|

Government Financial Statements

Government financial statements are annual financial statements or reports for the year. The financial statements, in contrast to budget, present the revenue collected and amounts spent. The government financial statements usually include a statement of activities (similar to an income statement in the private sector), a balance sheet and often some type of reconciliation. Cash flow statements are often included to show the sources of the revenue and the destination of the expenses. Specific countries and jurisdictions India The Annual Financial Statement of India is tabled in the Indian Parliament by the Finance Minister on the Budget Day. 13-15 other documents are also released in the Parliament along with the actual Statement. Briefly divided into three parts, namely- Consolidated Fund, Contingency Fund and Public Account, the Statement comprises the receipts and expenditure incurred by the Government on each part. United Kingdom The UK Government publishes annual accounts fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Statements

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements accompanied by a management discussion and analysis: # A balance sheet or statement of financial position, reports on a company's assets, liabilities, and owners equity at a given point in time. # An income statement—or profit and loss report (P&L report), or statement of comprehensive income, or statement of revenue & expense—reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period. # A statement of changes in equity or statement of equity, or statement of retained earnings, reports on t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comptroller And Auditor General (United Kingdom)

The Comptroller and Auditor General (C&AG) in the United Kingdom is the government official responsible for supervising the quality of public accounting and financial reporting. The C&AG is an officer of the House of Commons who is the head of the National Audit Office, the body that scrutinises central government expenditure. Under the Budget Responsibility and National Audit Act 2011 the C&AG is appointed by the monarch by letters patent upon an address of the House of Commons presented by the Prime Minister with the agreement of the Chair of the Public Accounts Committee. The C&AG can be removed from office, also by the monarch, only upon an address of both Houses of Parliament. The full title of the office is ''Comptroller General of the Receipt and Issue of Her Majesty's Exchequer and Auditor General of Public Accounts''. The current C&AG is Gareth Davies (not the MP). History The office of C&AG was created by the Exchequer and Audit Departments Act 1866, which combine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Statements

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The major types of political systems in the modern era are democracies, monarchies, and authoritarian and totalitarian regimes. Historically prevalent forms of government include monarchy, aristocracy, timocracy, oligarchy, democracy, theocracy, and tyranny. These forms are not always mutually exclusive, and mixed govern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

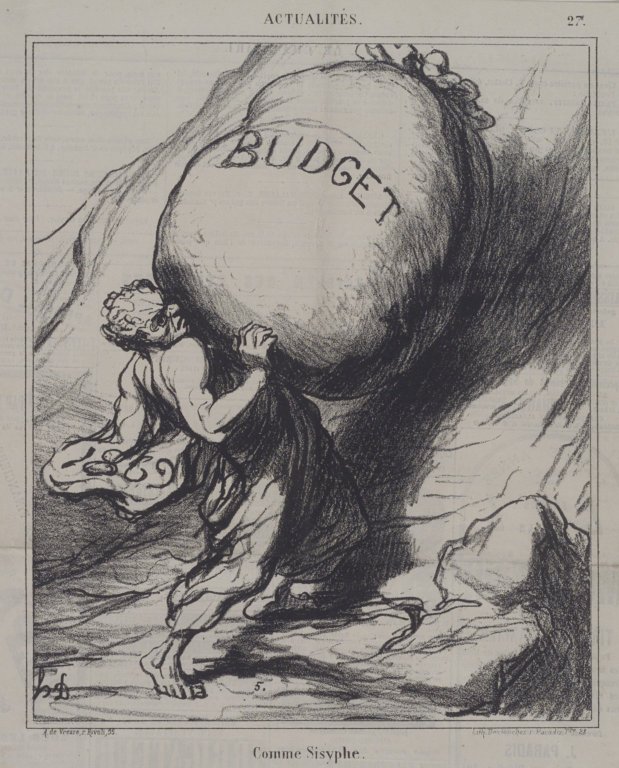

Budget Explained By The Economic Times

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Federation Of Accountants

The International Federation of Accountants (IFAC) is the global advocacy organization for the accountancy profession; mainly for the financial accounting and auditing professions. Founded in 1977, IFAC has more than 175 members and associates in more than 130 countries and jurisdictions, representing more than 3 million accountants employed in public practice, industry and commerce, government, and academia. The organization supports the development, adoption, and implementation of international standards for accounting education, ethics, and the public sector as well as audit and assurance. It supports four independent standard-setting boards, which establish international standards on ethics, auditing and assurance, accounting education, and public sector accounting. It also issues guidance to encourage high-quality performance by professional accountants in small and medium business accounting practices. To ensure the activities of IFAC and the independent standard-setting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Accounting Standards Board

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The major types of political systems in the modern era are democracies, monarchies, and authoritarian and totalitarian regimes. Historically prevalent forms of government include monarchy, aristocracy, timocracy, oligarchy, democracy, theocracy, and tyranny. These forms are not always mutually exclusive, and mixed govern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of Federal Financial Management

The Office of Federal Financial Management (OFFM) is a component of the United States Office of Management and Budget (OMB), which is part of the Executive Office of the President of the United States The Executive Office of the President (EOP) comprises the offices and agencies that support the work of the president at the center of the executive branch of the United States federal government. The EOP consists of several offices and agen ... (EOP). The President of the United States appoints the controller, who serves as the chief officer of OFFM. The current acting OFFM Controller is John C. Pasquantino. Organization OFFM is made up of two branches: the Management Controls and Assistance Branch and the Accountability, Performance and Reporting Branch. Mission and responsibilities OFFM's mission is to support the effective and transparent use of Federal financial resources. OFFM's responsibilities includes implementing the financial management priorities of the President ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CFO Act

The chief financial officer (CFO) is an officer of a company or organization that is assigned the primary responsibility for managing the company's finances, including financial planning, management of financial risks, record-keeping, and financial reporting. In some sectors, the CFO is also responsible for analysis of data. Some CFOs have the title CFOO for chief financial and operating officer. In the majority of countries, finance directors (FD) typically report into the CFO and FD is the level before reaching CFO. The CFO typically reports to the chief executive officer (CEO) and the board of directors and may additionally have a seat on the board. The CFO supervises the finance unit and is the chief financial spokesperson for the organization. The CFO directly assists the chief operating officer (COO) on all business matters relating to budget management, cost–benefit analysis, forecasting needs, and securing of new funding. Qualification Most CFOs of large companies ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Government

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a federal district (the city of Washington in the District of Columbia, where most of the federal government is based), five major self-governing territories and several island possessions. The federal government, sometimes simply referred to as Washington, is composed of three distinct branches: legislative, executive, and judicial, whose powers are vested by the U.S. Constitution in the Congress, the president and the federal courts, respectively. The powers and duties of these branches are further defined by acts of Congress, including the creation of executive departments and courts inferior to the Supreme Court. Naming The full name of the republic is "United States of America". No other name appears in the Constitution, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Treasury

His Majesty's Treasury (HM Treasury), occasionally referred to as the Exchequer, or more informally the Treasury, is a department of His Majesty's Government responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting (OSCAR), the replacement for the Combined Online Information System (COINS), which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts (WGA) annual financial statements are produced. History The origins of the Treasury of England have been traced by some to an individual known as Henry the Treasurer, a servant to King William the Conqueror. This claim is based on an entry in the Domesday Book showing the individual Henry "the treasurer" as a landowner in Winchester, where the royal treasure was stored. The Treasury of the United Kingdom thus traces its origins to the Treasury o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auditor Independence

Auditor's Independence Independence ensures that auditors don't have any financial interest in the firms in which they are auditing. An auditor is required to be impartial in all aspects of the audit, but must also acknowledge a commitment to fairness and to management of the client and any one person who may rely on the independent auditor's report. Independence requirements are founded on 4 major standards: (1) An auditor can not audit their own work, (2) An auditor can not participate in the role of management for their client, (3) Relationships that create a shared or opposing interests between client and auditor are not allowed, (4) An auditor is not allowed to advocate for their client. Auditor independence refers to the independence of the internal auditor or of the external auditor from parties that may have a financial interest in the business being audited. Independence requires integrity and an objective approach to the audit process. The concept requires the audi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow Statement

In financial accounting, a cash flow statement, also known as ''statement of cash flows'', is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7) is the International Accounting Standard that deals with cash flow statements. People and groups interested in cash flow statements include: * Accounting personnel, who need to know whether the organization will be able to cover payroll and other immediate expenses * Potential lenders or creditors, who want a clear picture of a company's ability to repay * Potential investors, who need to judge whether ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |