|

Multiplier-accelerator Model

The multiplier–accelerator model (also known as Hansen–Samuelson model) is a macroeconomic model which analyzes the business cycle. This model was developed by Paul Samuelson, who credited Alvin Hansen for the inspiration. This model is based on the Keynesian multiplier, which is a consequence of assuming that consumption intentions depend on the level of economic activity, and the accelerator theory of investment, which assumes that investment intentions depend on the pace of growth in economic activity. Model The multiplier–accelerator model can be stated for a closed economy as follows: First, the market-clearing level of economic activity is defined as that at which production exactly matches the total of government spending intentions, households' consumption intentions and firms' investing intentions. :Y_ = g_ + C_ + I_; then an equation to express the idea that households' consumption intentions depend upon some measure of economic activity, possibly with a lag: :C_ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomic Model

A macroeconomic model is an analytical tool designed to describe the operation of the problems of economy of a country or a region. These models are usually designed to examine the comparative statics and dynamics of aggregate quantities such as the total amount of goods and services produced, total income earned, the level of employment of productive resources, and the level of prices. Macroeconomic models may be logical, mathematical, and/or computational; the different types of macroeconomic models serve different purposes and have different advantages and disadvantages. Macroeconomic models may be used to clarify and illustrate basic theoretical principles; they may be used to test, compare, and quantify different macroeconomic theories; they may be used to produce "what if" scenarios (usually to predict the effects of changes in monetary, fiscal, or other macroeconomic policies); and they may be used to generate economic forecasts. Thus, macroeconomic models are widely ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of busine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "has done more than any other contemporary economist to raise the level of scientific analysis in economic theory". "In a career that spanned seven decades, he transformed his field, influenced millions of students and turned MIT into an economics powerhouse" Economic historian Randall E. Parker has called him the "Father of Modern Economics", and ''The New York Times'' considers him to be the "foremost academic economist of the 20th century". Samuelson was likely the most influential economist of the latter half of the 20th century."Paul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alvin Hansen

Alvin Harvey Hansen (August 23, 1887 – June 6, 1975) was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American Keynes", he was a widely read popular author on economic issues, and an influential advisor to the government on economic policy. Hansen helped create the Council of Economic Advisors and the Social Security system. He is best remembered today for introducing Keynesian economics in the United States in the 1930s and 40s. More effectively than anyone else, he explicated, extended, domesticated, and popularized the ideas embodied in Keynes's ''The General Theory.'' He helped develop with John Hicks the IS–LM model (or Hicks–Hansen model), a mathematical representation of Keynesian macroeconomic theory. In 1967, Paul McCracken, chairman of the President's Council of Economic Advisers, saluted Hansen stating: "It is certainly a statement of fact that you h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Review Of Economic Statistics

''The'' ''Review of Economics and Statistics'' is a peer-reviewed 103-year-old general journal that focuses on applied economics, with specific relevance to the scope of quantitative economics. The ''Review'', edited at the Harvard University’s Kennedy School of Government The Harvard Kennedy School (HKS), officially the John F. Kennedy School of Government, is the school of public policy and government of Harvard University in Cambridge, Massachusetts. The school offers master's degrees in public policy, public a ... (JSTOR), has the long-term aim of publishing influential articles in mainly theoretical and empirical economics that will contribute to the broader readership in economics in both the present and the continual future. Over the time, the journal has published several of the most significant articles in empirical economics (JSTOR) based on its recognizable history which includes works from “Kenneth Arrow, Milton Friedman, Robert Merton, Paul Samuelson, Robert Sol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accelerator Effect

The accelerator effect in economics is a positive effect on private fixed investment of the growth of the market economy (measured e.g. by a change in Gross Domestic Product). Rising GDP (an economic boom or prosperity) implies that businesses in general see rising profits, increased sales and cash flow, and greater use of existing capacity. This usually implies that profit expectations and business confidence rise, encouraging businesses to build more factories and other buildings and to install more machinery. (This expenditure is called ''fixed investment''.) This may lead to further growth of the economy through the stimulation of consumer incomes and purchases, i.e., via the Multiplier (economics), multiplier effect. Every firm has some strategies to work which usually make the progress towards achieving an optimum capital stock and not only moving smoothly from one type and size of plant and machinery to the other. This means that every firm aims to increase its profit to an o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Difference Equation

In mathematics, a recurrence relation is an equation according to which the nth term of a sequence of numbers is equal to some combination of the previous terms. Often, only k previous terms of the sequence appear in the equation, for a parameter k that is independent of n; this number k is called the ''order'' of the relation. If the values of the first k numbers in the sequence have been given, the rest of the sequence can be calculated by repeatedly applying the equation. In ''linear recurrences'', the th term is equated to a linear function of the k previous terms. A famous example is the recurrence for the Fibonacci numbers, F_n=F_+F_ where the order k is two and the linear function merely adds the two previous terms. This example is a linear recurrence with constant coefficients, because the coefficients of the linear function (1 and 1) are constants that do not depend on n. For these recurrences, one can express the general term of the sequence as a closed-form expression ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jay Wright Forrester

Jay Wright Forrester (July 14, 1918 – November 16, 2016) was a pioneering American computer engineer and systems scientist. He is credited with being one of the inventors of magnetic core memory, the predominant form of random-access computer memory during the most explosive years of digital computer development (between 1955 and 1975). It was part of a family of related technologies which bridged the gap between vacuum tubes and semiconductors by exploiting the magnetic properties of materials to perform switching and amplification. He is also believed to have created the first animation in the history of computer graphics, a "jumping ball" on an oscilloscope. Later, he was a professor at the MIT Sloan School of Management, where he introduced the Forrester effect describing fluctuations in supply chains, and is credited as the founder of system dynamics, which deals with the simulation of interactions between objects in dynamic systems and is most often applied to r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

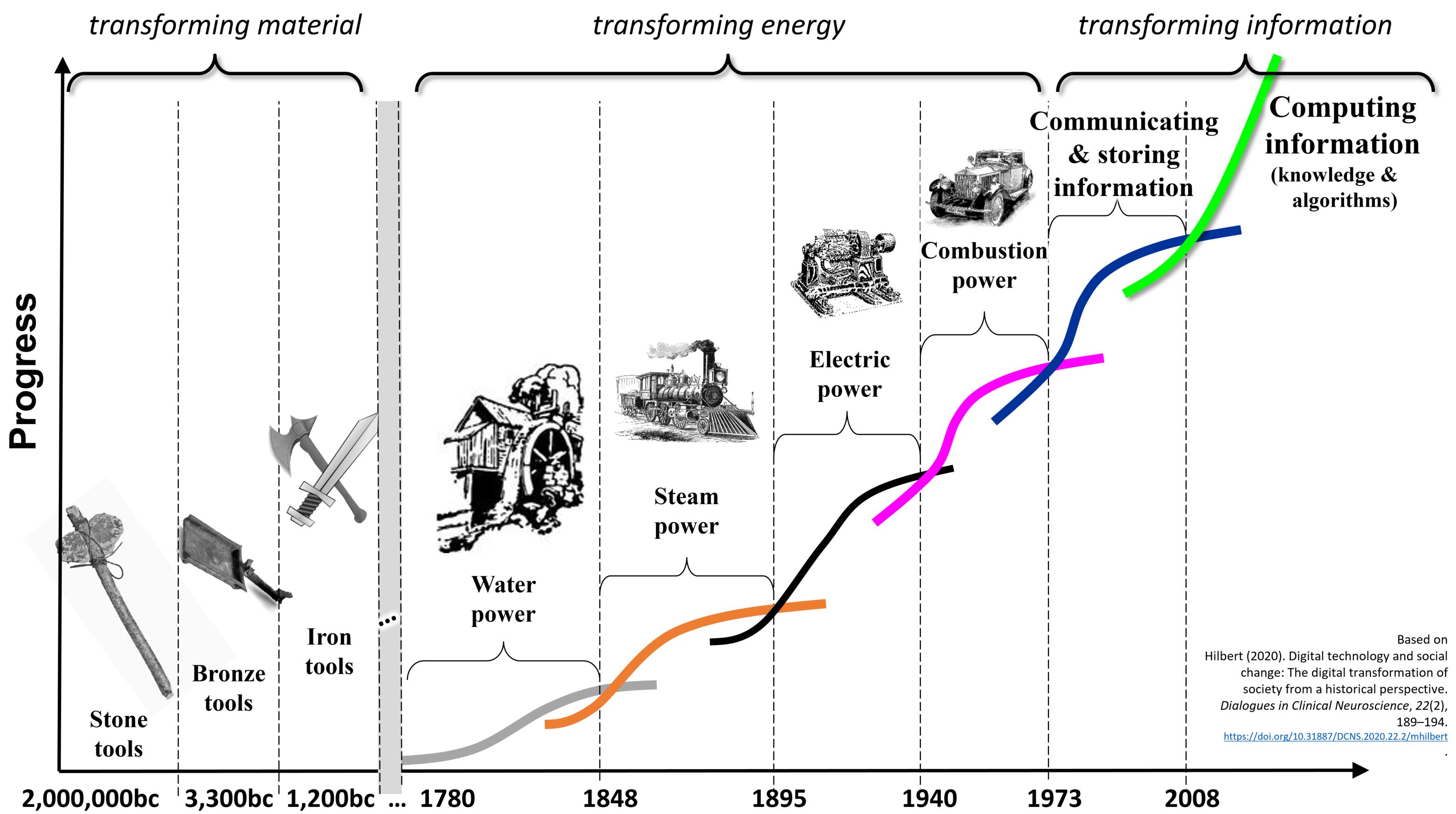

Kondratiev Wave

In economics, Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are hypothesized cycle-like phenomena in the modern world economy. The phenomenon is closely connected with the technology life cycle. It is stated that the period of a wave ranges from forty to sixty years, the cycles consist of alternating intervals of high sectoral growth and intervals of relatively slow growth.See, e.g. Long wave theory is not accepted by most academic economists. Among economists who accept it, there is a lack of agreement about both the cause of the waves and the start and end years of particular waves. Among critics of the theory, the consensus is that it involves recognizing patterns that may not exist ( apophenia). History of concept The Soviet economist Nikolai Kondratiev (also written Kondratieff or Kondratyev) was the first to bring these observations to international attention in his book ''The Major Economic Cycles'' (1925) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle Theories

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |