|

Mainstream Economics

Mainstream economics is the body of knowledge, theories, and models of economics, as taught by universities worldwide, that are generally accepted by economists as a basis for discussion. Also known as orthodox economics, it can be contrasted to heterodox economics, which encompasses various schools or approaches that are only accepted by a small minority of economists. The economics profession has traditionally been associated with neoclassical economics. However, this association has been challenged by prominent historians of economic thought including David Colander. They argue the current economic mainstream theories, such as game theory, behavioral economics, industrial organization, information economics, and the like, share very little common ground with the initial axioms of neoclassical economics. History Economics has historically featured multiple schools of economic thought, with different schools having different prominence across countries and over time. P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Historical School Of Economics

The German historical school of economics was an approach to academic economics and to public administration that emerged in the 19th century in Germany, and held sway there until well into the 20th century. The professors involved compiled massive economic histories of Germany and Europe. Numerous Americans were their students. The school was opposed by theoretical economists. Prominent leaders included Gustav von Schmoller (1838–1917), and Max Weber (1864–1920) in Germany, and Joseph Schumpeter (1883–1950) in Austria and the United States. Tenets The historical school held that history was the key source of knowledge about human actions and economic matters, since economics was culture-specific, and hence not generalizable over space and time. The Historical School of Economics, in addition to rejecting the universal validity of economic theorems and emphasizing an empirical and historical approach, drew significant methodological influence from the historism of Leopold ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics (textbook)

''Economics'' (''Economics: An Introductory Analysis'' in later editions) is an introductory textbook by American economists Paul Samuelson and William Nordhaus. The textbook was first published in 1948, and has appeared in nineteen different editions, the most recent in 2009. It was the bestselling economics textbook for many decades and still remains popular, selling over 300,000 copies of each edition from 1961 through 1976. The book has been translated into forty-one languages and in total has sold over four million copies. ''Economics'' was written entirely by Samuelson until the 12th edition (2001). Newer editions have been revised with others, including Nordhaus for the 17th edition (2001) and afterwards. Influence ''Economics'' has been called a "canonical textbook", and the development of mainstream economic thought has been traced by comparing the fourteen editions under Samuelson's editing. ''Economics'' coined the term "neoclassical synthesis" and popularized the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. Mostly written and edited in London, it has other editorial offices in the United States and in major cities in continental Europe, Asia, and the Middle East. The newspaper has a prominent focus on data journalism and interpretive analysis over News media, original reporting, to both criticism and acclaim. Founded in 1843, ''The Economist'' was first circulated by Scottish economist James Wilson (businessman), James Wilson to muster support for abolishing the British Corn Laws (1815–1846), a system of import tariffs. Over time, the newspaper's coverage expanded further into political economy and eventually began running articles on current events, finance, commerce, and British politics. Throughout the mid-to-late 20th century, it greatl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Bubble

A housing bubble (or housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. First there is a period where house prices increase dramatically, driven by real estate investing. In the second phase, house prices fall dramatically, making housing more affordable. Housing bubbles tend to be among the asset bubbles with the largest effect on the real economy because they are credit-fueled, and a large number of households participate and not just investors, and because the wealth effect from housing tends to be larger than for other types of financial assets. Housing bubble definition Most research papers on housing bubbles use standard asset price definitions. There are many definitions of bubbles. Most of them are normative definitions, like that of Joseph Stiglitz (1990),Stiglitz, J.E. (1990). “Symposium on bubbles” ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.“US Business Cycle Expansions and Contractions” United States NBER, or National Bureau of Economic Research, updated March 14, 2023. This government agency dates the Great Recession as starting in December 2007 and bottoming-out in June 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Neoclassical Synthesis

The new neoclassical synthesis (NNS), which is occasionally referred as the New Consensus, is the fusion of the major, modern macroeconomic schools of thought – new classical macroeconomics/ real business cycle theory and early New Keynesian economics – into a consensus view on the best way to explain short-run fluctuations in the economy. This new synthesis is analogous to the neoclassical synthesis that combined neoclassical economics with Keynesian macroeconomics. The new synthesis provides the theoretical foundation for much of contemporary mainstream macroeconomics. It is an important part of the theoretical foundation for the work done by the Federal Reserve and many other central banks. Prior to the synthesis, macroeconomics was split between partial-equilibrium New Keynesian work on market imperfections demonstrated with small models and new classical work on real business cycle theory that used fully specified general equilibrium models and used changes in tech ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfoundations

Microfoundations are an effort to understand macroeconomic phenomena in terms of individual agents' economic behavior and interactions.Maarten Janssen (2008),Microfoundations, in ''The New Palgrave Dictionary of Economics'', 2nd ed. Research in microfoundations explores the link between Macroeconomics, macroeconomic and Microeconomics, microeconomic principles in order to explore the aggregate relationships in macroeconomic models. During recent decades, macroeconomists have attempted to combine microeconomic models of individual behaviour to derive the relationships between macroeconomic variables. Presently, many macroeconomic models, representing different theories, are Dynamic stochastic general equilibrium, derived by aggregating microeconomic models, allowing economists to test them with both macroeconomic and microeconomic data. However, microfoundations research is still heavily debated with management, strategy and organization scholars having varying views on the "micro-m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Classical Macroeconomics

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of foundations based on microeconomics, especially rational expectations. New classical macroeconomics strives to provide neoclassical microeconomic foundations for macroeconomic analysis. This is in contrast with its rival new Keynesian school that uses microfoundations, such as price stickiness and imperfect competition, to generate macroeconomic models similar to earlier, Keynesian ones. History Classical economics is the term used for the first modern school of economics. The publication of Adam Smith's ''The Wealth of Nations'' in 1776 is considered to be the birth of the school. Perhaps the central idea behind it is on the ability of the market to be self-correcting as well as being the most superior institution in allocating resources. The cen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Keynesianism

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics. Two main assumptions define the New Keynesian approach to macroeconomics. Like the New Classical approach, New Keynesian macroeconomic analysis usually assumes that households and firms have rational expectations. However, the two schools differ in that New Keynesian analysis usually assumes a variety of market failures. In particular, New Keynesians assume that there is imperfect competition in price and wage setting to help explain why prices and wages can become " sticky", which means they do not adjust instantaneously to changes in economic conditions. Wage and price stickiness, and the other present descriptions of market failures in New Keynesian models, imply that the economy may fail to attain full employment. Therefore, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

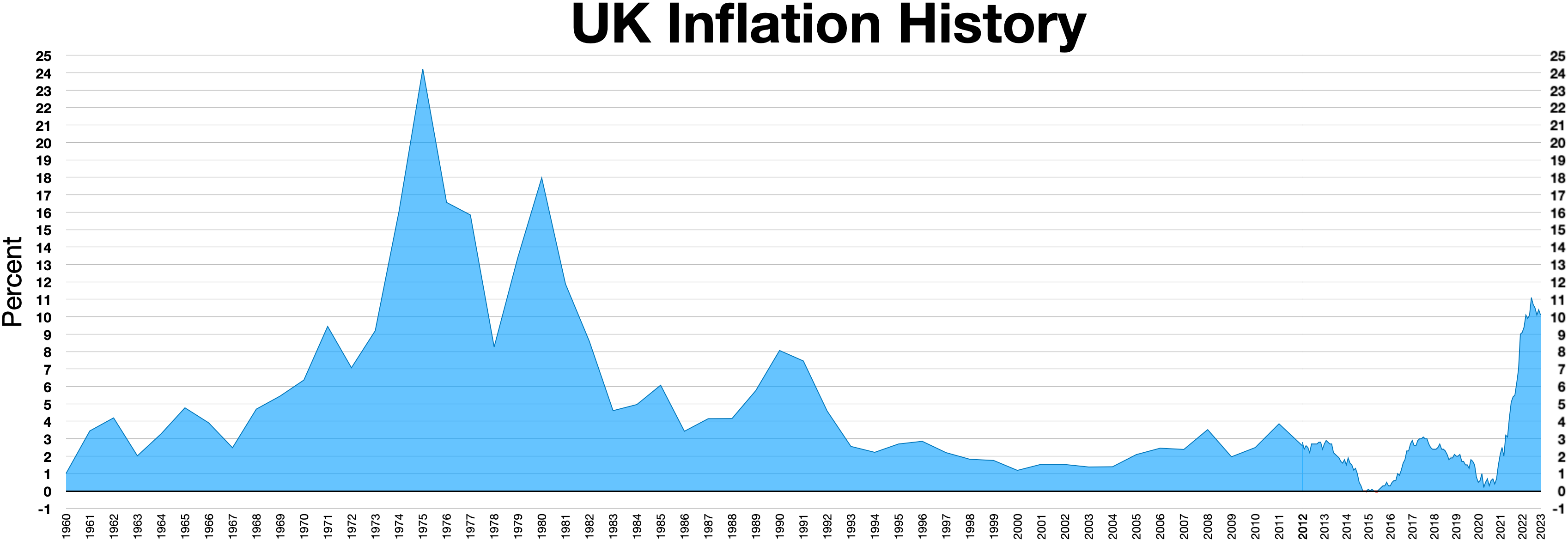

Stagflation

Stagflation is the combination of high inflation, stagnant economic growth, and elevated unemployment. The term ''stagflation'', a portmanteau of "stagnation" and "inflation," was popularized, and probably coined, by British politician Iain Macleod in the 1960s, during a period of economic distress in the United Kingdom. It gained broader recognition in the 1970s after a series of global economic shocks, particularly the 1973 oil crisis, which disrupted supply chains and led to rising prices and slowing growth. Stagflation challenges traditional economic theories, which suggest that inflation and unemployment are inversely related, as depicted by the Phillips Curve. Stagflation presents a policy dilemma, as measures to curb inflation—such as tightening monetary policy—can exacerbate unemployment, while policies aimed at reducing unemployment may fuel inflation. In economic theory, there are two main explanations for stagflation: supply shocks, such as a sharp increa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |