|

Expatriation Tax

An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. This often takes the form of a capital gains tax against unrealised gain attributable to the period in which the taxpayer was a tax resident of the country in question. In most cases, expatriation tax is assessed upon change of domicile or habitual residence; in the United States, which is one of only three countries (Eritrea and Myanmar are the others) to substantively tax its overseas citizens, the tax is applied upon relinquishment of American citizenship, on top of all taxes previously paid. Canada Canada imposes a "departure tax" on those who cease to be tax resident in Canada. The departure tax is a tax on the capital gains which would have arisen if the emigrant had sold assets after leaving Canada ("deemed disposition"), subject to exceptions. However, in Canada, unlike the U.S., the capital gain is generally based on the difference between the market value on the date ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Residence

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictions also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability of accommodation, family, and financial interests. For companies, some jurisdictions determine the residence of a corporation based on its place of incorporation. Other jurisdictions determine the residence of a corporation by reference to its place of management. Some jurisdictions use both a place-of-incorporation test and a place-of-management test. Domicile is, in common law jurisdictions, a different legal concept to residence, though the place of residence and the place of domicile would typically be the same. The criteria for residence in double taxation treaties may be different from those of d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

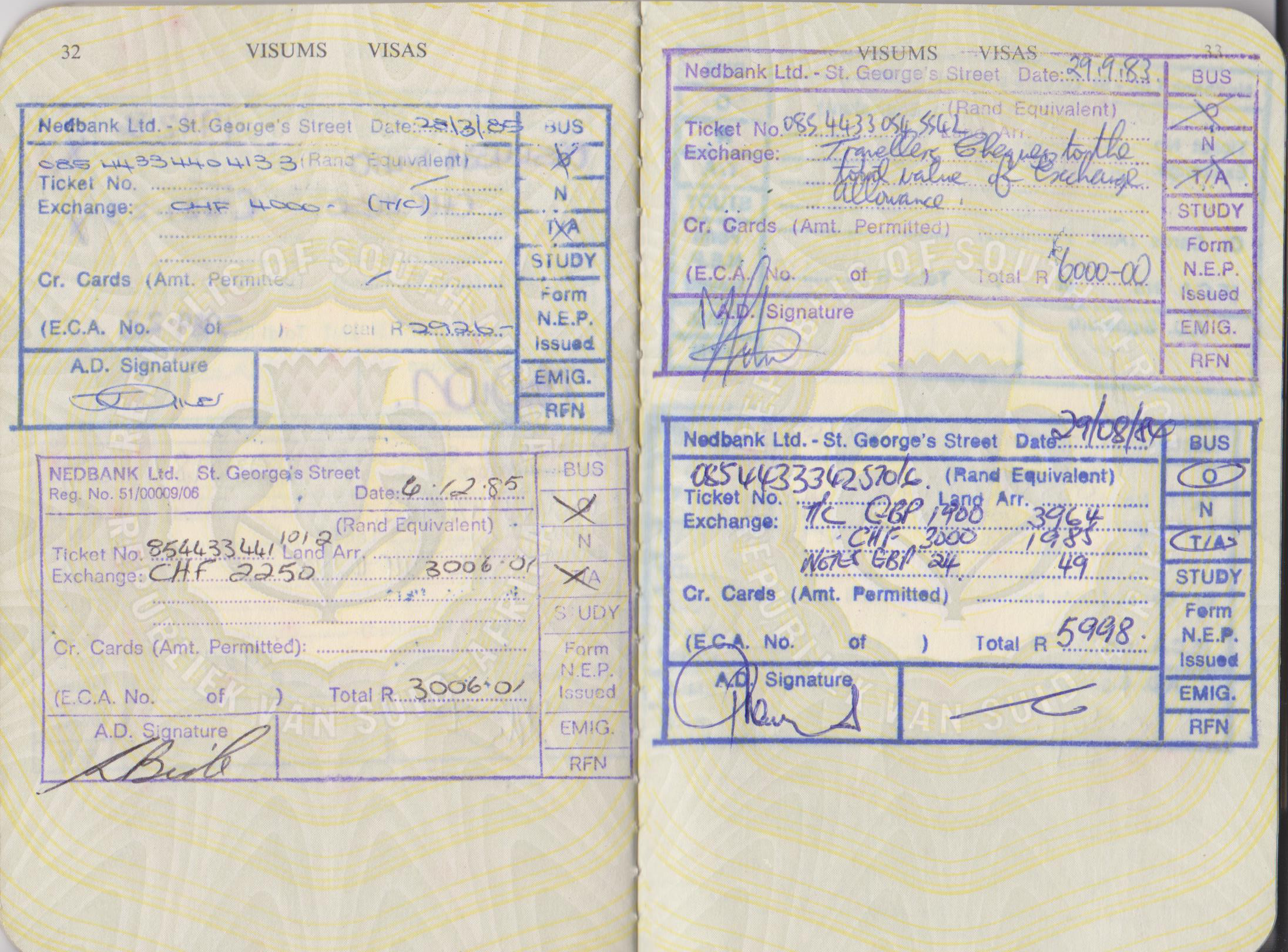

Foreign Exchange Controls

Foreign exchange controls are various forms of controls imposed by a government on the purchase/sale of foreign currencies by residents, on the purchase/sale of local currency by nonresidents, or the transfers of any currency across national borders. These controls allow countries to better manage their economies by controlling the inflow and outflow of currency, which may otherwise create exchange rate volatility. Countries with weak and/or developing economies generally use foreign exchange controls to limit speculation against their currencies. They may also introduce capital controls, which limit foreign investment in the country. Rationale Common foreign exchange controls include: * banning the use of foreign currency within the country; * banning locals from possessing foreign currency; * restricting currency exchange to government-approved exchangers; * fixed exchange rates * restricting the amount of currency that may be imported or exported; Often, foreign exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reed Amendment (immigration)

The Reed Amendment, also known as the Expatriate Exclusion Clause, created a provision of United States federal law () attempting to impose an entry ban on certain former U.S. citizens based on their reasons for renouncing U.S. citizenship. Notably, entry can be denied to persons who renounced their U.S. citizenship to avoid paying income taxes. The United States is one of two countries in the world that taxes its citizens' income earned abroad for citizens whose primary residence is abroad. The other country to do so is Eritrea. The Amendment was named for its author Jack Reed, and passed into law as part of the Illegal Immigration Reform and Immigrant Responsibility Act of 1996. Though the Reed Amendment received strong bipartisan support during the committee stage, Democratic lawmakers including Daniel Patrick Moynihan later criticised it as inappropriate, embarrassing, and badly-drafted. Efforts at establishing procedures to enforce the amendment ran into early difficult ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Former United States Citizens Who Relinquished Their Nationality

This is a list of notable former United States citizens who voluntarily relinquished their citizenship, and through that act, their nationality. It includes only public figures who completed the process of relinquishment of United States citizenship. This list excludes people who may have indicated their intent to do so but never formally completed the process, as well as immigrants who had their naturalizations canceled after convictions for war crimes or for fraud in the naturalization process. List ; Key of reasons To take or run for a position in a foreign government. Spouses of foreign heads of state are included in this category. To naturalize as a citizen of a foreign country, or to retain citizenship in a foreign country disallowing dual citizenship. To protest U.S. policies or actions Other or unclear reasons The column "'' Federal Register''" refers to whether and when the former citizen's name was published by the U.S. government in one of its lists of people ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

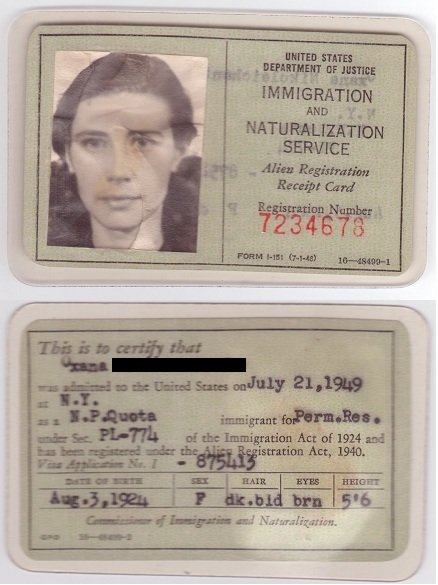

Permanent Residence (United States)

A green card, known officially as a permanent resident card, is an identity document which shows that a person has permanent residency in the United States. ("The term 'lawfully admitted for permanent residence' means the status of having been lawfully accorded the privilege of residing permanently in the United States as an immigrant in accordance with the immigration laws, such status not having changed."). Green card holders are formally known as lawful permanent residents (LPRs). , there are an estimated 13.9 million green card holders, of whom 9.1 million are eligible to become United States citizens. Approximately 65,000 of them serve in the U.S. Armed Forces. Green card holders are statutorily entitled to apply for U.S. citizenship after showing by a preponderance of the evidence that they, among other things, have continuously resided in the United States for one to five years and are persons of good moral character.''Al-Sharif v. United States Citizenship and Immig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BBC Online

BBC Online, formerly known as BBCi, is the BBC's online service. It is a large network of websites including such high-profile sites as BBC News and BBC Sport, Sport, the on-demand video and radio services branded BBC iPlayer and BBC Sounds, the children's sites CBBC (TV channel), CBBC and CBeebies, and learning services such as Bitesize and BBC Own It, Own It. The BBC has had an online presence supporting its TV and radio programmes and web-only initiatives since April 1994, but did not launch officially until 28 April 1997, following government approval to fund it by Television licensing in the United Kingdom, TV licence fee revenue as a service in its own right. Throughout its history, the online plans of the BBC have been subject to competition and complaint from its commercial rivals, which has resulted in various public consultations and government reviews to investigate their claims that its large presence and public funding distorts the UK market. The website has gone t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hungary

Hungary ( hu, Magyarország ) is a landlocked country in Central Europe. Spanning of the Pannonian Basin, Carpathian Basin, it is bordered by Slovakia to the north, Ukraine to the northeast, Romania to the east and southeast, Serbia to the south, Croatia and Slovenia to the southwest, and Austria to the west. Hungary has a population of nearly 9 million, mostly ethnic Hungarians and a significant Romani people in Hungary, Romani minority. Hungarian language, Hungarian, the Languages of Hungary, official language, is the world's most widely spoken Uralic languages, Uralic language and among the few non-Indo-European languages widely spoken in Europe. Budapest is the country's capital and List of cities and towns of Hungary, largest city; other major urban areas include Debrecen, Szeged, Miskolc, Pécs, and Győr. The territory of present-day Hungary has for centuries been a crossroads for various peoples, including Celts, Ancient Rome, Romans, Germanic peoples, Germanic trib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South African Revenue Service

The South African Revenue Service (SARS) is the revenue service of the South African government. It administers the country's tax system and customs service, and enforces compliance with related legislation. It is governed by the SARS Act 34 of 1997, which established it as "an organ of state within the public administration, but as an institution outside the public service." It thus has a significant degree of administrative autonomy, although it is under the policy control of the Minister of Finance. Effectively, SARS manages, administrates, and implements the tax regime as designed by the Minister and National Treasury. SARS was established in 1997 by a merger of the customs and inland revenue departments, at the recommendation of the Katz Commission, which had been instituted to review the South African tax system for the post-apartheid era. In subsequent years, under the leadership of Pravin Gordhan, SARS gained a reputation for effectiveness. However, between 2014 and 201 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |