|

Government Spending In The United States

Government spending in the United States is the spending of the federal government of the United States, and the spending of its state and local governments. Total government spending The US government's Bureau of Economic Analysis for 2019 estimates $7.3 trillion in total government expenditure and $21.4 trillion total GDP which is 34%.Tables 3.1 and 1.1.5, This government total excludes spending by "government enterprises" which sell goods and services "to households and businesses in a market transaction." These "government enterprises" include the U.S. Postal Service, Federal Housing Administration, flood insurance, housing authorities, transit systems, airports, water ports, and utilities. However "their investment, interest payments, and operating surplus (or deficit) are recorded as government transactions." BEA also shows $3.8 trillion government consumption expenditures and gross investment, which excludes transfer payments (like social security), subsidies and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Revenue And Spending GDP

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The major types of political systems in the modern era are democracies, monarchies, and authoritarian and totalitarian regimes. Historically prevalent forms of government include monarchy, aristocracy, timocracy, oligarchy, democracy, theocracy, and tyranny. These forms are not always mutually exclusive, and mixed governm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The original Social Security Act was enacted in 1935,Social Security Act of 1935 and the current version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for August 2022 was $1,547. The total cost of the Social Security program for the year 2021 was $1.145 trillion or about 5 percent of U.S. GDP. Social Security is funded primarily through payroll taxes called Federal Insurance Contributions Act tax (FICA) or Self Employed Contributions Act Tax (SECA). Wage and salary earnings in covered employment, up to an amount specifically determined by law (see tax rate table below), are subject to the Social Security payroll tax. Wage and salary earnings above this amount are not taxed. I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

President Of The United States

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces. The power of the presidency has grown substantially since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasingly strong role in American political life since the beginning of the 20th century, with a notable expansion during the presidency of Franklin D. Roosevelt. In contemporary times, the president is also looked upon as one of the world's most powerful political figures as the leader of the only remaining global superpower. As the leader of the nation with the largest economy by nominal GDP, the president possesses significant domestic and international hard and soft power. Article II of the Constitution establis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Appropriations Bill (United States)

In the United States Congress, an appropriations bill is legislation to appropriate federal funds to specific federal government departments, agencies and programs. The money provides funding for operations, personnel, equipment and activities. Regular appropriations bills are passed annually, with the funding they provide covering one fiscal year. The ''fiscal year'' is the accounting period of the federal government, which runs from October 1 to September 30 of the following year. Appropriations bills are under the jurisdiction of the United States House Committee on Appropriations and the United States Senate Committee on Appropriations. Both Committees have twelve matching subcommittees, each tasked with working on one of the twelve annual regular appropriations bills. There are three types of appropriations bills: regular appropriations bills, continuing resolutions, and supplemental appropriations bills. Regular appropriations bills are the twelve standard bills that cover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2021 US Federal Discretionary Outlays

1 (one, unit, unity) is a number representing a single or the only entity. 1 is also a numerical digit and represents a single unit of counting or measurement. For example, a line segment of ''unit length'' is a line segment of length 1. In conventions of sign where zero is considered neither positive nor negative, 1 is the first and smallest positive integer. It is also sometimes considered the first of the infinite sequence of natural numbers, followed by 2, although by other definitions 1 is the second natural number, following 0. The fundamental mathematical property of 1 is to be a multiplicative identity, meaning that any number multiplied by 1 equals the same number. Most if not all properties of 1 can be deduced from this. In advanced mathematics, a multiplicative identity is often denoted 1, even if it is not a number. 1 is by convention not considered a prime number; this was not universally accepted until the mid-20th century. Additionally, 1 is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

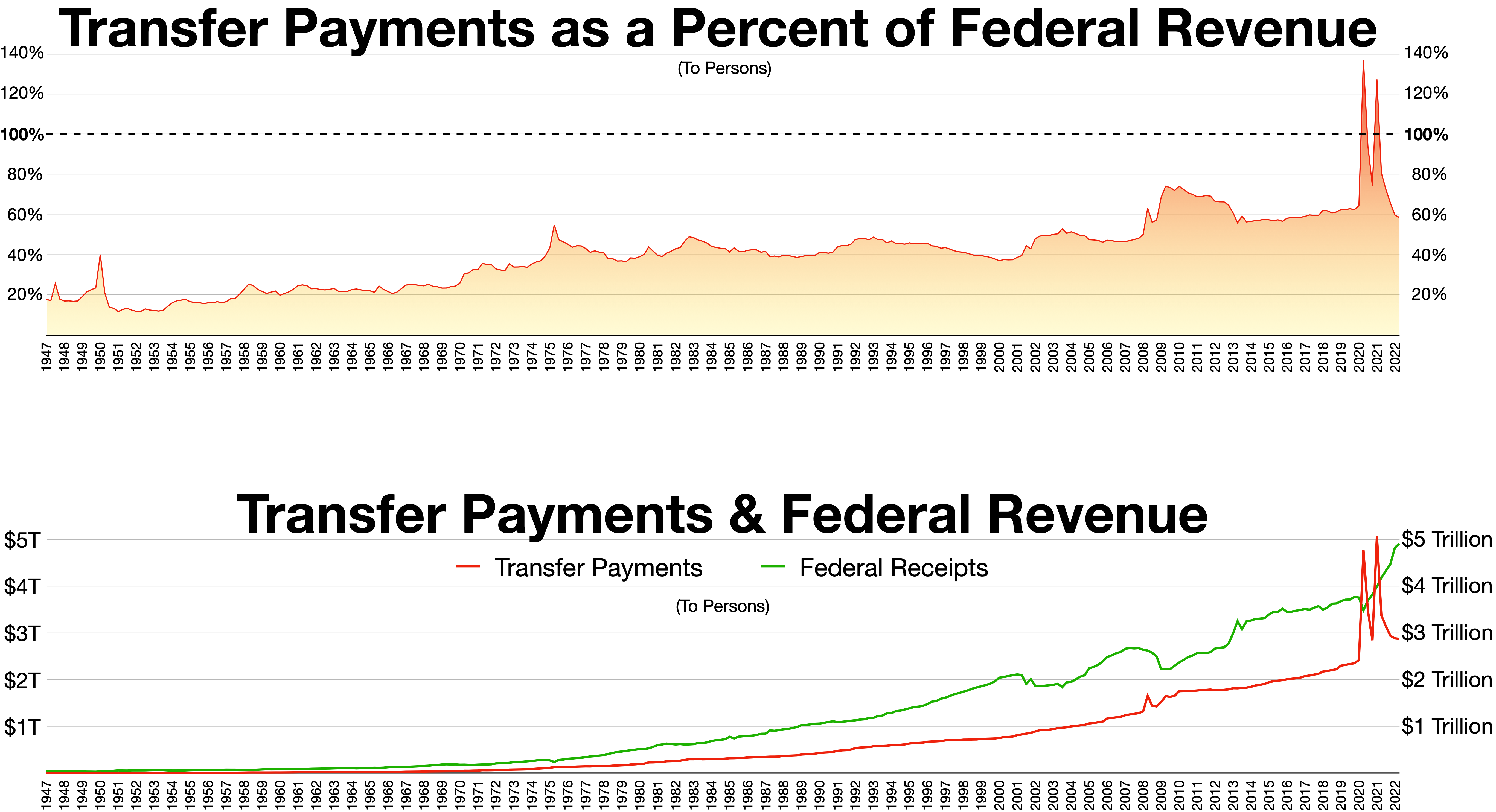

Mandatory Spending

The United States federal budget is divided into three categories: mandatory spending, discretionary spending, and interest on debt. Also known as entitlement spending, in US fiscal policy, mandatory spending is government spending on certain programs that are required by law. Congress established mandatory programs under authorization laws. Congress legislates spending for mandatory programs outside of the annual appropriations bill process. Congress can only reduce the funding for programs by changing the authorization law itself. This requires a 60-vote majority in the Senate to pass. Discretionary spending on the other hand will not occur unless Congress acts each year to provide the funding through an appropriations bill. Mandatory spending has taken up a larger share of the federal budget over time. In fiscal year (FY) 1965, mandatory spending accounted for 5.7 percent of gross domestic product (GDP). In FY 2016, mandatory spending accounted for about 60 percent of the fed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Energy In The United States

Energy in the United States came mostly from fossil fuels in 2021 as 36% of the nation's energy originated from petroleum, 32% from natural gas, and 11% from coal. Nuclear power supplied 8% and renewable energy supplied 12%, which includes hydroelectric dams, biomass, wind, geothermal, and solar. The United States was the second-largest energy consumer in 2010 after China. The country is ranked seventh in energy consumption per capita after Canada and several small nations.World Per Capita Total Primary Energy Consumption, 1980–2005 (MS Excel format) As of 2006, the country's energy consumption had increased more rapidly than domestic energy production over the last 50 years in the nation (when they were roughly equal). This difference was largely met through imports.< ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Agriculture In The United States

Agriculture is a major industry in the United States, which is a net exporter of food. As of the 2017 census of agriculture, there were 2.04 million farms, covering an area of , an average of per farm. Agriculture in the United States is highly mechanized, with an average of only one farmer or farm laborer required per square kilometer of farmland for agricultural production. Although agricultural activity occurs in every U.S. state, it is particularly concentrated in the Great Plains, a vast expanse of flat arable land in the center of the nation, in the region west of the Great Lakes and east of the Rocky Mountains. The eastern wetter half is a major corn and soybean producing region known as the Corn Belt, and the western drier half is known as the Wheat Belt because of its high rate of wheat production. The Central Valley of California produces fruits, vegetables, and nuts. The American South has historically been a large producer of cotton, tobacco, and rice, bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Veterans' Benefits

The US Department of Veterans Affairs provides a wide variety of benefits, e.g., educational assistance (GI Bill), healthcare, assisted living, home loans, insurance, and burial and memorial services, for retired or separated United States armed forces personnel, their dependents, and survivors. The VA provides compensation to disabled veterans who suffer from a medical disorder or injury that was incurred in, or aggravated by, their military service, and which causes social and occupational impairment. Many U.S. states also offer disability benefits for veterans. Archival record of the benefits awarded to injured soldiers and veterans of the American Civil War began after 1865. Union soldiers received a more committed pension archival effort on the part of the Federal government, thanks to superior databases in the North and a more stable bureaucratic oversight. Turmoil during Reconstruction in the war-weary South made any effort at maintaining pension records difficult if n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

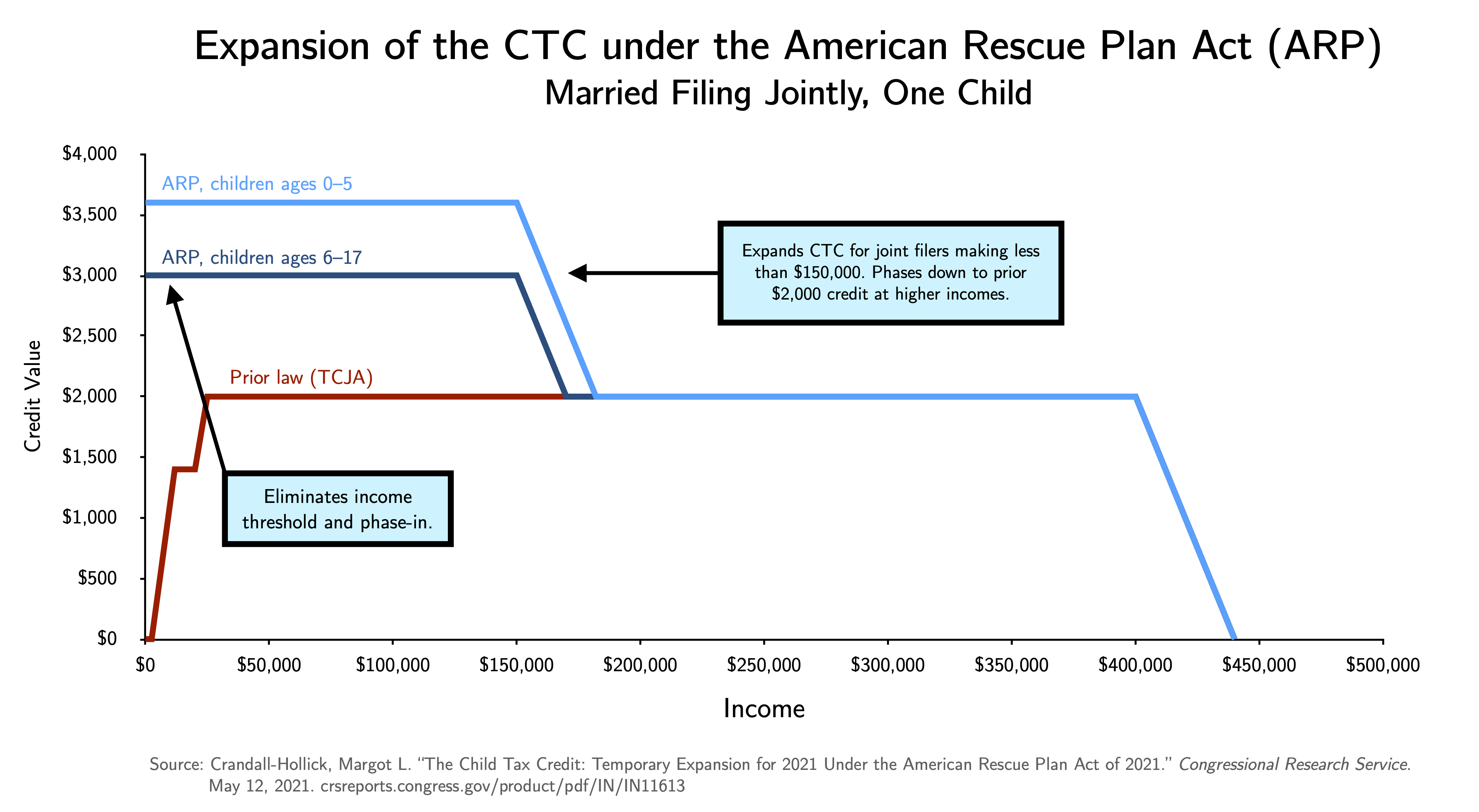

Child Tax Credit

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. EITC phases in slowly, has a medium-length plateau, and phases out more slowly than it was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |