|

FFELP

The Federal Family Education Loan (FFEL) Program was a system of private student loans which were subsidized and guaranteed by the United States federal government. The program issued loans from 1965 until it was ended in 2010. Similar loans are now provided under the Federal Direct Student Loan Program, which are federal loans issued directly by the United States Department of Education. The FFEL was initiated by the Higher Education Act of 1965 and was funded through a public/private partnership administered at the state and local level. In 2007-08, FFEL served 6.5 million students and parents, lending a total of $54.7 billion in new loans (or 80% of all new federal student loans). Since 1965, 60 million Americans have used FFEL loans to pay for education expenses. Following the passage of the Health Care and Education Reconciliation Act of 2010 on January 5, 2010 the program was terminated, and no subsequent loans were permitted to be made under the program after June 30, 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Navient Corporation

Navient Corporation is an American financial services company and former student loan servicer based in Wilmington, Delaware. The company was formed in 2014 by the split of Sallie Mae into two distinct entities: Sallie Mae Bank and Navient. The company employs 4,500 people at offices across the US. In 2018, Navient serviced a quarter of all student loans in the United States. In 2024, the company was barred from servicing federal student loans. History Navient was chartered in 1972 as a Government-Sponsored Enterprise (GSE) called Student Loan Marketing Association (nicknamed Sallie Mae). The company was created by Congress to support the student loan program established by the Higher Education Act of 1965. It was created mainly for two reasons: 1) to purchase student loans in the secondary market; and, 2) to securitize pools of student loans. The objective is to create liquidity for these loans to increase their value to lenders, reducing the costs to borrowers in the proces ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

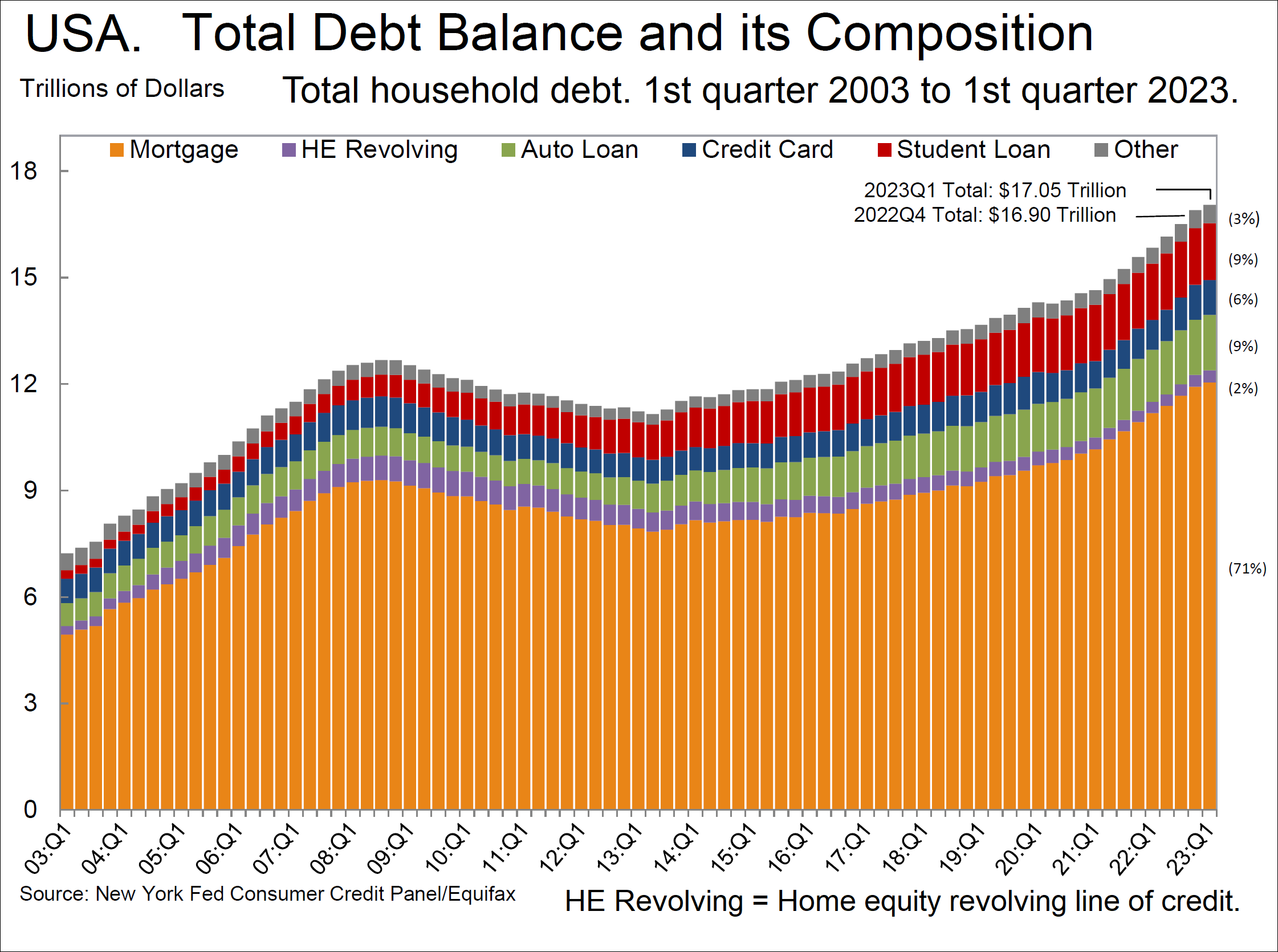

Student Loans In The United States

In the United States, student loans are a form of Student financial aid (United States), financial aid intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses. With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships and bursary, bursaries which are not repaid, and Grant (money), grants, which rarely have to be repaid. Student loans may be discharged through bankruptcy, but this is difficult. Research shows that access to student loans increases credit-constrained students' degree completion and later-life earnings while having no impact on overall debt. Student loan debt has proliferated since 2006, totaling $1.73 trillion by July 2021. In 2019, students who borrowed to complete a bachelor's degree had about $30,000 of debt upon graduation. Almost half of all loans are for graduate school, typically in much higher a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sallie Mae

SLM Corporation (commonly known as Sallie Mae; originally the Student Loan Marketing Association) is a publicly traded U.S. corporation that provides consumer banking. Its nature has changed dramatically since it was set up in the early 1970s; initially a government entity that serviced federal education loans, it then became private and began offering private student loans. The company's primary business is creating, servicing, and collecting private education loans. The company also provides online tools and resources for college planning. Sallie Mae previously originated federally guaranteed student loans under the Federal Family Education Loan Program (FFELP) and worked as a servicer and collector of federal student loans on behalf of the Department of Education. The company now offers private education loans and manages more than $12.97 billion in assets. On April 30, 2014, Sallie Mae spun off its loan servicing operation and most of its loan portfolio into a separate, p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Student Loan (United States)

A private student loan is a financing option for higher education in the United States that can supplement, but should not replace, federal loans, such as Stafford loans, Perkins loans and PLUS loans. Private loans, which are heavily advertised, do not have the forbearance and deferral options available with federal loans (which are never advertised). In contrast with federal subsidized loans, interest accrues while the student is in college, even if repayment does not begin until after graduation. While unsubsidized federal loans do have interest charges while the student is studying, private student loan rates are usually higher, sometimes much higher. Fees vary greatly, and legal cases have reported collection charges reaching 50% of amount of the loan. Since 2011, most private student loans are offered with zero fees, effectively rolling the fees into the interest rates. Interest rates and loan terms are set by the financial institution that underwrites the loan, typically b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PLUS Loan

A PLUS Loan is a student loan, which is part of the Federal Direct Student Loan Program, offered to parents of students enrolled at least half time, or graduate and professional students, at participating and eligible post-secondary institutions. The original, now obsolete, meaning of the acronym was "Parent Loan for Undergraduate Students". Similarities with Stafford and Perkins loans PLUS loans share some similarities with the Stafford and Perkins loans offered to students: * Offered under Title IV of the Higher Education Act of 1965 (with subsequent amendments) and are therefore backed by the full faith of the United States Government * Can be consolidated through the federal student loan consolidation In the United States, the Federal Direct Student Loan Program (FDLP) includes consolidation loans that allow students to consolidate Stafford Loans, Graduate PLUS Loans, and Federal Perkins Loans into one single debt. Interest rates and paym ... program Differences fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Aid And Fiscal Responsibility Act

The Student Aid and Fiscal Responsibility Act of 2009 (SAFRA; ) is a bill introduced in the U.S. House of Representatives of the 111th United States Congress by Congressman George Miller that would expand federal Pell Grants to a maximum of $5,500 in 2010 and tie increases in Pell Grant maximum values to annual increases in the Consumer Price Index plus 1%. It would also end the practice of federally subsidized private loans, using all federal student loan funding for Direct Loans and potentially cutting the federal deficit by $87 billion over 10 years. On September 17, 2009, the House approved the bill by a 253-171 margin. On March 18, 2010, the text of this act was included as a rider on the Health Care and Education Reconciliation Act of 2010, signed into law on March 30, 2010, by President Obama as an amendment to the Patient Protection and Affordable Care Act A patient is any recipient of health care services that are performed by healthcare professionals. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's California Legislative Analyst's Office, Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

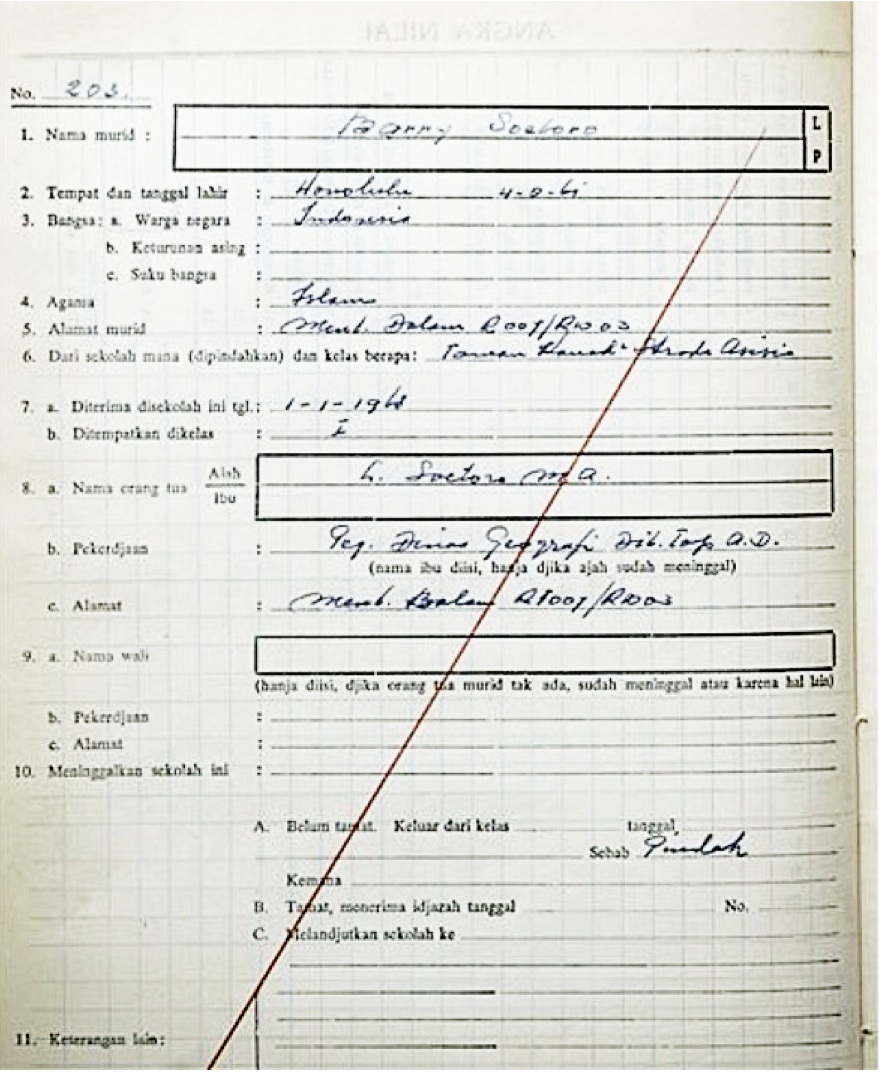

Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. Obama previously served as a U.S. senator representing Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004. Born in Honolulu, Hawaii, Obama graduated from Columbia University in 1983 with a Bachelor of Arts degree in political science and later worked as a community organizer in Chicago. In 1988, Obama enrolled in Harvard Law School, where he was the first black president of the ''Harvard Law Review''. He became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. In 1996, Obama was elected to represent the 13th district in the Illinois Senate, a position he held until 2004, when he successfully ran for the U.S. Senate. In the 2008 pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program is a United States government program that was created under the College Cost Reduction and Access Act of 2007 signed into law by President George W. Bush to provide indebted professionals a way out of their federal student loan debt burden by working full-time in public service. The program permits Direct Loan borrowers who make 120 qualifying monthly payments under a qualifying repayment plan, while working full-time for a qualifying employer, to have the remainder of their balance forgiven. The earliest time in which borrowers could receive forgiveness under the program was after October1, 2017. The Department of Education reported that 2,215 borrowers had the remainder of their respective student loans forgiven under the program as of April30, 2020 for a denial rate of 98.5%. Qualifying employers Government organizations or agencies ( federal, state or local), 501(c)(3) organizations as defined by the IRS, and some other ty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of The Treasury

The Department of the Treasury (USDT) is the Treasury, national treasury and finance department of the federal government of the United States. It is one of 15 current United States federal executive departments, U.S. government departments. The department oversees the Bureau of Engraving and Printing and the United States Mint, U.S. Mint, two federal agencies responsible for printing all paper currency and minting United States coinage, coins. The treasury executes Currency in circulation, currency circulation in the domestic fiscal system, Tax collector, collects all taxation in the United States, federal taxes through the Internal Revenue Service, manages United States Treasury security, U.S. government debt instruments, Bank regulation#Licensing and supervision, licenses and supervises banks and Savings and loan association, thrift institutions, and advises the Federal government of the United States#Legislative branch, legislative and Federal government of the United Stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stafford Loan

A Stafford Loan was a student loan offered from the United States Department of Education to eligible students enrolled in accredited American institutions of higher education to help finance their education. The terms of the loans are described in Title IV of the Higher Education Act of 1965 (with subsequent amendments), which guarantees repayment to the lender if a student defaults. As of July 1, 2010, Stafford Loans are no longer being offered, having been replaced with the William D. Ford Federal Direct Student Loan Program. In 1988, Congress renamed the Federal Guaranteed Student Loan program the Robert T. Stafford Student Loan program, in honor of U.S. Senator Robert Stafford, a Republican from Vermont, for his work on higher education. Stafford loans were guaranteed by the full faith of the US government, and were offered at a lower interest rate than the borrower would otherwise be able to get for a private loan. On the other hand, there were strict eligibility requirem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan Guarantee

A loan guarantee, in finance, is a promise by one party (the guarantor) to assume the debt obligation of a borrower if that borrower defaults. A guarantee can be limited or unlimited, making the guarantor liable for only a portion or all of the debt. Private loan guarantees There are two main types: # Guarantor mortgages # Unsecured guarantor loan Guarantor mortgages Popular with young borrowers who do not have a large deposit saved and need to borrow up to 100% of the property value to purchase a property. Generally, their parents will provide a guarantee to the lender to cover any shortfall in the event of default. There are three main types # Guarantor Mortgage: – generally, a parent or close family member will guarantee the mortgage debt and will cover the repayment obligations should the borrower default. # Family offset mortgage: typically, a parent or grandparent will put their savings into an account linked to the borrower’s mortgage. They do not get any intere ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |