|

LIBOR–OIS Spread

An overnight indexed swap (OIS) is an interest rate swap (''IRS'') over some given term, e.g. 10Y, where the periodic fixed payments are tied to a given fixed rate while the periodic floating payments are tied to a floating rate calculated from a daily compounded overnight rate over the floating coupon period. Note that the OIS term is not overnight; it is the underlying reference rate that is an overnight rate. The exact compounding formula depends on the type of such overnight rate. The index rate is typically the rate for overnight lending between banks, either non-secured or secured, for example the Federal funds rate or SOFR for US dollar, €STR (formerly EONIA) for Euro or SONIA for sterling. The fixed rate of OIS is typically an interest rate considered less risky than the corresponding interbank rate (LIBOR) because there is limited counterparty risk. LIBOR–OIS spread The LIBOR–OIS spread is the difference between IRS rates, based on the LIBOR, and OIS rates, ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

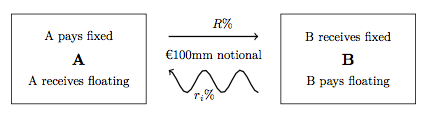

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Creditworthiness

Credit risk is the chance that a borrower does not repay a loan or fulfill a loan obligation. For lenders the risk includes late or lost interest and principal sum, principal payment, leading to disrupted Cash flow, cash flows and increased Collection cost, collection costs. The loss may be complete or partial. In an Efficient-market hypothesis, efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by Market participant, market participants. Losses can arise in a number of circumstances, for example: * A consumer may fail to make a payment due on a mortgage loan, credit card, line of credit, or other loan. * A company is unable to repay asset-secured fixed or floating charge debt. * A business or consumer does not pay a trade credit, trade invoice when due. * A business does not pay an employee's earned wages whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime Mortgage Crisis

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010, contributing to the 2008 financial crisis. It led to a severe economic recession, with millions becoming unemployed and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA). The collapse of the United States housing bubble and high interest rates led to unprecedented numbers of borrowers missing mortgage repayments and becoming delinquent. This ultimately led to mass foreclosures and the devaluation of housing-related securities. The housing bubble preceding the crisis was financed with mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than government securities, along with attractive risk ratin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nationalisation Of Northern Rock

In 2008 the Northern Rock bank was nationalised by the British government, due to financial problems caused by the subprime mortgage crisis. In 2010 the bank was split into two parts (Northern Rock (Asset Management), assets and banking) to aid the eventual sale of the bank back to the private sector. On 14 September 2007, the bank sought and received a liquidity support facility from the Bank of England, as a result of its exposure in the credit markets, during the 2008 financial crisis. On 22 February 2008 the bank was Nationalization, taken into state ownership. The nationalisation followed two unsuccessful bids to take over the bank, neither being able to fully commit to repayment of savers' and investors' money. In 2012 Virgin Money UK, Virgin Money completed the purchase of Northern Rock from UK Financial Investments (UKFI) for approximately £1 billion and by October of that year the high street bank operated under the Virgin Money brand. 2007 credit crisis Emergence ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one of the bankers for the government of the United Kingdom, it is the world's second oldest central bank. The bank was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. In the 21st century the bank took on increased responsibility for maintaining and monitoring financial stability in the UK, and it increasingly functions as a statutory Financial regulation, regulator. The bank's headquarters have been in London's main financial di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Risk

Liquidity risk is a financial risk that for a certain period of time a given financial asset, security or commodity cannot be traded quickly enough in the market without impacting the market price. Types Market liquidity – An asset cannot be sold due to lack of liquidity in the market – essentially a sub-set of market risk. This can be accounted for by: * Widening bid–ask spread * Making explicit liquidity reserves * Lengthening holding period for value at risk (VaR) calculations Funding liquidity – Risk that liabilities: * Cannot be met when they fall due * Can only be met at an uneconomic price * Can be name-specific or systemic Causes Liquidity risk arises from situations in which a party interested in trading an asset cannot do it because nobody in the market wants to trade for that asset. Liquidity risk becomes particularly important to parties who are about to hold or currently hold an asset, since it affects their ability to trade. Manifestation of liquidity r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Risk

Credit risk is the chance that a borrower does not repay a loan In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the deb ... or fulfill a loan obligation. For lenders the risk includes late or lost interest and principal payment, leading to disrupted cash flows and increased collection costs. The loss may be complete or partial. In an efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by market participants. Losses can arise in a number of circumstances, for example: * A consumer may fail to make a payment due on a mortgage loan, credit card, line of credit, or other loan. * A company is unable to repay asset- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Counterparty

A counterparty (sometimes contraparty) is a Juristic person, legal entity, unincorporated entity, or collection of entities to which an exposure of financial risk may exist. The word became widely used in the 1980s, particularly at the time of the Basel I deliberations in 1988. Well-drafted contracts usually attempt to spell out in explicit detail what each counterparty's rights and obligations are in every conceivable circumstance, though there are limits. There are general provisions for how counterparties are treated under the law, and (at least in common law legal systems) there are many legal precedents that shape the common law. Financial services sector Within the financial services sector, the term market counterparty is used to refer to governments, public banks, national monetary authorities and international monetary organisations such as the World Bank Group that act as the ultimate guarantor for loans and indemnities. The term may also be applied, in a more general se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Although an instrument of the U.S. government, the Federal Reserve System considers itself "an independent central bank because its monetary policy decisions do not have to be approved by the president or by anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms." Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurodollar

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States. The term was originally applied to U.S. dollar accounts held in banks situated in Europe, but it expanded over the years to cover US dollar accounts held anywhere outside the U.S. Thus, a U.S. dollar-denominated deposit in Dubai or Singapore would likewise be deemed a Eurodollar deposit (sometimes an Asiadollar). More generally, the ''euro-'' prefix can be used to indicate any currency held in a country where it is not the official currency, broadly termed "eurocurrency", for example, Euroyen or even Euroeuro. Eurodollars have different regulatory requirements than dollars held in U.S. banks. Eurodollars can be riskier than assets held in U.S. banks, which include at least partial deposit insurance, and as a result, demand a higher interest rate. There is no connection with the euro currency of the European Union. History After World War II, the quantity of physical U.S. dollar ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and, in some cases, to enforce policies on financial consumer protection, and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence. Central banks in most developed nations are usually set up to be institutionally independent from political interference, even though governments typically have governance rights over them, legislative bodies exercise scrutiny, and central banks frequently do show resp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |