|

RNPV

In finance, risk-adjusted net present value (rNPV) or expected net existing value (eNPV) is a method to value risky future cash flows. rNPV is the standard valuation method in the drug development industry, where sufficient data exists to estimate success rates for all R&D phases.Stewart JJ et alPutting a Price on Biotechnology Nature Biotechnology. 2001. 19:5 A similar technique is used in the probability model of credit default swap (CDS) valuation. rNPV modifies the standard NPV calculation of discounted cash flow (DCF) analysis by adjusting (multiplying) each cash flow by the estimated probability that it occurs (the estimated success rate). In the language of probability theory, the rNPV is the expected value. Note that this in contrast to the more general valuation approach, where risk is instead incorporated by adding a risk premium A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Present Value

The net present value (NPV) or net present worth (NPW) is a way of measuring the value of an asset that has cashflow by adding up the present value of all the future cash flows that asset will generate. The present value of a cash flow depends on the interval of time between now and the cash flow because of the Time value of money (which includes the annual effective discount rate). It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications. Time value of money dictates that time affects the value of cash flows. For example, a lender may offer 99 cents for the promise of receiving $1.00 a month from now, but the promise to receive that same dollar 20 years in the future would be worth much less today to that same person (lender), even if the payback in both cases was equally certain. This decrease in the current value of future c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

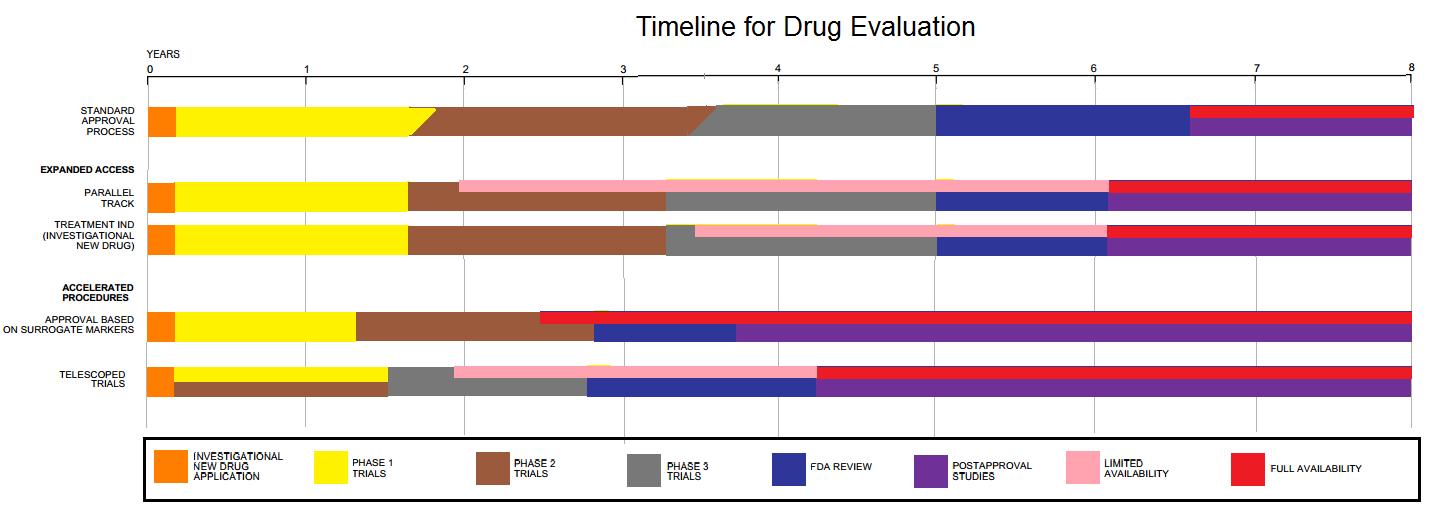

Drug Development

Drug development is the process of bringing a new pharmaceutical drug to the market once a lead compound has been identified through the process of drug discovery. It includes preclinical research on microorganisms and animals, filing for regulatory status, such as via the United States Food and Drug Administration for an investigational new drug to initiate clinical trials on humans, and may include the step of obtaining regulatory approval with a new drug application to market the drug. The entire process—from concept through preclinical testing in the laboratory to clinical trial development, including Phase I–III trials—to approved vaccine or drug typically takes more than a decade. New chemical entity development Broadly, the process of drug development can be divided into preclinical and clinical work. Pre-clinical New chemical entities (NCEs, also known as new molecular entities or NMEs) are compounds that emerge from the process of drug discovery. These h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Commercial Value

Expected commercial value (ECV), also known as estimated commercial value,Steven Bragg (2020)R&D funding decisions/ref> is a prospect-weighted value for a "project" with unclear conclusions; it is similar to expected net existing value (ENPV). In general ECV is used as a supplementary capital budgeting technique, in that it allows an analyst to compare each project's expected value against its net present value as usually calculated, i.e. using planned and contracted costs. The company can thereby maximize the value and worth of its portfolio of projects, while working within its budget constraints. As with ENPV, developments are defined to represent different project outcomes, with each scenario being assigned a possibility. A project value is computed for each scenario, and the expected commercial value is obtained by multiplying each situation's value by the scenario odds and adding the results. Depending on the procedures used to estimate the value of the project under each ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Valuation (finance)

In finance, valuation is the process of determining the value of a (potential) investment, asset, or security. Generally, there are three approaches taken, namely discounted cashflow valuation, relative valuation, and contingent claim valuation. Valuations can be done for assets (for example, investments in marketable securities such as companies' shares and related rights, business enterprises, or intangible assets such as patents, data and trademarks) or for liabilities (e.g., bonds issued by a company). Valuation is a subjective exercise, and in fact, the process of valuation itself can also affect the value of the asset in question. Valuations may be needed for various reasons such as investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability. In a business valuation context, various techniques are used to determine the (hypothetical) price that a third party would pay for a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money. *Cash flow, in its narrow sense, is a payment (in a currency), especially from one central bank account to another. The term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain, and therefore need to be forecast with cash flows. *A cash flow is determined by its time , nominal amount , currency , and account ; symbolically, . Cash flows are narrowly interconnected with the concepts of value, interest rate, and liquidity. A cash flow that shall happen on a future day can be transformed into a cash flow of the same value in . This transformation process is known as discounting, and it takes into account the time value of money by adjusting the nominal amount of the cash flow based on the prevailing interest rates at the time. Cash flow analy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Whitepaper

A white paper is a report or guide that informs readers concisely about a complex issue and presents the issuing body's philosophy on the matter. It is meant to help readers understand an issue, solve a problem, or make a decision. Since the 1990s, this type of document has proliferated in business. Today, a business-to-business (B2B) white paper falls under grey literature, more akin to a marketing presentation meant to persuade customers and partners, and promote a certain product or viewpoint. The term originated in the 1920s to mean a type of position paper or industry report published by a department of the UK government. Corporate and academic The most prolific publishers of white papers are corporate and academic organizations. In larger organizations, internal technical writers produce these documents based on the outlines and data an internal industry or academic expert develops and provides. White papers often follow strict industry styles and formats with a central ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nature Biotechnology

''Nature Biotechnology'' is a monthly peer-reviewed scientific journal published by Nature Portfolio. The editor-in-chief is Barbara Cheifet who heads an in-house team of editors. The focus of the journal is biotechnology including research results and the commercial business sector of this field. Coverage includes the related biological, biomedical, agricultural and environmental sciences. Also of interest are the commercial, political, legal, and societal influences that affect this field. The journal continues serial publication of the title "Bio/Technology", which had a publication period of 1983 to 1996. Abstracting and indexing This journal is indexed in Accessed 2012-06-29 * BIOBASE * BIOSIS * Chemical Abstracts Service * CSA Illumina * CAB Abstracts * EMBASE * Scopus * Current Contents * Science Citation Index * Medline (PubMed) A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounted Cash Flow

The discounted cash flow (DCF) analysis, in financial analysis, is a method used to value a security, project, company, or asset, that incorporates the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management, and patent valuation. Used in industry as early as the 1700s or 1800s, it was widely discussed in financial economics in the 1960s, and U.S. courts began employing the concept in the 1980s and 1990s. Application In discount cash flow analysis, all future cash flows are estimated and discounted by using cost of capital to give their present values (PVs). The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value of the cash flows in question; see aside. For further context see ; and for the mechanics see valuation using discounted cash flows, which includes modifications typical for startups, private equity and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability

Probability is a branch of mathematics and statistics concerning events and numerical descriptions of how likely they are to occur. The probability of an event is a number between 0 and 1; the larger the probability, the more likely an event is to occur."Kendall's Advanced Theory of Statistics, Volume 1: Distribution Theory", Alan Stuart and Keith Ord, 6th ed., (2009), .William Feller, ''An Introduction to Probability Theory and Its Applications'', vol. 1, 3rd ed., (1968), Wiley, . This number is often expressed as a percentage (%), ranging from 0% to 100%. A simple example is the tossing of a fair (unbiased) coin. Since the coin is fair, the two outcomes ("heads" and "tails") are both equally probable; the probability of "heads" equals the probability of "tails"; and since no other outcomes are possible, the probability of either "heads" or "tails" is 1/2 (which could also be written as 0.5 or 50%). These concepts have been given an axiomatic mathematical formaliza ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value

In probability theory, the expected value (also called expectation, expectancy, expectation operator, mathematical expectation, mean, expectation value, or first Moment (mathematics), moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean, mean of the possible values a random variable can take, weighted by the probability of those outcomes. Since it is obtained through arithmetic, the expected value sometimes may not even be included in the sample data set; it is not the value you would expect to get in reality. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by Integral, integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |