|

Pasargad Bank

Bank Pasargad ( fa, بانک پاسارگاد, ''Bank Pasargad''), also known as BPI, is a major Iranian bank offering retail, commercial and investment banking services. The company was established in 2005 as a part of the government's privatization of the banking system. While established in Tehran, the bank operates throughout the nation with 3685 employees and 327 branches. BPI is listed under the Tehran Stock Exchange. In 2006, The bank had an initial capital assessment of $250 million. In 2009, the bank funded and established an art gallery in Tehran. In 2013, ''The Banker'' magazine rated BPI as among the top "1000 banks in the world", ranking 257th overall. The Bank is also on ''The Banker's'' list of the top 500 Islamic financial institutions. Operations BPI operates as a private bank in Iran. In addition to offering short and fixed deposit accounts for domestic and overseas clients, the bank also provides letters of credit, treasury, currency exchange, corporate loans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not ( unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

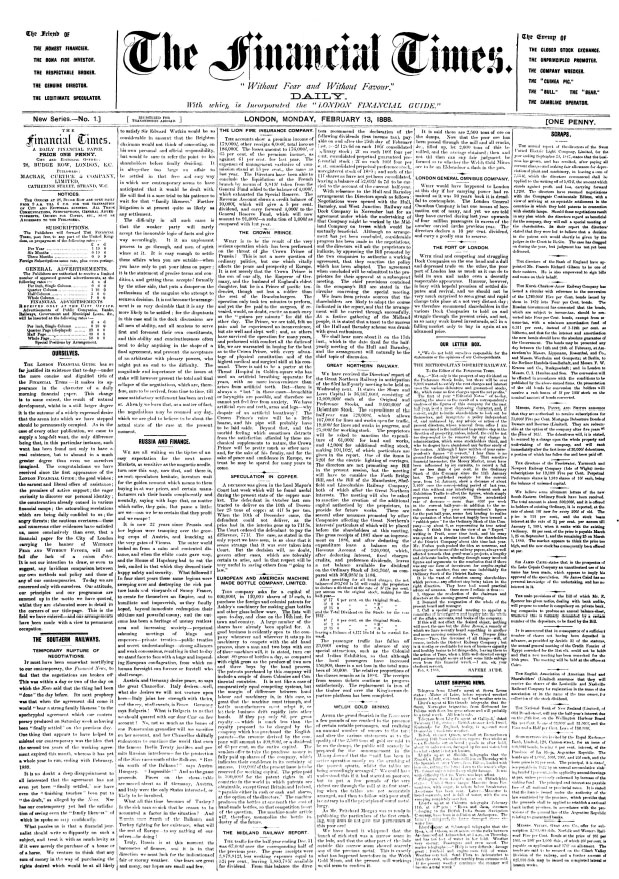

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Federal Institute Of Intellectual Property

The Swiss Federal Institute of Intellectual Property (French: ''Institut fédéral de la propriété intellectuelle'', IPI; German: ''Eidgenössisches Institut für Geistiges Eigentum'', IGE; Italian: ''Istituto federale della proprietà intellettuale''), based in Bern, is an agency of the federal administration of Switzerland responsible for patents, trademarks, geographical indications, industrial designs and copyright. It is part of the Federal Department of Justice and Police. Since 1996, it operates as an autonomous agency with control of its own budget. History The Federal Intellectual Property Agency was founded on 15 November 1888. Albert Einstein worked there as a patent clerk for several years, including 1905, his ''Annus Mirabilis'' (miracle year). That year, while continuing to work on patents, Einstein published four groundbreaking papers that are fundamental to modern physics. The agency was renamed the Federal Office of Intellectual Property in 1978 as part of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price–earnings Ratio

The price-earnings ratio, also known as P/E ratio, P/E, or PER, is the ratio of a company's share (stock) price to the company's earnings per share. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued. :\text=\frac As an example, if share A is trading at and the earnings per share for the most recent 12-month period is , then share A has a P/E ratio of = years. Put another way, the purchaser of the share is investing for every dollar of annual earnings; or, if earnings stayed constant it would take 8 years to recoup the share price. Companies with losses (negative earnings) or no profit have an undefined P/E ratio (usually shown as "not applicable" or " N/A"); sometimes, however, a negative P/E ratio may be shown. Versions There are multiple versions of the P/E ratio, depending on whether earnings are projected or realized, and the type of earnings. * "Trailing P/E" uses the weighted average share price of common shares i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iranian Rials

The rial ( fa, ریال ایران, riyâl-è Irân; sign: ﷼; abbreviation: Rl (singular) and Rls (plural) or IR in Latin; ISO code: IRR) is the official currency of Iran. There is no official symbol for the currency but the Iranian standard ISIRI 820 defined a symbol for use on typewriters (mentioning that it is an invention of the standards committee itself) and the two Iranian standards ISIRI 2900 and ISIRI 3342 define a character code to be used for it. The Unicode Standard has a compatibility character defined . A proposal has been agreed to by the Iranian parliament to drop four zeros, by replacing the rial with a new currency called the toman, the name of a previous Iranian currency, at the rate of 1 toman = 10,000 rials. History The rial was first introduced in 1798 as a coin worth 1,250 dinars or one-eighth of a '' toman''. In 1825, the rial ceased to be issued, with the qiran subdivided into 20 shahi or 1,000 dinars and was worth one-tenth of a toman, being is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earnings Per Share

Earnings per share (EPS) is the monetary value of earnings per outstanding share of common stock for a company. It is a key measure of corporate profitability and is commonly used to price stocks. In the United States, the Financial Accounting Standards Board (FASB) requires EPS information for the four major categories of the income statement: continuing operations, discontinued operations, extraordinary items, and net income. Calculating Preferred stock rights have precedence over common stock. Therefore, dividends on preferred shares are subtracted before calculating the EPS. When preferred shares are cumulative, annual dividends are deducted whether or not they have been declared. Dividends in arrears are not relevant when calculating EPS. ;Basic formula :Earnings per share = ;Net income formula :Earnings per share = ;Continuing operations formula :Earnings per share = Diluted earnings per share ''Diluted earnings per share'' (diluted EPS) is a company's earning ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Equity

The return on equity (ROE) is a measure of the profitability of a business in relation to the equity. Because shareholder's equity can be calculated by taking all assets and subtracting all liabilities, ROE can also be thought of as a return on ''assets minus liabilities''. ROE measures how many dollars of profit are generated for each dollar of shareholder's equity. ROE is a metric of how well the company utilizes its equity to generate profits. The formula : ROE is equal to a fiscal year net income (after preferred stock dividends, before common stock dividends), divided by total equity (excluding preferred shares), expressed as a percentage. Usage ROE is especially used for comparing the performance of companies in the same industry. As with return on capital, a ROE is a measure of management's ability to generate income from the equity available to it. ROEs of 15–20% are generally considered good. ROE is also a factor in stock valuation, in association with other fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Assets

The return on assets (ROA) shows the percentage of how profitable a company's assets are in generating revenue. ROA can be computed as below: :\mathrm = \frac This number tells you what the company can do with what it has, ''i.e.'' how many dollars of earnings they derive from each dollar of assets they control. It's a useful number for comparing competing companies in the same industry. The number will vary widely across different industries. Return on assets gives an indication of the capital intensity of the company, which will depend on the industry; companies that require large initial investments will generally have lower return on assets. ROAs over 5% are generally considered good. Usage Return on assets is one of the elements used in financial analysis using the Du Pont Identity. See also *Return on equity (ROE) * List of business and finance abbreviations *Rate of return on a portfolio * Return on brand (ROB) *Return on capital (ROC) *Return on investment (ROI) *Weight ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Adequacy Ratio

Capital Adequacy Ratio (CAR) is also known as ''Capital to Risk (Weighted) Assets Ratio'' (CRAR), is the ratio of a bank's capital to its risk. National regulators track a bank's CAR to ensure that it can absorb a reasonable amount of loss and complies with statutory Capital requirements. It is a measure of a bank's capital. It is expressed as a percentage of a bank's risk-weighted credit exposures. The enforcement of regulated levels of this ratio is intended to protect depositors and promote stability and efficiency of financial systems around the world. Two types of capital are measured: tier one capital, which can absorb losses without a bank being required to cease trading, and tier two capital, which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors. Formula Capital adequacy ratios (CARs) are a measure of the amount of a bank's core capital expressed as a percentage of its risk-weighted asset. Capital adequacy rat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pasargad Bank Branch At Amol

Pasargadae (from Old Persian ''Pāθra-gadā'', "protective club" or "strong club"; Modern Persian: ''Pāsārgād'') was the capital of the Achaemenid Empire under Cyrus the Great (559–530 BC), who ordered its construction and the location of his tomb. Today it is an archaeological site and one of Iran's UNESCO World Heritage Sites, about to the northeast of the modern city of Shiraz. History Pasargadae was founded in the 6th century BCE as the first capital of the Achaemenid Empire by Cyrus the Great, near the site of his victory over the Median king Astyages in 550 BCE. The city remained the Achaemenid capital until Darius moved it to Persepolis. The archaeological site covers 1.6 square kilometers and includes a structure commonly believed to be the mausoleum of Cyrus, the fortress of Toll-e Takht sitting on top of a nearby hill, and the remains of two royal palaces and gardens. Pasargadae Persian Gardens provide the earliest known example of the Persian '' ch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |