Stagflation on:

[Wikipedia]

[Google]

[Amazon]

In

The term ''stagflation'', a

The term ''stagflation'', a

economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes ...

, stagflation or recession-inflation is a situation in which the inflation rate

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

is high or increasing, the economic growth rate slows, and unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.

The term, a portmanteau of '' stagnation'' and ''inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

'', is generally attributed to Iain Macleod, a British Conservative Party

The Conservative Party is a name used by many political parties around the world. These political parties are generally right-wing though their exact ideologies can range from center-right to far-right.

Political parties called The Conservative P ...

politician who became Chancellor of the Exchequer in 1970. Macleod used the word in a 1965 speech to Parliament

In modern politics, and history, a parliament is a legislative body of government. Generally, a modern parliament has three functions: representing the electorate, making laws, and overseeing the government via hearings and inquiries. Th ...

during a period of simultaneously high inflation and unemployment in the United Kingdom.Introduction, page 9. Warning the House of Commons of the gravity of the situation, he said:

Macleod used the term again on 7 July 1970, and the media began also to use it, for example in ''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Eco ...

'' on 15 August 1970, and ''Newsweek

''Newsweek'' is an American weekly online news magazine co-owned 50 percent each by Dev Pragad, its president and CEO, and Johnathan Davis, who has no operational role at ''Newsweek''. Founded as a weekly print magazine in 1933, it was widely ...

'' on 19 March 1973. John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

did not use the term, but some of his work refers to the conditions that most would recognise as stagflation. In the version of Keynesian macroeconomic theory that was dominant between the end of World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing ...

and the late 1970s, inflation and recession were regarded as mutually exclusive, the relationship between the two being described by the Phillips curve

The Phillips curve is an economic model, named after William Phillips hypothesizing a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship ...

. Stagflation is very costly and difficult to eradicate once it starts.

Great Inflation

The term ''stagflation'', a

The term ''stagflation'', a portmanteau

A portmanteau word, or portmanteau (, ) is a blend of wordsstagnation'' and ''

Economists offer two principal explanations for why stagflation occurs. First, stagflation can result when the economy faces a

Economists offer two principal explanations for why stagflation occurs. First, stagflation can result when the economy faces a

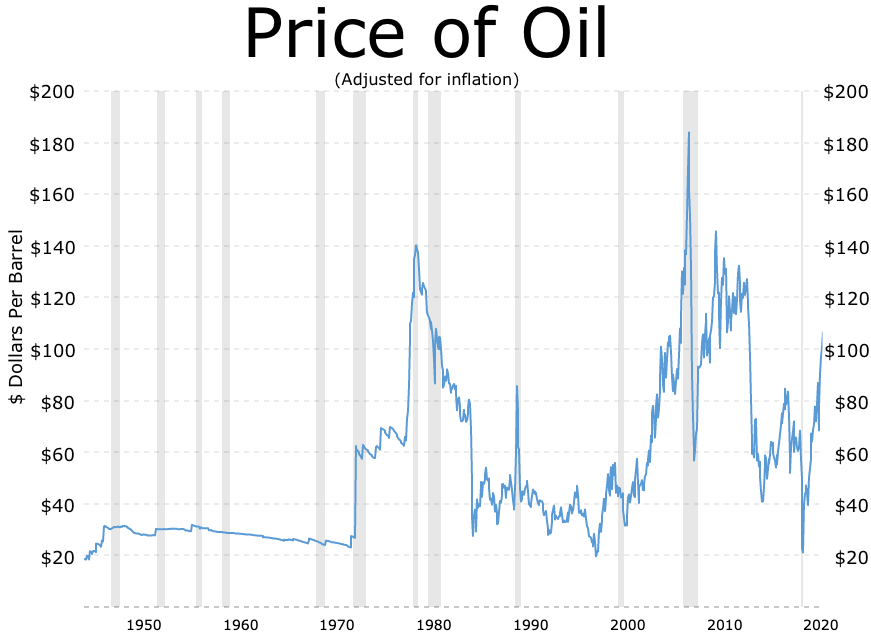

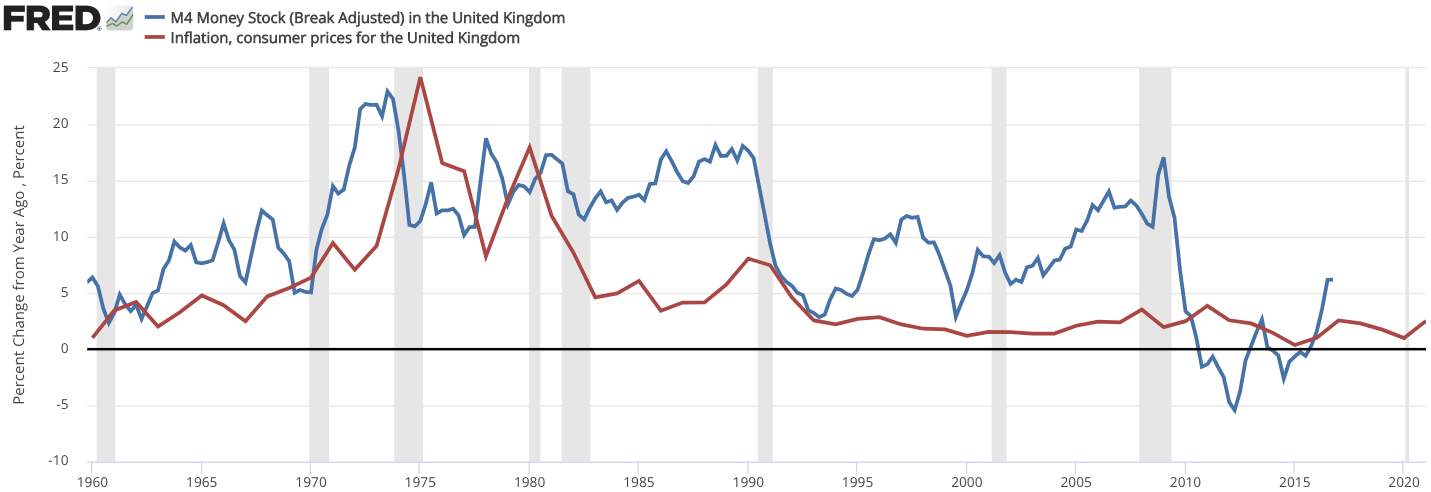

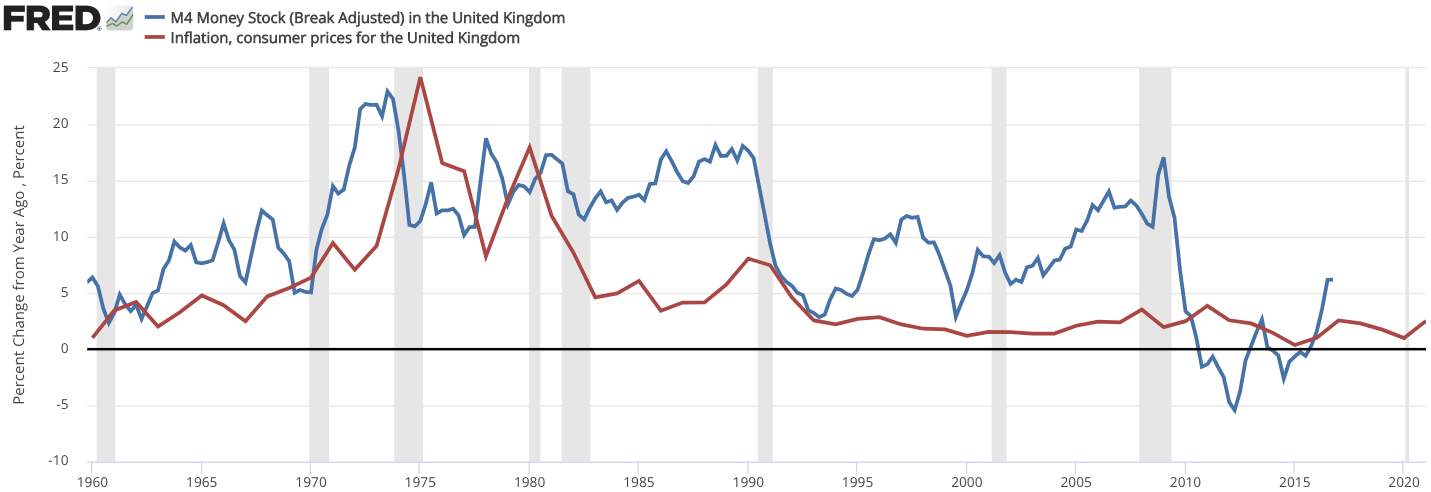

Money supply in the early 1970s increased at almost 15% year over year in the United States and the Consumer price index lags behind about one year or two. Britains monetary policy was also dovish causing excess demand.

Money supply in the early 1970s increased at almost 15% year over year in the United States and the Consumer price index lags behind about one year or two. Britains monetary policy was also dovish causing excess demand.

In the mid 1970s the Bretton Woods system was failing and countries

In the mid 1970s the Bretton Woods system was failing and countries

How Paul Volcker Stopped Inflation in the 1980s

{{Authority control 1960s neologisms 1970s economic history Inflation Political economy Unemployment

inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

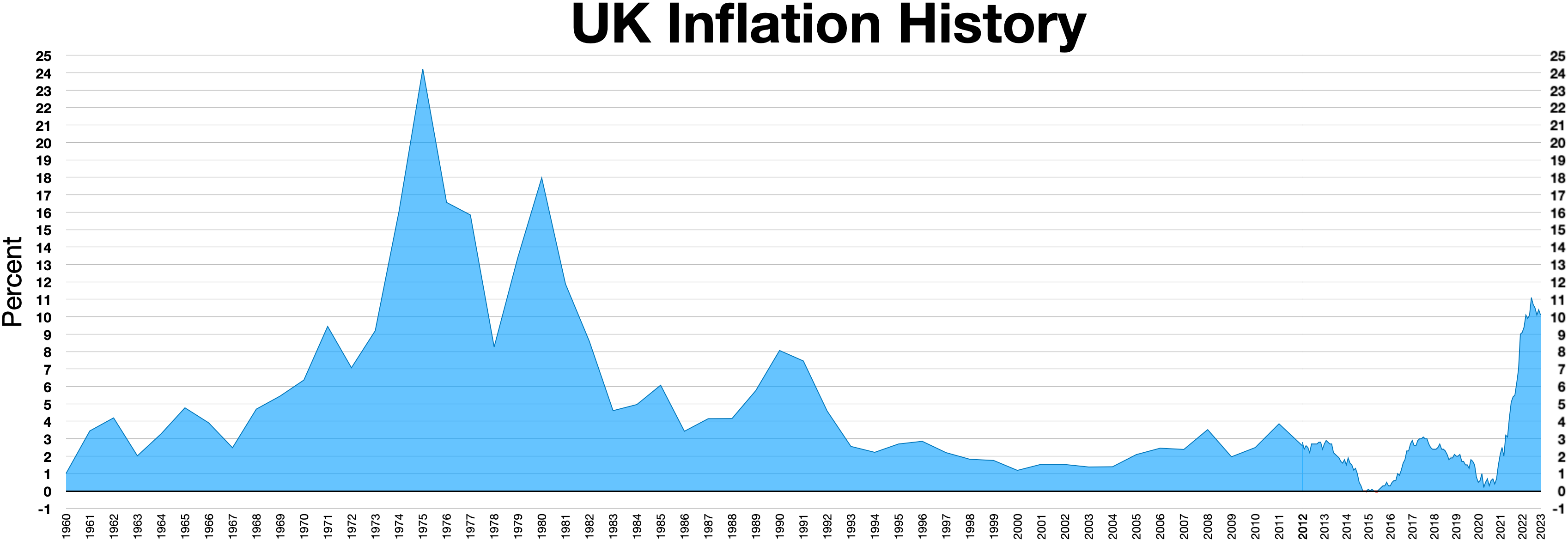

'', was first coined during a period of inflation and unemployment in the United Kingdom. The United Kingdom experienced an outbreak of inflation in the 1960s and 1970s. As inflation rose then, British policy makers failed to recognise the primary role of monetary policy in controlling inflation. Instead, they attempted to use non-monetary policies and devices to respond to the economic crisis. Policy makers also made "inaccurate estimates of the degree of excess demand in the economy, hich

Ij ( fa, ايج, also Romanized as Īj; also known as Hich and Īch) is a village in Golabar Rural District, in the Central District of Ijrud County, Zanjan Province, Iran

Iran, officially the Islamic Republic of Iran, and also ...

contributed significantly to the outbreak of inflation in the United Kingdom in the 1960s and 1970s."

Stagflation was not limited to the United Kingdom, however. Economists have shown that stagflation was prevalent among seven major market economies from 1973 to 1982. After inflation rates began to fall in 1982, economists' focus shifted from the causes of stagflation to the "determinants of productivity growth and the effects of real wages on the demand for labor".

Causes

Economists offer two principal explanations for why stagflation occurs. First, stagflation can result when the economy faces a

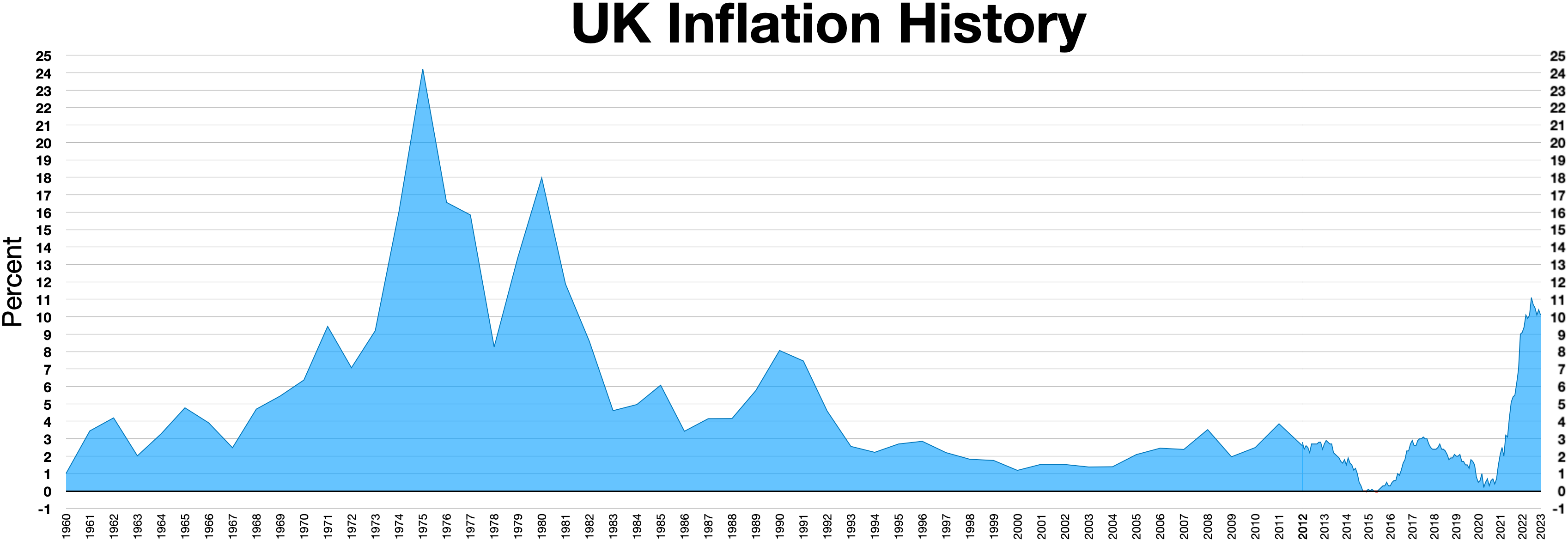

Economists offer two principal explanations for why stagflation occurs. First, stagflation can result when the economy faces a supply shock

A supply shock is an event that suddenly increases or decreases the supply of a commodity or service, or of commodities and services in general. This sudden change affects the equilibrium price of the good or service or the economy's general pr ...

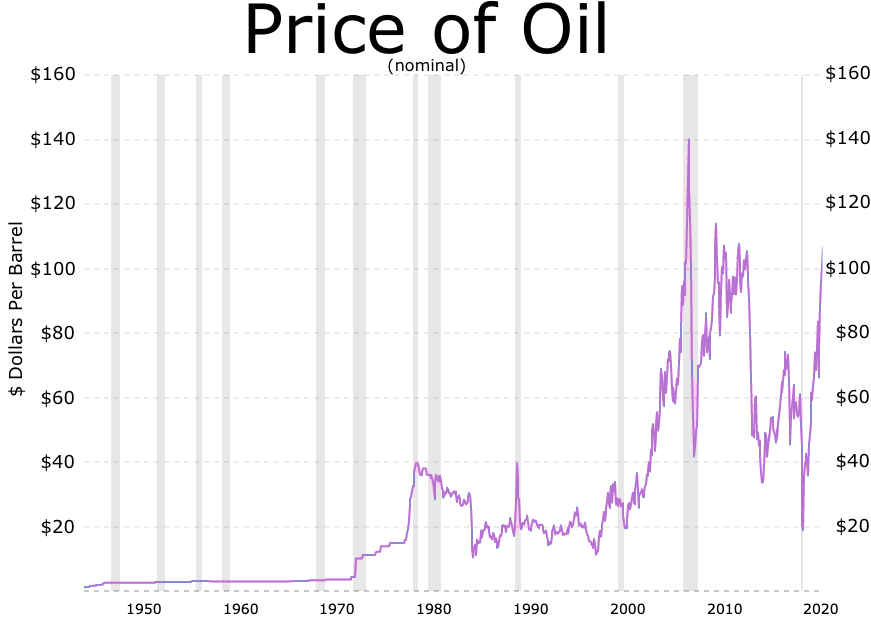

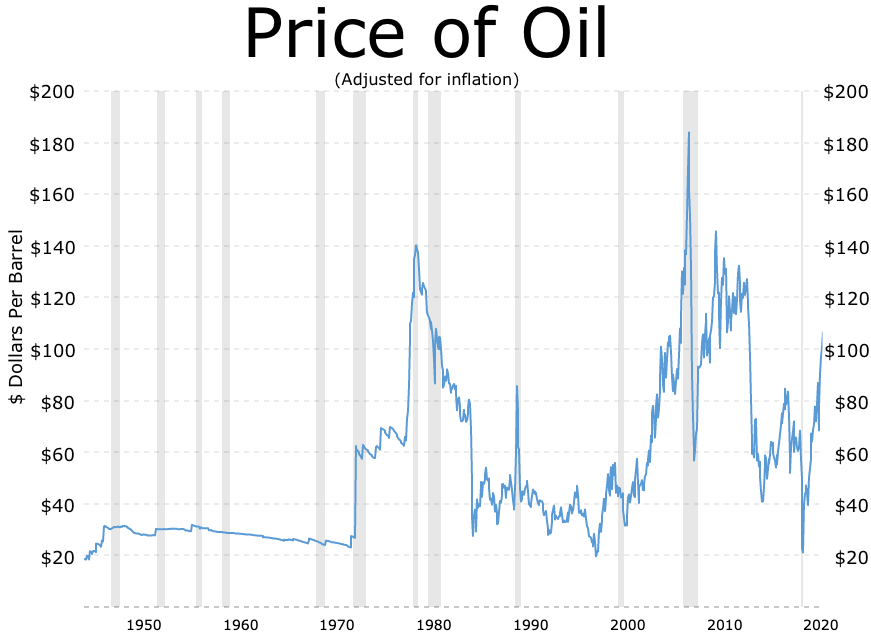

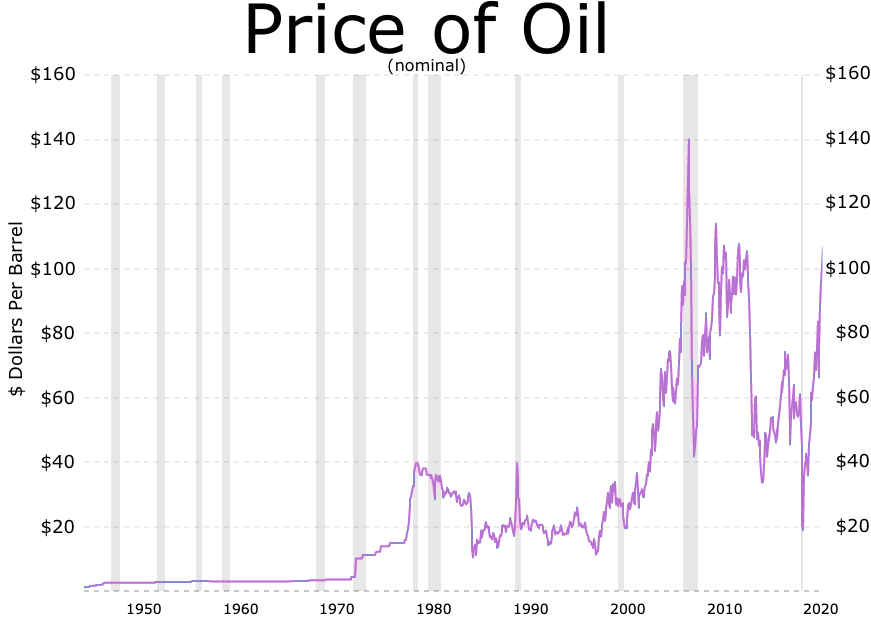

, such as a rapid increase in the price of oil

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC ...

. An unfavourable situation like that tends to raise prices at the same time as it slows economic growth by making production more costly and less profitable.

Second, the government can cause stagflation if it creates policies that harm industry while growing the money supply too quickly. These two things would probably have to occur simultaneously because policies that slow economic growth do not usually cause inflation, and policies that cause inflation do not usually slow economic growth.

Supply shock

At the start of theSix-Day War

The Six-Day War (, ; ar, النكسة, , or ) or June War, also known as the 1967 Arab–Israeli War or Third Arab–Israeli War, was fought between Israel and a coalition of Arab states (primarily Egypt, Syria, and Jordan) from 5 to 10 Ju ...

when Israel

Israel (; he, יִשְׂרָאֵל, ; ar, إِسْرَائِيل, ), officially the State of Israel ( he, מְדִינַת יִשְׂרָאֵל, label=none, translit=Medīnat Yīsrāʾēl; ), is a country in Western Asia. It is situated ...

invaded the Sinai Peninsula

The Sinai Peninsula, or simply Sinai (now usually ) (, , cop, Ⲥⲓⲛⲁ), is a peninsula in Egypt, and the only part of the country located in Asia. It is between the Mediterranean Sea to the north and the Red Sea to the south, and is ...

all the way down to the Suez Canal. The Egyptian

Egyptian describes something of, from, or related to Egypt.

Egyptian or Egyptians may refer to:

Nations and ethnic groups

* Egyptians, a national group in North Africa

** Egyptian culture, a complex and stable culture with thousands of years of ...

President Gamal Abdel Nasser, who was aligning with the Soviet Union

The Soviet Union,. officially the Union of Soviet Socialist Republics. (USSR),. was a List of former transcontinental countries#Since 1700, transcontinental country that spanned much of Eurasia from 1922 to 1991. A flagship communist state, ...

, closed down the Suez Canal for eight years starting in 1967 as soon as the Six-Day War broke out. Oil through the Suez Canal from the Middle East to Europe had to be rerouted around the Continent of Africa. When Egypt tried to cross the Suez Canal and take back the Sinai Peninsula in the Yom Kippur War

The Yom Kippur War, also known as the Ramadan War, the October War, the 1973 Arab–Israeli War, or the Fourth Arab–Israeli War, was an armed conflict fought from October 6 to 25, 1973 between Israel and a coalition of Arab states led by E ...

in late 1973, that is what triggered the Oil embargo An oil embargo is an economic situation wherein entities engage in an embargo to limit the transport of petroleum to or from an area, in order to exact some desired outcome. One commentator states, " oil embargo is not a common commercial practice; ...

in October 1973, when Richard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 to 1974. A member of the Republican Party, he previously served as a representative and senator from California and was ...

supported funding Israel with $2.2 billion over the conflict. That resulted in OAPEC

The Organization of Arab Petroleum Exporting Countries (OAPEC) is a multi-governmental organization headquartered in Kuwait which coordinates energy policies among oil-producing Arab nations. OAPEC's primary objective is safeguarding the cooperati ...

countries cutting production of oil and placing an embargo

Economic sanctions are commercial and financial penalties applied by one or more countries against a targeted self-governing state, group, or individual. Economic sanctions are not necessarily imposed because of economic circumstances—they m ...

on oil exports to the United States and other countries backing Israel.

Excess demand

Money supply in the early 1970s increased at almost 15% year over year in the United States and the Consumer price index lags behind about one year or two. Britains monetary policy was also dovish causing excess demand.

Money supply in the early 1970s increased at almost 15% year over year in the United States and the Consumer price index lags behind about one year or two. Britains monetary policy was also dovish causing excess demand.

End of Bretton Woods system

In the mid 1970s the Bretton Woods system was failing and countries

In the mid 1970s the Bretton Woods system was failing and countries fixed exchange rate system

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another ...

between currencies started to float

Float may refer to:

Arts and entertainment Music Albums

* ''Float'' (Aesop Rock album), 2000

* ''Float'' (Flogging Molly album), 2008

* ''Float'' (Styles P album), 2013

Songs

* "Float" (Tim and the Glory Boys song), 2022

* "Float", by Bush ...

, and the Gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the l ...

where currencies were pegged to gold was abandoned. The price of gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile me ...

and oil

An oil is any nonpolar chemical substance that is composed primarily of hydrocarbons and is hydrophobic (does not mix with water) & lipophilic (mixes with other oils). Oils are usually flammable and surface active. Most oils are unsaturated ...

became very volatile after many years of steadiness.

Other reasons

A wide range of diverse evidence has been compiled supporting the second explanation against the supply shock view that the 1970s stagflation was due to OPEC’s quadrupling of oil prices in October 1973. Data show that its seeds were sown during the late sixties and began to be reaped in that decade. Between 1968 and 1970 unemployment rose from 3.6% to 4.9% while the CPI inflation rose from 4.7% to 5.6%. Further in the Michigan survey expected inflation rose from 3.8% to 4.9% between 1967 and 1970. The rise in expected inflation strongly supports the view that Expected Augmented Phillips Curve (EAPC) can explain the early, mild stagflation. Although the weakening economy was putting some downward pressure on inflation overall inflation rose in accordance with EAPC, as expected inflation kept rising. The stagflation became more severe in the early 1970s but was suppressed by the price controls and wage freeze imposed by President Nixon starting in August 1971 and through 1972. But when the controls were lifted in mid-1973 the CPI surged to 8.5%. Arguably, if there were no wage-price controls, the mini stagflation documented above would have been clearly evident before the October 1973 OPEC oil price hike. As for the direct impact of dollar depreciation on inflation, data again imply that just as higher inflation shifted up the labor supply curve and made workers demand and get higher money wages, similarly a falling dollar made commodity producers demand higher prices to compensate for the dollar decline. Further, the weakening of the dollar, while exogeneous to oil prices, was itself a delayed response to rising inflation from 1968 onwards. This pattern of an overheated economy, leading to inflation, dollar depreciation, and then to higher oil prices and another bout of stagflation repeated itself in 1979. Both explanations are offered in analyses of the 1970s stagflation in the West. It began with a large rise in oil prices, but then continued as central banks used excessively stimulative monetary policy to counteract the resulting recession, thereby causing aprice/wage spiral

In macroeconomics, a wage-price spiral (also called a wage/price spiral or price/wage spiral) is a proposed explanation for inflation, in which wage increases cause price increases which in turn cause wage increases, in a positive feedback loop. Gr ...

.

Increased requirements on skill (education and experience) on work force, for example because of increased technical complexity, can cause shortage on skilled employees and rising salaries for them, at the same time as uneducated work tasks have in part moved to low salary countries such as in Asia, causing high unemployment.

Postwar Keynesian and monetarist views

Early Keynesianism and monetarism

Up to the 1960s, manyKeynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

economists ignored the possibility of stagflation, because historical experience suggested that high unemployment was typically associated with low inflation, and vice versa (this relationship is called the Phillips curve

The Phillips curve is an economic model, named after William Phillips hypothesizing a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship ...

). The idea was that high demand for goods drives up prices, and also encourages firms to hire more; and likewise, high employment raises demand. However, in the 1970s and 1980s, when stagflation occurred, it became obvious that the relationship between inflation and employment levels was not necessarily stable: that is, the Phillips relationship could shift. Macroeconomists became more sceptical of Keynesian theories, and Keynesians themselves reconsidered their ideas in search of an explanation for stagflation.

The explanation for the shift of the Phillips curve was initially provided by the monetarist economist Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

, and also by Edmund Phelps

Edmund Strother Phelps (born July 26, 1933) is an American economist and the recipient of the 2006 Nobel Memorial Prize in Economic Sciences.

Early in his career, he became known for his research at Yale's Cowles Foundation in the first half of ...

. Both argued that when workers and firms begin to expect more inflation, the Phillips curve shifts up (meaning that more inflation occurs at any given level of unemployment). In particular, they suggested that if inflation lasted for several years, workers and firms would start to take it into account during wage negotiations, causing workers' wages and firms' costs to rise more quickly, thus further increasing inflation. While this idea was a severe criticism of early Keynesian theories, it was gradually accepted by most Keynesians, and has been incorporated into New Keynesian

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroec ...

economic models.

Neo-Keynesianism

Neo-Keynesian theory distinguished two distinct kinds of inflation: demand-pull (caused by shifts of the aggregate demand curve) and cost-push (caused by shifts of the aggregate supply curve). Stagflation, in this view, is caused by cost-push inflation. Cost-push inflation occurs when some force or condition increases the costs of production. This could be caused by government policies (such as taxes) or from purely external factors such as a shortage of natural resources or an act of war. Contemporary Keynesian analyses argue that stagflation can be understood by distinguishing factors that affect aggregate demand from those that affectaggregate supply

In economics, aggregate supply (AS) or domestic final supply (DFS) is the total supply of goods and services that firms in a national economy plan on selling during a specific time period. It is the total amount of goods and services that firms ...

. While monetary and fiscal policy can be used to stabilise the economy in the face of aggregate demand fluctuations, they are not very useful in confronting aggregate supply fluctuations. In particular, an adverse shock to aggregate supply, such as an increase in oil prices, can give rise to stagflation.

Supply theory

Fundamentals

Supply theories are based on the neo-Keynesian cost-push model and attribute stagflation to significant disruptions to the supply side of the supply-demand market equation, such as when there is a sudden real or relative scarcity of key commodities, natural resources, ornatural capital

Natural capital is the world's stock of natural resources, which includes geology, soils, air, water and all living organisms. Some natural capital assets provide people with free goods and services, often called ecosystem services. All of t ...

needed to produce goods and services. In this view, stagflation is thought to occur when there is an adverse supply shock

A supply shock is an event that suddenly increases or decreases the supply of a commodity or service, or of commodities and services in general. This sudden change affects the equilibrium price of the good or service or the economy's general pr ...

(for example, a sudden increase in the price of oil

An oil is any nonpolar chemical substance that is composed primarily of hydrocarbons and is hydrophobic (does not mix with water) & lipophilic (mixes with other oils). Oils are usually flammable and surface active. Most oils are unsaturated ...

or a new tax) that causes a subsequent jump in the "cost" of goods and services (often at the wholesale level). In technical terms, this results in contraction or negative shift in an economy's aggregate supply curve.

In the resource scarcity scenario (Zinam 1982), stagflation results when economic growth is inhibited by a restricted supply of raw materials. That is, when the actual or relative supply of basic materials (fossil fuels (energy), minerals, agricultural land in production, timber, etc.) decreases and/or cannot be increased fast enough in response to rising or continuing demand. The resource shortage may be a real physical shortage, or a relative scarcity due to factors such as taxes or bad monetary policy influencing the "cost" or availability of raw materials. This is consistent with the cost-push inflation factors in neo-Keynesian theory (above). The way this plays out is that after supply shock occurs, the economy first tries to maintain momentum. That is, consumers and businesses begin paying higher prices to maintain their level of demand. The central bank may exacerbate this by increasing the money supply, by lowering interest rates for example, in an effort to combat a recession. The increased money supply props up the demand for goods and services, though demand would normally drop during a recession.

In the Keynesian model, higher prices prompt increases in the supply of goods and services. However, during a supply shock (i.e., scarcity, "bottleneck" in resources, etc.), supplies do not respond as they normally would to these price pressures. So, inflation jumps and output drops, producing stagflation.

Explaining the 1970s stagflation

FollowingRichard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 to 1974. A member of the Republican Party, he previously served as a representative and senator from California and was ...

's imposition of wage and price controls

Incomes policies in economics are economy-wide wage and price controls, most commonly instituted as a response to inflation, and usually seeking to establish wages and prices below free market level.

Incomes policies have often been resorted to ...

on 15 August 1971, an initial wave of cost-push shocks in commodities were blamed for causing spiraling prices. The second major shock was the 1973 oil crisis, when the Organization of Petroleum Exporting Countries ( OPEC) constrained the worldwide supply of oil. Both events, combined with the overall energy shortage that characterised the 1970s, resulted in actual or relative scarcity of raw materials. The price controls resulted in shortages at the point of purchase, causing, for example, queues of consumers at fuelling stations and increased production costs for industry.

Recent views

Through the mid-1970s, it was alleged that none of the major macroeconomic models (Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

, New Classical

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundat ...

, and monetarist) were able to explain stagflation.

Later, an explanation was provided based on the effects of adverse supply shocks on both inflation and output.

According to Blanchard (2009), these adverse events were one of two components of stagflation; the other was "ideas"—which Robert Lucas, Thomas Sargent

Thomas John Sargent (born July 19, 1943) is an American economist and the W.R. Berkley Professor of Economics and Business at New York University. He specializes in the fields of macroeconomics, monetary economics, and time series econometric ...

, and Robert Barro

Robert Joseph Barro (born September 28, 1944) is an American macroeconomist and the Paul M. Warburg Professor of Economics at Harvard University. Barro is considered one of the founders of new classical macroeconomics, along with Robert Lucas, J ...

were cited as expressing as "wildly incorrect" and "fundamentally flawed" predictions (of Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

economics) which, they said, left stagflation to be explained by "contemporary students of the business cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examin ...

".

In this discussion, Blanchard hypothesizes that the recent oil price

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Ref ...

increases could trigger another period of stagflation, although this has not yet happened (pg. 152).

Neoclassical views

A purely neoclassical view of the macroeconomy rejects the idea that monetary policy can have real effects. Neoclassical macroeconomists argue thatreal

Real may refer to:

Currencies

* Brazilian real (R$)

* Central American Republic real

* Mexican real

* Portuguese real

* Spanish real

* Spanish colonial real

Music Albums

* ''Real'' (L'Arc-en-Ciel album) (2000)

* ''Real'' (Bright album) (2010) ...

economic quantities, like real output

Output may refer to:

* The information produced by a computer, see Input/output

* An output state of a system, see state (computer science)

* Output (economics), the amount of goods and services produced

** Gross output in economics, the value o ...

, employment, and unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

, are determined by real factors only. Nominal

Nominal may refer to:

Linguistics and grammar

* Nominal (linguistics), one of the parts of speech

* Nominal, the adjectival form of "noun", as in "nominal agreement" (= "noun agreement")

* Nominal sentence, a sentence without a finite verb

* Nou ...

factors like changes in the money supply only affect nominal variables like inflation. The neoclassical idea that nominal factors cannot have real effects is often called ''monetary neutrality

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as ...

'' or also the ''classical dichotomy In macroeconomics, the classical dichotomy is the idea, attributed to classical and pre-Keynesian economics, that real and nominal variables can be analyzed separately. To be precise, an economy exhibits the classical dichotomy if real variables su ...

''.

Since the neoclassical viewpoint says that real phenomena like unemployment are essentially unrelated to nominal phenomena like inflation, a neoclassical economist would offer two separate explanations for 'stagnation' and 'inflation'. Neoclassical explanations of stagnation (low growth and high unemployment) include inefficient government regulations or high benefits for the unemployed that give people less incentive to look for jobs. Another neoclassical explanation of stagnation is given by real business cycle theory

Real business-cycle theory (RBC theory) is a class of new classical macroeconomics models in which business-cycle fluctuations are accounted for by real (in contrast to nominal) shocks. Unlike other leading theories of the business cycle, RBC th ...

, in which any decrease in labour productivity

Workforce productivity is the amount of goods and services that a group of workers produce in a given amount of time. It is one of several types of productivity that economists measure. Workforce productivity, often referred to as labor product ...

makes it efficient to work less. The main neoclassical explanation of inflation is very simple: it happens when the monetary authorities increase the money supply too much.

Ch. 8, Fig. 8.1.

In the neoclassical viewpoint, the real factors that determine output and unemployment affect the aggregate supply

In economics, aggregate supply (AS) or domestic final supply (DFS) is the total supply of goods and services that firms in a national economy plan on selling during a specific time period. It is the total amount of goods and services that firms ...

curve only. The nominal factors that determine inflation affect the aggregate demand curve only. When some adverse changes in real factors are shifting the aggregate supply curve left at the same time that unwise monetary policies are shifting the aggregate demand curve right, the result is stagflation.

Thus the main explanation for stagflation under a classical view of the economy is simply policy errors that affect both inflation and the labour market. Ironically, a very clear argument in favour of the classical explanation of stagflation was provided by Keynes himself. In 1919, John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

described the inflation and economic stagnation gripping Europe in his book '' The Economic Consequences of the Peace''. Keynes wrote:

Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. ..Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.Keynes explicitly pointed out the relationship between governments printing money and inflation.

The inflationism of the currency systems of Europe has proceeded to extraordinary lengths. The various belligerent Governments, unable, or too timid or too short-sighted to secure from loans or taxes the resources they required, have printed notes for the balance.Keynes also pointed out how government price controls discourage production.

The presumption of a spurious value for the currency, by the force of law expressed in the regulation of prices, contains in itself, however, the seeds of final economic decay, and soon dries up the sources of ultimate supply. If a man is compelled to exchange the fruits of his labours for paper which, as experience soon teaches him, he cannot use to purchase what he requires at a price comparable to that which he has received for his own products, he will keep his produce for himself, dispose of it to his friends and neighbours as a favour, or relax his efforts in producing it. A system of compelling the exchange of commodities at what is not their real relative value not only relaxes production, but leads finally to the waste and inefficiency of barter.Keynes detailed the relationship between German government deficits and inflation.

In Germany the total expenditure of the Empire, the Federal States, and the Communes in 1919–20 is estimated at 25 milliards of marks, of which not above 10 milliards are covered by previously existing taxation. This is without allowing anything for the payment of the indemnity. In Russia, Poland, Hungary, or Austria such a thing as a budget cannot be seriously considered to exist at all. Thus the menace of inflationism described above is not merely a product of the war, of which peace begins the cure. It is a continuing phenomenon of which the end is not yet in sight.

Zimmermann conclusion

While most economists believe that changes in money supply can have some real effects in the short run, neoclassical and neo-Keynesian economists tend to agree that there are no long-run effects from changing the money supply. Therefore, even economists who consider themselves neo-Keynesians usually believe that in the long run, money isneutral

Neutral or neutrality may refer to:

Mathematics and natural science Biology

* Neutral organisms, in ecology, those that obey the unified neutral theory of biodiversity

Chemistry and physics

* Neutralization (chemistry), a chemical reaction in ...

. In other words, while neoclassical and neo-Keynesian models are often seen as competing points of view, they can also be seen as two descriptions appropriate for different time horizons. Many mainstream textbooks today treat the neo-Keynesian model as a more appropriate description of the economy in the short run, when prices are 'sticky

Sticky may refer to:

People

*Sticky (musician), alias of UK garage producer Richard Forbes

* Sticky Fingaz or Sticky (born 1973), nickname of the US rapper and actor Kirk Jones

Adhesion

*Adhesion

Adhesion is the tendency of dissimilar ...

', and treat the neoclassical model as a more appropriate description of the economy in the long run, when prices have sufficient time to adjust fully.

Therefore, while mainstream economists today might often attribute short periods of stagflation (not more than a few years) to adverse changes in supply, they would not accept this as an explanation of very prolonged stagflation. More prolonged stagflation would be explained as the effect of inappropriate government policies: excessive regulation of product markets and labour markets leading to long-run stagnation, and excessive growth of the money supply leading to long-run inflation.

Alternative views

As differential accumulation

Political economists

Political economy is the study of how economic systems (e.g. markets and national economies) and political systems (e.g. law, institutions, government) are linked. Widely studied phenomena within the discipline are systems such as labour ma ...

Jonathan Nitzan

Jonathan Nitzan is Professor of Political Economy at York University, Toronto, Canada.

Work

Nitzan is the co-author (with Shimshon Bichler) of ''Capital as Power: A Study of Order and Creorder'', published 2009. Their writings focus of the nature ...

and Shimshon Bichler

Shimshon Bichler is an educator who teaches political economy at colleges and universities in Israel. Along with Jonathan Nitzan, Bichler has created a power theory of capitalism and theory of differential accumulation in their analysis of the po ...

have proposed an explanation of stagflation as part of a theory they call differential accumulation, which says firms seek to beat the average profit and capitalisation rather than maximise. According to this theory, periods of mergers and acquisitions oscillate with periods of stagflation. When mergers and acquisitions are no longer politically feasible (governments clamp down with anti-monopoly rules), stagflation is used as an alternative to have higher relative profit than the competition. With increasing mergers and acquisitions, the power to implement stagflation increases.

Stagflation appears as a societal crisis, such as during the period of the oil crisis in the 70s and in 2007 to 2010. Inflation in stagflation, however, does not affect all firms equally. Dominant firms are able to increase their own prices at a faster rate than competitors. While in the aggregate no one appears to profit, differentially dominant firms improve their positions with higher relative profits and higher relative capitalisation. Stagflation is not due to any actual supply shock, but because of the societal crisis that hints at a supply crisis. It is mostly a 20th and 21st century phenomenon that has been mainly used by the "weapondollar-petrodollar coalition" creating or using Middle East crises for the benefit of pecuniary interests.

Demand-pull stagflation theory

Demand-pull stagflation theory explores the idea that stagflation can result exclusively from monetary shocks without any concurrent supply shocks or negative shifts in economic output potential. Demand-pull theory describes a scenario where stagflation can occur following a period of monetary policy implementations that cause inflation. This theory was first proposed in 1999 by Eduardo Loyo ofHarvard University

Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of high ...

's John F. Kennedy School of Government

The Harvard Kennedy School (HKS), officially the John F. Kennedy School of Government, is the school of public policy and government of Harvard University in Cambridge, Massachusetts. The school offers master's degrees in public policy, public ...

.

Supply-side theory

Supply-side economics emerged as a response to US stagflation in the 1970s. It largely attributed inflation to the ending of the Bretton Woods system in 1971 and the lack of a specific price reference in the subsequent monetary policies (Keynesian and Monetarism). Supply-side economists asserted that the contraction component of stagflation resulted from an inflation-induced rise in real tax rates (see bracket creep).Austrian School of economics

Adherents to theAustrian School

The Austrian School is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result exclusively from the motivations and actions of individuals. Austrian schoo ...

maintain that creation of new money ex nihilo

(Latin for "creation out of nothing") is the doctrine that matter is not eternal but had to be created by some divine creative act. It is a theistic answer to the question of how the universe comes to exist. It is in contrast to ''Ex nihilo ...

benefits the creators and early recipients of the new money relative to late recipients. Money creation is not wealth creation; it merely allows early money recipients to outbid late recipients for resources, goods, and services. Since the actual producers of wealth are typically late recipients, increases in the money supply weakens wealth formation and undermines the rate of economic growth. Austrian economist Frank Shostak says: "The increase in the money supply rate of growth coupled with the slowdown in the rate of growth of goods produced is what the increase in the rate of price inflation is all about. (Note that a price is the amount of money paid for a unit of a good.) What we have here is a faster increase in price inflation and a decline in the rate of growth in the production of goods. But this is exactly what stagflation is all about, i.e., an increase in price inflation and a fall in real economic growth. Popular opinion is that stagflation is totally made up. It seems therefore that the phenomenon of stagflation is the normal outcome of loose monetary policy. This is in agreement with helps and Friedman (PF) Contrary to PF, however, we maintain that stagflation is not caused by the fact that in the short run people are fooled by the central bank. Stagflation is the natural result of monetary pumping which weakens the pace of economic growth and at the same time raises the rate of increase of the prices of goods and services."

Jane Jacobs and the influence of cities on stagflation

In 1984, journalist and activistJane Jacobs

Jane Jacobs (''née'' Butzner; 4 May 1916 – 25 April 2006) was an American-Canadian journalist, author, theorist, and activist who influenced urban studies, sociology, and economics. Her book '' The Death and Life of Great American Cities ...

proposed the failure of major macroeconomic theoriesincluding those of Adam Smith, Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

, John Stuart Mill, John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

, Irving Fisher, and Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

to explain stagflation was due to their focus on the nation as the salient unit of economic analysis, rather than the city. She proposed that the key to avoiding stagflation was for a nation to focus on the development of "import-replacing cities" that would experience economic ups and downs at different times, providing overall national stability and avoiding widespread stagflation. According to Jacobs, import-replacing cities are those with developed economies that balance their own production with domestic imports—so they can respond with flexibility as economic supply and demand cycles change. While lauding her originality, clarity, and consistency, urban planning scholars have criticised Jacobs for not comparing her own ideas to those of major theorists (e.g., Adam Smith, Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

) with the same depth and breadth they developed, as well as a lack of scholarly documentation. Despite these issues, Jacobs' work is notable for having widespread public readership and influence on decision-makers.

Responses

Stagflation undermined support for the Keynesian consensus. Federal Reserve chairmanPaul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended th ...

very sharply increased interest rates from 1979 to 1983 in what was called a " disinflationary scenario". After U.S. prime interest rates had soared into the double-digits, inflation did come down; these interest rates were the highest long-term prime interest rates that had ever existed in modern capital markets. Volcker is often credited with having stopped at least the inflationary side of stagflation, although the American economy also dipped into recession. Starting in approximately 1983, growth began a recovery. Both fiscal stimulus and money supply growth were policy at this time. A five- to six-year jump in unemployment during the Volcker disinflation suggests Volcker may have trusted unemployment to self-correct and return to its natural rate within a reasonable period.

See also

* Biflation * Chronic inflation *Deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflatio ...

*Economic stagnation

Economic stagnation is a prolonged period of slow economic growth (traditionally measured in terms of the GDP growth), usually accompanied by high unemployment. Under some definitions, "slow" means significantly slower than potential growth as e ...

*Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

* Inflationism

*Shrinkflation

In economics, shrinkflation, also known as the grocery shrink ray, deflation, or package downsizing, is the process of items shrinking in size or quantity, or even sometimes reformulating or reducing quality, while their prices remain the same o ...

* Stagflation in the United States

* Zero interest-rate policy

*1976 sterling crisis

The 1976 sterling crisis was a currency crisis in the United Kingdom. Inflation (at close to 25% in 1975, causing high bond yields and borrowing costs), a balance of payments deficit, a public spending deficit, and the 1973 oil crisis were co ...

*2000s commodities boom

The 2000s commodities boom or the commodities super cycle was the rise of many physical commodity prices (such as those of food, oil, metals, chemicals and fuels) during the early 21st century (2000–2014), following the Great Commodities Depress ...

*2020s commodities boom

The 2020s commodities boom refers to the rise of many commodity prices in the early 2020s following the COVID-19 pandemic. The COVID-19 recession initially made commodity prices drop, but lockdowns, supply chain bottlenecks, and dovish monet ...

Notes

References

Further reading

* * * * * *External links

How Paul Volcker Stopped Inflation in the 1980s

{{Authority control 1960s neologisms 1970s economic history Inflation Political economy Unemployment