|

Payroll Tax

Payroll taxes are taxes imposed on employers or employees. They are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education. National payroll tax systems Australia The Australian federal government ( ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, payroll tax accounts for over a third of the annual nation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Flemmi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll And Income Tax By Country

A payroll is a list of employment, employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including Salary, salaries and wages, Bonus payment, bonuses, and Withholding tax, withheld taxes, or the company's department that deals with Remuneration, compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company. Payroll in the U.S. is subject to federal, state and local regulations including Fair Labor Standards Act of 1938, employee exemptions, Records management, record keeping, and Taxation in the United States, tax requirements. In recent years, there has been a significant shift towards cloud-based payroll solutions. These platfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form W-2

Form W-2 (officially, the "Wage and Tax Statement") is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31 of any year in which an employment relationship existed and which was not contractually independent (see below). This deadline gives these taxpayers about 2 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. Form W-2 along with Form W-3 generally must be filed by the employer with the Social Security Administration by the end of February following employment the previous year. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Intern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form W-4

Form W-4 (officially, the "Employee's Withholding Allowance Certificate") is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation (Tax exemption, exemptions, status, etc.) to the employer. The W-4 form tells the employer the correct amount of federal tax to withhold from an employee's paycheck. Motivation The W-4 is based on the idea of "allowances"; the more allowances claimed, the less money the employer withholds for tax purposes. The W-4 Form is usually not sent to the IRS; rather, the employer uses the form in order to calculate how much of an employee's salary is withheld. An employee may claim allowances for oneself, one's spouse, and any dependents, along with other miscellaneous reasons, such as being single with only one job. In the latter case, this creates an oddity in that the employee will have one more exemption on the W-4 than on the 1040 tax return. This is not a tax deduction in itself, but ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Withholding Tax

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, renting, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common. Typically, the withheld tax is treated as a pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

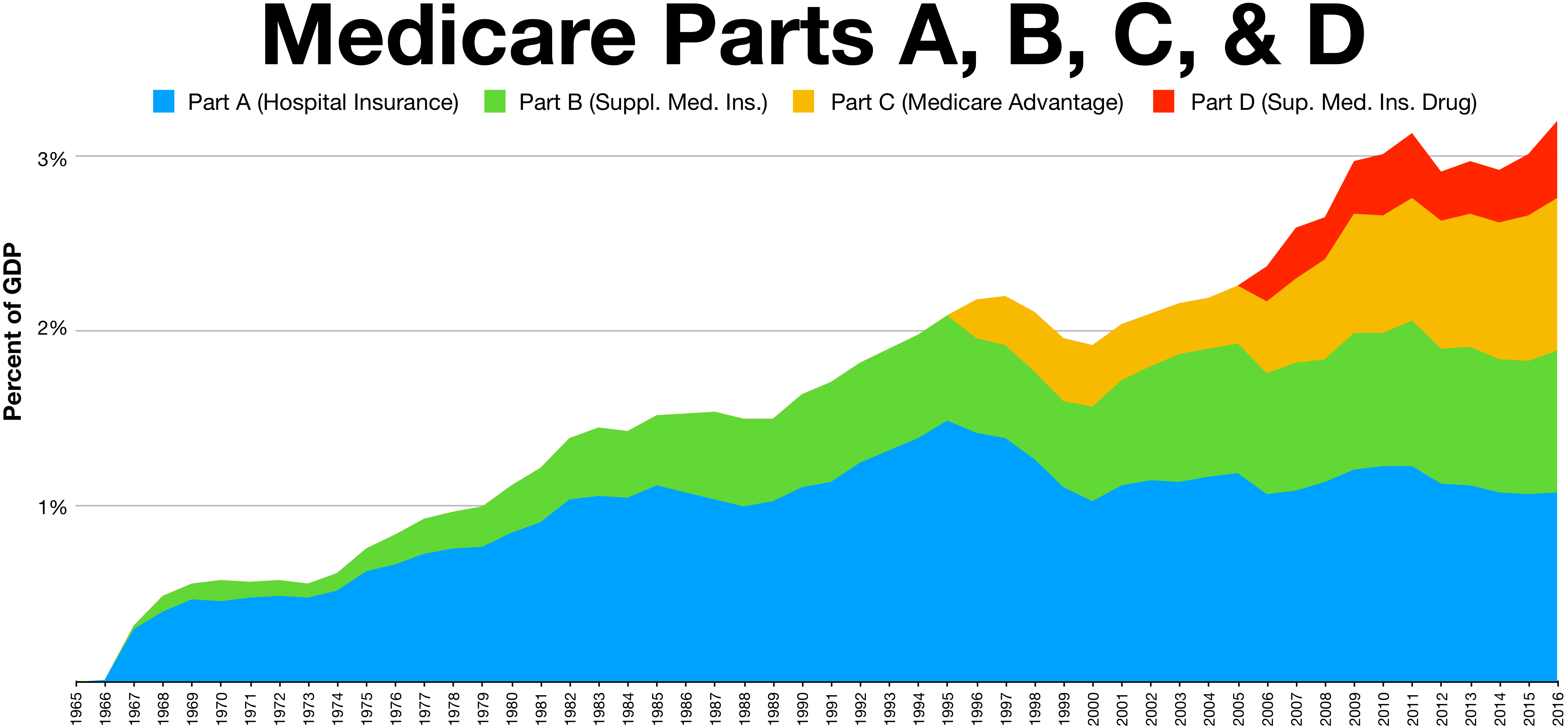

Medicare (United States)

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with End Stage Renal Disease Program, end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). It started in 1965 under the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services (CMS). Medicare is divided into four parts: A, B, C and D. Part A covers hospital, skilled nursing, and hospice services. Part B covers outpatient services. Part D covers self-administered prescription drugs. Part C is an alternative that allows patients to choose private plans with different benefit structures that provide the same services as Parts A and B, usually with additional benefits. In 2022, Medicare provided health insurance for 65.0 million individuals—more than 57 million people aged 65 and older and about 8 million younger people. According to annual Medicare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll Tax History

A payroll is a list of employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including salaries and wages, bonuses, and withheld taxes, or the company's department that deals with compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company. Payroll in the U.S. is subject to federal, state and local regulations including employee exemptions, record keeping, and tax requirements. In recent years, there has been a significant shift towards cloud-based payroll solutions. These platforms offer advantages such as cost savings, scalability, and real-time data access, making them increasingly popular among businesses of all sizes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |