Accidental American on:

[Wikipedia]

[Google]

[Amazon]

An Accidental American is someone whom US law deems to be an

Like the United States, many other countries have laws for transmission of citizenship by descent, but those countries impose tax filing obligations only on people who reside or earn income in those countries; the United States and

Like the United States, many other countries have laws for transmission of citizenship by descent, but those countries impose tax filing obligations only on people who reside or earn income in those countries; the United States and

The Internal Revenue Code provides for a foreign earned income exclusion allowing non-resident U.S. tax filers to exclude wage income up to a certain threshold ($99,400 for the 2013 tax filing season) from U.S. taxation, as well as credits for taxes paid to other countries. The result is that accidental Americans often do not owe U.S. income tax, but must spend thousands of dollars in accounting fees to prove that fact, and face potential fines of tens of thousands of dollars for paperwork errors. The reason is that the foreign earned income exclusion does not affect filing obligations nor the treatment of non-U.S bank accounts and investment plans. Tax lawyers state that compliance with the foreign trust and

The Internal Revenue Code provides for a foreign earned income exclusion allowing non-resident U.S. tax filers to exclude wage income up to a certain threshold ($99,400 for the 2013 tax filing season) from U.S. taxation, as well as credits for taxes paid to other countries. The result is that accidental Americans often do not owe U.S. income tax, but must spend thousands of dollars in accounting fees to prove that fact, and face potential fines of tens of thousands of dollars for paperwork errors. The reason is that the foreign earned income exclusion does not affect filing obligations nor the treatment of non-U.S bank accounts and investment plans. Tax lawyers state that compliance with the foreign trust and

Accidental Americans who become aware of their U.S. citizenship status have the option of looking into ways of renouncing or relinquishing it. Although it is possible for children to acquire U.S. citizenship "accidentally" without any voluntary action on their part, under current law they cannot lose that citizenship status accidentally or automatically as adults; instead, they must take voluntary action to give it up. United States nationality law () formerly provided for automatic loss of U.S. citizenship by dual citizens resident abroad, but this was repealed by the Immigration and Nationality Act Amendments of 1978 (; ).

The Quarterly Publication of Individuals Who Have Chosen to Expatriate, which lists names of certain people with respect to whom the IRS received information on

Accidental Americans who become aware of their U.S. citizenship status have the option of looking into ways of renouncing or relinquishing it. Although it is possible for children to acquire U.S. citizenship "accidentally" without any voluntary action on their part, under current law they cannot lose that citizenship status accidentally or automatically as adults; instead, they must take voluntary action to give it up. United States nationality law () formerly provided for automatic loss of U.S. citizenship by dual citizens resident abroad, but this was repealed by the Immigration and Nationality Act Amendments of 1978 (; ).

The Quarterly Publication of Individuals Who Have Chosen to Expatriate, which lists names of certain people with respect to whom the IRS received information on

American citizen

Citizenship of the United States is a legal status that entails Americans with specific rights, duties, protections, and benefits in the United States. It serves as a foundation of fundamental rights derived from and protected by the Constit ...

, but who has only a tenuous connection with that country. For example, American nationality law

United States nationality law details the conditions in which a person holds United States nationality. In the United States, nationality is typically obtained through provisions in the U.S. Constitution, various laws, and international agre ...

provides (with limited exceptions) that anyone born on US territory is a US citizen (''jus soli

''Jus soli'' ( , , ; meaning "right of soil"), commonly referred to as birthright citizenship, is the right of anyone born in the territory of a state to nationality or citizenship.

''Jus soli'' was part of the English common law, in cont ...

''), including those who leave as infants or young children, even if neither parent is a US citizen (as in the case of Boris Johnson

Alexander Boris de Pfeffel Johnson (; born 19 June 1964) is a British politician, writer and journalist who served as Prime Minister of the United Kingdom and Leader of the Conservative Party from 2019 to 2022. He previously served as ...

until he renounced his US citizenship in 2016). US law also ascribes American citizenship to some children born abroad to a US citizen parent (''jus sanguinis

( , , ; 'right of blood') is a principle of nationality law by which citizenship is determined or acquired by the nationality or ethnicity of one or both parents. Children at birth may be citizens of a particular state if either or both of th ...

''), even if those children never enter the United States. Since the early 2000s, the term "Accidental American" has been adopted by several activist groups to protest tax treaties and Inter-Governmental Agreements which treat such people as American citizens who are therefore potentially subject to tax and financial reporting (e.g. FATCA

The Foreign Account Tax Compliance Act (FATCA) is a 2010 United States federal law requiring all non-U.S. foreign financial institutions (FFIs) to search their records for customers with indicia of a connection to the U.S., including indication ...

and FBAR) requirements – requirements which few other countries impose on their nonresident citizens. Accidental Americans may be unaware of these requirements, or their US citizen status, until they encounter problems accessing bank services in their home countries, for example, or are barred from entering the US on a non-US passport. Furthermore, the US State Department

The United States Department of State (DOS), or State Department, is an executive department of the U.S. federal government responsible for the country's foreign policy and relations. Equivalent to the ministry of foreign affairs of other nati ...

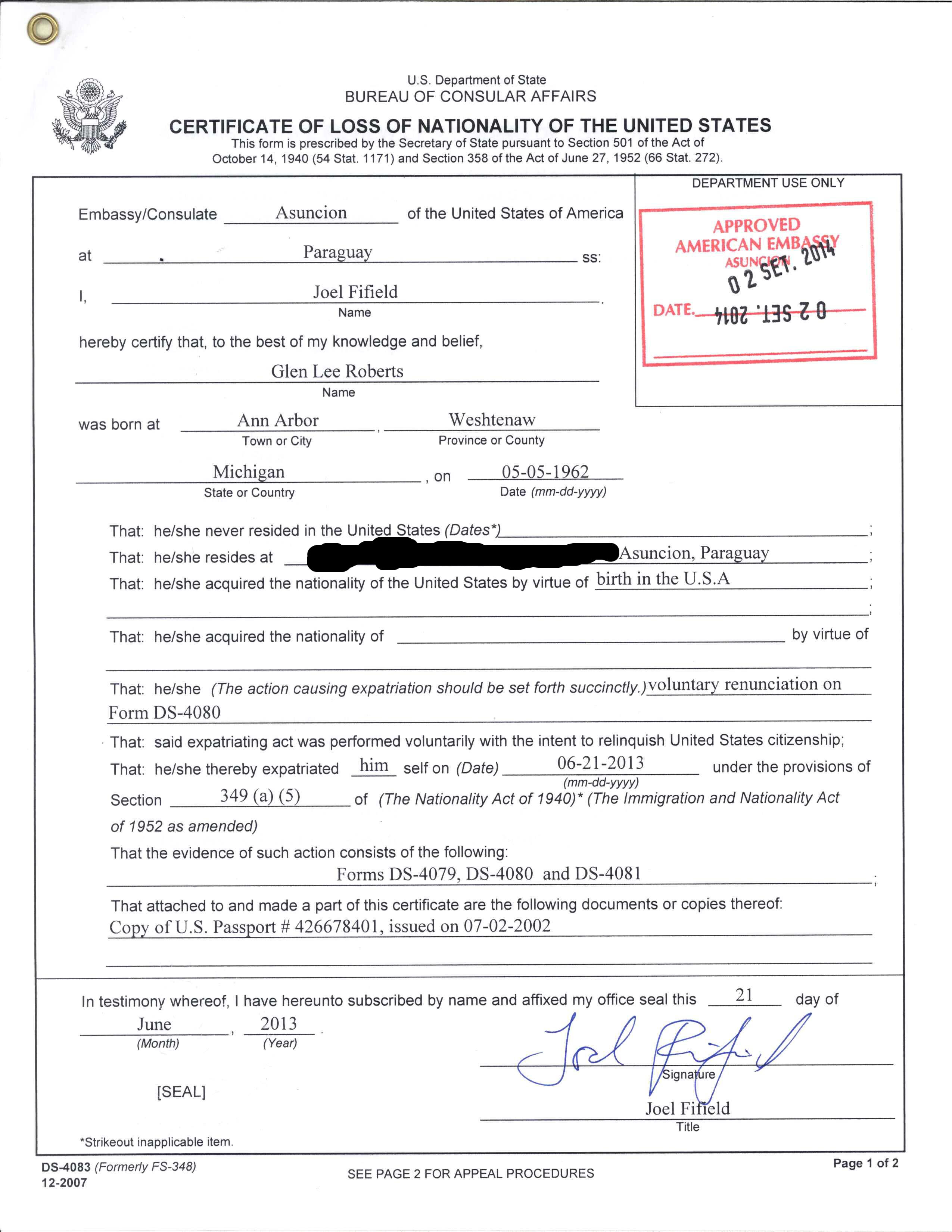

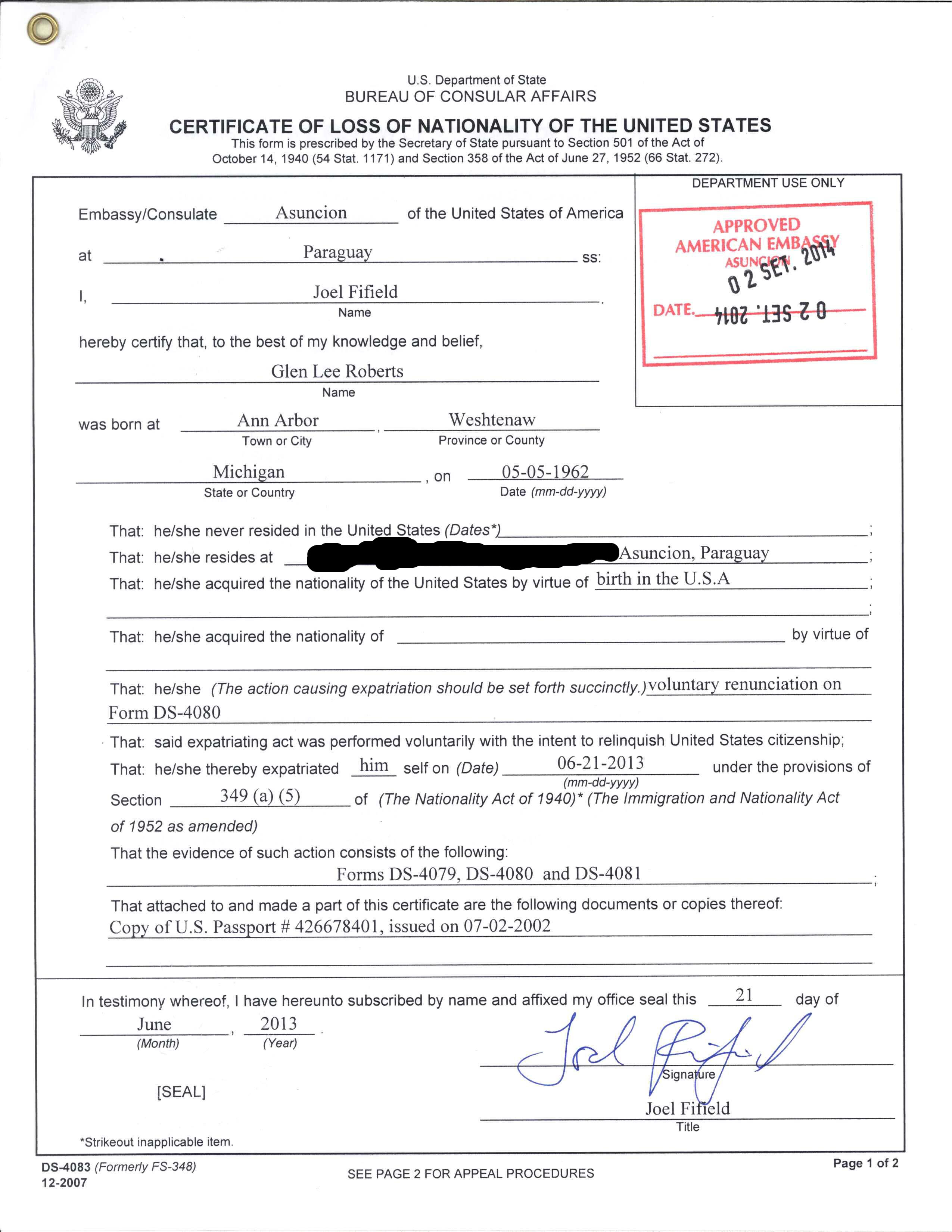

now charges USD 2350 to renounce citizenship (or otherwise obtain a Certificate of Loss of Nationality

The Certificate of Loss of Nationality of the United States (CLN) is form DS-4083 of the Bureau of Consular Affairs of the United States Department of State which is completed by a consular official of the United States documenting relinquishment ...

), while tax reporting requirements associated with legal expatriation

An expatriate (often shortened to expat) is a person who resides outside their native country. In common usage, the term often refers to educated professionals, skilled workers, or artists taking positions outside their home country, either ...

may pose additional financial burdens.

Nationality law

U.S. nationality law provides for both ''jus soli

''Jus soli'' ( , , ; meaning "right of soil"), commonly referred to as birthright citizenship, is the right of anyone born in the territory of a state to nationality or citizenship.

''Jus soli'' was part of the English common law, in cont ...

'' and ''jus sanguinis

( , , ; 'right of blood') is a principle of nationality law by which citizenship is determined or acquired by the nationality or ethnicity of one or both parents. Children at birth may be citizens of a particular state if either or both of th ...

'' (see ), as well as derivative citizenship upon the naturalization of a parent ().

Birth or parental naturalization in the U.S.

Children born in the U.S. are U.S. citizens, regardless of their parents' citizenship or immigration status or whether the family lives in the U.S. after the child is born; the only exception recognized under current law is for children born to foreign diplomats. Many babies who grew up in towns along theCanada–United States border

The border between Canada and the United States is the longest international border in the world. The terrestrial boundary (including boundaries in the Great Lakes, Atlantic, and Pacific coasts) is long. The land border has two sections: ...

were born in a hospital on the opposite side of the border and thus acquired the citizenship of the other country this way. Also, when an immigrant to the U.S. becomes a naturalized citizen, under the Child Citizenship Act of 2000

The Child Citizenship Act of 2000 (CCA) is a United States federal law that amended the Immigration and Nationality Act of 1965 regarding acquisition of citizenship by children of US citizens and added protections for individuals who have voted ...

, the immigrant's minor children become U.S. citizens along with their parent as long as they are living in the U.S. as lawful permanent residents at the time of the parent's naturalization or later enter the U.S. under LPR status in their minority.

In each of these cases, the child becomes a U.S. citizen automatically, without any choice in the matter. Mumbai tax lawyer Poorvi Chothani stated that many Indians living in the U.S. on work visas "eagerly obtain U.S. citizenship" for their children but "do not even examine the long-term implications of this", and that she even has a client who is suing his own father for the reason of such an unwanted U.S. citizenship.

Birth abroad and role of registration

U.S. law also states that a child born outside of the U.S to a U.S. citizen parent who previously spent sufficient time in the U.S. is a U.S. citizen at birth, regardless of whether the child also has the citizenship of the country of birth or another citizenship. U.S. citizens married to fellow U.S. citizens can transmit U.S. citizenship to their children if either parent has ever had a residence in the United States (without any minimum time limitation on how long they held that residence.) However, for U.S. citizens married to non-U.S. citizens, the required period of residence is longer; under the Nationality Act of 1940 and theImmigration and Nationality Act of 1952

The Immigration and Nationality Act of 1952 (), also known as the McCarran–Walter Act, codified under Title 8 of the United States Code (), governs immigration to and citizenship in the United States. It came into effect on June 27, 1952. Befor ...

, the required period of residence was set to ten years, five of which had to be after the age of 14. The Immigration and Nationality Act Amendments of 1986 reduced this to five years, two of which had to be after the age of 14.

This makes it possible in some cases for "accidental American" status to be passed down over multiple generations, for example if an accidental American spends sufficient time in the U.S. to meet the physical presence requirements to pass down their U.S. citizenship to their own children born outside of the United States. Previously, this had been most likely to occur in the case of the child of an unmarried U.S. citizen mother and non-American father. Under , only one year of continuous physical presence in the United States is required for an unmarried mother to pass down citizenship to children born abroad. However, in 2017 the Supreme Court struck down the distinction between unmarried mothers and unmarried fathers as a violation of the Equal Protection Clause

The Equal Protection Clause is part of the first section of the Fourteenth Amendment to the United States Constitution. The clause, which took effect in 1868, provides "''nor shall any State ... deny to any person within its jurisdiction the equal ...

(resolving an earlier split

Split(s) or The Split may refer to:

Places

* Split, Croatia, the largest coastal city in Croatia

* Split Island, Canada, an island in the Hudson Bay

* Split Island, Falkland Islands

* Split Island, Fiji, better known as Hạfliua

Arts, entertai ...

between the Second

The second (symbol: s) is the unit of time in the International System of Units (SI), historically defined as of a day – this factor derived from the division of the day first into 24 hours, then to 60 minutes and finally to 60 seconds ea ...

and Ninth Circuit

The United States Court of Appeals for the Ninth Circuit (in case citations, 9th Cir.) is the U.S. federal court of appeals that has appellate jurisdiction over the U.S. district courts in the following federal judicial districts:

* District ...

s), holding instead that all American parents married to non-Americans should be required to meet the same longer five-year standard of residence to pass citizenship to their children.

Under a strict reading of U.S. nationality law, consular registration is not required in order for a child born outside of the U.S. to a qualifying parent to "become" a U.S. citizen; the child is a U.S. citizen from the moment of birth. However, for practical reasons, if a child's birth is not reported to a U.S. consulate or United States Citizenship and Immigration Services

U.S. Citizenship and Immigration Services (USCIS) is an agency of the United States Department of Homeland Security (DHS) that administers the country's naturalization and immigration system. It is a successor to the Immigration and Naturalizati ...

, the child would not have any proof of U.S. citizenship and the U.S. government might remain unaware of the child's citizenship status. Retired U.S. State Department official Andrew Grossman wrote in 2007 that in cases of "doubtful nationality" in which a child's derivative U.S. citizenship remained undocumented and unreported to the U.S. government, the child was not regarded as a U.S. citizen either for tax or other purposes, and he expected that it would be quite difficult for tax authorities to make determinations of ''jus sanguinis'' citizenship on their own. Karen Christensen, also of the U.S. State Department (Deputy Assistant Secretary for Overseas Citizens Services, Bureau of Consular Affairs), stated that "it is the process of being documented as a U.S. citizen that would result in official government recognition of the child’s U.S. citizenship status". This ambiguity has resulted in American emigrant parents, particularly those married to people of other nationalities, choosing not to report the births of their children born in other countries to U.S. consulates, in the hopes that this would allow the children to escape notice by the U.S. government. Mark Matthews of Caplin & Drysdale stated, "When clients who have lived abroad for years come in, concerned about whether they have an obligation under FATCA, they sometimes react to the suggestion that their kids might be American the way one might react to a horrible medical diagnosis."

Retroactive restoration of citizenship

Retroactive restoration of U.S. citizenship previously lost might occur when a statute regarding loss of U.S. citizenship is declared unconstitutional. The issue ultimately arises from the fact that obtaining aCertificate of Loss of Nationality

The Certificate of Loss of Nationality of the United States (CLN) is form DS-4083 of the Bureau of Consular Affairs of the United States Department of State which is completed by a consular official of the United States documenting relinquishment ...

has never been necessary under U.S. nationality law to trigger loss of citizenship, but is merely a document which confirms the loss of citizenship caused by an earlier act. In earlier years, an unknown number of people who lost U.S. citizenship according to contemporary law simply ceased to exercise the benefits of U.S. citizenship (for example, no longer voting, letting their U.S. passport expire) and began identifying themselves to the U.S. government as foreigners (for example, by using foreign passports to enter the United States) without obtaining a CLN. Additionally, the U.S. government has asserted that even a person who has been issued a CLN, but under a provision of law later found unconstitutional, remains a U.S. citizen all along. In 1998, the State Department estimated that there were several thousand individuals of this latter type, who had never contacted the U.S. government seeking to have their CLNs vacated.

One early case causing retroactive restoration of citizenship was ''Schneider v. Rusk

''Schneider v. Rusk'', 377 U.S. 163 (1964), was a United States Supreme Court case which invalidated a law that treated naturalized and native-born citizens differentially under the due process clause of the Fifth Amendment..

Background

Angelika ...

'' (1964). In that case, the Supreme Court considered , which provided for loss of U.S. citizenship by a naturalized citizen taking up residence in a country of which they had previously been a citizen. The Court found that the statute unconstitutionally discriminated between native-born and naturalized citizens. This ruling protected plaintiff-appellee Angelika Schneider from unwanted loss of her U.S. citizenship, against which she had protested by taking her case to the Supreme Court. However, in the aftermath the U.S. government took the position that all persons who had lost U.S. citizenship under Section 1482 should be treated as never having lost citizenship, regardless of whether they made a subsequent claim to the benefits of U.S. citizenship, were ignorant of their restored citizenship, or were even unwilling to have it restored.

A more complicated situation arose from '' Vance v. Terrazas'' (1980). In that case, the Supreme Court considered , providing that U.S. citizens could expatriate themselves by performing certain acts involving citizenship or allegiance to a foreign country, including swearing an oath of allegiance to a foreign country. The State Department at the time argued that those acts themselves constituted evidence of intent to give up citizenship, but the Court disagreed and required that the intent be proven by the party asserting the loss of citizenship through the preponderance of the evidence

In a legal dispute, one party has the burden of proof to show that they are correct, while the other party had no such burden and is presumed to be correct. The burden of proof requires a party to produce evidence to establish the truth of facts ...

, encompassing not only the act itself but the individual's other statements and conduct. Again, this ruling protected the individual involved, who asserted his citizenship against State Department efforts to demonstrate that he had relinquished it. However, this effectively imposed a new requirement on other people, without notification to them and without regard to whether they preferred to be U.S. citizens: before they only had to commit the act to relinquish U.S. citizenship, but afterwards if they sought to obtain a CLN, they had the affirmative burden of proving intent contemporary with the act, otherwise the U.S. government would deem them to have been U.S. citizens all along.

The issue of retroactive restoration of citizenship interacts with birth abroad as mentioned above, in that children born during a period in which the parent believed themself not to be a U.S. citizen might themselves be regarded as citizens at birth due to a retroactive restoration of the parent's citizenship to the year in which the child was born.

Awareness of U.S. citizenship

Accidental Americans may become aware in various ways that the U.S. considers them to be its citizens. First, accidental Americans born in the United States may encounter difficulties when attempting to enter the U.S. on a non-U.S. passport, as U.S. law () requires all U.S. citizens to use U.S. passports when entering the country. An airline employee or U.S. Customs and Border Protection official who notes the U.S. place of birth in the passport might refuse to allow the person to board a flight, or demand that the person pay a fee to apply for a waiver of the passport requirement. Famously, former Prime Minister of theUnited Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and ...

, Boris Johnson

Alexander Boris de Pfeffel Johnson (; born 19 June 1964) is a British politician, writer and journalist who served as Prime Minister of the United Kingdom and Leader of the Conservative Party from 2019 to 2022. He previously served as ...

was denied boarding on a flight which transited the U.S. in 2006, after which he first claimed that he wanted to renounce his U.S. citizenship, but instead applied for a U.S. passport some years later. In the past, Canadians were unlikely to encounter such difficulties, because passports were not required to cross the Canada–United States border

The border between Canada and the United States is the longest international border in the world. The terrestrial boundary (including boundaries in the Great Lakes, Atlantic, and Pacific coasts) is long. The land border has two sections: ...

, but in the aftermath of the September 11, 2001 attacks

The September 11 attacks, commonly known as 9/11, were four coordinated suicide terrorist attacks carried out by al-Qaeda against the United States on Tuesday, September 11, 2001. That morning, nineteen terrorists hijacked four commer ...

, the Western Hemisphere Travel Initiative tightened documentary requirements for entering the United States by land or by sea, and so Canadians crossing into the United States had to show proof of Canadian citizenship

Canadian nationality law details the conditions in which a person is a national of Canada. With few exceptions, almost all individuals born in the country are automatically citizens at birth. Foreign nationals may naturalize after living in ...

; if they used a Canadian passport

A Canadian passport (french: passeport canadien) is the passport issued to citizens of Canada. It enables the bearer to enter or re-enter Canada freely; travel to and from other countries in accordance with visa requirements; facilitates the ...

as such proof, it would indicate their place of birth.

Furthermore, in the aftermath of the 2009 UBS tax evasion controversy, the U.S. government began concerted efforts to identify U.S. citizens who held non-U.S. financial accounts. A major limb of this effort was the Foreign Account Tax Compliance Act

The Foreign Account Tax Compliance Act (FATCA) is a 2010 United States federal law requiring all non-U.S. foreign financial institutions (FFIs) to search their records for customers with indicia of a connection to the U.S., including indication ...

(FATCA), passed in 2010, which imposed additional taxes on the U.S. income of non-U.S. banks which did not sign an agreement with the IRS to collect information about their customers' citizenships and to provide the IRS with any information on customers identified as having "U.S. indicia", including a U.S. place of birth. Following FATCA's passage, many banks began inquiring into the birthplaces and parentage of their customers, raising awareness among accidental Americans that the U.S. government might consider them to be citizens. FATCA also resulted in closures of bank accounts belonging to people identified as U.S. citizens; a 2014 survey of U.S. citizens in other countries by Democrats Abroad found that 12.7% of respondents had been denied financial services by their banks. Often, banks requested CLNs from customers born in the United States who asserted they were not U.S. citizens, leading to difficulties both for customers who had been U.S. citizens all along without knowing it, and for those whose U.S. citizenship had been restored retroactively without their knowledge. Allison Christians Allison Christians is a tax law scholar and the H. Heward Stikeman Chair in Tax Law at the McGill University Faculty of Law/Faculté de Droit in Montreal, Quebec, Canada. Her research and teaching focus on Canadian and U.S. domestic and internatio ...

of McGill University

McGill University (french: link=no, Université McGill) is an English-language public research university located in Montreal, Quebec, Canada. Founded in 1821 by royal charter granted by King George IV,Frost, Stanley Brice. ''McGill Univer ...

noted that whether or not the IRS is interested in pursuing non-wealthy accidental Americans, banks had been known to "overreact" to customers' potential ties to the United States, due to the banks' own fears of IRS penalties for errors.

Tax consequences

Taxation of non-residents

Eritrea

Eritrea ( ; ti, ኤርትራ, Ertra, ; ar, إرتريا, ʾIritriyā), officially the State of Eritrea, is a country in the Horn of Africa region of Eastern Africa, with its capital and largest city at Asmara. It is bordered by Ethiopi ...

are the only countries which impose taxation and reporting requirements on the income which citizens living abroad permanently earn in their countries of residence. Despite their lack of personal or business ties to the United States, accidental Americans have the same U.S. tax filing and payment obligations as do self-identifying "Americans abroad" who are aware of their U.S. citizenship status, and are subject to the same fines for failure to file. Tax treaties

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritan ...

generally do not serve to mitigate the double taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes).

Double liability may be mitigated in ...

and filing burdens such people face, as all U.S. tax treaties give the U.S. the power to tax U.S. citizens residing in other countries as if the treaty did not exist; such treaties generally only benefit business entities and dual-resident non-U.S. citizens. The result, as tax attorney Gavin Leckie put it, is that "people who have no sense of being American find themselves caught up in a maze of rules really aimed at the U.S. resident citizen seeking to defer or evade U.S. taxes by holding assets offshore".

People who once had U.S. permanent residence status ("green card holders") may also face similar tax issues as accidental citizens, combined with similar unawareness of their status. Green card holders generally have the same U.S. tax filing obligations as U.S. citizens, regardless of their actual residence. Many green card holders later emigrated from the U.S. and let their green cards expire, believing that since they were no longer entitled under immigration law to live in the U.S., they also correspondingly had no further tax obligations. However, provides that a green card holder's tax obligations do not end until a formal administrative or judicial determination of abandonment of U.S. residence; this generally requires the green card holder not just to move out of the United States, but to file Form I-407 with United States Citizenship and Immigration Services

U.S. Citizenship and Immigration Services (USCIS) is an agency of the United States Department of Homeland Security (DHS) that administers the country's naturalization and immigration system. It is a successor to the Immigration and Naturalizati ...

. About eighteen thousand people per year file this form, but it is likely that many more green card holders moving out of the U.S. are unaware that this procedure is required.

Filing and compliance difficulties

The Internal Revenue Code provides for a foreign earned income exclusion allowing non-resident U.S. tax filers to exclude wage income up to a certain threshold ($99,400 for the 2013 tax filing season) from U.S. taxation, as well as credits for taxes paid to other countries. The result is that accidental Americans often do not owe U.S. income tax, but must spend thousands of dollars in accounting fees to prove that fact, and face potential fines of tens of thousands of dollars for paperwork errors. The reason is that the foreign earned income exclusion does not affect filing obligations nor the treatment of non-U.S bank accounts and investment plans. Tax lawyers state that compliance with the foreign trust and

The Internal Revenue Code provides for a foreign earned income exclusion allowing non-resident U.S. tax filers to exclude wage income up to a certain threshold ($99,400 for the 2013 tax filing season) from U.S. taxation, as well as credits for taxes paid to other countries. The result is that accidental Americans often do not owe U.S. income tax, but must spend thousands of dollars in accounting fees to prove that fact, and face potential fines of tens of thousands of dollars for paperwork errors. The reason is that the foreign earned income exclusion does not affect filing obligations nor the treatment of non-U.S bank accounts and investment plans. Tax lawyers state that compliance with the foreign trust and passive foreign investment company

For purposes of income tax in the United States, U.S. persons owning shares of a passive foreign investment company (PFIC) may choose between (i) current taxation on the income of the PFIC or (ii) deferral of such income subject to a deemed tax an ...

rules can be particularly onerous, because their definitions are so broad as to include mutual fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICA ...

s, retirement accounts, and similar such structures owned by accidental Americans in their country of residence; people with savings in these kinds of plans will face higher taxes and compliance burdens than U.S. residents who keep money in similar U.S. investment plans. Those who have spent their lives planning for their retirement without considering the U.S. tax consequences of the non-U.S. financial instruments they hold may find that U.S. taxation, in particular PFIC taxation, wipes out most of their returns on investments; as Allison Christians states, "the PFIC regime is designed to be so harsh that no one would ever knowingly own one unless they were treating it like a partnership, and marking it to market annually with the assistance of sophisticated tax counsel". Even Canada's Registered Disability Savings Plan A Registered Disability Savings Plan (RDSP; french: Régime enregistré d'épargne invalidité) is a Government of Canada program designed to enable individuals with disabilities, with assistance from family and friends to save for their future fina ...

(RDSP) falls under U.S. foreign trust reporting requirements. RDSPs and other registered Canadian accounts for education and retirement savings are exempt from FATCA reporting by banks under the FATCA agreement between Canada and the United States, but this agreement does not relieve the U.S. individual income taxes owed on such plans, nor the individual owner's obligation to file the non-FATCA-related trust or PFIC forms. Under the 2011 Offshore Voluntary Disclosure Initiative, people residing outside of the U.S. who stated that they did not file U.S. tax and asset-reporting forms because they were unaware of their U.S. citizenship faced fines of 5% of their assets.

In many cases, it has also proven difficult for accidental Americans born abroad to obtain Social Security number

In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as . The number is issued to ...

s (SSNs), which are required for them to file U.S. taxes. In response to this issue, the State Bar of California

The State Bar of California is California's official attorney licensing agency. It is responsible for managing the admission of lawyers to the practice of law, investigating complaints of professional misconduct, prescribing appropriate disciplin ...

's Taxation Section issued a proposal in 2015 for the IRS to allow Americans citizens without SSNs residing in other countries to obtain Individual Taxpayer Identification Numbers (ITINs) instead. Current regulations () require all U.S. citizens to use SSNs as their Taxpayer Identification Number, while ITINs are only available to non-citizens; however, the underlying statute () does not require this, and so the California Bar suggested that their proposal could be accomplished by issuing new Treasury regulations without needing to wait for Congress to pass any new legislation.

Non-compliance

While FATCA certainly raised awareness of US tax filing obligations among Accidental Americans, overall compliance in the years after 2010 has remained low. Rough estimates (based on State Department figures for the number of US persons abroad, plus IRS data for claims of the Foreign Earned Income Exemption and Foreign Tax Credit) suggest that overall compliance rates are approximately 10 to 15 percent. Furthermore, the IRS has extremely limited ability to penalize Accidental Americans for failure to file, provided they have no US assets or income sources. The IRS has mutual assistance in collection agreements with only five countries (Canada, Denmark, France, Netherlands, Sweden) but those agreements specifically exclude a country's own citizens, thus protecting dual citizens living in their home country. FBAR penalties are not covered by these agreements, and remain fully uncollected outside the US. Beyond FATCA data (year-end balance and interest/dividend income for reportable accounts only) the IRS receives no information about the income or assets of Accidental Americans who fail to file US tax returns. And even then, according to Treasury audit report from April 2022, the IRS does not have the resources to use FATCA data to locate or pursue Accidental Americans who do not voluntarily enter the US tax system.Non-Tax consequences

Amateur Radio

A U.S. Citizen is not eligible for reciprocal operating arrangements to operate anamateur radio

Amateur radio, also known as ham radio, is the use of the radio frequency spectrum for purposes of non-commercial exchange of messages, wireless experimentation, self-training, private recreation, radiosport, contesting, and emergency commu ...

within the United States despite being duly licensed in a country with reciprocal arrangements.

Giving up U.S. citizenship

Overview

Accidental Americans who become aware of their U.S. citizenship status have the option of looking into ways of renouncing or relinquishing it. Although it is possible for children to acquire U.S. citizenship "accidentally" without any voluntary action on their part, under current law they cannot lose that citizenship status accidentally or automatically as adults; instead, they must take voluntary action to give it up. United States nationality law () formerly provided for automatic loss of U.S. citizenship by dual citizens resident abroad, but this was repealed by the Immigration and Nationality Act Amendments of 1978 (; ).

The Quarterly Publication of Individuals Who Have Chosen to Expatriate, which lists names of certain people with respect to whom the IRS received information on

Accidental Americans who become aware of their U.S. citizenship status have the option of looking into ways of renouncing or relinquishing it. Although it is possible for children to acquire U.S. citizenship "accidentally" without any voluntary action on their part, under current law they cannot lose that citizenship status accidentally or automatically as adults; instead, they must take voluntary action to give it up. United States nationality law () formerly provided for automatic loss of U.S. citizenship by dual citizens resident abroad, but this was repealed by the Immigration and Nationality Act Amendments of 1978 (; ).

The Quarterly Publication of Individuals Who Have Chosen to Expatriate, which lists names of certain people with respect to whom the IRS received information on loss of citizenship

Loss of citizenship, also referred to as loss of nationality, is the event of ceasing to be a citizen of a country under the nationality law of that country.

Grounds

Citizenship can be lost in a variety of different ways. In a study of the nation ...

during the quarter in question, in 2011 began showing a sharp rise in the number of names included. Lawyers disagree whether the Quarterly Publication is a complete list of all people giving up U.S. citizenship, or whether it only includes covered expatriates (people with certain levels of assets, tax liabilities, or tax filing or payment deficiencies). Regardless, various U.S. lawyers have commented, based on their experiences with clients, that the majority of the early 2010s increase in renunciations of U.S. citizenship is probably attributable to accidental Americans, rather than the popular stereotype of wealthy people who move to a tax haven after becoming rich in the United States.

As a practical matter, renunciation of U.S. citizenship became markedly more difficult in 2014, meaning that even accidental Americans who were aware of their U.S. citizenship status and wanted to rid themselves of it faced obstacles: in addition to the cost of possible tax filings with the IRS, the State Department

The United States Department of State (DOS), or State Department, is an executive department of the U.S. federal government responsible for the country's foreign policy and relations. Equivalent to the ministry of foreign affairs of other na ...

raised the fee for renunciation to US$2,350, roughly twenty times the fee charged by other high-income countries, and wait times for renunciation appointments at some U.S consulates grew to ten months or longer.

Expatriation tax

The Internal Revenue Code imposes anexpatriation tax

An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. This often takes the form of a capital gains tax against unrealised gain attributable to the period in which the taxpayer was a tax resident of t ...

on people giving up U.S. citizenship. Payment of the tax is not a prerequisite to giving up citizenship; rather, the tax and its associated reporting forms are paid and filed during the following year, on the normal tax return due date. People who had both U.S. and another citizenship at birth, reside in their country of other citizenship, and have not been U.S. residents in more than 10 of the past 15 tax years, may be exempt from this tax (); this provides a potential exception for some accidental Americans. However, this exception only applies to those who can state, under penalty of perjury, that they have fulfilled all of their U.S. tax filing and payment requirements for the preceding five years, and people who were not aware of their status as U.S. citizens are unlikely to have made the required filings and payments. Furthermore, accidental Americans who do not reside in their country of other citizenship but rather a third country, for example due to work or family ties there, cannot qualify for this expatriation tax exemption either.

In the late 1990s, the newly tightened U.S. expatriation tax system allowed individuals who would otherwise be subject to the tax to apply for a private letter ruling (PLR) that their termination of U.S. citizenship was not tax-motivated. (The American Jobs Creation Act of 2004 terminated the PLR exception to the expatriation tax.) The very first such PLR request came from a British citizen

British nationality law prescribes the conditions under which a person is recognised as being a national of the United Kingdom. The six different classes of British nationality each have varying degrees of civil and political rights, due to the ...

who stated that he was unaware of his U.S. citizenship; Willard Yates, a retired tax attorney then with the IRS' Office of Associate Chief Council (International) who handled that PLR request, initially expressed disbelief at the possibility that anyone could be unaware of their U.S. citizenship, but states that later, "after working a bunch of 877 PLRs, I realized we didn’t know anything about anything when it came to U.S. citizens working overseas, accidental or otherwise."

Tax obligations and non-compliance

Tax compliance is not required for renunciation of US citizenship, but only to formally exit the US tax system after expatriation. Consular officials will not inquire about a person's tax status during the renunciation interview, nor is a potential renunciant required to supply a Social Security Number at any point during the process. The common but mistaken belief that tax compliance is required prior to renunciation is encouraged by the US tax preparation industry, often at great cost to unsuspecting Accidental Americans. It appears, however, that a significant number of former US citizens have renounced without any attempt at tax compliance. First, in response to political pressure from EU governments due to the loss of banking privileges by Accidental Americans, the IRS created a "relief procedure for certain former citizens" in 2019 to encourage compliance among those who had renounced without filing; this program allowed one to file without a Social Security Number, and waived up to USD 25,000 per year in taxes owing. Second, according to a Treasury audit in 2020, over 40 percent of those renouncing US citizenship do not file Form 8854 to make a formal exit from the US tax system after expatriation, and the IRS lacks the resources to contact any of these former citizens, even those who potentially owed an exit tax. An Accidental American without US assets or income sources can simply renounce US citizenship to obtain their Certificate of Loss of Nationality (thus ending any FATCA reporting and restrictions on banking or investment services) without entering the US tax system and potentially facing both costs for preparation of tax returns, and possible taxes owing.Proposed remedies

PresidentBarack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party (United States), Democratic Party, Obama was the first Af ...

's proposed United States federal budget

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. Th ...

for 2016 included provisions to exempt certain accidental Americans from both the payment of U.S. tax on non-U.S. source income, and the expatriation tax, if they gave up U.S. citizenship within two years from the time they became aware of it. The proposal was limited to those who had been dual citizens at birth, had maintained citizenship of a foreign country since birth, had not lived in the United States since age 18½, and had only held a United States passport in order to depart from the United States in compliance with . The Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

estimated that this proposal would cost the United States roughly $403 million in tax revenue over the following ten years, with the majority ($208 million) of the revenue loss occurring in the first three years. Temple University law professor Peter Spiro

Peter John Spiro (born 1961) is an American legal scholar whose specialities include international law and U.S. constitutional law. He is a leading expert on dual citizenship. Formerly the Rusk Professor of International Law at the University of ...

described this as possible evidence that the U.S. government was beginning to conclude "that the imposition of U.S. taxes on accidental Americans is unsustainable." Roy A. Berg of tax law firm Moodys Gartner believed that the proposal had little chance of being passed by Congress, but that the executive branch might be able to implement similar relief solely through regulatory amendments.

Notable "Accidental Americans"

*Boris Johnson

Alexander Boris de Pfeffel Johnson (; born 19 June 1964) is a British politician, writer and journalist who served as Prime Minister of the United Kingdom and Leader of the Conservative Party from 2019 to 2022. He previously served as ...

, former Prime Minister of the United Kingdom. Johnson renounced his citizenship in 2016 when he became the UK Foreign Secretary

The secretary of state for foreign, Commonwealth and development affairs, known as the foreign secretary, is a Secretary of State (United Kingdom), minister of the Crown of the Government of the United Kingdom and head of the Foreign, Commonwe ...

.

* Viktor Király

Dov Viktor Király (born March 29, 1984) is a Hungarian-American singer and songwriter. In 2006, he was part of the Hungarian band Twinz with his twin brother Benjamin. In 2008, he became the fourth winner of the Hungarian music competition '' M ...

, Hungarian singer, born in New York to Hungarian parents, later returned to Hungary with his parents.

* Pietro Fittipaldi and his brother Enzo Fittipaldi

Enzo Fittipaldi da Cruz (born 18 July 2001) is a Brazilian-American racing driver, who is set to compete in the FIA Formula 2 Championship with Carlin. After signing with Carlin, he became a member of the Red Bull Junior Team in November 2022, ...

were born in Florida, but relinquished their American citizenship at a young age to gain citizenship in their ancestral homeland of Brazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

.

* Edward Seaga

Edward Philip George Seaga ( or ; 28 May 1930 – 28 May 2019) was a Jamaican politician. He was the fifth Prime Minister of Jamaica, from 1980 to 1989, and the leader of the Jamaica Labour Party from 1974 to 2005.Jamaica

Jamaica (; ) is an island country situated in the Caribbean Sea. Spanning in area, it is the third-largest island of the Greater Antilles and the Caribbean (after Cuba and Hispaniola). Jamaica lies about south of Cuba, and west of Hispa ...

from 1980-1989. Born in Boston, Massachusetts on May 28, 1932.

*Anya Taylor-Joy

Anya-Josephine Marie Taylor-Joy ( ; born 16 April 1996) is an actress. She has won several accolades, including a Golden Globe Award and a Screen Actors Guild Award, in addition to a nomination for a Primetime Emmy Award. In 2021, she was featu ...

, British-Argentinian actress who was born in Miami, and now holds dual British-American citizenship.

* Emma Terho, former ice hockey player for Finland

Finland ( fi, Suomi ; sv, Finland ), officially the Republic of Finland (; ), is a Nordic country in Northern Europe. It shares land borders with Sweden to the northwest, Norway to the north, and Russia to the east, with the Gulf of Bot ...

and member of the International Olympic Committee

The International Olympic Committee (IOC; french: link=no, Comité international olympique, ''CIO'') is a non-governmental sports organisation based in Lausanne, Switzerland. It is constituted in the form of an association under the Swis ...

.

* Mina Myoi, Japanese singer and member of South Korean girl group Twice

Twice (; Japanese: トゥワイス, Hepburn: ''To~uwaisu''; commonly stylized as TWICE) is a South Korean girl group formed by JYP Entertainment. The group is composed of nine members: Nayeon, Jeongyeon, Momo, Sana, Jihyo, Mina, Dahyun, ...

. No longer holds citizenship since 2019.

*Luis Villar Borda

Luis Villar Borda (1929–2008) was a Colombian politician, diplomat, and lawyer.

Personal life

He was born in New York City to Colombian parents who returned to Colombia during the Great Depression. In Colombia he studied political science ...

, Colombian politician and diplomat born to Colombian parents in New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

.

References

{{reflist Political terminology of the United States Taxation of foreigners United States federal income tax Citizenship of the United States