|

Fund Administration

Fund administration is the name given to the execution of back-office activities including fund accounting, financial reporting, net asset value calculation, capital calls, distributions, investor communications and other functions carried out in support of an investment fund, which may take the form of a traditional mutual fund, a hedge fund, a private equity fund, a venture capital fund, a pension fund, a unit trust, or other pooled investment vehicle. Managers of funds often choose to outsource some or all of these activities to external specialist companies, such as the fund's custodian bank or transfer agent. These companies are known as fund administrators. Calculation of NAV, and other administrator activities These administrative activities may include the following administrative functions, which may include "fund accounting" functions. Some of these items may be specific to fund operations in the US, and some pertain only whether the fund is an SEC-registered fund: *Cal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fund Accounting

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law.Leon E. Hay (1980). ''Accounting for Governmental and Nonprofit Entities, Sixth edition'', page 5. Richard D. Irwin, Inc., Homewood, IL. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a ''fund'' consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions. The label ''fund accounting'' has also been applied to investment accounting, portfolio accounting or securities accounting – all synonyms describing the process of accounting for a portfolio of investments such as securities, commodities and/or real estate held in an investment fund such as a mutual fund or hedge fund. Investment accou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Broker

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confused with that of an agent—one who acts on behalf of a principal party in a deal. Definition A broker is an independent party whose services are used extensively in some industries. A broker's prime responsibility is to bring sellers and buyers together and thus a broker is the third-person facilitator between a buyer and a seller. An example would be a real estate or stock broker who facilitates the sale of a property. Brokers can furnish market research and market data. Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers for the perf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fund Governance

Fund governance refers to a system of checks and balances and work performed by the governing body (board) of an investment fund to ensure that the fund is operated not only in accordance with law, but also in the best interests of the fund and its investors. The objective of fund governance is to uphold the regulatory principles commonly known as the four pillars of investor protection that are typically promulgated through the investment fund regulation applicable in the jurisdiction of the fund. These principles vary by jurisdiction and in the US, the 1940 Act generally ensure that: (i) The investment fund will be managed in accordance with the fund's investment objectives, (ii) The assets of the investment fund will be kept safe, (iii) When investors redeem they will get their pro rata share of the investment fund's assets, (iv) The investment fund will be managed for the benefit of the fund's shareholders and not its service providers. Fund governance structures Offshore inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duty Of Care

In tort law, a duty of care is a legal obligation that is imposed on an individual, requiring adherence to a standard of reasonable care while performing any acts that could foreseeably harm others. It is the first element that must be established to proceed with an action in negligence. The claimant must be able to show a duty of care imposed by law that the defendant has breached. In turn, breaching a duty may subject an individual to liability. The duty of care may be imposed ''by operation of law'' between individuals who have no ''current'' direct relationship (familial or contractual or otherwise) but eventually become related in some manner, as defined by common law (meaning case law). Duty of care may be considered a formalisation of the social contract, the implicit responsibilities held by individuals towards others within society. It is not a requirement that a duty of care be defined by law, though it will often develop through the jurisprudence of common law. Dev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citco

The Intelligence Center for Counter-Terrorism and Organized Crime ( es, Centro de Inteligencia contra el Terrorismo y el Crimen Organizado, CITCO) is the Spanish domestic intelligence agency responsible for the prevention of terrorism, organized crime and other violent radical organizations by managing and analyzing all internal information of the country. It was formed in October 2014 by merging of the National Anti-Terrorism Coordination Center and Intelligence Center against Organized Crime. History The agency was created on October 15, 2014 by the Royal Decree 873/2014, of 10 October 2014, which modified the Royal Decree 400/2012, of 17 February 2014, by which the basic structure of the Ministry of the Interior was developed. The agency resulted from the merged of two predecessor domestic intelligence agencies, the ''National Anti-Terrorism Coordination Center'' (CNCA) and the ''Intelligence Center against Organized Crime'' (CICO) under the Secretariat of State for Securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fairfield Greenwich Group

Fairfield Greenwich Group is an investment firm founded in 1983 in New York City. The firm had among the largest exposures to the Bernard Madoff fraud. History of the firm The firm was founded in 1983 by Walter M. Noel Jr. At one time, the firm operated from Noel's adopted hometown in Greenwich, Connecticut, before relocating its headquarters to New York City, New York. In 1989, Noel merged his business with a small brokerage firm whose general partner was Jeffrey Tucker, who had worked as a lawyer in the enforcement division of the Securities and Exchange Commission. Both Noel and Tucker are semi-retired. Fairfield offered feeder funds of single-strategy trading managers. Fairfield also started several fund of funds, each investing in a basket of hedge funds, though the offering of feeder funds has been the primary business of Fairfield. It described its investigation of investment options as "deeper and broader" than competitive firms, because of Tucker's regulatory exp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ponzi Scheme

A Ponzi scheme (, ) is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, the scheme leads victims to believe that profits are coming from legitimate business activity (e.g., product sales or successful investments), and they remain unaware that other investors are the source of funds. A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own. Some of the first recorded incidents to meet the modern definition of the Ponzi scheme were carried out from 1869 to 1872 by Adele Spitzeder in Germany and by Sarah Howe in the United States in the 1880s through the "Ladies' Deposit". Howe offered a solely female clientele an 8% monthly interest rate and then stole the money that the wome ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bernard Madoff

Bernard Lawrence Madoff ( ; April 29, 1938April 14, 2021) was an American fraudster and financier who was the admitted mastermind of the largest Ponzi scheme in history, worth about $64.8 billion. He was at one time chairman of the NASDAQ stock exchange. He advanced the proliferation of electronic trading platforms and the concept of payment for order flow, which has been described as a "legal kickback." Madoff founded a penny stock brokerage in 1960, which eventually grew into Bernard L. Madoff Investment Securities. He served as the company's chairman until his arrest on December 11, 2008. That year, the firm was the 6th-largest market maker in S&P 500 stocks. At the firm, he employed his brother Peter Madoff as senior managing director and chief compliance officer, Peter's daughter Shana Madoff as the firm's rules and compliance officer and attorney, and his now deceased sons Mark Madoff and Andrew Madoff. Peter was sentenced to 10 years in prison in 2012, and Mark h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crisis

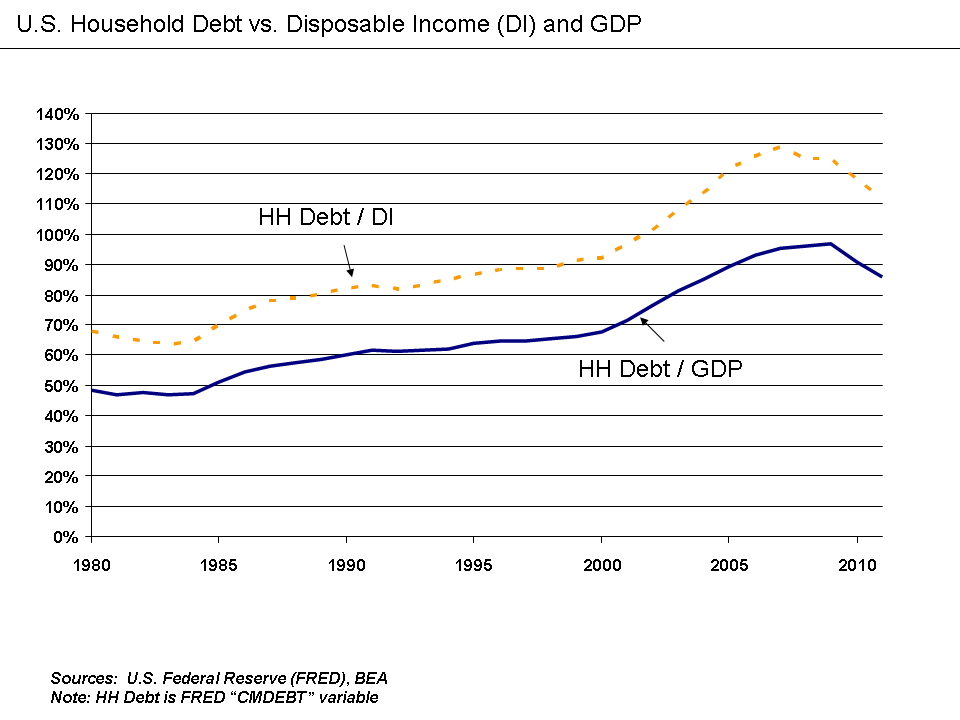

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dissolution (law)

In law, dissolution is any of several legal events that terminate a legal entity or agreement such as a marriage, adoption, corporation, or union. Dissolution is the last stage of liquidation, the process by which a company (or part of a company) is brought to an end, and the assets and property of the company are gone forever. Dissolution of a partnership is the first of two stages in the termination of a partnership. "Winding up" is the second stage.Slides 11-17 oPowerpoint for Chapter 21 from McGraw-Hill from 2nd Ed. of Kusabek Dissolution may also refer to the termination of a contract or other legal relationship; for example, a divorce is the dissolution of a marriage only if the husband or wife does not agree. If the husband and wife agree then it is a dissolution. Dissolution is also the term for the legal process by which an adoption is reversed. While this applies to the vast majority of adoptions which are terminated, they are more commonly referred to as disr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidation

Liquidation is the process in accounting by which a company is brought to an end in Canada, United Kingdom, United States, Ireland, Australia, New Zealand, Italy, and many other countries. The assets and property of the company are redistributed. Liquidation is also sometimes referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation. The process of liquidation also arises when customs, an authority or agency in a country responsible for collecting and safeguarding customs duties, determines the final computation or ascertainment of the duties or drawback accruing on an entry. Liquidation may either be compulsory (sometimes referred to as a ''creditors' liquidation'' or ''receivership'' following bankruptcy, which may result in the court creating a "liquidation trust") or voluntary (sometimes referred to as a ''shareholders' liquidation'', although some voluntary liquidations are controlled by the creditors). The term ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |