|

Misappropriation Doctrine

The misappropriation doctrine is a U.S. legal theory conferring a "quasi-property right" on a person who invests "labor, skill, and money" to create an intangible asset. The right operates against another person (usually a competitor of the first person) "endeavoring to reap where it has not sown" by "misappropriating" the value of the asset (ordinarily by copying what the first person has created). The quoted language and the legal principle come from the decision of the United States Supreme Court in ''International News Service v. Associated Press'', 248 U.S. 215 (1918), also known as ''INS v. AP'' or simply the ''INS'' case. The misappropriation doctrine originated as federal common law but since 1938 it has been based on state law. The current viability of the misappropriation doctrine is uncertain because of subsequent developments in U.S. patent and copyright law that "preempt" state law that operates in the same field of law, as is explained in the article on ''INS v. AP''. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Intangible Asset

An intangible asset is an asset that lacks physical substance. Examples are patents, copyright, exclusive franchises, Goodwill (accounting), goodwill, trademarks, and trade names, reputation, Research and development, R&D, Procedural knowledge, know-how, organizational capital as well as any form of digital asset such as software and data. This is in contrast to physical assets (machinery, buildings, etc.) and financial assets (government securities, etc.). Intangible assets are usually very difficult to Valuation (finance), value. Today, a large part of the corporate economy (in terms of net present value) consists of intangible assets, reflecting the growth of information technology (IT) and organizational capital. Specifically, each dollar of IT has been found to be associated with and increase in firm market valuation of over $10, compared with an increase of just over $1 per dollar of investment in other tangible assets. Furthermore, firms that both make organizational capit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Kellogg Co

Kellogg may refer to: Education * Kellogg College, Oxford, one of the constituent colleges of Oxford University *Kellogg Community College, a public community college in Battle Creek, Michigan *Kellogg School of Management at Northwestern University, in Evanston, Illinois * Kellogg School of Science and Technology at Scripps Research, in San Diego, California People and organizations *Kellanova, American multinational food-manufacturing company formerly known as Kellogg's **Will Keith Kellogg, founder of the company **John Harvey Kellogg, his brother, inventor of cornflakes and medical practitioner **WK Kellogg Co, a food company spun off from Kellogg's *Kellogg Brothers, 19th century lithographers of Hartford, Connecticut *Kellogg (name), including a list of people with the surname *W. K. Kellogg Foundation, a philanthropic, non-profit organization Places *Kellogg, Idaho *Kellogg, Iowa *Kellogg, Kansas *Kellogg, Minnesota *Kellogg, Missouri *Kellogg, Oregon *Kellog, a rural ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

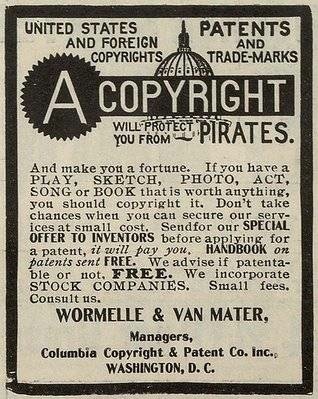

United States Copyright Law

The copyright law of the United States grants monopoly A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce ... protection for "original works of authorship". With the stated purpose to promote art and culture, copyright law assigns a set of exclusive rights to authors: to make and sell copies of their works, to create derivative works, and to perform or display their works publicly. These exclusive rights are subject to a time and generally expire 70 years after the author's death or 95 years after publication. In the United States, works Publication (copyright), published before January 1, , are in the public domain. United States copyright law was last generally revised by the Copyright Act of 1976, codified in Title 17 of the United States Code. The United States Constitution expli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |