subject to different rates of duty are commingled, the entire shipment may be taxed at the highest applicable duty rate.

Procedures

Imported goods are generally accompanied by a

bill of lading

A bill of lading () (sometimes abbreviated as B/L or BOL) is a document issued by a common carrier, carrier (or their Law of agency, agent) to acknowledge receipt of cargo for shipment. Although the term is historically related only to Contract of ...

or air waybill describing the goods. For purposes of customs duty assessment, they must also be accompanied by an invoice documenting the transaction value. The goods on the bill of lading and invoice are classified and duty is computed by the importer or CBP. The amount of this duty is payable immediately, and must be paid before the goods can be imported. Most assessments of goods are now done by the importer and documentation filed with CBP electronically.

After duties have been paid, CBP approves the goods for import. They can then be removed from the port of entry, bonded warehouse, or Free-Trade Zone.

After duty has been paid on particular goods, the importer can seek a refund of duties if the goods are exported without substantial modification. The process of claiming a refund is known as duty drawback.

Penalties

Certain civil penalties apply for failures to follow CBP rules and pay duty. Goods of persons subject to such penalties may be seized and sold by CBP. In addition, criminal penalties may apply for certain offenses. Criminal penalties may be as high as twice the value of the goods plus twenty years in jail.

Foreign-Trade Zones

Foreign-Trade Zones are secure areas physically in the United States but legally outside the customs territory of the United States. Such zones are generally near ports of entry. They may be within the warehouse of an importer. Such zones are limited in scope and operation based on approval of the Foreign-Trade Zones Board. Goods in a Foreign-Trade Zone are not considered imported to the United States until they leave the Zone. Foreign goods may be used to manufacture other goods within the zone for export without payment of customs duties.

Estate and gift taxes

Estate and gift taxes in the United States are imposed by the federal and some state governments. The estate tax is an excise tax levied on the right to pass property at death. It is imposed on the estate, not the beneficiary. Some states impose an inheritance tax on recipients of bequests. Gift taxes are levied on the giver (donor) of property where the property is transferred for less than adequate consideration. An additional generation-skipping transfer (GST) tax is imposed by the federal and some state governments on transfers to grandchildren (or their descendants).

The federal gift tax is applicable to the donor, not the recipient, and is computed based on cumulative taxable gifts, and is reduced by prior gift taxes paid. The federal estate tax is computed on the sum of taxable estate and taxable gifts, and is reduced by prior gift taxes paid. These taxes are computed as the taxable amount times a graduated tax rate (up to 35% in 2011). The estate and gift taxes are also reduced by a major "unified credit" equivalent to an exclusion ($5 million in 2011). Rates and exclusions have varied, and the benefits of lower rates and the credit have been phased out during some years.

Taxable gifts are certain gifts of U.S. property by nonresident aliens, most gifts of any property by citizens or residents, in excess of an annual exclusion ($13,000 for gifts made in 2011) per donor per donee. Taxable estates are certain U.S. property of non-resident alien decedents, and most property of citizens or residents. For aliens, residence for estate tax purposes is primarily based on domicile, but U.S. citizens are taxed regardless of their country of residence. U.S. real estate and most tangible property in the U.S. are subject to estate and gift tax whether the decedent or donor is resident or nonresident, citizen or alien.

The taxable amount of a gift is the fair market value of the property in excess of consideration received at the date of gift. The taxable amount of an estate is the gross fair market value of all rights considered property at the date of death (or an alternative valuation date) ("gross estate"), less liabilities of the decedent, costs of administration (including funeral expenses) and certain other deductions, see

Stepped-up basis

The tax code of the United States holds that when a person (the beneficiary) receives an asset from a giver (the benefactor) after the benefactor dies, the asset receives a stepped-up basis, which is its market value at the time the benefactor dies ...

. State estate taxes are deductible, with limitations, in computing the federal taxable estate. Bequests to charities reduce the taxable estate.

Gift tax applies to all irrevocable transfers of interests in tangible or intangible property. Estate tax applies to all property owned in whole or in part by a citizen or resident at the time of his or her death, to the extent of the interest in the property. Generally, all types of property are subject to estate tax. Whether a decedent has sufficient interest in property for the property to be subject to gift or estate tax is determined under applicable state property laws. Certain interests in property that lapse at death (such as life insurance) are included in the taxable estate.

Taxable values of estates and gifts are the fair market value. For some assets, such as widely traded stocks and bonds, the value may be determined by market listings. The value of other property may be determined by appraisals, which are subject to potential contest by the taxing authority. Special use valuation applies to farms and

closely held businesses, subject to limited dollar amount and other conditions. Monetary assets, such as cash, mortgages, and notes, are valued at the face amount, unless another value is clearly established.

Life insurance proceeds are included in the gross estate. The value of a right of a beneficiary of an estate to receive an annuity is included in the gross estate. Certain transfers during lifetime may be included in the gross estate. Certain powers of a decedent to control the disposition of property by another are included in the gross estate.

The taxable estate of a married decedent is reduced by a deduction for all property passing to the decedent's spouse. Certain terminable interests are included. Other conditions may apply.

Donors of gifts in excess of the annual exclusion must file gift tax returns on IRS Form 709 and pay the tax. Executors of estates with a gross value in excess of the unified credit must file an estate tax return on IRS Form 706 and pay the tax from the estate. Returns are required if the gifts or gross estate exceed the exclusions. Each state has its own forms and filing requirements. Tax authorities may examine and adjust gift and estate tax returns.

Licenses and occupational taxes

Many jurisdictions within the United States impose taxes or fees on the privilege of carrying on a particular business or maintaining a particular professional certification. These licensing or occupational taxes may be a fixed dollar amount per year for the licensee, an amount based on the number of practitioners in the firm, a percentage of revenue, or any of several other bases. Persons providing professional or personal services are often subject to such fees. Common examples include accountants, attorneys, barbers, casinos, dentists, doctors, auto mechanics, plumbers, and stockbrokers. In addition to the tax, other requirements may be imposed for licensure.

All 50 states impose a vehicle license fee. Generally, the fees are based on the type and size of the vehicle and are imposed annually or biannually. All states and the District of Columbia also impose a fee for a driver's license, which generally must be renewed with payment of fee every few years.

User fees

Fees are often imposed by governments for use of certain facilities or services. Such fees are generally imposed at the time of use. Multi-use permits may be available. For example, fees are imposed for use of national or state parks, for requesting and obtaining certain rulings from the U.S. Internal Revenue Service (IRS), for the use of certain highways (called "tolls" or toll roads), for parking on public streets, and for the use of public transit.

Tax administration

Taxes in the United States are administered by hundreds of tax authorities. At the federal level there are three tax administrations. Most domestic federal taxes are administered by the Internal Revenue Service, which is part of the

Department of the Treasury. Alcohol, tobacco, and firearms taxes are administered by the Alcohol and Tobacco Tax and Trade Bureau (TTB). Taxes on imports (customs duties) are administered by

U.S. Customs and Border Protection

United States Customs and Border Protection (CBP) is the largest federal law enforcement agency of the United States Department of Homeland Security. It is the country's primary border control organization, charged with regulating and facilita ...

(CBP). TTB is also part of the

Department of the Treasury and CBP belongs to the

Department of Homeland Security

The United States Department of Homeland Security (DHS) is the U.S. federal executive department responsible for public security, roughly comparable to the interior, home, or public security ministries in other countries. Its missions invol ...

.

Organization of state and local tax administrations varies widely. Every state maintains a tax administration. A few states administer some local taxes in whole or part. Most localities also maintain a tax administration or share one with neighboring localities.

Federal

Internal Revenue Service

The Internal Revenue Service administers all U.S. federal tax laws on domestic activities, except those taxes administered by TTB. IRS functions include:

* Processing federal tax returns (except TTB returns), including those for Social Security and other federal payroll taxes

* Providing assistance to taxpayers in completing tax returns

* Collecting all taxes due related to such returns

* Enforcement of tax laws through examination of returns and assessment of penalties

* Providing an appeals mechanism for federal tax disputes

* Referring matters to the Justice Department for prosecution

* Publishing information about U.S. federal taxes, including forms, publications, and other materials

* Providing written guidance in the form of rulings binding on the IRS for the public and for particular taxpayers

The IRS maintains several Service Centers at which tax returns are processed. Taxpayers generally file most types of tax returns by mail with these Service Centers, or file electronically. The IRS also maintains a National Office in Washington, DC, and numerous local offices providing taxpayer services and administering tax examinations.

=Examination

=

Tax returns filed with the IRS are subject to examination and adjustment, commonly called an IRS audit. Only a small percentage of returns (about 1% of individual returns in IRS FY 2008) are examined each year. The selection of returns uses a variety of methods based on IRS experiences. On examination, the IRS may request additional information from the taxpayer by mail, in person at IRS local offices, or at the business location of the taxpayer. The taxpayer is entitled to representation by an

attorney,

Certified Public Accountant

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries. In the United Stat ...

(CPA), or

enrolled agent, at the expense of the taxpayer, who may make representations to the IRS on behalf of the taxpayer.

Taxpayers have certain rights in an audit. Upon conclusion of the audit, the IRS may accept the tax return as filed or propose adjustments to the return. The IRS may also assess

penalties and interest. Generally, adjustments must be proposed within three years of the due date of the tax return. Certain circumstances extend this time limit, including substantial understatement of income and fraud. The taxpayer and the IRS may agree to allow the IRS additional time to conclude an audit. If the IRS proposes adjustments, the taxpayer may agree to the adjustment,

appeal within the IRS, or seek judicial determination of the tax.

=Published and private rulings

=

In addition to enforcing tax laws, the IRS provides formal and informal guidance to taxpayers. While often referred to as IRS Regulations, the regulations under the Internal Revenue Code are issued by the Department of Treasury. IRS guidance consists of:

*

Revenue Ruling

Revenue rulings are public administrative rulings by the Internal Revenue Service (IRS) in the United States Department of the Treasury of the United States federal government that apply the law to particular factual situations. A revenue ruling c ...

s, Revenue Procedures, and various IRS pronouncements applicable to all taxpayers and published in the

Internal Revenue Bulletin

The ''Internal Revenue Bulletin'' (also known as the ''IRB''), is a weekly publication of the U.S. Internal Revenue Service that announces "official rulings and procedures of the Internal Revenue Service and for publishing Treasury Decisions, Execu ...

, which are binding on the IRS

*

Private letter ruling

Private letter rulings (PLRs), in the United States, are written decisions by the Internal Revenue Service (IRS) in response to taxpayer requests for guidance. A letter ruling is "a written statement issued to a taxpayer by an Associate Chief Couns ...

s on specific issues, applicable only to the taxpayer who applied for the ruling

* IRS Publications providing informal instruction to the public on tax matters

* IRS forms and instructions

* A comprehensive web site

* Informal (nonbinding) advice by telephone

Alcohol and Tobacco Tax and Trade Bureau

The Alcohol and Tobacco Tax Trade Bureau (TTB), a division of the

Department of the Treasury, enforces federal excise tax laws related to alcohol, tobacco, and firearms. TTB has six divisions, each with discrete functions:

* Revenue Center: processes tax returns and issues permits, and related activities

* Risk Management: internally develops guidelines and monitors programs

* Tax Audit: verifies filing and payment of taxes

* Trade Investigations: investigating arm for non-tobacco items

* Tobacco Enforcement Division: enforcement actions for tobacco

* Advertising, Labeling, and Formulation Division: implements various labeling and ingredient monitoring

Criminal enforcement related to TTB is done by the

Bureau of Alcohol, Tobacco, Firearms, and Explosives, a division of the

Justice Department

A justice ministry, ministry of justice, or department of justice, is a ministry or other government agency in charge of the administration of justice. The ministry or department is often headed by a minister of justice (minister for justice in a ...

.

Customs and Border Protection

U.S. Customs and Border Protection (CBP), an agency of the

United States Department of Homeland Security

The United States Department of Homeland Security (DHS) is the U.S. United States federal executive departments, federal executive department responsible for public security, roughly comparable to the Interior minister, interior, Home Secretary ...

, collects customs duties and regulates international trade. It has a workforce of over 58,000 employees covering over 300 official ports of entry to the United States. CBP has authority to seize and dispose of cargo in the case of certain violations of customs rules.

State administrations

Every state in the United States has its own tax administration, subject to the rules of that state's law and regulations. For example, the

California Franchise Tax Board

The California Franchise Tax Board (FTB) administers and collects state personal income tax and corporate franchise and income tax of California. It is part of the California Government Operations Agency.

The board is composed of the Calif ...

. These are referred to in most states as the Department of Revenue or Department of Taxation. The powers of the state taxing authorities vary widely. Most enforce all state level taxes but not most local taxes. However, many states have unified state-level sales tax administration, including for local sales taxes.

State tax returns are filed separately with those tax administrations, not with the federal tax administrations. Each state has its own procedural rules, which vary widely.

Local administrations

Most localities within the United States administer most of their own taxes. In many cases, there are multiple local taxing jurisdictions with respect to a particular taxpayer or property. For property taxes, the taxing jurisdiction is typically represented by a tax assessor/collector whose offices are located at the taxing jurisdiction's facilities.

Legal basis

The

United States Constitution

The Constitution of the United States is the Supremacy Clause, supreme law of the United States, United States of America. It superseded the Articles of Confederation, the nation's first constitution, on March 4, 1789. Originally includi ...

provides that

Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

"shall have the power to lay and collect Taxes, Duties, Imposts, and Excises ... but all Duties, Imposts, and Excises shall be uniform throughout the United States." Prior to amendment, it provided that "No Capitation, or other direct, Tax shall be Laid unless in proportion to the Census ..." The

16th Amendment provided that "Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration." The

10th Amendment provided that "powers not delegated to the United States by this Constitution, nor prohibited to the States, are reserved to the States respectively, or to the people."

Congress has enacted numerous laws dealing with taxes since adoption of the Constitution. Those laws are now codified as Title 19, Customs Duties, Title 26, Internal Revenue Code, and various other provisions. These laws specifically authorize the United States Secretary of the Treasury to delegate various powers related to levy, assessment and collection of taxes.

State constitutions uniformly grant the state government the right to levy and collect taxes. Limitations under state constitutions vary widely.

Various fringe

individuals and groups have questioned the legitimacy of United States federal income tax. These

arguments

An argument is a series of sentences, statements, or propositions some of which are called premises and one is the conclusion. The purpose of an argument is to give reasons for one's conclusion via justification, explanation, and/or persua ...

are varied, but have been uniformly rejected by the Internal Revenue Service and by the courts and ruled to be frivolous.

Policy issues

Commentators Benjamin Page, Larry Bartels, and Jason Seawright contend that Federal tax policy in relation to regulation and reform in the United States tends to favor wealthy Americans. They assert that political influence is a legal right the wealthy can exercise by contributing funds to lobby for their policy preference.

Each major type of tax in the United States has been used by some jurisdiction at some time as a tool of social policy. Both liberals and conservatives have called for more

progressive tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the ...

es in the U.S.