|

Windfall Elimination Provision

The Windfall Elimination Provision (abbreviated WEP) is a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security Act. It reduces the Primary Insurance Amount (PIA) of a person's Retirement Insurance Benefits (RIB) or Disability Insurance Benefits (DIB) when that person is eligible or entitled to a pension based on a job which did not contribute to the Social Security Trust Fund The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and D .... While in effect, it also affects the benefits of others claiming on the same social security record. History The Social Security Amendments of 1983 (Public Law 98-21) provided for the WEP as a means of eliminating the "windfall" of social security benefits recei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Administration

The United States Social Security Administration (SSA) is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability and survivor benefits. To qualify for most of these benefits, most workers pay Social Security taxes on their earnings; the claimant's benefits are based on the wage earner's contributions. Otherwise benefits such as Supplemental Security Income (SSI) are given based on need. The Social Security Administration was established by the Social Security Act of 1935 and is codified in (). It was created in 1935 as the "Social Security Board", then assumed its present name in 1946. Its current leader is Kilolo Kijakazi, who serves on an acting basis. SSA offers its services to the public through 1,200 field offices, a website, and a national toll-free number. Field offices, which served 43 million individuals in 2019, were reopened on April 7, 2022 after being closed for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Act

The Social Security Act of 1935 is a law enacted by the 74th United States Congress and signed into law by US President Franklin D. Roosevelt. The law created the Social Security program as well as insurance against unemployment. The law was part of Roosevelt's New Deal domestic program. By the 1930s, the United States was the only modern industrial country without any national system of social security. In the midst of the Great Depression, the physician Francis Townsend galvanized support behind a proposal to issue direct payments to the elderly. Responding to that movement, Roosevelt organized a committee led by Secretary of Labor Frances Perkins to develop a major social welfare program proposal. Roosevelt presented the plan in early 1935 and signed the Social Security Act into law on August 14, 1935. The act was upheld by the Supreme Court in two major cases decided in 1937. The law established the Social Security program. The old-age program is funded by payroll ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

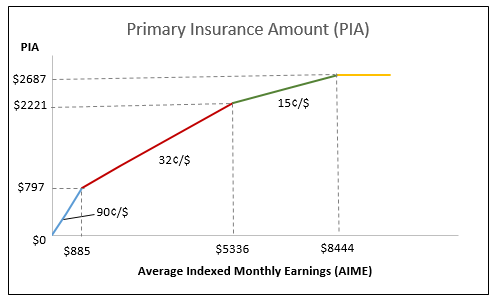

Primary Insurance Amount

The Primary Insurance Amount (PIA) is a component of Social Security provision in the United States. Eligibility for receiving Social Security benefits is contingent upon the recipient: (i) having worked for at least 10 (noncontiguous) years and (ii) having paid the Federal Insurance Contributions Act (FICA) tax up to a maximum taxable earnings threshold. For the purposes of the United States Social Security Administration, PIA is used as the beginning point in calculating the annuity payment of benefits that is provided to an eligible recipient each month during retirement until the recipient's death. Generally, the more a person pays into the Social Security Trust Fund during their life, the higher their PIA will be. However, specific rules in its computation may deviate from this general rule. Computation The main determinant of PIA is the Average Indexed Monthly Earnings (AIME). To calculate AIME, the individual's wages are first expressed in today's dollars by inflating th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement Insurance Benefits

Retirement Insurance Benefits (abbreviated RIB) or old-age insurance benefits are a form of social insurance payments made by the U.S. Social Security Administration paid based upon the attainment of old age (62 or older). Benefit payments are made on the 3rd of the month, or the 2nd, 3rd, or 4th Wednesday of the month, based upon the date of birth and entitlement to other benefits. Legal authority RIB is authorized under Title II of the Social Security Act. Entitlement factors Certain requirements must be met before a person becomes entitled to RIB. These requirements are based on both age and payments made into the Social Security System through payroll taxes. These are: *Be fully insured under the Social Security system *Have obtained the age of 62 by the first of the month. *Have either applied for the benefits ''or'' have been automatically converted from Disability Insurance Benefits at Full Retirement Age. Fully insured status People attain fully insured status based u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disability Insurance Benefits

Social Security Disability Insurance (SSD or SSDI) is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide monthly benefits to people who have a medically determinable disability (physical or mental) that restricts their ability to be employed. SSDI does not provide partial or temporary benefits but rather pays only full benefits and only pays benefits in cases in which the disability is "expected to last at least one year or result in death." Relative to disability programs in other countries in the Organisation for Economic Co-operation and Development (OECD), the SSDI program in the United States has strict requirements regarding eligibility. People frequently confuse Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Unlike SSDI (as well as Social Security retirement benefits) where payment is based on contribution credits earned through p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

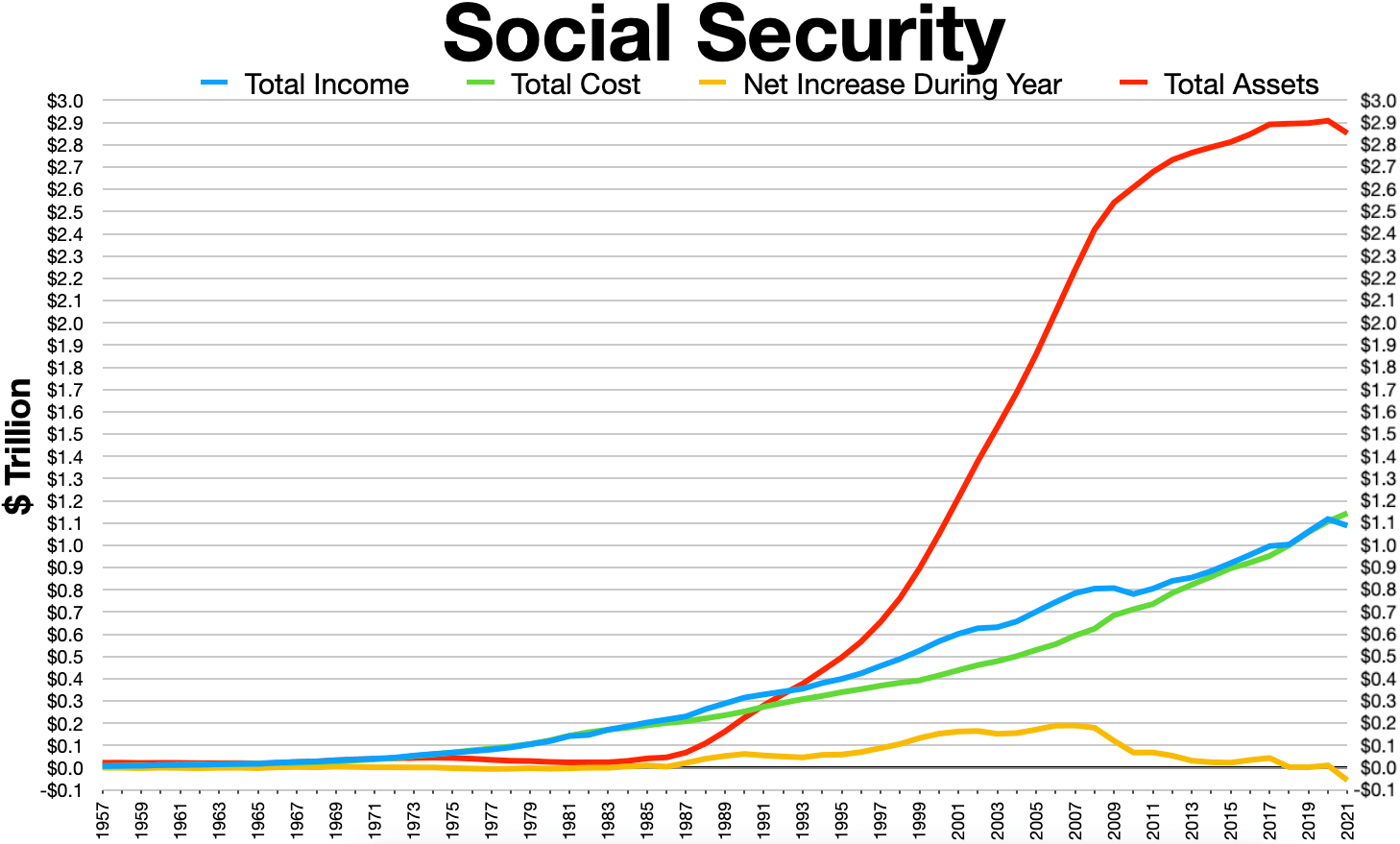

Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and Disability Insurance; OASDI) benefits administered by the United States Social Security Administration. The Social Security Administration collects payroll taxes and uses the money collected to pay Old-Age, Survivors, and Disability Insurance benefits by way of trust funds. When the program runs a surplus, the excess funds increase the value of the Trust Fund. As of 2021, the Trust Fund contained (or alternatively, was owed) $2.908 trillion The Trust Fund is required by law to be invested in non-marketable securities issued and guaranteed by the "full faith and credit" of the federal government. These securities earn a market rate of interest. Excess funds are used by the government for non-Social Security purposes, creating the obligatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Years Of Coverage (social Security)

Years of coverage, for purposes of the American Social Security program, are years in which a beneficiary is considered to have contributed a substantial amount into the Social Security Trust Fund. Years of coverage are used in the computations in whether and how to apply the Windfall Elimination Provision The Windfall Elimination Provision (abbreviated WEP) is a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security Act. It reduces the Primary Insurance Amo .... Years of coverage are not the amounts used in similar computations, such as with Quarter Credits. Calculating years of coverage Years of coverage are calculated in two different manners. Because the amount paid into the Social Security Trust Fund were not identified by year prior to 1951, Years of coverage before 1951 are determined by dividing pre-1951 earnings by $900.00 with any remainder dropped. The resulting number, limite ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Indexed Monthly Earnings (social Security)

The Average Indexed Monthly Earnings (AIME) is used in the United States' Social Security system to calculate the Primary Insurance Amount which decides the value of benefits paid under Title II of the Social Security Act under the 1978 New Start Method. Specifically, Average Indexed Monthly Earnings is an average of monthly income received by a beneficiary during their work life, adjusted for inflation. Each calendar year, the wages of each ''covered worker'' up to the Social Security Wage Base (SSWB) are recorded along with the calendar by the Social Security Administration. If a worker has 35 or fewer years of earnings, then the Average Indexed Monthly Earnings is the numerical average of those 35 years of covered wages; with zeros used to calculate the average for the number of years less than 35. However, because of wage inflation the federal government indexes wages so that $35,648.55 earned in year 2004 is exactly the same as $23,753.53 earned in 1994. Those two figures cam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |