|

Payroll

A payroll is a list of employment, employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including Salary, salaries and wages, Bonus payment, bonuses, and Withholding tax, withheld taxes, or the company's department that deals with Remuneration, compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company. Payroll in the U.S. is subject to federal, state and local regulations including Fair Labor Standards Act of 1938, employee exemptions, Records management, record keeping, and Taxation in the United States, tax requirements. In recent years, there has been a significant shift towards cloud-based payroll solutions. These platfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Payroll Tax

Payroll taxes are taxes imposed on employers or employees. They are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education. National payroll tax systems Australia The Australian federal government ( ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, payroll tax accounts for over a third of the annual nation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Taxation In The United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Payroll Service Bureau

A financial bureau is an accounting business whose main focus is the preparation of finance for other businesses. In the United States such firms are often run by Certified Public Accountants, though a typical financial processing company will refer to itself as a bureau rather than a CPA firm, to distinguish its finance from the general tax and accounting that are generally not offered by a financial bureau. The typical client of a bureau is a small business - one just large enough for finance to be complicated to the point of a hassle, but one still small enough to not merit its own full-time finance department. The tasks that can generally be expected of just about all finance bureaus in the USA are as follows: * Printing of employee pay checks on time for payday * Direct deposit of pay into employee bank accounts, when desired * Appropriate calculation and withholding of federal, state, and local taxes * Calculation of financial taxes to be paid by employer (such as Social S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Income Tax In The United States

The United States federal government and most State governments in the United States, state governments impose an income tax. They are determined by applying a tax rate, which Progressive tax, may increase as income increases, to taxable income, which is the total income less allowable tax deduction, deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnership taxation in the United States, Partnerships are not taxed (with some exceptions in the case of federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of tax credit, credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mort ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Medicare (United States)

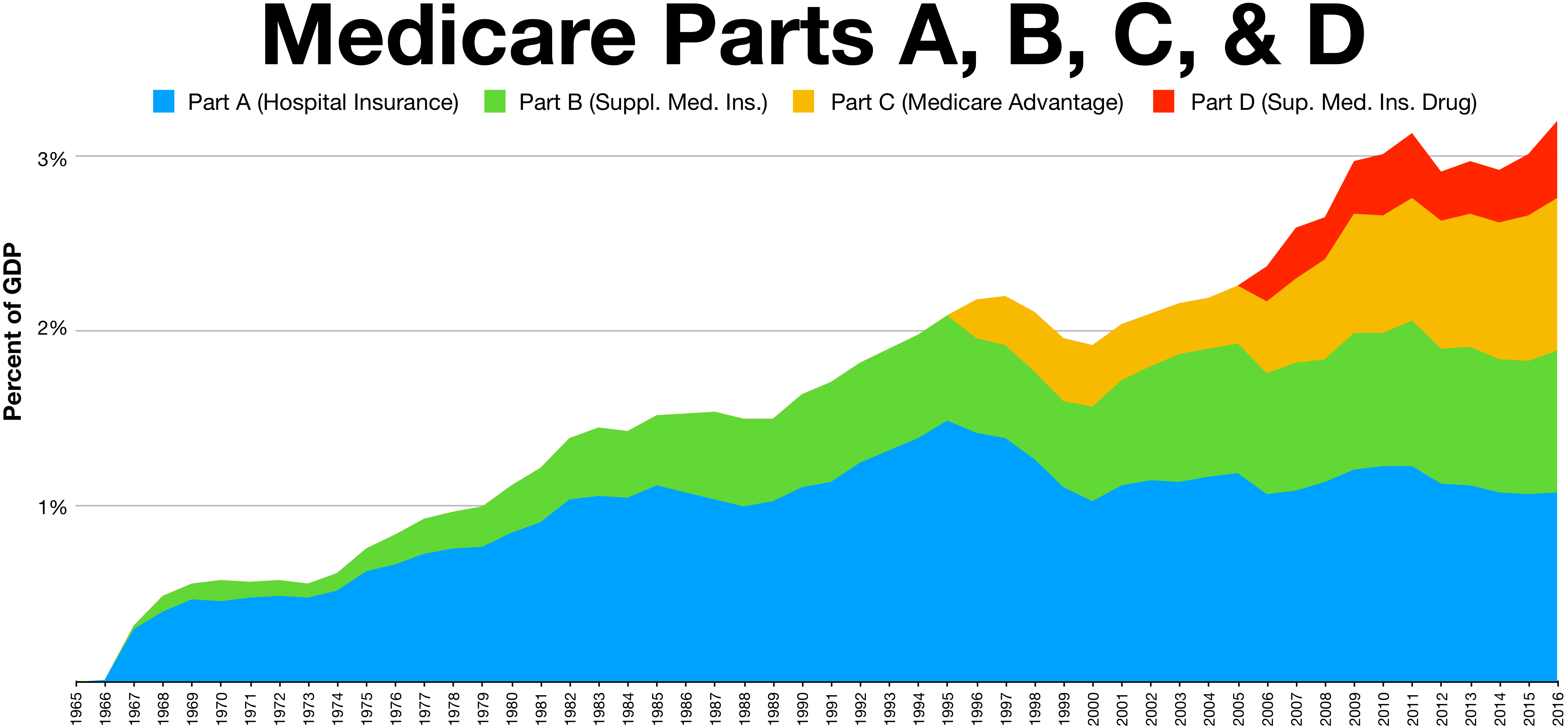

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with End Stage Renal Disease Program, end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). It started in 1965 under the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services (CMS). Medicare is divided into four parts: A, B, C and D. Part A covers hospital, skilled nursing, and hospice services. Part B covers outpatient services. Part D covers self-administered prescription drugs. Part C is an alternative that allows patients to choose private plans with different benefit structures that provide the same services as Parts A and B, usually with additional benefits. In 2022, Medicare provided health insurance for 65.0 million individuals—more than 57 million people aged 65 and older and about 8 million younger people. According to annual Medicare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

State Income Tax

In addition to Federal government of the United States, federal Income tax in the United States, income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose an income tax, often based on state income tax calculations. Forty-one United States state, states, the Washington, D.C., District of Columbia, and many localities in the United States impose an income tax on individuals. Nine states impose no state income tax. Forty-seven states and many localities impose a tax on the income of corporations. State income tax is imposed at a fixed or graduated rate on taxable income of individuals, corporations, and certain estates and trusts. These tax rates vary by state and by entity type. Taxable income conforms closely to federal taxable income in most states with limited modifications. States are prohibited from taxing income from federal bonds or other federal obligations. Most states do not tax Social Security b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Flexible Spending Account

In the United States, a flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts, resulting in payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are forfeited to the employer, known as the "use it or lose it" rule. Under the terms of the Affordable Care Act however a plan may permit an employee to carry over up to $660 into the following year without losing the funds but this does not apply to all plans and some plans may have lower limits. The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a Health Reimbursement Account, health reimbursement account (HRA). However, while HSAs and HRAs are almost exclusively used as components of a consumer-driven health care plan, medical FSAs are commonly offered with more traditional health plans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Withholding Tax

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, renting, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common. Typically, the withheld tax is treated as a pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tip (gratuity)

A gratuity (often called a tip) is a sum of money customarily given by a customer to certain service sector workers such as hospitality for the service they have performed, in addition to the basic price of the service. Tips and their amount are a matter of social custom and etiquette, and the custom varies between countries and between settings. In some countries, it is customary to tip servers in bars and restaurants, taxi drivers, tattoo artists, hair stylists and so on. However, in some places tipping is not expected and may be discouraged or considered insulting. The customary amount of a tip can be a specific range or a certain percentage of the bill based on the perceived quality of the service given. It is illegal to offer tips to some groups of workers, such as U.S. government workers and more widely police officers, as the tips may be regarded as bribery. A fixed percentage service charge is sometimes added to bills in restaurants and similar establishments. Ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Garnishment

Garnishment is a legal process for collecting a monetary judgment on behalf of a plaintiff from a defendant. Garnishment allows the plaintiff (the "garnishor") to take the money or property of the debtor from the person or institution that holds that property (the "garnishee"). A similar legal mechanism called execution allows the seizure of money or property held directly by the debtor. Some jurisdictions may allow for garnishment by a tax agency without the need to first obtain a judgment or other court order. Wages Wage garnishment, the most common type of garnishment, is the process of deducting money from an employee's monetary compensation (including salary), usually as a result of a court order. Wage garnishments may continue until the entire debt is paid or arrangements are made to pay off the debt. Garnishments can be taken for any type of debt but common examples of debt that result in garnishments include: * Child support * Defaulted student loans * Taxes * Unpaid cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |