|

Seasonal Spread Trading

Seasonal spread traders are spread traders that take advantage of seasonal patterns by holding long and short positions in futures contracts simultaneously in the same or a related commodity markets, such as the Chicago Mercantile Exchange, the New York Mercantile Exchange and the London Metal Exchange among others. The spread is the difference between the simultaneous values of these futures contracts. The 4 main commodity groups are: * Energetic, where you can find gasoil and natural gas. * Metals, such as gold, silver and copper. * Tropicals, like coffee, cocoa, cotton and sugar. * Grains and Meat, including lean hogs, corn, soybeans, etc. Traders may use a combination of fundamental analysis, technical, and historical factors in their analysis. Speculators hope to profit from the relative changes in price between the initial and offsetting positions. Contracts may be spread against different months or different markets. Traders are concerned with whether the changes i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seasonal

A season is a division of the year based on changes in weather, ecology, and the number of daylight hours in a given region. On Earth, seasons are the result of the axial parallelism of Earth's tilted orbit around the Sun. In temperate and polar regions, the seasons are marked by changes in the intensity of sunlight that reaches the Earth's surface, variations of which may cause animals to undergo hibernation or to migrate, and plants to be dormant. Various cultures define the number and nature of seasons based on regional variations, and as such there are a number of both modern and historical cultures whose number of seasons varies. The Northern Hemisphere experiences most direct sunlight during May, June, and July, as the hemisphere faces the Sun. The same is true of the Southern Hemisphere in November, December, and January. It is Earth's axial tilt that causes the Sun to be higher in the sky during the summer months, which increases the solar flux. However, due to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. The international standard definition of risk for common understanding in different applications is “effect of uncertainty on objectives”. The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas ( business, economics, environment, finance, information technology, health, insurance, safety, security etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and generic guidelines on managing risks faced by organizations. Def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

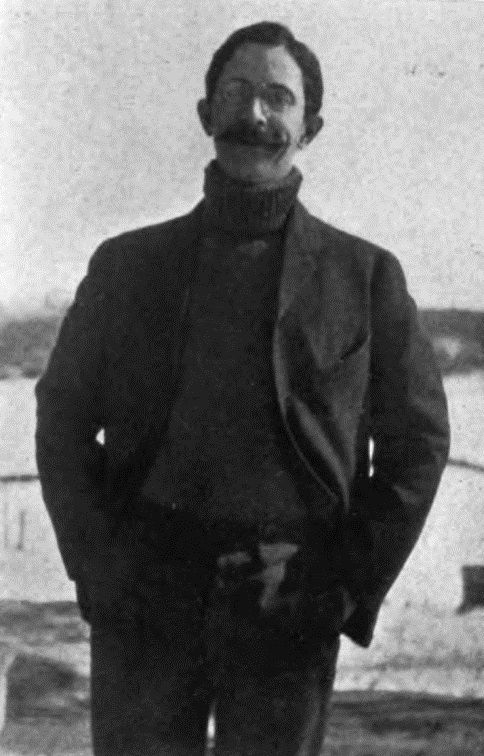

Edwin Lefèvre

Edwin Lefèvre (1871–1943) was an American journalist, writer, and diplomat, who is most noted for his writings on Wall Street business. Biography Lefèvre was born George Edwin Henry Lefèvre on January 23, 1871 in Colón, Colombia (now the Republic of Panama). He was the son of Emilia Luísa María Santiago de la Ossa, sister of Jerónimo and María de la Ossa de Amador, and Henry Lefèvre (1841–1899). Henry was born in Jersey, in the Channel Islands and emigrated to the United States in his youth. For many years, Henry was the general agent of the Pacific Steamship Company American for Panama. Their son, Edwin, bore dual citizenship and was sent to the United States when he was a boy. He completed his education at Lehigh University, where he received training as a mining engineer. At the age of nineteen, however, he began his career as a journalist and eventually became a stockbroker, as well. Following his father's death, Edwin inherited some wealth and became an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reminiscences Of A Stock Operator

''Reminiscences of a Stock Operator'' is a 1923 roman à clef by American author Edwin Lefèvre. It is told in the first person by a character inspired by the life of stock trader Jesse Livermore up to that point. The book remains in print (). In December 2009, Wiley published an annotated edition in hardcover, , that bridges the gap between Lefèvre's fictionalized account and the actual people and places referred to in the book. It also includes a foreword by hedge fund manager Paul Tudor Jones. Plot The book can be divided into three parts: * 1890-1910: Livermore was able to make easy money by taking advantage of the bid–ask spread on inactive stocks with leverage of 100-to-1 at bucket shops. * 1910-1920: Livermore was a stock trader on the New York Stock Exchange, where he went boom and bust several times using high leverage. * 1920s: Livermore engaged in market manipulation which was not illegal or without precedent then, charging fees of 25% of the market value of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jesse Livermore

Jesse Lauriston Livermore (July 26, 1877 – November 28, 1940) was an American stock trader. He is considered a pioneer of day trading and was the basis for the main character of '' Reminiscences of a Stock Operator'', a best-selling book by Edwin Lefèvre. At one time, Livermore was one of the richest people in the world; however, at the time of his suicide, he had liabilities greater than his assets. In a time when accurate financial statements were rarely published, getting current stock quotes required a large operation, and market manipulation was rampant, Livermore used what is now known as technical analysis as the basis for his trades. His principles, including the effects of emotion on trading, continue to be studied. Some of Livermore's trades, such as taking short positions before the 1906 San Francisco earthquake and just before the Wall Street Crash of 1929, are legendary within investing circles. Some observers have regarded Livermore as the greatest trader who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.) Many speculators pay little attention to the fundamental value of a security and instead focus purely on price movements. In principle, speculation can involve any tradable good or financial instrument. Speculators are particularly common in the markets for stocks, bonds, commodity futures, currencies, fine art, collectibles, real estate, and derivatives. Speculators play one of four primary roles in financial markets, along with hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageus who seek to profit from situations where fungible instruments trade at different prices in different market segments, and investors who seek profit through long-term ownership of an instrument's underlying attributes. Hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Margin (finance)

In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty (most often their broker or an exchange) to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following: * Borrowed cash from the counterparty to buy financial instruments, * Borrowed financial instruments to sell them short, * Entered into a derivative contract. The collateral for a margin account can be the cash deposited in the account or securities provided, and represents the funds available to the account holder for further share trading. On United States futures exchanges, margins were formerly called performance bonds. Most of the exchanges today use SPAN ("Standard Portfolio Analysis of Risk") methodology, which was developed by the Chicago Mercantile Exchange in 1988, for calculating margins for options and futures. Margin account A margin account is a loan account with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commitments Of Traders

The Commitments of Traders is a weekly market report issued by the Commodity Futures Trading Commission (CFTC) enumerating the holdings of participants in various futures markets in the United States. It is collated by the CFTC from submissions from traders in the market and covers positions in futures on grains, cattle, financial instruments, metals, petroleum and other commodities. The exchanges that trade futures are primarily based in Chicago and New York. The Commodity Futures Trading Commission (CFTC) releases a new report every Friday at 3:30 p.m. Eastern Time, and the report reflects the commitments of traders on the prior Tuesday. The weekly Commitments of Traders report is sometimes abbreviated as "CoT" or "COT." The report was first published in June 1962, but versions of the report can be traced back to as early as 1924 when the U.S. Department of Agriculture’s Grain Futures Administration started regularly publishing a Commitments of Traders report. Methodology The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Position Trader

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long (finance)

In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value. This is known as a bullish position. Security In terms of a security, such as a stock or a bond, or equivalently ''to be long'' in a security, means the holder of the position owns the security, on the expectation that the security will increase in value, and will profit if the price of the security goes up. ''Going long'' a security is the more conventional practice of investing. Future Going long in a future means the holder of the position is obliged to buy the underlying instrument at the contract price at expiry. The holder of the position will profit if the price of the underlying instrument goes up, as the price he will pay will be less than the market price. Option An options investor goes long in an underlying investment (in technica ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Speculators

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.) Many speculators pay little attention to the fundamental value of a security and instead focus purely on price movements. In principle, speculation can involve any tradable good or financial instrument. Speculators are particularly common in the markets for stocks, bonds, commodity futures, currencies, fine art, collectibles, real estate, and derivatives. Speculators play one of four primary roles in financial markets, along with hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageus who seek to profit from situations where fungible instruments trade at different prices in different market segments, and investors who seek profit through long-term ownership of an instrument's underlying attributes. History ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)