|

Unincorporated Entity

An unincorporated entity is an organisation that has not been granted formal corporate status by incorporation. Description The most common and traditional unincorporated entities are sole traders, partnerships, and trustees of trusts. Modern unincorporated entities include limited partnerships (but not incorporated limited partnerships), limited liability partnerships (but not UK Limited Liability Partnerships, which are corporations), Limited liability limited partnerships, and limited liability companies. Unincorporated societies and clubs are also unincorporated entities. An unincorporated entity will generally be a separate entity for accounting purposes, but may or may not be a separate legal entity. For example, partnerships in England and Scotland are separate entities for accounting purposes, but while English partnerships are not separate legal entities, in Scotland they are separate legal persons. (but are not regarded as corporations). Australia In Austral ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in Corporate law, law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue share capital, stock, or whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this articl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Partnerships

A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts. Limited partnerships are distinct from limited liability partnerships in which all partners have limited liability. The general partners (GPs) are, in all major respects, in the same legal position as partners in a conventional firm: they have management control, share the right to use partnership property, share the profits of the firm in predefined proportions, and have joint and several liability for the debts of the partnership. As in a general partnership, the GPs have actual authority, as agents of the firm, to bind the partnership in contracts with third parties that are in the ordinary course of the partnership's business. As with a general partnership, "an act of a general partner which is not apparently for carrying on in the ordinary course th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Partnerships

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit aspects of both partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence. This distinguishes an LLP from a traditional partnership under the UK Partnership Act 1890, in which each partner has joint (but not several) liability. In an LLP, some or all partners have a form of limited liability similar to that of the shareholders of a corporation. Depending on the jurisdiction, however, the limited liability may extend only to the negligence or misconduct of the other partners, and the partners may be personally liable for other liabilities of the firm or partners. Unlike corporate shareholders, the partners have the power to manage the business directly. In contrast, corporate shareholders must elect a board of directors under the laws of v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Limited Partnership

The limited liability limited partnership (LLLP) is a relatively new modification of the limited partnership. The LLLP form of business entity is recognized under United States commercial law. An LLLP is a limited partnership A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts. Limited partnership ..., and it consists of one or more general partners who are liable for the obligations of the entity, as well as or more protected-liability limited partners. Typically, general partners manage the LLLP, while the limited partners' interest is purely financial. Thus, the most common use of limited partnership is for purposes of investment. LLLP versus LP In a traditional limited partnership, the general partners are jointly and severally liable for their debts and obligations. Limited partners are not liable f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Companies

A limited liability company (LLC) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under the laws of every state; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit. In certain U.S. states (for example, Texas), businesses that provide professional services requiring a state professional license, such as legal or medical services, may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company (PLLC). An LL ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unincorporated Associations

A voluntary group or union (also sometimes called a voluntary organization, common-interest association, association, or society) is a group of individuals who enter into an agreement, usually as volunteers, to form a body (or organization) to accomplish a purpose. Common examples include trade associations, trade unions, learned societies, professional associations, and environmental groups. All such associations reflect freedom of association in ultimate terms (members may choose whether to join or leave), although membership is not necessarily voluntary in the sense that one's employment may effectively require it via occupational closure. For example, in order for particular associations to function effectively, they might need to be mandatory or at least strongly encouraged, as is true of trade unions. Because of this, some people prefer the term common-interest association to describe groups which form out of a common interest, although this term is not widely used or unde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Law

The legal system of Australia has multiple forms. It includes a written constitution, unwritten constitutional conventions, statutes, regulations, and the judicially determined common law system. Its legal institutions and traditions are substantially derived from that of the English legal system, which superseded Indigenous Australian customary law during colonisation. Australia is a common-law jurisdiction, its court system having originated in the common law system of English law. The country's common law is the same across the states and territories.. The Australian Constitution sets out a federal system of government. There exists a national legislature, with a power to pass laws of overriding force on a number of express topics. The states are separate jurisdictions with their own system of courts and parliaments, and are vested with plenary power. Some Australian territories such as the Northern Territory and the Australian Capital Territory have been granted a region ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporations Act 2001

The ''Corporations Act 2001'' is an Act of the Parliament of Australia, which sets out the laws dealing with business entities in Australia. The company is the Act's primary focus, but other entities, such as partnerships and managed investment schemes, are also regulated. The Act is the foundational basis of Australian corporate law, with every Australian state having adopted the Act as required by the Australian Constitution. The Act is the principal legislation regulating companies in Australia. It regulates matters such as the formation and operation of companies (in conjunction with a constitution that may be adopted by a company), duties of officers, takeovers and fundraising. Background Constitutional basis Australian corporate law was the subject of a successful legal challenge in the High Court of Australia in ''New South Wales v Commonwealth'' (1990) ('The Corporations Act Case'). In that case, the Commonwealth was found to have insufficient power to leg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

States And Territories Of Australia

The states and territories are the national subdivisions and second level of government of Australia. The states are partially sovereignty, sovereign, administrative divisions that are autonomous administrative division, self-governing polity, polities, having ceded some sovereign rights to the Australian Government, federal government. They have their own state constitutions in Australia, constitutions, Parliaments of the Australian states and territories, legislatures, Premiers and chief ministers of the Australian states and territories, executive governments, Judiciary of Australia#State and territory courts and tribunals, judiciaries and state police#Australia, law enforcement agencies that administer and deliver public policy, public policies and programs. Territories can be autonomous administrative division, autonomous and administer local policies and programs much like the states in practice, but are still legally subordinate to the federal government. Australia has si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charitable Organization

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, Religion, religious or other activities serving the public interest or common good). The legal definition of a charitable organization (and of charity) varies between countries and in some instances regions of the country. The Charity regulators, regulation, the tax treatment, and the way in which charity law affects charitable organizations also vary. Charitable organizations may not use any of their funds to profit individual persons or entities. However, some charitable organizations have come under scrutiny for spending a disproportionate amount of their income to pay the salaries of their leadership. Financial figures (e.g. tax refunds, revenue from fundraising, revenue from the sale of goods and services or revenue from investment, and funds held in reserve) are indicators to assess the financial sustainability of a charity, especiall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Club (organization)

A club is an voluntary association, association of people united by a common interest or goal. A service club, for example, exists for voluntary or charitable activities. There are clubs devoted to hobbies and sports, social activities clubs, political and religious clubs, and so forth. History Historically, clubs occurred in all ancient states of which exists detailed knowledge. Once people started living together in larger groups, there was need for people with a common interest to be able to associate despite having no ties of kinship. Organizations of the sort have existed for many years, as evidenced by Ancient Greek clubs and associations (''collegia'') in Ancient Rome. Origins of the word and concept It is uncertain whether the use of the word "club" originated in its meaning of a knot of people, or from the fact that the members "clubbed" together to pay the expenses of their gatherings. The oldest English clubs were merely informal periodic gatherings of friends fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

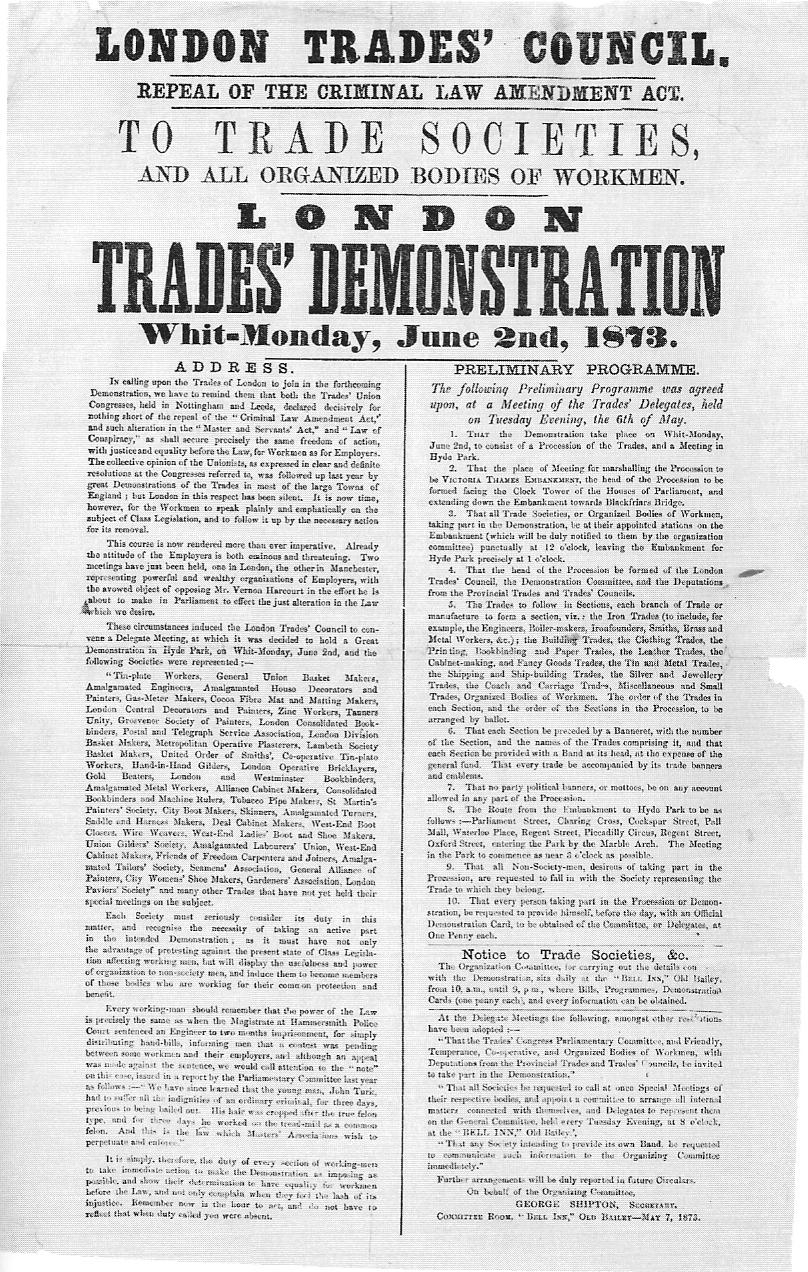

Trade Union

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is to maintain or improve the conditions of their employment, such as attaining better wages and Employee benefits, benefits, improving Work (human activity), working conditions, improving safety standards, establishing complaint procedures, developing rules governing status of employees (rules governing promotions, just-cause conditions for termination) and protecting and increasing the bargaining power of workers. Trade unions typically fund their head office and legal team functions through regularly imposed fees called ''union dues''. The union representatives in the workforce are usually made up of workplace volunteers who are often appointed by members through internal democratic elections. The trade union, through an elected leadership and bargaining committee, bargains with the employer on behalf of its members, known as t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |