|

Revenue On-Line Service

The Revenue On-Line Service (ROS), is a pioneer in European internet applications, and it is run by Revenue Commissioners in the Republic of Ireland. The ROS system allows companies and other business concerns who are liable for tax in the Republic of Ireland to file certain tax returns online using a secure site facility. Originally it used the Java Virtual Machine for the application process, but moved to a JavaScript process in 2016. Users download ("retrieve") a digital certificate, which is in the form of a PKCS 12 file. This acts as their signature would on a normal paper form. ROS is estimated to be used by 60% of all taxpayers and over 80% of tax agents. ROS has been developed as part of Revenue's overall customer-service strategy. In addition to the current filing and payment options available to customers they are now extending these options to include Internet filing. The purpose of the exercise is to make it as easy as possible for Irish taxpayers to comply with their ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irish Language

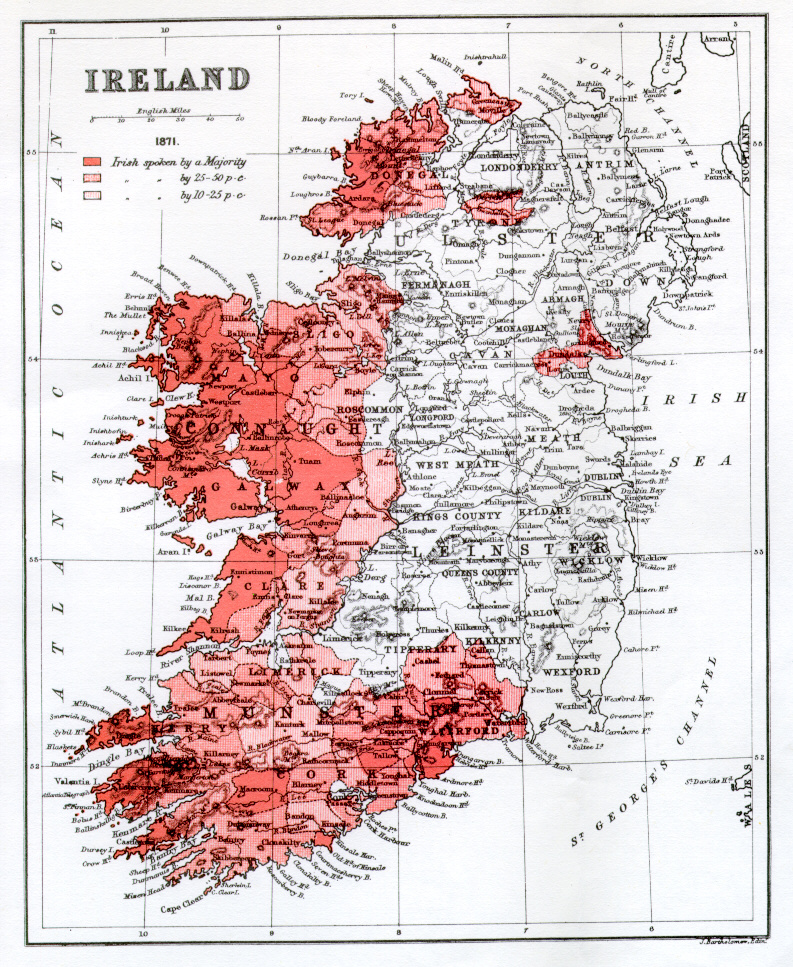

Irish (an Caighdeán Oifigiúil, Standard Irish: ), also known as Gaelic, is a Goidelic languages, Goidelic language of the Insular Celtic branch of the Celtic language family, which is a part of the Indo-European languages, Indo-European language family. Irish is indigenous language, indigenous to the Ireland, island of Ireland and was the population's first language until the 19th century, when English (language), English gradually became Linguistic imperialism, dominant, particularly in the last decades of the century. Irish is still spoken as a first language in a small number of areas of certain counties such as County Cork, Cork, County Donegal, Donegal, County Galway, Galway, and County Kerry, Kerry, as well as smaller areas of counties County Mayo, Mayo, County Meath, Meath, and County Waterford, Waterford. It is also spoken by a larger group of habitual but non-traditional speakers, mostly in urban areas where the majority are second language, second-language speakers. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The Republic Of Ireland

Taxation in Ireland in 2017 came from Personal Income taxes (40% of Exchequer Tax Revenues, or ETR), and Consumption taxes, being VAT (27% of ETR) and Excise and Customs duties (12% of ETR). Corporation taxes (16% of ETR) represents most of the balance (to 95% of ETR), but Ireland's Corporate Tax System (CT) is a central part of Ireland's economic model. Ireland summarises its taxation policy using the OECD's ''Hierarchy of Taxes'' pyramid (see graphic), which emphasises high corporate tax rates as the most harmful types of taxes where economic growth is the objective. The balance of Ireland's taxes are Property taxes (<3% of ETR, being Stamp duty and LPT) and Capital taxes (<3% of ETR, being CGT and CAT). An issue in comparing the Irish tax system to other economies is adjusting for the artificial inflation of Irish GDP by the [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intrastat

Intrastat is the system for collecting information and producing statistics on the trade in goods between countries of the European Union (EU). It began operation on 1 January 1993, when it replaced customs declarations as the source of trade statistics within the EU. The requirements of Intrastat are similar in all member states of the EU, although there are important exceptions. Motivation Trade statistics are an essential part of a country's balance of payments account and are regarded as an important economic indicator of the performance of any country. Export data in particular can be used as an indicator of the state of a country's manufacturing industries as a whole. The statistics are used by government departments to help set overall trade policy and generate initiatives on new trade areas. The volume of goods moving is also assessed to allow the planning of future transport infrastructure needs. Intrastat is also being used as a tool against VAT fraud, permitting the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special Savings Incentive Account

A Special Saving Incentive Account (SSIA) was a type of interest-bearing account in Ireland. These accounts were available to open between 1 May 2001 and 30 April 2002, and featured a state-provided top-up of 25% of the sum deposited. Scheme details Introduced in the ''Finance Act 2001'', the SSIA was structured so that the Government of Ireland contributed one euro for every four invested by the account holder. The maximum contribution was €254 per month. For deposit account SSIAs, banks paid interest on top of the government bonus and principal accumulated. Equity SSIAs were also available to investors seeking higher returns than the state-guaranteed minimum of 25%. The scheme, which was restricted to those over eighteen, was most popular among middle-income earners. All SSIAs matured five years from the date of opening. Intended effects In 2006/7 the maturing SSIA funds were hoped to boost the slowing Irish economy. The funds amounted to €14 billion and were expected to incre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Professional Services

Professional services are occupations in the service sector requiring special training in the arts or sciences. Some professional services, such as architects, accountants, engineers, doctors, and lawyers require the practitioner to hold professional degrees or licenses and possess specific skills. Other professional services involve providing specialist business support to businesses of all sizes and in all sectors; this can include tax advice, supporting a company with accounting, IT services, public relations services or providing management services. Definition Many industry groups have been used for academic research, while looking at professional services firms, making a clear definition hard to attain. Some work has been directed at better defining professional service firms (PSF). In particular, Von Nordenflycht generated a taxonomy of professional service firms, defining four types: # Classic PSFs (e.g. law and accounting firms): characterized by a high knowledge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Withholding Tax

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a ''Prélèvement à la source'', is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common. Typi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

P45 (tax)

In the United Kingdom, a P45 is and was until 1 January 2019 in the Republic of Ireland the reference code of a document titled ''Details of employee leaving work''. The term is used in British and Irish slang as a metonym for termination of employment. The equivalent slang term in the United States is " pink slip". A P45 is issued by the employer when an employee leaves work. In the United Kingdom In the UK, the front section, Part 1, is given by the old employer to HM Revenue and Customs, who then record the pay and tax details on to the individual's taxpayer record. Part 1A is to be retained by the employee, Part 2 retained by the new employer, and Part 3 taken by the new employer and sent to their tax office. The P45 contains details of earnings and tax paid during the tax year (tax paid in previous years is detailed on the P60 for that year). The "P" code refers to documents in the PAYE series, in the same way that self-assessment documents are prefixed "SA" (e.g., SA1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Commissioners

The Revenue Commissioners ( ga, Na Coimisinéirí Ioncaim), commonly called Revenue, is the Irish Government agency responsible for customs, excise, taxation and related matters. Though Revenue can trace itself back to predecessors (with the Act of Union 1800 amalgamating its forerunners with HM Customs and Excise in the United Kingdom), the current organisation was created for the independent Irish Free State on 21 February 1923 by the ''Revenue Commissioners Order, 1923'' which established the Revenue Commissioners to carry out the functions that the Commissioners of Inland Revenue and the Commissioners of Customs and Excise had carried out in the Free State prior to independence. The Revenue Commissioners are responsible to the Minister for Finance. Overview Revenue consists of a chairman and two commissioners, all of whom have the status of secretary general as used in Departments of State. The first commissioners, appointed by the then President of the Executive Council ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PKCS 12

In cryptography, PKCS #12 defines an archive file format for storing many cryptography objects as a single file. It is commonly used to bundle a private key with its X.509 certificate or to bundle all the members of a chain of trust. A PKCS #12 file may be encrypted and signed. The internal storage containers, called "SafeBags", may also be encrypted and signed. A few SafeBags are predefined to store certificates, private keys and CRLs. Another SafeBag is provided to store any other data at individual implementer's choice. PKCS #12 is one of the family of standards called Public-Key Cryptography Standards (PKCS) published by RSA Laboratories. The filename extension for PKCS #12 files is .p12 or .pfx. These files can be created, parsed and read out with the OpenSSL pkcs12 command. Relationship to PFX file format PKCS #12 is the successor to Microsoft's "PFX"; however, the terms "PKCS #12 file" and "PFX file" are sometimes used interchangeably. The PFX format has been critic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Certificate

In cryptography, a public key certificate, also known as a digital certificate or identity certificate, is an electronic document used to prove the validity of a public key. The certificate includes information about the key, information about the identity of its owner (called the subject), and the digital signature of an entity that has verified the certificate's contents (called the issuer). If the signature is valid, and the software examining the certificate trusts the issuer, then it can use that key to communicate securely with the certificate's subject. In email encryption, code signing, and e-signature systems, a certificate's subject is typically a person or organization. However, in Transport Layer Security (TLS) a certificate's subject is typically a computer or other device, though TLS certificates may identify organizations or individuals in addition to their core role in identifying devices. TLS, sometimes called by its older name Secure Sockets Layer (SSL), is no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |