|

Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States. After Democrats won unified control of Congress and the presidency in the 1912 United States elections, 1912 elections, President Wilson, Congressman Carter Glass, and Senator Robert Latham Owen crafted a central banking bill that occupied a middle ground between the Aldrich Plan, which called for private control of the central banking system, and Progressivism in the United States, progressives like William Jennings Bryan, who favored government control over the central banking system. Wilson made the bill a top priority of his The New Freedom, New Freedom domestic agenda, and he helped ensure that it passed both houses of Congress without major amendments. The Federal Reserve Act created the Federal Reserve System, consisting of twelve regional F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carter Glass

Carter Glass (January 4, 1858 – May 28, 1946) was an American newspaper publisher and Democratic Party (United States), Democratic politician from Lynchburg, Virginia, Lynchburg, Virginia. He represented Virginia in both houses of United States Congress, Congress and served as the United States Secretary of the Treasury under President Woodrow Wilson. He played a major role in the establishment of the U.S. Bank regulation in the United States, financial regulatory system, helping to establish the Federal Reserve System and the Federal Deposit Insurance Corporation. After working as a newspaper editor and publisher, Glass won election to the Senate of Virginia in 1899. He was a delegate to the Virginia Constitutional Convention of 1902, where he was an influential advocate for Racial segregation in the United States, segregationist policies. Historian J. Douglas Smith described him as “the architect of disenfranchisement in the Old Dominion.” He also promoted Progressivism ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Jennings Bryan

William Jennings Bryan (March 19, 1860 – July 26, 1925) was an American lawyer, orator, and politician. He was a dominant force in the History of the Democratic Party (United States), Democratic Party, running three times as the party's nominee for President of the United States in the 1896 United States presidential election, 1896, 1900 United States presidential election, 1900, and 1908 United States presidential election, 1908 elections. He served in the United States House of Representatives, House of Representatives from 1891 to 1895 and as the United States Secretary of State, Secretary of State under Woodrow Wilson from 1913 to 1915. Because of his faith in the wisdom of the common people, Bryan was often called "the Great Commoner", and because of his rhetorical power and early fame as the youngest presidential candidate, "the Boy Orator". Born and raised in Illinois, Bryan moved to Nebraska in the 1880s. He won election to the House of Representatives in the 18 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 during the Presidency of George Washington, presidency of George Washington, the first president of the United States. Born out of wedlock in Charlestown, Nevis, Hamilton was orphaned as a child and taken in by a prosperous merchant. He was given a scholarship and pursued his education at Columbia College, Columbia University, King's College (now Columbia University) in New York City where, despite his young age, he was an anonymous but prolific and widely read pamphleteer and advocate for the American Revolution. He then served as an artillery officer in the American Revolutionary War, where he saw military action against the British Army during the American Revolutionary War, British Army in the New York and New Jersey campaign, served for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

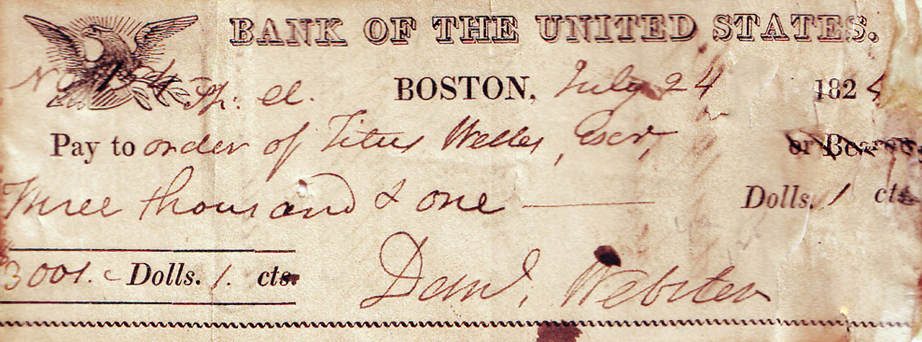

Second Bank Of The United States

The Second Bank of the United States was the second federally authorized Second Report on Public Credit, Hamiltonian national bank in the United States. Located in Philadelphia, Pennsylvania, the bank was chartered from February 1816 to January 1836.. The bank's formal name, according to section 9 of its charter as passed by Congress, was "The President, Directors, and Company, of the Bank of the United States". While other banks in the US were chartered by and only allowed to have branches in a single state, it was authorized to have branches in multiple states and lend money to the US government. A private corporation with Public–private partnership, public duties, the bank handled all fiscal transactions for the U.S. government, and was accountable to United States Congress, Congress and the U.S. Treasury. Twenty percent of its capital was owned by the federal government, the bank's single largest stockholder.. Four thousand private investors held 80 percent of the bank's ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Bank Of The United States

The President, Directors and Company of the Bank of the United States, commonly known as the First Bank of the United States, was a National bank (United States), national bank, chartered for a term of twenty years, by the United States Congress on February 25, 1791. It followed the Bank of North America, the nation's first ''de facto'' national bank. However, neither served the functions of a modern central bank: They did not set monetary policy, regulate private banks, hold their excess reserves, or act as a lender of last resort. They were national insofar as they were allowed to have branches in multiple states and lend money to the US government. Other banks in the US were each chartered by, and only allowed to have branches in, a single state. Establishment of the Bank of the United States was part of a three-part expansion of federal fiscal and monetary power, along with a federal mint and excise taxes, championed by Alexander Hamilton, first United States Secretary of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discount Window

Discount may refer to: Arts and entertainment * Discount (band), punk rock band that formed in Vero Beach, Florida in 1995 and disbanded in 2000 * ''Discount'' (film), French comedy-drama film * "Discounts" (song), 2020 single by American rapper Cupcakke Economics and business * Discounts and allowances, reductions in the basic prices of goods or services *Discounting In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Effici ..., a financial mechanism in which a debtor obtains the right to delay payments to a creditor * Delay discounting, the decrease in perceived value of receiving a good at a later date compared with receiving it at an earlier date * Discount store {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Note

Federal Reserve Notes are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Federal Reserve Board of Governors, Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States. Federal Reserve Notes are legal tender, with the words "this note is legal tender for all debts, public and private" printed on each note. The notes are backed by financial assets that the Federal Reserve Banks pledge as collateral, which are mainly United States Treasury security, Treasury securities and agency security, mortgage agency securities that they purchase on the open market by fiat money, fiat payment. History Following the enactment of the Cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Open Market Operation

In macroeconomics, an open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with a bank or a group of banks. The central bank can either transact government bonds and other financial assets in the open market or enter into a repurchase agreement or secured lending transaction with a commercial bank. The latter option, often preferred by central banks, involves them making fixed period deposits at commercial banks with the security of eligible assets as collateral. Central banks regularly use OMOs as one of their tools for implementing monetary policy. A frequent aim of open market operations is — aside from supplying commercial banks with liquidity and sometimes taking surplus liquidity from commercial banks — to influence the short-term interest rate. Open market operations have become less prominent in this respect since the 2008 financial crisis, however, as many central banks have changed their monetary policy implementatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Open Market Committee

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System (the Fed) that is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treasury securities). This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply. Under the terms of the original Federal Reserve Act, each of the Federal Reserve banks were authorized to buy and sell in the open market bonds and short term obligations of the United States Government, bank acceptances, cable transfers, and bills of exchange. Hence, the reserve banks were at times bidding against each other in the open market. In 1922, an informal committee was established to execute purchases and sales. The Banking Act of 1933 formed an official FOMC. The FOMC is the principal organ of United States national monetary policy. The Committee sets monetary policy by specifying ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1933 Banking Act

The Banking Act of 1933 () was a statute enacted by the United States Congress that established the Federal Deposit Insurance Corporation (FDIC) and imposed various other banking reforms. The entire law is often referred to as the Glass–Steagall Act, after its Congressional sponsors, Senator Carter Glass ( D) of Virginia, and Representative Henry B. Steagall (D) of Alabama. The term "Glass–Steagall Act", however, is most often used to refer to four provisions of the Banking Act of 1933 that limited commercial bank securities activities and affiliations between commercial banks and securities firms. That limited meaning of the term is described in the article on Glass–Steagall Legislation. The Banking Act of 1933 (the 1933 Banking Act) joined two long-standing Congressional projects: #A federal system of bank deposit insurance championed by Representative Steagall #The regulation (or prohibition) of the combination of commercial and investment banking and other restric ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Board Of Governors

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See It is headquartered in the Eccles Building on Constitution Avenue, N.W. in Washington, D.C. Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the chair and vice chair of the Board are two of seven members of the Board of Governors who are appointed by the president from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lender Of Last Resort

In public finance, a lender of last resort (LOLR) is a financial entity, generally a central bank, that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other facilities or such sources have been exhausted. It is, in effect, a government guarantee to provide liquidity to financial institutions. Since the beginning of the 20th century, most central banks have been providers of lender of last resort facilities, and their functions usually also include ensuring liquidity in the international markets in general. The objective is to prevent economic disruption as a result of financial panics and bank runs spreading from one bank to the others due to a lack of liquidity in the first one. There are varying definitions of a lender of last resort, but a comprehensive one is that it is "the discretionary provision of liquidity to a financial institution (or the market as a wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |