|

High-frequency Trading

High-frequency trading (HFT) is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. While there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, co-location, and very short-term investment horizons. HFT can be viewed as a primary form of algorithmic trading in finance.Lin, Tom C. W. "The New Financial Industry" (March 30, 2014). 65 Alabama Law Review 567 (2014); Temple University Legal Studies Research Paper No. 2014-11; . Specifically, it is the use of sophisticated technological tools and computer algorithms to rapidly trade securities. HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second. In 2017, Aldridge and Krawciw estimated that in 2016 HFT on average initiated 10–40% of trading volume in equities, and 10 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Algorithmic Trading

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. It is widely used by investment banks, pension funds, mutual funds, and hedge funds that may need to spread out the execution of a larger order or perform trades too fast for human traders to react to. A study in 2019 showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans. The term algorithmic trading is often used synonymously with automated trading system. These encompass a variety of trading strategies, some of which are based on formulas and results from mathematical finance, and often rely on specialized software. Examples ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

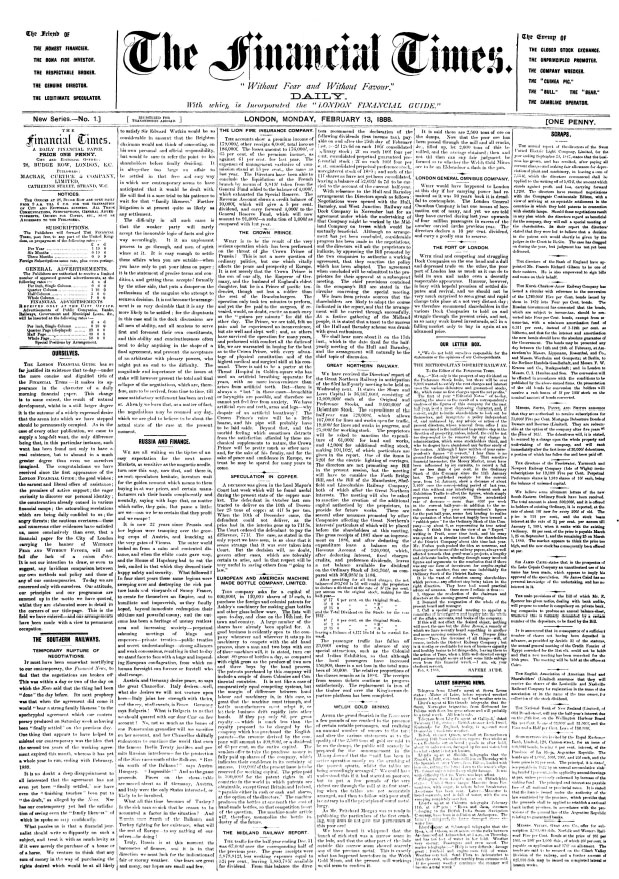

The Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a "Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Markets

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 2022 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Purdue University

Purdue University is a public land-grant research university in West Lafayette, Indiana, and the flagship campus of the Purdue University system. The university was founded in 1869 after Lafayette businessman John Purdue donated land and money to establish a college of science, technology, and agriculture in his name. The first classes were held on September 16, 1874, with six instructors and 39 students. It has been ranked as among the best public universities in the United States by major institutional rankings, and is renowned for its engineering program. The main campus in West Lafayette offers more than 200 majors for undergraduates, over 70 masters and doctoral programs, and professional degrees in pharmacy, veterinary medicine, and doctor of nursing practice. In addition, Purdue has 18 intercollegiate sports teams and more than 900 student organizations. Purdue is the founding member of the Big Ten Conference and enrolls the largest student body of any individual ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a "Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nomura Research Institute

Nomura Research Institute, Ltd. (NRI; Japanese: 株式会社野村総合研究所 or 野村総研 for short) is the largest economic research and consulting firm in Japan, and a member of the Nomura Group. Established in 1965, the firm now employs over 13,000 people. It owns ten subsidiaries in Japan and multiple subsidiaries overseas, in India, New York City, Dallas, London, Seoul, Shanghai, Beijing, Hong Kong, Moscow, Taipei, the Philippines, Singapore, Bangkok, and Jakarta. In 2016 NRI acquired Cutter Associates. ''cutterassociates.com''. Retrieved 2016-08-15. Overview Nomura Research Institute (Japan's first full-fledged private comprehensive think tank) and Nomura Computer Systems, Inc. (Japan's first systems development company to use commercial computers for business purposes) merged to form the current Nomura Researc ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citadel LLC

Citadel LLC (formerly known as Citadel Investment Group, LLC) is an American multinational hedge fund and financial services company. Founded in 1990 by Kenneth C. Griffin, it has more than $50 billion in assets under management . The company has over 2,600 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Kenneth C. Griffin owns approximately 85% of the firm. Citadel LLC is a separate entity from the market maker Citadel Securities, although both were founded and are owned by American financier Kenneth C. Griffin. History Kenneth Griffin started his trading career out of his dorm room at Harvard University in 1987 trading convertible bonds. As a sophomore, he traded convertible bonds and hooked a satellite dish to the roof of his dormitory. After graduating with a degree in economics, Griffin joined Chicago-based hedge fund Glenwood Partners. Citadel was started with $4.6 million in c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tradebot

Tradebot Systems, Inc. is one of the larger high-frequency equity trading firms in the US. Based in Kansas City, Missouri, they regularly account for 5% of the total trading volume in the US stock market. According to the founder, Dave Cummings, as of 2008, the firm "typically held stocks for 11 seconds", and "had not had a losing day in 4 years". That streak continued uninterrupted until 2018. The firm was founded in 1999 and had an early relationship with fellow high-frequency trading shop Getco. In 2005 Cummings left Tradebot to start a new electronic market, which he called the Better Alternative Trading System. That market eventually became the BATS stock exchange. In 2007 Cummings left BATS to return to Tradebot. The firm is affiliated with Tradebot Ventures, Tradebot Properties, Tatora and Auxby. In summer 2014, New York Attorney General Eric Schneiderman accused Barclays of hiding that Tradebot was one of the largest participants in their dark pool In finance, a da ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IMC Financial Markets

IMC Financial Markets, sometimes referred to as IMC Trading, is a proprietary trading firm and market maker for various financial instruments listed on exchanges throughout the world. Founded in 1989 as International Market makers Combination, the company employs over 1100 people and has offices in Amsterdam, Chicago, Sydney, Hong Kong and Mumbai. Trading IMC is a technology-driven trading firm active in over 100 trading venues throughout the world and offering liquidity to over 200,000 securities. IMC makes markets in the major exchange-traded instruments – equities, bonds, commodities, and currencies – on 100 exchanges worldwide and is a significant liquidity provider on the NYSE Arca, NASDAQ, CBOE, BATS Bats are mammals of the order Chiroptera.''cheir'', "hand" and πτερόν''pteron'', "wing". With their forelimbs adapted as wings, they are the only mammals capable of true and sustained flight. Bats are more agile in flight than most bir ..., and CME exchang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tower Research

Tower Research Capital LLC, or simply Tower Research, is a high-frequency trading, algorithmic trading, and financial services fund. About Tower Tower Research Capital is one of the oldest automated trading firms. It was started by Mark Gorton and Alistair Brown in February 1998. Tower's internal trading teams are independent from one another, enjoying autonomy while accessing shared technology resources such as hardware, software, and connectivity as well as resources such as business management, legal, compliance, and risk management. At the heart of operations is the core engineering team, which owns the architecture, implementation and optimization of the trading platform itself. This includes developing systems and tools to access market data, perform trend analysis, run trading simulations, order entry and management, real-time trade support, risk management and post-trade services. Working together, Tower builds technology and deploys diverse automated and quantitative ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Virtu Financial

Virtu Financial is an American company that provides financial services, trading products and market making services. Virtu provides product suite including offerings in execution, liquidity sourcing, analytics and broker-neutral, multi-dealer platforms in workflow technology and two-sided quotations and trades in equities, commodities, currencies, options, fixed income, and other securities on over 230 exchanges, markets, and dark pools. Virtu uses proprietary technology to trade large volumes of securities. The company went public on the Nasdaq in 2015. Organization Based in New York City, Virtu was founded by Vincent Viola, a former chairman of the New York Mercantile Exchange and current owner of the Florida Panthers.Man Vs. Machine: Seven Major Pla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |