|

Tullett Prebon

TP ICAP Group plc is a financial services firm headquartered in London, United Kingdom. Its stock is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. History The company was founded by Derek Tullett in 1971 as a foreign exchange broker trading as Tullett & Riley. During the 1970s and 1980s it opened a number of overseas offices and started its own computer graphical analysis company of financial futures, options and FX rates (Futrend Ltd). In 1999 the Company merged with Liberty Brokerage to create Tullett Liberty. In early 2003, the company was bought by Collins Stewart plc, a financial services company, creating Collins Stewart Tullett plc. In October 2004, the company acquired Prebon Yamane, a broking business formed in 1990 following the merger of three leading London-based money broking businesses (Babcock & Brown, Kirkland-Whittaker and Fulton Prebon) and had adopted that name in acknowledgement of the firm's close business alliance with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FTSE 250 Index

The FTSE 250 Index ( "Footsie") is a capitalisation-weighted index consisting of the 101st to the 350th largest companies listed on the London Stock Exchange. Promotions and demotions to and from the index occur quarterly in March, June, September, and December. The Index is calculated in real-time and published every minute. Related indices are the FTSE 100 Index (which lists the largest 100 companies), the FTSE 350 Index (which combines the FTSE 100 and 250), the FTSE SmallCap Index and the FTSE All-Share Index (an aggregation of the FTSE 100 Index, the FTSE 250 Index and the FTSE SmallCap Index). Annual returns The following table lists the Total Return of the FTSE 250 index up to 31 December 2021. Constituents The following table lists the FTSE 250 companies after the changes on 19 December 2022. See also *FTSE 100 The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" , is a share index of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidnet

Liquidnet is a global institutional investment network that connects asset managers with liquidity. Liquidnet trades in 46 equity markets for over 1000 institutional investment firms who collectively manage US$33 trillion in equity and fixed income assets. Liquidnet is headquartered in New York City and has offices in Boston, Dublin, London, San Francisco, Hong Kong, Singapore, Sydney, Tokyo, and Toronto. History Liquidnet was founded in April 2001 by Seth Merrin as a wholesale electronic marketplace where institutional investors could anonymously trade large blocks of stocks. Merrin estimated that the network needed at least 100 buy side firms live on Day One to create a critical mass. This number was revised to 75, but the company ultimately launched with only 38 institutions. In 2002, Liquidnet Europe launched with nine member firms, with Liquidnet Asia launching with 26 member firms in 2007, bringing its global reach to 28 markets. Merrin describes his company as “creati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1971

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Companies Based In The City Of London

Multinational may refer to: * Multinational corporation, a corporate organization operating in multiple countries * Multinational force, a military body from multiple countries * Multinational state, a sovereign state that comprises two or more nations See also * International (other) * Transnational (other) * Supranational (other) Supranational or supra-national may refer to: * Supranational union, a type of multinational political union * Supranational law, a form of international law * Supranational legislature, a form of international legislature * Supranational curre ... * Subnational (other) {{disambig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Listed On The London Stock Exchange

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Based In The City Of London

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assess ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities — more commonly known as bonds — can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not — in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing. For a company to grow its business, it often must raise money – for example, to finance an acquisition; buy equipment or land, or invest in new product development. The terms on which investors will finance the company will depend on the risk profile of the compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements ( hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets. Some of the more common derivatives include forwards, futures, options, swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps. Most derivatives are traded over-the-counter (off-exchange) or on an exchange such as the Chicago Mercantile Exchange, while most insurance contracts have developed into a separate industry. In the United States, after the financial crisis of 2007–2009, there has been increased pressure to move derivatives to trade on exchanges. Derivatives are one of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crude Oil

Petroleum, also known as crude oil, or simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name ''petroleum'' covers both naturally occurring unprocessed crude oil and petroleum products that consist of refined crude oil. A fossil fuel, petroleum is formed when large quantities of dead organisms, mostly zooplankton and algae, are buried underneath sedimentary rock and subjected to both prolonged heat and pressure. Petroleum is primarily recovered by oil drilling. Drilling is carried out after studies of structural geology, sedimentary basin analysis, and reservoir characterisation. Recent developments in technologies have also led to exploitation of other unconventional reserves such as oil sands and oil shale. Once extracted, oil is refined and separated, most easily by distillation, into innumerable products for direct use or use in manufacturing. Products include fuels such as gasoli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swap (finance)

In finance, a swap is an agreement between two counterparties to exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.Financial Industry Business Ontology Version 2 Annex D: Derivatives, EDM Council, Inc., Object Management Group, Inc., 2019 The general swap can also be seen as a series of forward contracts through which two parties exchange financial instruments, resulting in a common series of exchange dates and two streams of instruments, the ''legs'' of the swap. The legs can be almost anything but usually one leg involves cash flows based on a |

Equity Derivative

In finance, an equity derivative is a class of derivatives whose value is at least partly ''derived'' from one or more underlying equity securities. Options and futures are by far the most common equity derivatives, however there are many other types of equity derivatives that are actively traded. Equity options Equity options are the most common type of equity derivative. They provide the right, but not the obligation, to buy (call) or sell (put) a quantity of stock (1 contract = 100 shares of stock), at a set price (strike price), within a certain period of time (prior to the expiration date). Warrants In finance, a warrant is a security that entitles the holder to buy stock of the company that issued it at a specified price, which is much lower than the stock price at time of issue. Warrants are frequently attached to bonds or preferred stock as a sweetener, allowing the issuer to pay lower interest rates or dividends. They can be used to enhance the yield of the bond, and m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

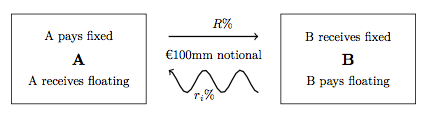

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |