|

Perpetual Bond

A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, therefore allowing it to be treated as equity, not as debt. Issuers pay coupons on perpetual bonds forever, and they do not have to redeem the principal. Perpetual bond cash flows are, therefore, those of a perpetuity. Perpetual bonds vs. equity * Although similar to equity, perpetual bonds do not have attached votes and, therefore, provide no means of control over the issuer. * Perpetual bonds are still fixed-income securities; therefore, paying coupons is mandatory whereas paying dividends on equity is discretionary. Examples * Consols that were issued by the United States and the UK governments. * The oldest examples of a perpetual bond was issued on 15 May 1624 by the Dutch water board of Lekdijk Bovendams. It is currently in the possession of Yale University and interest was most recently paid by the eventual successor of Lekdijk Bovendams ( Hoogheemraadschap De Stichtse R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maturity Date

Maturity or immaturity may refer to: * Adulthood or age of majority * Maturity model ** Capability Maturity Model, in software engineering, a model representing the degree of formality and optimization of processes in an organization * Developmental age, the age of an embryo as measured from the point of fertilization * Mature technology, a technology has been in use and development for long enough that most of its initial problems have been overcome * Maturity (finance), indicating the final date for payment of principal and interest * Maturity (geology), rock, source rock, and hydrocarbon generation * Maturity (psychological), the attainment of one's final level of psychological functioning and the integration of their personality into an organized whole * Maturity (sedimentology), the proximity of a sedimentary deposit from its source * Sexual maturity, the stage when an organism can reproduce, though this is distinct from adulthood See also * Evolution * Maturation (disambi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is ownership of assets that may have debts or other liabilities attached to them. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that developed in England during the Late Middle Ages to meet the growing demands of commercial activity. While the older common law courts dealt with questions of property title, eq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coupon (bond)

In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. Typically, this will consist of two semi-annual payments of $25 each. History The origin of the term "coupon" is that bonds were historically issued in the form of bearer certificates. Physical possession of the certificate was (deemed) proof of ownership. Several coupons, one for each scheduled interest payment, were printed on the certificate. At the date the coupon was due, the owner would detach the coupon and present it for payment (an act called "clipping the coupon"). The certificate often also contained a document called a ''talon'', which (when the original ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flows

A cash flow is a real or virtual movement of money: *a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain and therefore need to be forecast with cash flows; *a cash flow is determined by its time ''t'', nominal amount ''N'', currency ''CCY'' and account ''A''; symbolically ''CF'' = ''CF''(''t,N,CCY,A''). * it is however popular to use ''cash flow'' in a less specified sense describing (symbolic) payments into or out of a business, project, or financial product. Cash flows are narrowly interconnected with the concepts of value, ''interest rate'' and liquidity. A cash flow that shall happen on a future day ''t''N can be transformed into a cash flow of the same value in ''t''0. Cash flow analysis Cash flows are often transformed into measures that give information e.g. on a company's value and situat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perpetuity

A perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. There are few actual perpetuities in existence. For example, the United Kingdom (UK) government issued them in the past; these were known as consols and were all finally redeemed in 2015. Real estate and preferred stock are among some types of investments that affect the results of a perpetuity, and prices can be established using techniques for valuing a perpetuity. Perpetuities are but one of the time value of money methods for valuing financial assets. Perpetuities are a form of ordinary annuities. The concept is closely linked to terminal value and terminal growth rate in valuation. Detailed description A perpetuity is an annuity in which the periodic payments begin on a fixed date and continue indefinitely. It is sometimes referred to as a perpetual annuity. Fixed coupon payments on permanently invested (irredeemable) sums of money are prime examples of perpetuities. Scholar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed-income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities — more commonly known as bonds — can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not — in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing. For a company to grow its business, it often must raise money – for example, to finance an acquisition; buy equipment or land, or invest in new product development. The terms on which investors will finance the company will depend on the risk profile of the compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consols

Consols (originally short for consolidated annuities, but subsequently taken to mean consolidated stock) were government debt issues in the form of perpetual bonds, redeemable at the option of the government. They were issued by the Bank of England and the U.S. Government. The first British consols were issued in 1751. They have now been fully redeemed. The United States government issued consols from 1877 to 1930, which have likewise been redeemed. History In 1752 the Chancellor of the Exchequer and Prime Minister Sir Henry Pelham converted all outstanding issues of redeemable government stock into one bond, Consolidated 3.5% Annuities, in order to reduce the coupon (interest rate) paid on the government debt. In 1757, the annual interest rate on the stock was reduced to 3%, leaving the stock as consolidated 3% annuities. The coupon rate remained at 3% until 1888. In 1888, the Chancellor of the Exchequer, George Joachim Goschen, converted the consolidated 3% annuities, along w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Water Board (Netherlands)

In the Netherlands, a water board, water council or water authority ( nl, waterschap or heemraadschap) is a regional governing body solely charged with the management of surface water in the environment. Water boards are independent of administrative governing bodies like provinces and municipalities. In general, they are responsible for managing rivers and canals, issues with the flow of watercourses and drainage issues, water collection, flood and erosion prevention and provision of potable water. They manage polder systems, water levels, water barriers and locks, enforcements, water quality and sewage treatment in their respective regions. The concept of a coordinating "High Water Authority" (''Hoogheemraadschap'') originated in what now is the province of South Holland in the 12th century. Background Since the settlement of the Netherlands, large parts of the land has been constantly threatened by rivers and the sea. Fertile soil and peatlands often were located near rive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

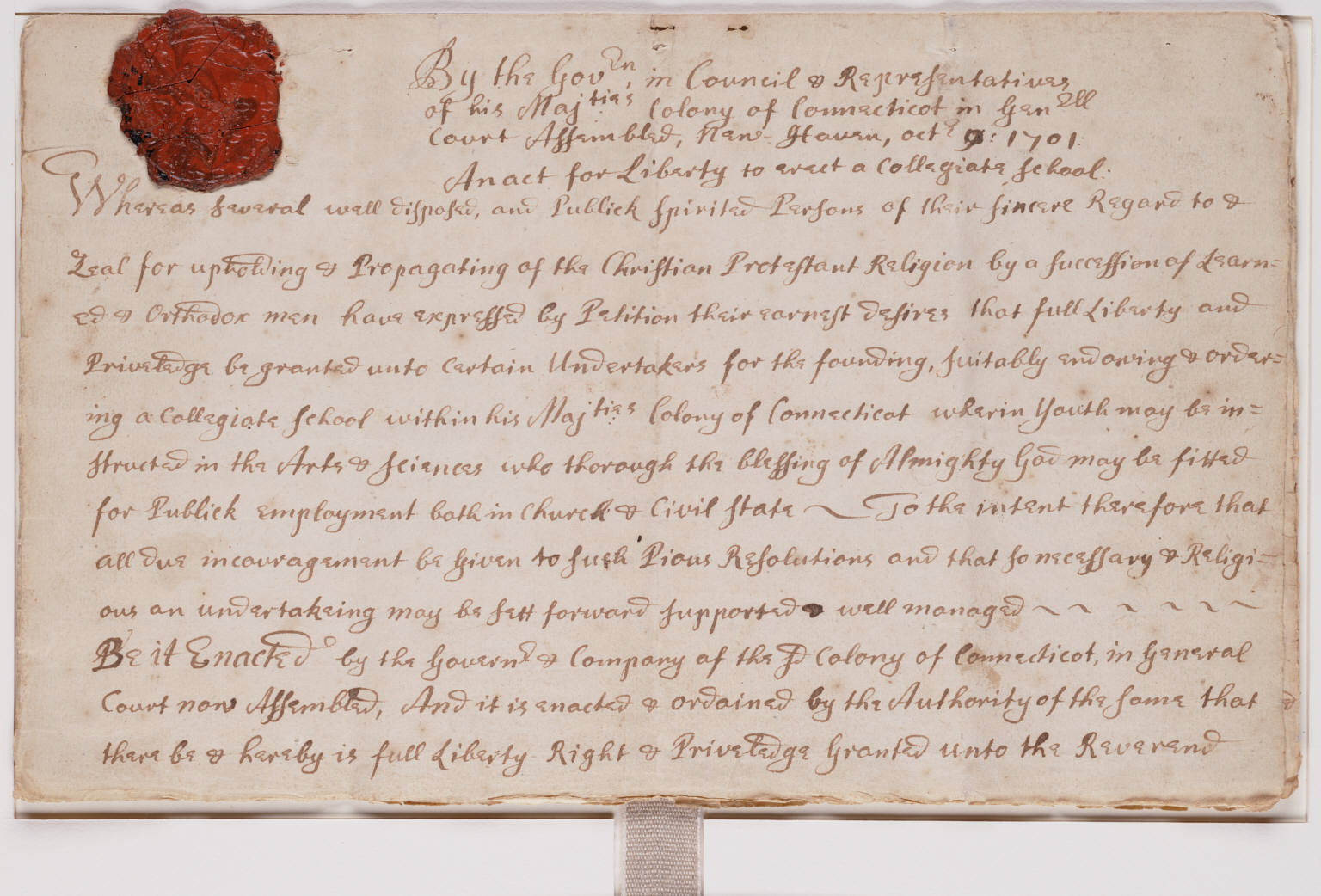

Yale University

Yale University is a Private university, private research university in New Haven, Connecticut. Established in 1701 as the Collegiate School, it is the List of Colonial Colleges, third-oldest institution of higher education in the United States and among the most prestigious in the world. It is a member of the Ivy League. Chartered by the Connecticut Colony, the Collegiate School was established in 1701 by clergy to educate Congregationalism in the United States, Congregational ministers before moving to New Haven in 1716. Originally restricted to theology and sacred languages, the curriculum began to incorporate humanities and sciences by the time of the American Revolution. In the 19th century, the college expanded into graduate and professional instruction, awarding the first Doctor of Philosophy, PhD in the United States in 1861 and organizing as a university in 1887. Yale's faculty and student populations grew after 1890 with rapid expansion of the physical campus and sc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

YouTube

YouTube is a global online video sharing and social media platform headquartered in San Bruno, California. It was launched on February 14, 2005, by Steve Chen, Chad Hurley, and Jawed Karim. It is owned by Google, and is the second most visited website, after Google Search. YouTube has more than 2.5 billion monthly users who collectively watch more than one billion hours of videos each day. , videos were being uploaded at a rate of more than 500 hours of content per minute. In October 2006, YouTube was bought by Google for $1.65 billion. Google's ownership of YouTube expanded the site's business model, expanding from generating revenue from advertisements alone, to offering paid content such as movies and exclusive content produced by YouTube. It also offers YouTube Premium, a paid subscription option for watching content without ads. YouTube also approved creators to participate in Google's AdSense program, which seeks to generate more revenue for both parties ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)