|

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States. Federal Reserve Notes are legal tender, with the words "this note is legal tender for all debts, public and private" printed on each note. The notes are backed by financial assets that the Federal Reserve Banks pledge as collateral, which are mainly Treasury securities and mortgage agency securities that they purchase on the open market by fiat payment. History Prior to centralized banking, each commercial bank issued its own notes. The first institution ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

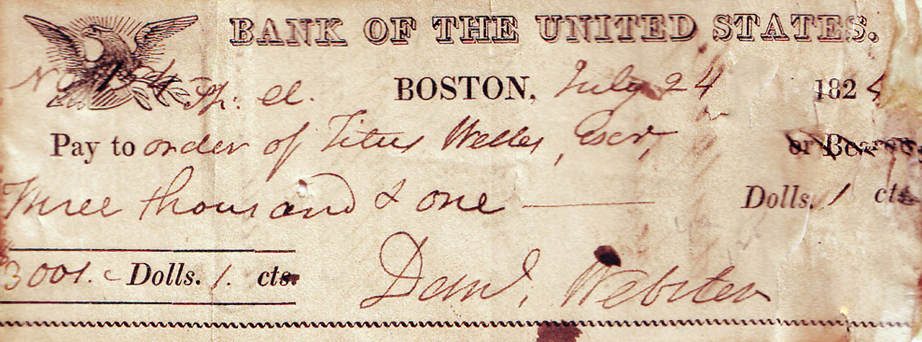

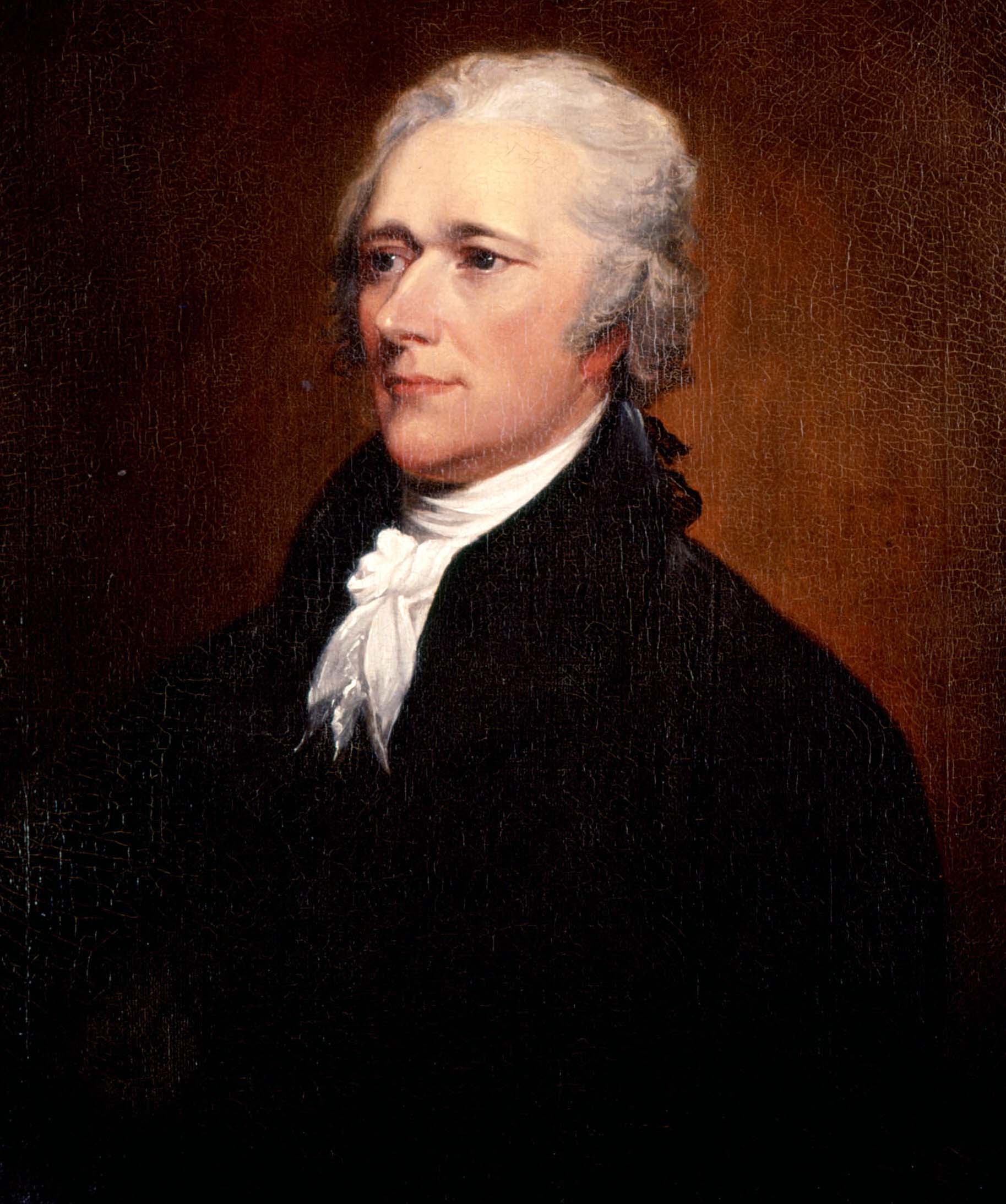

Second Bank Of The United States

The Second Bank of the United States was the second federally authorized Hamiltonian national bank in the United States. Located in Philadelphia, Pennsylvania, the bank was chartered from February 1816 to January 1836.. The Bank's formal name, according to section 9 of its charter as passed by Congress, was "The President Directors and Company of the Bank of the United States". While other banks in the US were chartered by and only allowed to have branches in a single state, it was authorized to have branches in multiple states and lend money to the US government. A private corporation with public duties, the Bank handled all fiscal transactions for the U.S. Government, and was accountable to Congress and the U.S. Treasury. Twenty percent of its capital was owned by the federal government, the Bank's single largest stockholder.. Four thousand private investors held 80 percent of the Bank's capital, including three thousand Europeans. The bulk of the stocks were held by a few hundr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Note

National Bank Notes were United States currency banknotes issued by National Banks chartered by the United States Government. The notes were usually backed by United States bonds the bank deposited with the United States Treasury. In addition, banks were required to maintain a redemption fund amounting to five percent of any outstanding note balance, in gold or "lawful money." The notes were not legal tender in general, but were satisfactory for nearly all payments to and by the federal government. National Bank Notes were retired as a currency type by the U.S. government in the 1930s, when U.S. currency was consolidated into Federal Reserve Notes, United States Notes, and silver certificates. Background Prior to the American Civil War, state banks and chartered private banks issued their own banknotes. Privately issued banknotes were nominally backed by specie ( hard money) or financial securities held by the banks but oversight of issuing banks often was lax and encourage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

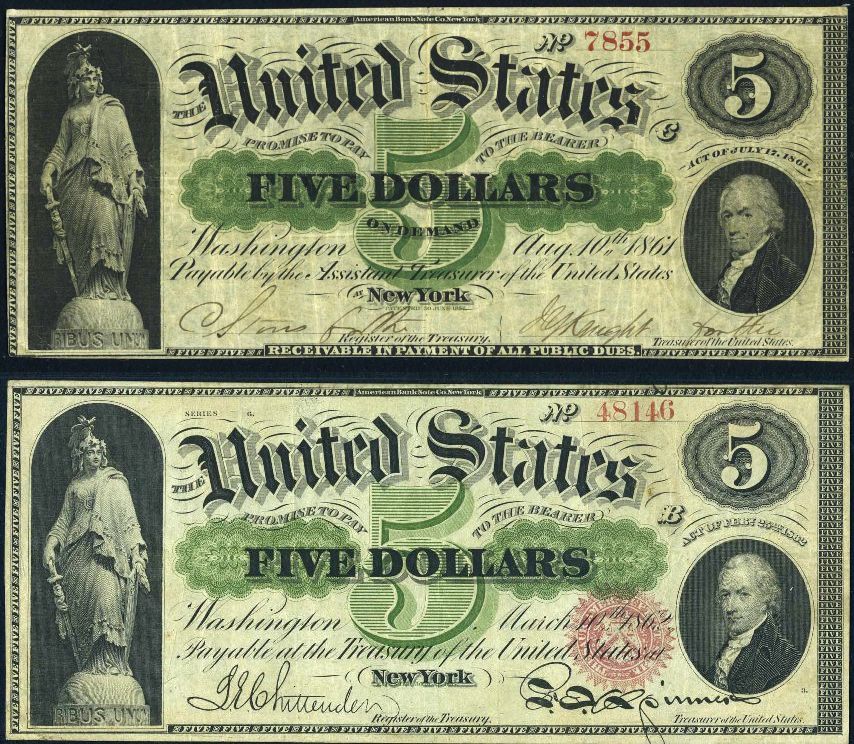

United States Note

A United States Note, also known as a Legal Tender Note, is a type of paper money that was issued from 1862 to 1971 in the U.S. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money. They were known popularly as "greenbacks", a name inherited from the earlier greenbacks, the Demand Notes, that they replaced in 1862. Often termed Legal Tender Notes, they were named United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. During the early 1860s the so-called ''second obligation'' on the reverse of the notes stated: By the 1930s, this obligation would eventually be shortened to: They were originally issued directly into circulation by the U.S. Treasury to pay expenses incurred by the Union during the American Civil War. During the next century, the legislation governing these notes was modified many times and numerous versions were issued by the Treasury. United States Notes that w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the United States presidential line of succession, presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the United States Senate Committee on Finance, Senate Committee on Finance, is confirmed by the United States Senate. The United States Secretary of State, secretary of state, the secretary of the treasury, the United States Secretary of Defense, secretary of defense, and the United States Att ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasurer Of The United States

The treasurer of the United States is an officer in the United States Department of the Treasury who serves as custodian and trustee of the federal government's collateral assets and the supervisor of the department's currency and coinage production functions. The current treasurer is Marilynn Malerba, who is the first Native American to hold the post. Responsibilities By law, the treasurer is the depositary officer of the United States with regard to deposits of gold, special drawing rights, and financial gifts to the Library of Congress. The treasurer also directly oversees the Bureau of Engraving and Printing (BEP) and the United States Mint, which respectively print and mint U.S. currency and coinage. In connection to the influence of federal monetary policy on currency and coinage production, the treasurer liaises on a regular basis with the Federal Reserve. However, the duty perhaps most widely associated with the treasurer of the United States is affixing a facsimile sign ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The departm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States. The Panic of 1907 convinced many Americans of the need to establish a central banking system, which the country had lacked since the Bank War of the 1830s. After Democrats won unified control of Congress and the presidency in the 1912 elections, President Wilson, Congressman Carter Glass, and Senator Robert Latham Owen crafted a central banking bill that occupied a middle ground between the Aldrich Plan, which called for private control of the central banking system, and progressives like William Jennings Bryan, who favored government control over the central banking system. Wilson made the bill a top priority of his New Freedom domestic agenda, and he helped ensure that it passed both houses of Congress without major amendments. Later, President ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Howard Taft

William Howard Taft (September 15, 1857March 8, 1930) was the 27th president of the United States (1909–1913) and the tenth chief justice of the United States (1921–1930), the only person to have held both offices. Taft was elected president in 1908, the chosen successor of Theodore Roosevelt, but was defeated for reelection in 1912 by Woodrow Wilson after Roosevelt split the Republican vote by running as a third-party candidate. In 1921, President Warren G. Harding appointed Taft to be chief justice, a position he held until a month before his death. Taft was born in Cincinnati, Ohio, in 1857. His father, Alphonso Taft, was a U.S. attorney general and secretary of war. Taft attended Yale and joined the Skull and Bones, of which his father was a founding member. After becoming a lawyer, Taft was appointed a judge while still in his twenties. He continued a rapid rise, being named solicitor general and a judge of the Sixth Circuit Court of Appeals. In 1901, President ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philippine Peso

The Philippine peso, also referred to by its Tagalog name ''piso'' (Philippine English: , , plural pesos; tl, piso ; sign: ₱; code: PHP), is the official currency of the Philippines. It is subdivided into 100 ''sentimo'', also called centavos. The Philippine peso sign is denoted by the symbol "₱", introduced under American rule in place of the original peso sign "$" used throughout Spanish America. Alternative symbols used are "PHP", "PhP", "Php", or just "P". The monetary policy of the Philippines is conducted by the Bangko Sentral ng Pilipinas (BSP), established on July 3, 1993, as its central bank. It produces the country's banknotes and coins at its Security Plant Complex, which is set to move to New Clark City in Capas, Tarlac."Overview of the BSP" Bangko Sentral ng Pilipinas (BSP) Official Website. Retrieved on October 1, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Series Of 1928 (United States Currency)

The Series of 1928 was the first issue of small-size currency printed and released by the U.S. government. These notes, first released to the public on July 10, 1929, were the first standardized notes in terms of design and characteristics, featuring similar portraits and other facets. These notes were also the first to measure 6.313" by 2.688", smaller than the large-sized predecessors of Series 1923 and earlier that measured 7.438" by 3.141". Federal Reserve Notes Federal Reserve Notes featured a green Treasury Seal starting in 1928. This was the only type of currency that, at first, featured the seal over the large engraved word to the right of the portrait. These notes also carried a seal bearing the identity of the Federal Reserve Bank of issuance. The bank was noted in the black, circular seal to the left of the portrait. This can be seen in the picture at the upper right, with a "7" in the seal. The Federal Reserve Bank of Chicago, responsible for the 7th district of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)