|

Merger Simulation

Merger simulation is a commonly used technique when analyzing potential welfare costs and benefits of mergers between firms. Merger simulation models differ with respect to assumed form of competition that best describes the market (e.g. differentiated Bertrand competition, Cournot competition, auction models, etc.) as well as the structure of the chosen demand system (e.g. linear or log-linear demand, logit, almost ideal demand system (AIDS), etc.) Simulation methods Cournot oligopoly Farrell and Shapiro (1990) highlighted issues of the US Department of Justice's Merger Guidelines (1984), with its use of Herfindahl-Hirschman indices. The main issues they raised were the base assumptions that: # Outputs remain unchanged in the merger process (both companies retained their initial outputs); # There is a reliable and inverse relationship between market concentration) and market performance. They sought to instead to model mergers by Cournot oligopoly theory, establishing a se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merger

Mergers and acquisitions (M&A) are business transactions in which the ownership of a company, business organization, or one of their operating units is transferred to or consolidated with another entity. They may happen through direct absorption, a merger, a tender offer or a hostile takeover. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is the legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. Most countries require mergers and acquisitions to comply with antitrust or competition law. In the United States, for example, the Clayt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Differentiated Bertrand Competition

As a solution to the Bertrand paradox in economics, it has been suggested that each firm produces a somewhat differentiated product, and consequently faces a demand curve that is downward-sloping for all levels of the firm's price. An increase in a competitor's price is represented as an increase (for example, an upward shift) of the firm's demand curve. As a result, when a competitor raises price, generally a firm can also raise its own price and increase its profits. Calculating the differentiated Bertrand model *q1 = firm 1's demand, *q1≥0 *q2 = firm 2's demand, *q1≥0 *A1 = Constant in equation for firm 1's demand *A2 = Constant in equation for firm 2's demand *a1 = slope coefficient for firm 1's price *a2 = slope coefficient for firm 2's price *p1 = firm 1's price level pr unit *p2 = firm 2's price level pr unit *b1 = slope coefficient for how much firm 2's price affects firm 1's demand *b2 = slope coefficient for how much firm 1's price affects firm 2's demand *q1=A1-a1* ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cournot Competition

Cournot competition is an economic model used to describe an industry structure in which companies compete on the amount of output they will produce, which they decide on independently of each other and at the same time. It is named after Antoine Augustin Cournot (1801–1877) who was inspired by observing competition in a spring water duopoly. It has the following features: * There is more than one firm and all firms produce a homogeneous product, i.e., there is no product differentiation; * Firms do not cooperate, i.e., there is no collusion; * Firms have market power, i.e., each firm's output decision affects the good's price; * The number of firms is fixed; * Firms compete in quantities rather than prices; and * The firms are economically rational and act strategically, usually seeking to maximize profit given their competitors' decisions. An essential assumption of this model is the "not conjecture" that each firm aims to maximize profits, based on the expectation that i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Logit

In statistics, the logit ( ) function is the quantile function associated with the standard logistic distribution. It has many uses in data analysis and machine learning, especially in Data transformation (statistics), data transformations. Mathematically, the logit is the inverse function, inverse of the logistic function, standard logistic function \sigma(x) = 1/(1+e^), so the logit is defined as : \operatorname p = \sigma^(p) = \ln \frac \quad \text \quad p \in (0,1). Because of this, the logit is also called the log-odds since it is equal to the logarithm of the odds \frac where is a probability. Thus, the logit is a type of function that maps probability values from (0, 1) to real numbers in (-\infty, +\infty), akin to the probit, probit function. Definition If is a probability, then is the corresponding odds; the of the probability is the logarithm of the odds, i.e.: : \operatorname(p)=\ln\left( \frac \right) =\ln(p)-\ln(1-p)=-\ln\left( \frac-1\right)=2\operatornam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Almost Ideal Demand System

The Almost Ideal Demand System (AIDS) is a consumer demand model used primarily by economists to study consumer behavior. The AIDS model gives an arbitrary second-order approximation to any demand system and has many desirable qualities of demand systems. For instance it satisfies the axioms of order, aggregates over consumers without invoking parallel linear Engel curves, is consistent with budget constraints, and is simple to estimate. Model The AIDS model is based on a first specification of a cost/expenditure function c(u,p): :\log(c(u,p))=\alpha_+\sum_\alpha_\log(p_)+\frac\sum_\sum_\gamma_^\log(p_)\log(p_)+u\beta_\prod_p_^ where ''p'' stand for price of L goods, and ''u'' the utility level. This specification satisfies homogeneity of order 1 in prices, and is a second order approximation of any cost function. From this, demand equations are derived (using Shephard's lemma), but are however simpler to put in term of budget shares w_i = \frac : : w_=\alpha_+\sum_\gamma_\ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economies Of Scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of Productivity, output produced per unit of cost (production cost). A decrease in unit cost, cost per unit of output enables an increase in scale that is, increased production with lowered cost. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of Market (economics), market control. Economies of scale arise in a variety of organizational and business situations and at various levels, such as a production, plant or an entire enterprise. When average costs start falling as output increases, then economies of scale occur. Some economies of scale, such as capital cost of manufacturing facilities and friction loss of transportation and industrial equipment, have a physical or engineering basis. The economic concept dates back to Adam Smith and the idea o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monte Carlo Method

Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be deterministic in principle. The name comes from the Monte Carlo Casino in Monaco, where the primary developer of the method, mathematician Stanisław Ulam, was inspired by his uncle's gambling habits. Monte Carlo methods are mainly used in three distinct problem classes: optimization, numerical integration, and generating draws from a probability distribution. They can also be used to model phenomena with significant uncertainty in inputs, such as calculating the risk of a nuclear power plant failure. Monte Carlo methods are often implemented using computer simulations, and they can provide approximate solutions to problems that are otherwise intractable or too complex to analyze mathematically. Monte Carlo methods are widely used in va ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backward Induction

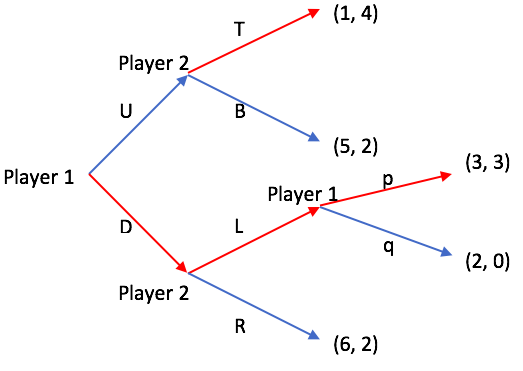

Backward induction is the process of determining a sequence of optimal choices by reasoning from the endpoint of a problem or situation back to its beginning using individual events or actions. Backward induction involves examining the final point in a series of decisions and identifying the optimal process or action required to arrive at that point. This process continues backward until the best action for every possible point along the sequence is determined. Backward induction was first utilized in 1875 by Arthur Cayley, who discovered the method while attempting to solve the secretary problem. In dynamic programming, a method of mathematical optimization, backward induction is used for solving the Bellman equation. In the related fields of automated planning and scheduling and automated theorem proving, the method is called backward search or backward chaining. In chess, it is called retrograde analysis. In game theory, a variant of backward induction is used to compute subgame ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subgame Perfect Equilibrium

In game theory, a subgame perfect equilibrium (SPE), or subgame perfect Nash equilibrium (SPNE), is a refinement of the Nash equilibrium concept, specifically designed for dynamic games where players make sequential decisions. A strategy profile is an SPE if it represents a Nash equilibrium in every possible subgame of the original game. Informally, this means that at any point in the game, the players' behavior from that point onward should represent a Nash equilibrium of the continuation game (i.e. of the subgame), no matter what happened before. This ensures that strategies are credible and rational throughout the entire game, eliminating non-credible threats. Every finite extensive game with complete information (all players know the complete state of the game) and perfect recall (each player remembers all their previous actions and knowledge throughout the game) has a subgame perfect equilibrium. A common method for finding SPE in finite games is backward induction, wher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |