|

Income Inequality In The United States

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a lower level of inequality from approximately 1950-1980 (a period named the Great Compression), followed by increasing inequality, in what has been coined as the Great Divergence (inequality), great divergence. The U.S. has the highest level of income inequality among its (post-industrialized) peers.United Press International (UPI), June 22, 2018"U.N. Report: With 40M in Poverty, U.S. Most Unequal Developed Nation"/ref> When measured for all households, U.S. income inequality is comparable to other developed countries before taxes and transfers, but is among the highest after taxes and transfers, meaning the U.S. shifts relatively less income from higher income households to lower income households. In 2016, average market income was $15,600 for the lowest Quantile, quintile and $280,300 for the highest quintile. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shares Of Income 2016 CBO

In financial markets, a share (sometimes referred to as stock or equity) is a unit of equity ownership in the capital stock of a corporation. It can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share expresses the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Terminology * Stock * Equity * Shares outstanding are shares that are authoriz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's California Legislative Analyst's Office, Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Workers’ Compensation

Workers' compensation or workers' comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue his or her employer for the tort of negligence. The trade-off between assured, limited coverage and lack of recourse outside the worker compensation system is known as "the compensation bargain.” One of the problems that the compensation bargain solved is the problem of employers becoming insolvent as a result of high damage awards. The system of collective liability was created to prevent that and thus to ensure security of compensation to the workers. While plans differ among jurisdictions, provision can be made for weekly payments in place of wages (functioning in this case as a form of disability insurance), compensation for economic loss (past and future), reimbursement or payment of medical and like expenses (functioning in this case as a form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Insurance

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the reference period. Unemployment is measured by the unemployment rate, which is the number of people who are unemployed as a percentage of the labour force (the total number of people employed added to those unemployed). Unemployment can have many sources, such as the following: * the status of the economy, which can be influenced by a recession * competition caused by globalization and international trade * new technologies and inventions * policies of the government * regulation and market * war, civil disorder, and natural disasters Unemployment and the status of the economy can be influenced by a country through, for example, fiscal policy. Furthermore, the monetary authority of a country, such as the central bank, can in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

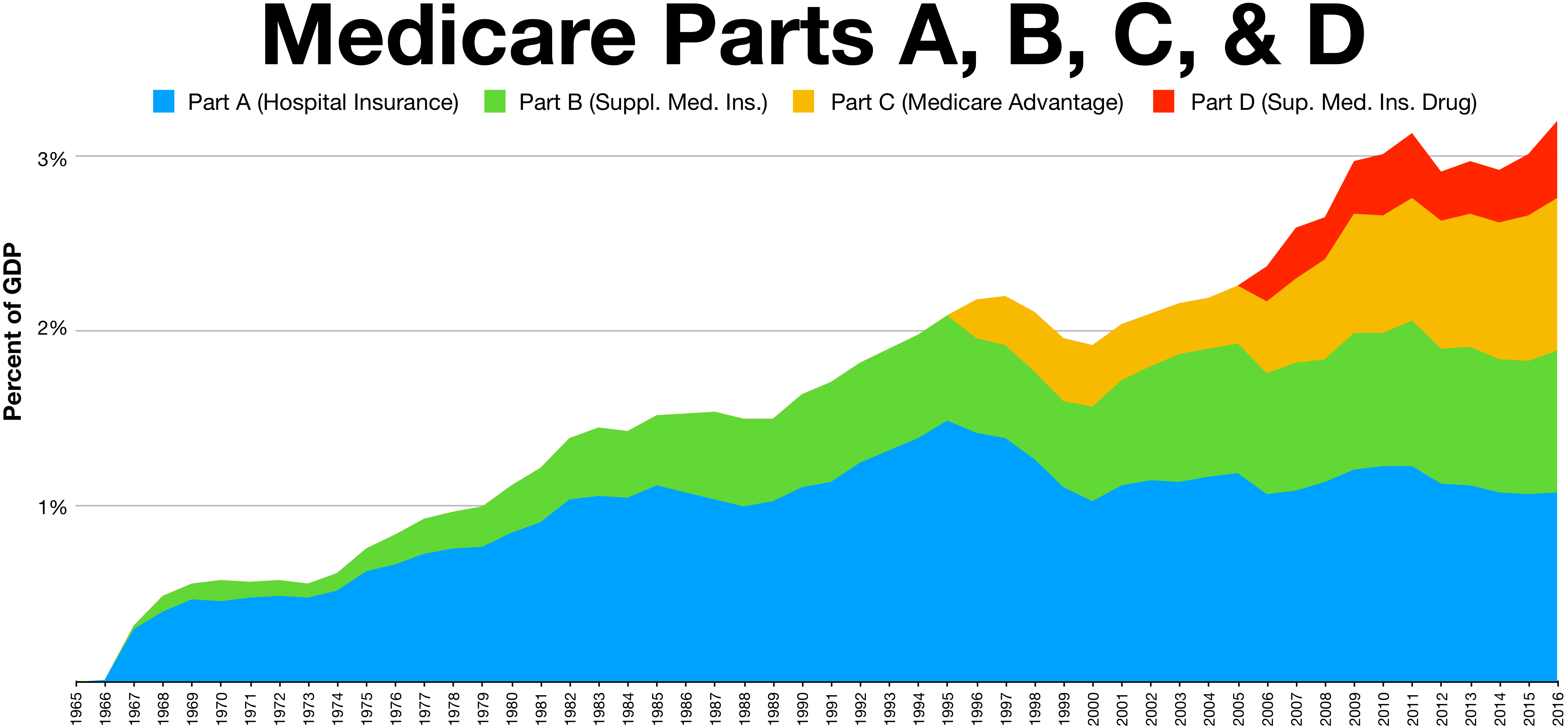

Medicare (United States)

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with End Stage Renal Disease Program, end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). It started in 1965 under the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services (CMS). Medicare is divided into four parts: A, B, C and D. Part A covers hospital, skilled nursing, and hospice services. Part B covers outpatient services. Part D covers self-administered prescription drugs. Part C is an alternative that allows patients to choose private plans with different benefit structures that provide the same services as Parts A and B, usually with additional benefits. In 2022, Medicare provided health insurance for 65.0 million individuals—more than 57 million people aged 65 and older and about 8 million younger people. According to annual Medicare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

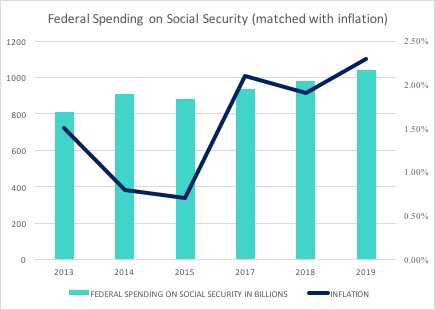

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Insurance

Social insurance is a form of Social protection, social welfare that provides insurance against economic risks. The insurance may be provided publicly or through the subsidizing of private insurance. In contrast to other forms of Welfare spending, social assistance, individuals' claims are partly dependent on their contributions, which can be considered insurance premiums to create a common fund out of which the individuals are then paid benefits in the future. Types of social insurance include: * Universal health care, Public health insurance * Social Security (United States), Social Security * Unemployment Insurance, Public Unemployment Insurance * Public auto insurance * Parental leave, Universal parental leave Features * The contributions of individuals is nominal and never goes beyond what they can afford * the Social welfare, benefits, eligibility requirements and other aspects of the program are defined by statute; * explicit provision is made to account for the incom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Federal Minimum Wage If It Had Kept Pace With Productivity

US or Us most often refers to: * ''Us'' (pronoun), the objective case of the English first-person plural pronoun ''we'' * US, an abbreviation for the United States US, U.S., Us, us, or u.s. may also refer to: Arts and entertainment Albums * ''Us'' (Brother Ali album) or the title song, 2009 * ''Us'' (Empress Of album), 2018 * ''Us'' (Mull Historical Society album), 2003 * ''Us'' (Peter Gabriel album), 1992 * ''Us'' (EP), by Moon Jong-up, 2021 * ''Us'', by Maceo Parker, 1974 * ''Us'', mini-album by Peakboy, 2019 Songs * "Us" (James Bay song), 2018 * "Us" (Jennifer Lopez song), 2018 * "Us" (Regina Spektor song), 2004 * "Us" (Gracie Abrams song), 2024 * "Us", by Azealia Banks from '' Fantasea'', 2012 * "Us", by Celine Dion from ''Let's Talk About Love'', 1997 * "Us", by Gucci Mane from '' Delusions of Grandeur'', 2019 * "Us", by Spoon from '' Hot Thoughts'', 2017 Other media * US Festival, two 1980s California music festivals organized by Steve Wozniak * ''Us'' (1991 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ratio For Each Income Percentile To Median Income In The U

In mathematics, a ratio () shows how many times one number contains another. For example, if there are eight oranges and six lemons in a bowl of fruit, then the ratio of oranges to lemons is eight to six (that is, 8:6, which is equivalent to the ratio 4:3). Similarly, the ratio of lemons to oranges is 6:8 (or 3:4) and the ratio of oranges to the total amount of fruit is 8:14 (or 4:7). The numbers in a ratio may be quantities of any kind, such as counts of people or objects, or such as measurements of lengths, weights, time, etc. In most contexts, both numbers are restricted to be positive. A ratio may be specified either by giving both constituting numbers, written as "''a'' to ''b''" or "''a'':''b''", or by giving just the value of their quotient Equal quotients correspond to equal ratios. A statement expressing the equality of two ratios is called a ''proportion''. Consequently, a ratio may be considered as an ordered pair of numbers, a fraction with the first number in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Logarithmic Scale

A logarithmic scale (or log scale) is a method used to display numerical data that spans a broad range of values, especially when there are significant differences among the magnitudes of the numbers involved. Unlike a linear Scale (measurement), scale where each unit of distance corresponds to the same increment, on a logarithmic scale each unit of length is a multiple of some base value raised to a power, and corresponds to the multiplication of the previous value in the scale by the base value. In common use, logarithmic scales are in base 10 (unless otherwise specified). A logarithmic scale is Nonlinear system, nonlinear, and as such numbers with equal distance between them such as 1, 2, 3, 4, 5 are not equally spaced. Equally spaced values on a logarithmic scale have exponents that increment uniformly. Examples of equally spaced values are 10, 100, 1000, 10000, and 100000 (i.e., 101, 102, 103, 104, 105) and 2, 4, 8, 16, and 32 (i.e., 21, 22, 23, 24, 25). Exponential growt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. The earned income tax credit has been part of political debates in the United States over ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Class In The United States

In the United States, the concept of a working class remains vaguely defined, and classifying people or jobs into this class can be contentious. According to Frank Newport, "for some, working class is a more literal label; namely, an indication that one is working." Economists and pollsters in the United States generally define "working class" adults as those lacking a college degree, rather than by occupation or income. Other definitions refer to those in blue-collar occupations, despite the considerable range in required skills and income among such occupations. Many members of the working class, as defined by academic models, are often identified in the vernacular as being middle-class, despite there being considerable ambiguity over the term's meaning. Sociologists such as Dennis Gilbert and Joseph Kahl see the working class as the most populous in the United States, while other sociologists such as William Thompson, Joseph Hickey and James Henslin deem the lower middle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |