|

IRS Volunteer Income Tax Assistance Program

The Volunteer Income Tax Assistance (VITA) grant program is an Internal Revenue Service (IRS) initiative in the United States that supports free tax preparation service for the underserved through various partner organizations. VITA service helps low- to moderate-income individuals, persons with disabilities, the elderly, and limited English speakers file their taxes each year. IRS awards matching funds to partner organizations throughout the country. The IRS awarded $18 million in grants for FY2019. Description VITA was founded in 1971 by Gary Iskowitz at California State University, Northridge. Since the 1970s the program has grown to several thousand sites nationwide, partnering with non-profit organizations, local municipalities, and colleges and universities. In Tax Year 2015, 3.7 million VITA tax returns were filed with a 94% accuracy rate. VITA provides service to taxpayers making less than $56,000 per year. Volunteers VITA volunteers include greeters, intake spec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governmental Organization

A government or state agency, sometimes an appointed commission, is a permanent or semi-permanent organization in the machinery of government that is responsible for the oversight and administration of specific functions, such as an administration. There is a notable variety of agency types. Although usage differs, a government agency is normally distinct both from a department or ministry, and other types of public body established by government. The functions of an agency are normally executive in character since different types of organizations (''such as commissions'') are most often constituted in an advisory role—this distinction is often blurred in practice however, it is not allowed. A government agency may be established by either a national government or a state government within a federal system. Agencies can be established by legislation or by executive powers. The autonomy, independence, and accountability of government agencies also vary widely. History Early exa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. EITC phases in slowly, has a medium-length plateau, and phases out more slowly than it was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kiddie Tax

The kiddie tax rule exists in the United States of America and can be found iInternal Revenue Code § 1(g) which "taxes certain unearned income of a child at the parent's marginal rate, no matter whether the child can be claimed as a dependent on the parent's return". Background The United States federal income tax system is progressive, meaning, the higher the income the higher percentage of that income is paid to the government in the form of a tax. The progressivity of the income tax system encourages income redistribution, which is the shifting of income from individuals in high tax brackets to others in lower tax brackets. Taxpayers, however, will not likely shift the income to just any person, but may be willing to shift income to a close family member or friend. Children are usually in a lower tax bracket than their parents and grandparents, which makes them the likely receiver of the shifted income. The incentive, however, to shift income from the taxpayer to the taxpay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Protection And Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act of 2010 amendment, it represents the U.S. healthcare system's most significant regulatory overhaul and expansion of coverage since the enactment of Medicare and Medicaid in 1965. The ACA's major provisions came into force in 2014. By 2016, the uninsured share of the population had roughly halved, with estimates ranging from 20 to 24 million additional people covered. The law also enacted a host of delivery system reforms intended to constrain healthcare costs and improve quality. After it went into effect, increases in overall healthcare spending slowed, including premiums for employer-based insurance plans. The increased coverage was d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disability Insurance

Disability Insurance, often called DI or disability income insurance, or income protection, is a form of insurance that insures the beneficiary's earned income against the risk that a disability creates a barrier for completion of core work functions. For example, the worker may be unable to maintain composure in the case of psychological disorders or sustain an injury, illness or condition that causes physical impairment or incapacity to work. DI encompasses paid sick leave, short-term disability benefits (STD), and long-term disability benefits (LTD). The same concept is instantiated in some countries as income protection insurance. History In the late 19th century, modern disability insurance began to become available. It was originally known as "accident insurance". The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent railway system. It was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prosperity Now

Prosperity Now, formerly known as the Corporation for Enterprise Development (CFED), is a national nonprofit based in Washington, DC, dedicated to expanding economic opportunity for low-income families and communities in the United States. CFED uses an approach grounded in community practice, public policy and private markets. CFED publishes research, partners with local practitioners to carry out demonstration projects, and engages in policy advocacy work at the local, state and national levels. The organization works domestically with satellite offices in San Francisco, California, and Durham, North Carolina. History CFED was founded in 1979 by Bob Friedman. The organization was initially focused on economic development and microenterprise. It worked to reduce unemployment and expand opportunity by advocating for policies that would make it easier for entrepreneurs to start or expand a small business. In 1988, CFED launched the Development Report Card (DRC) for the States, a b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Cuts And Jobs Act Of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and cancelling the penalty enforcing individual mandate of the Affordable Care Act (ACA). The Act is based on tax reform advocated by congressional Republicans and the Trump administration. The nonpartisan Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Reduction Act Of 1975

The United States Tax Reduction Act of 1975 provided a 10-percent rebate on 1974 tax liability ($200 cap). It created a temporary $30 general tax credit for each taxpayer and dependent. The investment tax credit was temporarily increased to 10 percent through 1976. The minimum standard deduction was temporarily increased to $1,900 (joint returns) for one year. For one year, the percentage standard deduction was increased to 16 percent of adjusted gross income, up to $2,600 if married filing jointly, $2,300 if single, or $1,300 if married filing separately. The bill became public law 94–12 when it was signed by President Gerald Ford Gerald Rudolph Ford Jr. ( ; born Leslie Lynch King Jr.; July 14, 1913December 26, 2006) was an American politician who served as the 38th president of the United States from 1974 to 1977. He was the only president never to have been elected ... on March 29, 1975. External links * {{US_tax_acts United States federal taxation legislatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

War On Poverty

The war on poverty is the unofficial name for legislation first introduced by United States President Lyndon B. Johnson during his State of the Union address on January 8, 1964. This legislation was proposed by Johnson in response to a national poverty rate of around nineteen percent. The speech led the United States Congress to pass the Economic Opportunity Act, which established the Office of Economic Opportunity (OEO) to administer the local application of federal funds targeted against poverty. The forty programs established by the Act were collectively aimed at eliminating poverty by improving living conditions for residents of low-income neighborhoods and by helping the poor access economic opportunities long denied from them. As a part of the Great Society, Johnson believed in expanding the federal government's roles in education and health care as poverty reduction strategies. These policies can also be seen as a continuation of Franklin D. Roosevelt's New Deal, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Tax Credit (United States)

The United States federal child tax credit (CTC) is a partially-refundable tax credit for parents with dependent children. It provides $2,000 in tax relief per qualifying child, with up to $1,400 of that refundable (subject to a refundability threshold, phase-in and phase-out). In 2021, following the passage of the American Rescue Plan Act of 2021, it was temporarily raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17; it was also made fully-refundable and half was paid out as monthly benefits. The CTC is scheduled to revert to a $1,000 credit after 2025. The CTC was estimated to have lifted about 3 million children out of poverty in 2016. In 2021, a Columbia University study estimated that the expansion of the CTC in the American Rescue Plan Act reduced child poverty by an additional 26%, and would have decreased child poverty by an additional 40% had all eligible households claimed the credit. The expansion also substantially reduce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

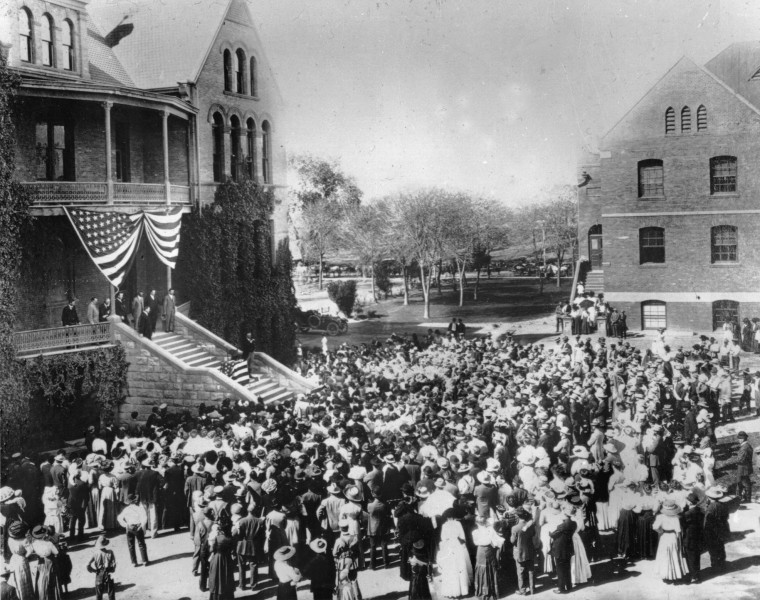

Arizona State University

Arizona State University (Arizona State or ASU) is a public research university in the Phoenix metropolitan area. Founded in 1885 by the 13th Arizona Territorial Legislature, ASU is one of the largest public universities by enrollment in the U.S. One of three universities governed by the Arizona Board of Regents, ASU is a member of the Universities Research Association and classified among "R1: Doctoral Universities – Very High Research Activity". ASU has nearly 150,000 students attending classes, with more than 38,000 students attending online, and 90,000 undergraduates and nearly 20,000 postgraduates across its five campuses and four regional learning centers throughout Arizona. ASU offers 350 degree options from its 17 colleges and more than 170 cross-discipline centers and institutes for undergraduates students, as well as more than 400 graduate degree and certificate programs. The Arizona State Sun Devils compete in 26 varsity-level sports in the NCAA Division ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-governmental Organization

A non-governmental organization (NGO) or non-governmental organisation (see American and British English spelling differences#-ise, -ize (-isation, -ization), spelling differences) is an organization that generally is formed independent from government. They are typically nonprofit organization, nonprofit entities, and many of them are active in humanitarianism or the social sciences; they can also include club (organization), clubs and voluntary association, associations that provide services to their members and others. Surveys indicate that NGOs have a high degree of public trust, which can make them a useful proxy for the concerns of society and stakeholders. However, NGOs can also be lobby groups for corporations, such as the World Economic Forum. NGOs are distinguished from International organization, international and intergovernmental organizations (''IOs'') in that the latter are more directly involved with sovereign states and their governments. The term as it is used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)