|

Gulf Finance House

GFH Financial Group, previously known as Gulf Finance House, is an Islamic investment bank with headquarters in Bahrain Financial Harbour, Bahrain. One of its most notable investments is a 25% stake in the UK Football Premier League club Leeds United through their wholly owned subsidiary, Dubai-based GFH Capital, having initially acquired 100% ownership of the club from Ken Bates in December 2012. On 7 February 2014 GFH Capital announced that they had exchanged contracts for the sale of Leeds to Massimo Cellino's family consortium 'Eleonora Sport Ltd'. The deal saw the Cellino family acquire a 75% ownership of the club in April 2014 after winning an appeal against the Football League's decision initially to block the sale. History of GFH GFH was established in the Kingdom of Bahrain in 1999 under a license granted by the Central Bank of Bahrain (CBB). Since its inception, GFH raised over US$11 billion of investments. The bank carries on its business activities in accordance w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not ( unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

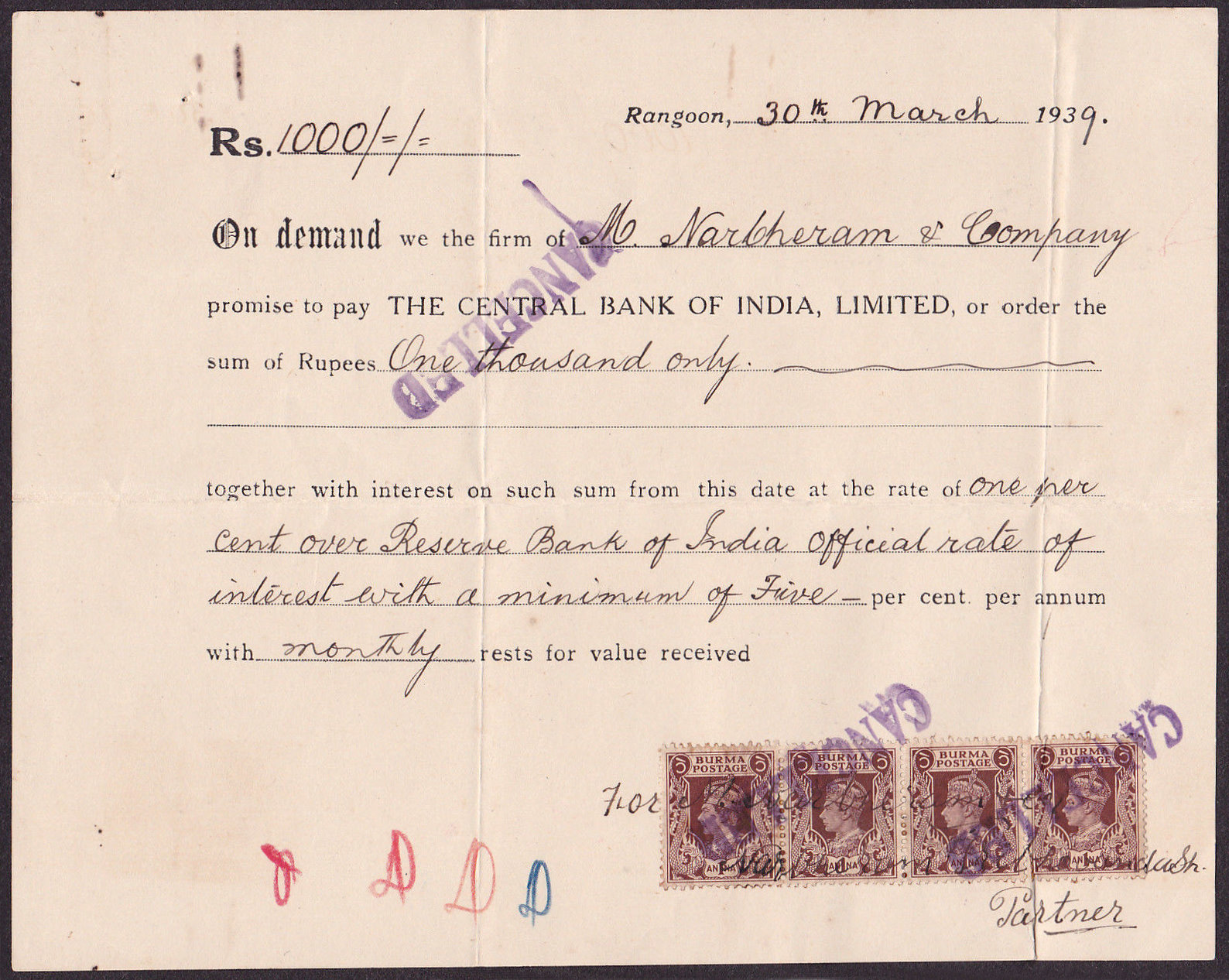

Negotiable Instrument

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings depending on the use of the term as it is used in the application of different laws, and depending in which country and context it is used. Concept of negotiability William Searle Holdsworth defines the concept of negotiability as follows: #Negotiable instruments are transferable under the following circumstances: they are transferable by delivery where they are made payable to the bearer, they are transferable by delivery and endorsement where they are made payable to order. #Consideration is presumed. #The transferee acquires a good title, even though the transferor had a defective or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Management

Asset management is a systematic approach to the governance and realization of value from the things that a group or entity is responsible for, over their whole life cycles. It may apply both to tangible assets (physical objects such as buildings or equipment) and to intangible assets (such as human capital, intellectual property, goodwill or financial assets). Asset management is a systematic process of developing, operating, maintaining, upgrading, and disposing of assets in the most cost-effective manner (including all costs, risks, and performance attributes). The term is commonly used in the financial sector to describe people and companies who manage investments on behalf of others. Those include, for example, investment managers that manage the assets of a pension fund. It is also increasingly used in both the business world and public infrastructure sectors to ensure a coordinated approach to the optimization of costs, risks, service/performance, and sustainability. I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Management

Wealth management (WM) or wealth management advisory (WMA) is an investment advisory service that provides financial management and wealth advisory services to a wide array of clients ranging from affluent to high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and families. It is a discipline which incorporates structuring and planning wealth to assist in growing, preserving, and protecting wealth, whilst passing it onto the family in a tax-efficient manner and in accordance with their wishes. Wealth management brings together tax planning, wealth protection, estate planning, succession planning, and family governance. Private wealth management Private wealth management is delivered to high-net-worth investors. Generally, this includes advice on the use of various estate planning vehicles, business-succession or stock-option planning, and the occasional use of hedging derivatives for large blocks of stock. Traditionally, the wealthiest retail clients of investment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Banking

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit. It can also refer to a bank, or a division of a large bank, which deals with corporations or a large/middle-sized business to differentiate it from a retail bank and an investment bank. Commercial banks include private sector banks and public sector banks. History The name ''bank'' derives from the Italian word ''banco'' "desk/bench", used during the Italian Renaissance era by Florentine bankers, who used to carry out their transactions on a desk covered by a green tablecloth. However, traces of banking activity can be found even in ancient times. In the United States, the term commercial bank was often used to distinguish it from an investment bank due to differences in bank regulation. After the Great Depression, through the Glass–Steagall Act, the U.S. Congress required that commercial banks only engage in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate Development

Real estate development, or property development, is a business process, encompassing activities that range from the renovation and re-lease of existing buildings to the purchase of raw land and the sale of developed land or parcels to others. Real estate developers are the people and companies who coordinate all of these activities, converting ideas from paper to real property. Real estate development is different from construction or housebuilding, although many developers also manage the construction process or engage in housebuilding. Developers buy land, finance real estate deals, build or have builders build projects, develop projects in joint venture, create, imagine, control, and orchestrate the process of development from the beginning to end.New York Times, March 16, 1963, "Personality Boom is Loud for Louis Lesser" Developers usually take the greatest risk in the creation or renovation of real estate and receive the greatest rewards. Typically, developers purchas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cathedral in the City of London. Since 2007, it has been part of the London Stock Exchange Group (LSEG, that it also lists ()). The LSE was the most-valued stock exchange in Europe from 2003 when records began till Autumn 2022, when the Paris exchange was briefly larger, until the LSE retook its position as Europe’s largest stock exchange 10 days later. History Coffee House The Royal Exchange had been founded by English financier Thomas Gresham and Sir Richard Clough on the model of the Antwerp Bourse. It was opened by Elizabeth I of England in 1571. During the 17th century, stockbrokers were not allowed in the Royal Exchange due to their rude manners. They had to operate from other establishments in the vicinity, notably ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dubai Financial Market

The Dubai Financial Market (DFM) ( ar, سوق دبي المالي) is a stock exchange located in Dubai, United Arab Emirates. It was founded on 26 March 2000. Overview , there are 67 companies listed on DFM. Most of them are UAE-based companies and a few others are dual listings for companies based in other MENA region countries. Foreign companies are from the following countries: Kuwait, Bahrain, Oman, and Sudan. Many companies allow foreigners to own their shares. During 2004 and 2005, there were significant increases in the volume of shares traded and the share prices of many companies. However, towards the end of 2005 and through the first few months of 2006 the bubble burst and share values dropped by around 60% on DFM, along with similar decreases in most other Persian Gulf stock markets. DFM is one of three stock exchanges in the UAE. Abu Dhabi Securities Exchange (ADX) also lists mostly UAE companies and NASDAQ Dubai was set up to trade international stocks. DFM and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kuwait Stock Exchange

Boursa Kuwait Securities Co., is the private-sector corporate owner and operator of the Kuwait Stock Exchange (KSE), the national stock market of Kuwait. History Although several share holding companies (such as National Bank of Kuwait (NBK) in 1952) existed in Kuwait prior to the creation of the Kuwait Stock Exchange, it was not until October 1962 that a law was passed to organize the country's stock market. In April 1977, the stock exchange was initiated and it was named as the Kuwait Stock Exchange (KSE) in 1983. The stock market in Kuwait is regulated by four bodies: the KSE, the Ministry of Commerce and Industry, the Ministry of Finance and the Central Bank of Kuwait. On April 24, 2016, the Kuwait Stock Exchange became fully operated by a private company and its name changed to Boursa Kuwait, making it the only stock exchange in the Middle East owned by the private sector. On September 14, 2020, the Boursa Kuwait Securities Co. was listed on Boursa Kuwait, becoming a self- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bahrain Stock Exchange

The Bahrain Bourse, also called the Bahrain Stock Exchange (BSE), is the stock exchange of Bahrain. As at 2017, 42 companies were listed on the exchange. The exchange operates from Sunday to Thursday. Three indices track the Bahrain Bourse (BHB): the Bahrain All Share Index, the Dow Jones Bahrain Index and the Estirad Index. The BSE was established in 1987 by Amiri decree Amiri decree No.(4) and officially commenced operations on 17 June 1989, with 29 listed companies. It operated as an autonomous institution supervised by an independent Board of Directors, chaired by the Governor of the Central Bank of Bahrain. Bahrain Bourse (BHB) was established as a shareholding company under Law No. 60 of 2010 that replaced the BSE. The Bahrain Bourse is a member of the Federation of Euro-Asian Stock Exchanges. Foreign ownership of securities foreigners can purchase, own or sell bonds, units of mutual funds, and warrants of domestic joint-stock companies. Foreigners who reside in Bahrain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not ( unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Risk

Liquidity risk is a financial risk that for a certain period of time a given financial asset, security or commodity cannot be traded quickly enough in the market without impacting the market price. Types Market liquidity – An asset cannot be sold due to lack of liquidity in the market – essentially a sub-set of market risk. This can be accounted for by: * Widening bid–offer spread * Making explicit liquidity reserves * Lengthening holding period for value at risk (VaR) calculations Funding liquidity – Risk that liabilities: * Cannot be met when they fall due * Can only be met at an uneconomic price * Can be name-specific or systemic Causes Liquidity risk arises from situations in which a party interested in trading an asset cannot do it because nobody in the market wants to trade for that asset. Liquidity risk becomes particularly important to parties who are about to hold or currently hold an asset, since it affects their ability to trade. Manifestation of liquidity r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |