|

Financial Assistance (share Purchase)

Financial assistance in law refers to assistance given by a company for the purchase of its own shares or the shares of its holding companies. In many jurisdictions such assistance is prohibited or restricted by law. For example, all EU member states are required to restrict financial assistance by public companies up to the limit of the company's distributable reserves, although some members go further, for example, Belgium, Bulgaria, France, and The Netherlands restrict financial assistance by all companies. Where such assistance is given in breach of applicable law it will render the relevant transaction void and may constitute a criminal offence. Outline The assistance can be of a variety of different types. The most common type of assistance is a financial guarantee for a loan and/or third party security to allow a borrower to borrow money to buy shares which is routinely given (to the extent legally possible) after a leveraged buyout in support of the new owner's acquisition ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

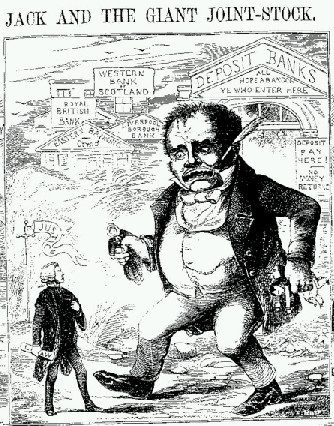

Company (law)

A company, abbreviated as co., is a legal entity representing an association of legal people, whether natural, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Over time, companies have evolved to have the following features: "separate legal personality, limited liability, transferable shares, investor ownership, and a managerial hierarchy". The company, as an entity, was created by the state which granted the privilege of incorporation. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is to generate sales, revenue, and profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duties according to the publicly declared incorporat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security Interest

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the '' collateral'') which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: a person is loaned money from a bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan. Although most security interests are created by agreement between the parties, it is also possible for a security interest to arise by operation of law. For example, in many jurisdictions a mechanic who repairs a car benefits from a lien over the car for the cost of repairs. This lien arises by operation of law in the absence of any agreement between the parties. Most security interests are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Law

Corporate law (also known as company law or enterprise law) is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation.John Armour, Henry Hansmann, Reinier Kraakman, Mariana Pargendler "What is Corporate Law?" in ''The Anatomy of Corporate Law: A Comparative and Functional Approach''(Eds Reinier Kraakman, John Armour, Paul Davies, Luca Enriques, Henry Hansmann, Gerard Hertig, Klaus Hopt, Hideki Kanda, Mariana Pargendler, Wolf-Georg Ringe, and Edward Rock, Oxford University Press 2017)1.1 It thus encompasses the formation, funding, governance, and death of a corporation. While the minute nature of corporate governance as personified by share ownership, capital market, and business culture rules diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Stock

A treasury stock or reacquired stock is stock which is bought back by the issuing company, reducing the amount of outstanding stock on the open market ("open market" including insiders' holdings). Stock repurchases are used as a tax efficient method to put cash into shareholders' hands, rather than paying dividends, in jurisdictions that treat capital gains more favorably. Sometimes, companies repurchase their stock when they feel that it is undervalued on the open market. Other times, companies repurchase their stock to reduce dilution from incentive compensation plans for employees. Another reason for stock repurchase is to protect the company against a takeover threat.Robert T. Sprouse, "Accounting for treasury stock transactions: Prevailing practices and new statutory provisions." ''Columbia Law Review'' 59.6 (1959): 882-900online/ref> The United Kingdom equivalent of treasury stock as used in the United States is treasury share. Treasury stocks in the UK refers to gover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Act 1985

The Companies Act 1985 (c. 6) is an Act of the Parliament of the United Kingdom of Great Britain and Northern Ireland, enacted in 1985, which enabled companies to be formed by registration, and set out the responsibilities of companies, their directors and secretaries. It has largely been superseded by the Companies Act 2006. The Act was a consolidation of various other pieces of company legislation, and was one component of the rules governing companies in England and Wales and in Scotland. A company will also be governed by its own memorandum and articles of association. Table A, which lays out default articles of association, was not included in the body of the Act, as it had been in all previous Companies Acts. Instead, it was introduced by statutory instrument - the Companies (Tables A to F) Regulations 1985. The Act applied only to companies incorporated under it, or under earlier Companies Acts. Sole traders, partnerships, limited liability partnerships etc. were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EU Directive

A directive is a legal act of the European Union that requires Member state of the European Union, member states to achieve particular goals without dictating how the member states achieve those goals. A directive's goals have to be made the goals of one or more new or changed national laws by the member states before this legislation applies to individuals residing in the member states. Directives normally leave member states with a certain amount of leeway as to the exact rules to be adopted. Directives can be adopted by means of a variety of European Union legislative procedure, legislative procedures depending on their subject matter. The text of a draft directive (if subject to the co-decision process, as contentious matters usually are) is prepared by the European Commission, Commission after consultation with its own and national experts. The draft is presented to the European Parliament, Parliament and the Council of the European Union, Council—composed of relevant min ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Act 2006

The Companies Act 2006 (c. 46) is an act of the Parliament of the United Kingdom which forms the primary source of UK company law. The act was brought into force in stages, with the final provision being commenced on 1 October 2009. It largely superseded the Companies Act 1985. The act provides a comprehensive code of company law for the United Kingdom, and made changes to almost every facet of the law in relation to companies. The key provisions are: * the act codifies certain existing common law principles, such as those relating to directors' duties. * it transposes into UK law the Takeover Directive and the Transparency Directive of the European Union * it introduces various new provisions for private and public companies. * it applies a single company law regime across the United Kingdom, replacing the two separate (if identical) systems for Great Britain and Northern Ireland. * it otherwise amends or restates almost all of the Companies Act 1985 to varying degrees ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commonwealth Of Nations

The Commonwealth of Nations, often referred to as the British Commonwealth or simply the Commonwealth, is an International organization, international association of member states of the Commonwealth of Nations, 56 member states, the vast majority of which are former territorial evolution of the British Empire, territories of the British Empire from which it developed. They are connected through their English in the Commonwealth of Nations, use of the English language and cultural and historical ties. The chief institutions of the organisation are the Commonwealth Secretariat, which focuses on intergovernmental relations, and the Commonwealth Foundation, which focuses on non-governmental relations between member nations. Numerous List of Commonwealth organisations, organisations are associated with and operate within the Commonwealth. The Commonwealth dates back to the first half of the 20th century with the decolonisation of the British Empire through increased self-governance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Law

Common law (also known as judicial precedent, judge-made law, or case law) is the body of law primarily developed through judicial decisions rather than statutes. Although common law may incorporate certain statutes, it is largely based on precedent—judicial rulings made in previous similar cases. The presiding judge determines which precedents to apply in deciding each new case. Common law is deeply rooted in Precedent, ''stare decisis'' ("to stand by things decided"), where courts follow precedents established by previous decisions. When a similar case has been resolved, courts typically align their reasoning with the precedent set in that decision. However, in a "case of first impression" with no precedent or clear legislative guidance, judges are empowered to resolve the issue and establish new precedent. The common law, so named because it was common to all the king's courts across England, originated in the practices of the courts of the English kings in the centuries fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leveraged Buyout

A leveraged buyout (LBO) is the acquisition of a company using a significant proportion of borrowed money (Leverage (finance), leverage) to fund the acquisition with the remainder of the purchase price funded with private equity. The assets of the acquired company are often used as collateral for the financing, along with any equity contributed by the acquiror. While corporate acquisitions often employ leverage to finance the purchase of the target, the term "leveraged buyout" is typically only employed when the acquiror is a financial sponsor (a private equity investment firm). The use of debt, which normally has a lower cost of capital than Equity (finance), equity, serves to reduce the overall cost of financing for the acquisition and enhance returns for the private equity investor. The equity investor can increase their projected returns by employing more leverage, creating incentives to maximize the proportion of debt relative to equity (i.e., debt-to-equity ratio). Whi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Surety

In finance, a surety , surety bond, or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a person or company (a ''surety'' or ''guarantor'') to pay one party (the ''obligee'') a certain amount if a second party (the ''principal'') fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. Overview A surety bond is defined as a contract among at least three parties: * the ''obligee'': the party who is the recipient of an obligation * the ''principal'': the primary party who will perform the contractual obligation * the ''surety'': who assures the obligee that the principal can perform the task European surety bonds can be issued by banks and surety companies. If issued by banks they are called "Bank Guaranties" in English a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all Seniority (financial), senior claims such as secured and unsecured debt), or Voting interest, voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of Shareholder, shareholders. Stock can be bought and sold over-the-counter (finance), privately or on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |