|

Grace Period

A grace period is a period immediately after the deadline for an obligation during which a late fee, or other action that would have been taken as a result of failing to meet the deadline, is waived provided that the obligation is satisfied during the grace period. In other words, it is a length of time during which rules or penalties are waived or deferred. Grace periods can range from a number of minutes to a number of days or longer, and can apply in situations including arrival at a job, paying a bill, or meeting a government or legal requirement. In law, a grace period is a time period during which a particular rule exceptionally does not apply, or only partially applies. For the grace period in patent law, see novelty (patent). In games (video and real life), a grace period is the time after a respawn in which a player cannot be hit or killed – they are 'safe' for a short time so that they will not die repeatedly, which would lead to loss of enjoyment and excessive l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Novelty (patent)

Novelty is one of the patentability requirements for a patent claim, whose purpose is to prevent issuing patents on known things, i.e. to prevent public knowledge from being taken away from the public domain.: "I. Patentability; C. Novelty; 1. General" ("An invention can be patented only if it is new. An invention is considered to be new if it does not form part of the state of the art. The purpose of Art. 54(1) EPC is to prevent the state of the art being patented again (T 12/81, OJ 1982, 296; T 198/84, OJ 1985, 209).") An invention is anticipated (i.e. not new) and therefore not patentable if it was known to the public before the priority date of the patent application. Although the concept of "novelty" in patent law appears simple and self-explanatory, this view is very far from reality. Some of the most contentious questions of novelty comprise: # inventor's own prior disclosures (only a few countries provide a grace period, most notably, 1 year in the US); # new uses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Late Fee

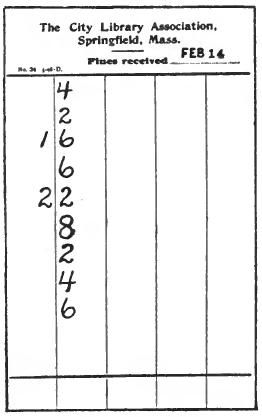

A late fee, also known as an overdue fine, late fine, or past due fee, is a charge fined against a client by a company or organization for not paying a bill or returning a rented or borrowed item by its due date. Its use is most commonly associated with businesses like creditors, video rental outlets and libraries. Late fees are generally calculated on a per day, per item basis. Organizations encourage the payment of late fees by suspending a client's borrowing or rental privileges until accumulated fees are paid, sometimes after these fees have exceeded a certain level. Late fees are issued to people who do not pay on time and don't honor a lease or obligation for which they are responsible. Library fine Library fines, also known as overdue fines, late fees, or overdue fees, are small daily or weekly fees that libraries in many countries charge borrowers after a book or other borrowed item is kept past its due date. Library fines are an enforcement mechanism designed to ensure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self Storage

Self storage (a shorthand for "self-service storage") is an industry that renting, rents storage space (such as rooms, lockers, Shipping container, shipping containers, and/or outdoor space), also known as "storage units," to tenants, usually on a short-term basis (often month-to-month). Self-storage tenants include businesses and individuals. When discussing why a storage space is rented, industry experts often refer to "4Ds of life" (death, divorce, delimitation, and discombobulation; the latter can refer to either the renter relocating to another area and needing space to store items until they can be moved to the new location, or a subsequent marriage resulting in the couple having duplicate items). Description Self-storage facilities rent space on a short-term basis (often month-to-month, though options for longer-term leases are available) to individuals (usually storing household goods; nearly all jurisdictions prohibit the space from being used as a residence) or to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sunset Clause

In public policy, a sunset provision or sunset clause is a measure within a statute, regulation, or other law that provides for the law to cease to be effective after a specified date, unless further legislative action is taken to extend it. Unlike most laws that remain in force indefinitely unless they are amended or repealed, sunset provisions have a specified expiration date. Desuetude renders a law invalid after long non-use. Origin The roots of sunset provisions are laid in Roman law of the mandate but the first philosophical reference is traced in the laws of Plato.Antonios Kouroutakis, "The Constitutional Value of Sunset Clauses" Routledge 2017 At the time of the Roman Republic, the empowerment of the Roman Senate to collect special taxes and to activate troops was limited in time and extent. Those empowerments ended before the expiration of an electoral office, such as the Proconsul. The rule ''Ad tempus concessa post tempus censetur denegata'' is translated as "what is a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Interest

Credit card interest is a way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer (the cardholder) a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously. The bank pays the payee and then charges the cardholder interest over the time the money remains borrowed. Banks suffer losses when cardholders do not pay back the borrowed money as agreed. As a result, optimal calculation of interest based on any information they have about the cardholder's credit risk is key to a card issuer's profitability. Before determining what interest rate to offer, banks typically check national, and international (if applicable), credit bureau reports to identify the borrowing history of the card holder applicant with other banks and conduct detailed interviews and documentation of the applicant's finances. Interest rates Interest rates vary widely. Some credit card loans ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Finance

Personal finance is the financial management that an individual or a family unit performs to budget, save, and spend monetary resources in a controlled manner, taking into account various financial risks and future life events. When planning personal finances, the individual would take into account the suitability of various banking products ( checking accounts, savings accounts, credit cards, and loans), insurance products ( health insurance, disability insurance, life insurance, etc.), and investment products ( bonds, stocks, real estate, etc.), as well as participation in monitoring and management of credit scores, income taxes, retirement funds and pensions. History Before a specialty in personal finance was developed, various closely related disciplines, such as family economics and consumer economics, were taught in various colleges as part of home economics for over 100 years. In 1920, Hazel Kyrk's dissertation at the University of Chicago was inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Procrastinator

Procrastination is the act of unnecessarily delaying or postponing something despite knowing that there could be negative consequences for doing so. It is a common human experience involving delays in everyday chores or even putting off tasks such as attending an appointment, submitting a job report or academic assignment, or broaching a stressful issue with a partner. It is often perceived as a negative trait due to its hindering effect on one's productivity, associated with depression, low self-esteem, guilt, and feelings of inadequacy. However, it can also be considered a wise response to certain demands that could present risky or negative outcomes or require waiting for new information to arrive. From a cultural and social perspective, students from both Western and Non-Western cultures are found to exhibit academic procrastination, but for different reasons. Students from Western cultures tend to procrastinate in order to avoid doing worse than they have done before or faili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Turn-off Notice

A turn-off notice, cut-off notice, or shut-off notice is a warning letter sent out by the provider of a service for a residence or other building, such as utility, phone service, or cable television, that if payment is not sent by the date indicated in the notice, the service will be interrupted. Turn-off notices, which are sent after a regular bill has been sent, but may resemble a bill, are generally sent several days to weeks before the planned date, giving the customer a sufficient amount of time to make a payment that would avert the interruption. Turn-off notices are often sent to those who are economically struggling, thereby having difficulty paying their bills on time, the absent-minded who are able to afford their bills but are disorganized in making timely payments, and to those who are out of commission to pay bills due to personal unforeseen circumstances, such as illness. In some cases, the turnoff notice may be necessary to obtain government or private aid in payi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment

Employment is a relationship between two party (law), parties Regulation, regulating the provision of paid Labour (human activity), labour services. Usually based on a employment contract, contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wage, wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuity, gratuities, bonus payments or employee stock option, stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, and disability insurance. Employment is typically governed by Labour law, employment laws, o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility

In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings. * In a normative context, utility refers to a goal or objective that we wish to maximize, i.e., an objective function. This kind of utility bears a closer resemblance to the original utilitarian concept, developed by moral philosophers such as Jeremy Bentham and John Stuart Mill. * In a descriptive context, the term refers to an ''apparent'' objective function; such a function is revealed by a person's behavior, and specifically by their preferences over lotteries, which can be any quantified choice. The relationship between these two kinds of utility functions has been a source of controversy among both economists and ethicists, with most maintaining that the two are distinct but generally related. Utility function Consider a set of alternatives among which a person has a preference ordering. A utility fu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |