|

Payment Gateway

A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses, online retailers, bricks and clicks, or traditional brick and mortar. The payment gateway may be provided by a bank to its customers, but can be provided by a specialised financial service provider as a separate service, such as a payment service provider. A payment gateway facilitates a payment transaction by the transfer of information between a payment portal (such as a website, mobile phone or interactive voice response service) and the front end processor or acquiring bank. Payment gateways are a service that helps merchants initiate ecommerce, in-app, and point of sale payments for a broad variety of payment methods. The gateway is not directly involved in the money flow; typically it is a web server to which a merchant's website or POS system is connected. A payment gateway often connects several acquir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Services

Merchant services is a broad category of financial services intended for use by businesses. In its most specific use, it usually refers to merchant processing services that enables a business to accept a transaction payment through a secure (encrypted) channel using the customer's credit card or debit card or NFC/ RFID enabled device. More generally, the term may include: * Credit and debit cards payment processing * Check guarantee and check conversion services * Automated clearing house check drafting and payment services * Gift card and loyalty programs * Payment gateway * Merchant cash advances * Online transaction processing * Point of sale (POS) systems * Electronic benefit transfer programs, such as ration stamps (called ''food stamps'' in the U.S.). Merchant service providers work as an intermediary between the bank, a person or organisation wanting to receive funds and the person or organisation looking to purchase goods or services. The merchant service provid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ISO 8583

ISO 8583 is an international standard for ''financial transaction card originated'' interchange messaging. It is the International Organization for Standardization standard for systems that exchange electronic transactions initiated by cardholders using payment cards. ISO 8583 defines a message format and a communication flow so that different systems can exchange these transaction requests and responses. The vast majority of transactions made when a customer uses a card to make a payment in a store ( EFTPOS) use ISO 8583 at some point in the communication chain, as do transactions made at ATMs. In particular, the Mastercard, Visa and Verve networks base their authorization communications on the ISO 8583 standard, as do many other institutions and networks. Although ISO 8583 defines a common standard, it is not typically used directly by systems or networks. It defines many standard fields (data elements) which remain the same in all systems or networks, and leaves a few ad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Online Payment Service Providers

The following is a list of notable online payment service providers and payment gateway providing companies, their platform base and the countries they offer services in: (POS -- Point of Sale) See also * Payment gateway * Payments as a service Payments as a service (PaaS) is a marketing phrase used to describe a software as a service to connect a group of international payment systems. The architecture is represented by a layer – or overlay – that resides on top of these dispar ... * Ripple (payment protocol) References {{Payment service providers * Online companies Online payment service providers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Account

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Know Your Customer

Know Your Customer (KYC) guidelines in financial services require that professionals make an effort to verify the identity, suitability, and risks involved with maintaining a business relationship. The procedures fit within the broader scope of a bank's anti-money laundering (AML) policy. KYC processes are also employed by companies of all sizes for the purpose of ensuring their proposed customers, agents, consultants, or distributors are anti-bribery compliant, and are actually who they claim to be. Banks, insurers, export creditors, and other financial institutions are increasingly demanding that customers provide detailed due diligence information. Initially, these regulations were imposed only on the financial institutions but now the non-financial industry, fintech, virtual assets dealers, and even non-profit organizations are liable to oblige. Laws by country *Australia: The Australian Transaction Reports and Analysis Centre (AUSTRAC), established in 1989, monitors financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Service Provider

A payment service provider (PSP) is a third-party company that assists businesses to accept electronic payments, such as credit cards and debit cards payments. PSPs act as intermediaries between those who make payments, i.e. consumers, and those who accept them, i.e. retailers. Some of the most renowned PSPs are: * Adyen * PayPal * Stripe Operation PSPs establish technical connections with acquiring banks and card networks, enabling merchants to accept different payment methods without the need to partner with a particular bank. They fully manage payment processing and external network relationships, making the merchant less dependent on banking institutions. PSP can also offer risk management services for card and bank based payments, transaction payment matching, reporting, fund remittance and fraud protection. Some PSPs provide services to process other next generation methods (payment systems) including cash payments, wallets, prepaid cards or vouchers, and even p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Address Verification System

address verification service (AVS) is a service provided by major credit card processors to enable merchants to authenticate ownership of a credit or debit card used by a customer. AVS is done as part of the merchant's request for authorization in a non-face-to-face credit card transaction. The credit card company or issuing bank automatically checks the billing address provided by the customer to the merchant against the billing address in its records, and reports back to the merchant who has the ultimate responsibility to determine whether or not to go ahead with a transaction. AVS can be used in addition to other security features of a credit card, such as the CVV2 number. AVS is not available by all credit card providers, and not in all countries. It is generally not available for foreign credit cards; that is, cards issued in a country other than where it is being used. AVS is available in a number of countries, including the United States, Canada, and the United Kingdom. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OFAC List

The Office of Foreign Assets Control (OFAC) is a financial intelligence and enforcement agency of the U.S. Treasury Department. It administers and enforces economic and trade sanctions in support of U.S. national security and foreign policy objectives. Under Presidential national emergency powers, OFAC carries out its activities against foreign states as well as a variety of other organizations and individuals, like terrorist groups, deemed to be a threat to U.S. national security. As a component of the U.S. Treasury Department, OFAC operates under the Office of Terrorism and Financial Intelligence and is primarily composed of intelligence targeters and lawyers. While many of OFAC's targets are broadly set by the White House, most individual cases are developed as a result of investigations by OFAC's Office of Global Targeting (OGT).Yukhananov, Anna, and Warren Strobel"After Success on Iran, U.S. Treasury's Sanctions Team Faces New Challenges" Reuters, April 14, 2014. Someti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Geolocation

Geopositioning, also known as geotracking, geolocalization, geolocating, geolocation, or geoposition fixing, is the process of determining or estimating the geographic position of an object. Geopositioning yields a set of geographic coordinates (such as latitude and longitude) in a given map datum; positions may also be expressed as a bearing and range from a known landmark. In turn, positions can determine a meaningful location, such as a street address. Specific instances include: animal geotracking, the process of inferring the location of animals; positioning system, the mechanisms for the determination of geographic positions in general; internet geolocation, geolocating a device connected to the internet; and mobile phone tracking. Background Geopositioning uses various visual and electronic methods including position lines and position circles, celestial navigation, radio navigation, and the use of satellite navigation systems. The calculation requires measurements ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Issuing Bank

An issuing bank is a bank that offers card association branded payment cards directly to consumers, such as credit cards, debit cards, contactless devices such as key fobs as well as prepaid cards. The name is derived from the practice of issuing cards to a consumer. Details An issuing bank (also called an issuer) is part of the 4-party model of payments. It is the bank of the consumer (also called a cardholder) and is responsible for paying the merchant's bank (called an Acquiring Bank or Acquirer) for the goods and services the consumer purchases. It issues the payment card and holds the account with the consumer (such as a credit card account or checking account for a debit card). The parties in the 4-party model are: # Consumer (also called a cardholder): Makes purchases and promises to pay the Issuing Bank for them. # Issuing Bank (also called an Issuer): The consumer's bank. Transfers money for purchases to the Acquiring Bank. Is liable for purchases made by the consumer if th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discover Card

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit, features that were disruptive to the existing credit card industry. A subsequent innovation was "Cashback Bonus" on purchases. Most cards with the Discover brand are issued by Discover Bank, formerly the Greenwood Trust Company. Discover transactions are processed through the Discover Network payment network. In 2005, Discover Financial Services acquired Pulse, an electronic funds transfer network, allowing it to market and issue debit and ATM cards. In February 2006, Discover Financial Services announced that it would begin offering Discover debit cards to other financial institutions, made possible by the acquisition of Pulse. Discover is the third largest credit card brand in the U.S. based on the number of cards in circulation, behind Visa and Mastercard, with 57 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

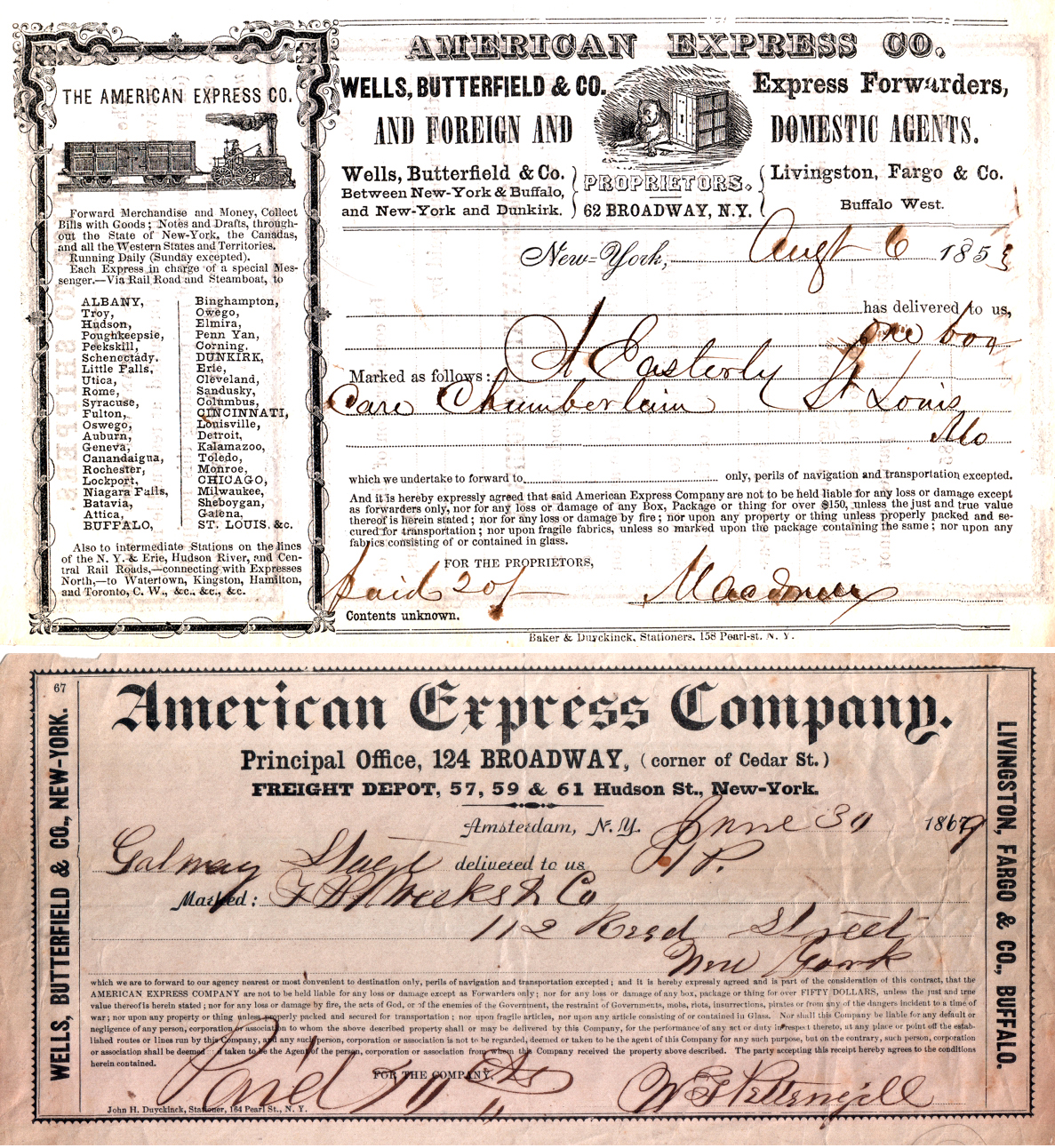

American Express

American Express Company (Amex) is an American multinational corporation, multinational corporation specialized in payment card industry, payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |