|

Drag-along Right

Drag-along right (DAR) is a concept in corporate law, often encountered in the context of venture capital and private equity. Under the concept, if the majority shareholder(s) of an entity sells their stake, the prospective owner(s) have the right to force the remaining minority shareholders to join the deal. However, the owner must usually offer the same terms and conditions to the minority shareholders as to the majority shareholder(s). Drag-along rights are fairly standard terms in a stock purchase agreement. This right protects majority shareholders (allowing them to sell to an owner desiring total control of the entity, without being encumbered by holdout investors), but also protects minority shareholders (who can sell their investment on the same terms and conditions as the majority shareholder). This differs from a tag-along right, which also allows minority shareholders to sell on the same terms and conditions (and requires the new owner to offer them), but does not re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

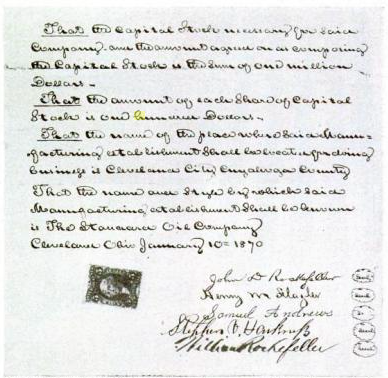

Corporate Law

Corporate law (also known as company law or enterprise law) is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation.John Armour, Henry Hansmann, Reinier Kraakman, Mariana Pargendler "What is Corporate Law?" in ''The Anatomy of Corporate Law: A Comparative and Functional Approach''(Eds Reinier Kraakman, John Armour, Paul Davies, Luca Enriques, Henry Hansmann, Gerard Hertig, Klaus Hopt, Hideki Kanda, Mariana Pargendler, Wolf-Georg Ringe, and Edward Rock, Oxford University Press 2017)1.1 It thus encompasses the formation, funding, governance, and death of a corporation. While the minute nature of corporate governance as personified by share ownership, capital market, and business culture rules diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (VC) is a form of private equity financing provided by firms or funds to start-up company, startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for Equity (finance), equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because Startup company, startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovation, innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology. Pre-seed and seed money, seed rounds are the initial stages of funding for a startup company, typically occurring earl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage "private equity" can refer to these investment firms rather than the companies in which they invest. Private-equity capital (economics), capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Private equity can provide working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control. As a financial product, a private-equity fund is private capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Majority Shareholder

A shareholder (in the United States often referred to as stockholder) of corporate stock refers to an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation. Shareholders may be referred to as members of a corporation. A person or legal entity becomes a shareholder in a corporation when their name and other details are entered in the corporation's register of shareholders or members, and unless required by law the corporation is not required or permitted to enquire as to the beneficial ownership of the shares. A corporation generally cannot own shares of itself. The influence of shareholders on the business is determined by the shareholding percentage owned. Shareholders of corporations are legally separate from the corporation itself. They are generally not liable for the corporation's debts, and the shareholders' lia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minority Interest

In accounting, minority interest (or non-controlling interest) is the portion of a subsidiary corporation's stock that is not owned by the parent corporation. The magnitude of the minority interest in the subsidiary company is generally less than 50% of outstanding shares, or the corporation would generally cease to be a subsidiary of the parent. It is, however, possible (such as through special voting rights) for a controlling interest requiring consolidation to be achieved without exceeding 50% ownership, depending on the accounting standards being employed. Minority interest belongs to other investors and is reported on the consolidated balance sheet of the owning company to reflect the claim on assets belonging to other, non-controlling shareholders. Also, minority interest is reported on the consolidated income statement as a share of profit belonging to minority shareholders. The reporting of 'minority interest' is a consequence of the requirement by accounting standards ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tag-along Right

Tag along rights (TARs) comprise a group of clauses in a contract which together have the effect of allowing the minority shareholder(s) in a corporation to also take part in a sale of shares by the majority shareholder to a third party under the same terms and conditions. Consider an example: A and B are both shareholders in a company, with A being the majority shareholder and B the minority shareholder. C, a third party, offers to buy A's shares at an attractive price, and A accepts. In this situation, tag-along rights would allow B to also participate in the sale under the same terms and conditions as A. As with other contractual provisions, tag-along rights originated from the doctrine of freedom of contract and is governed by contract law (in common law countries) or the law of obligations (in civil law countries). As tag-along rights are contractual terms between private parties, they are often found in venture capital and private equity firms but not public companies. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Articles Of Association

In corporate governance, a company's articles of association (AoA, called articles of incorporation in some jurisdictions) is a document that, along with the memorandum of association (where applicable), forms the company's constitution. The articles define the responsibilities of the Board of directors, directors, the nature of business, and the mechanisms by which shareholders exert control over the board of directors. Articles of association are essential to corporate operations, as they may regulate both internal and external affairs. Articles of incorporation, also referred to as the certificate of incorporation or the corporate charter, is a document or charter that establishes the existence of a corporation in the United States and Canada. They generally are filed with the Secretary of State in the U.S. State where the company is incorporated, or other list of company registers, company registrar. An equivalent term for limited liability companies (LLCs) in the United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pre-emption Right

A pre-emption right, right of pre-emption, or first option to buy is a contractual right to acquire certain property newly coming into existence before it can be offered to any other person or entity. It comes from the Latin verb ''emo, emere, emi, emptum'', to buy or purchase, plus the inseparable preposition ''pre'', before. A right to acquire existing property in preference to any other person is usually referred to as a ''right of first refusal''. Company shares In practice, the most common form of pre-emption right is the right of existing shareholders to acquire new shares issued by a company in a rights issue, usually a public offering. In this context, the pre-emptive right is also called subscription right or subscription privilege. It is the right but not the obligation of existing shareholders to buy the new shares before they are offered to the public. In that way, existing shareholders can maintain their proportional ownership of the company and thus prevent stock dil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Right Of First Refusal

Right of first refusal (ROFR or RFR) is a contractual right that gives its holder the option to enter a business transaction with the owner of something, according to specified terms, before the owner is entitled to enter into that transaction with a third party. A first refusal right must have at least three parties: the owner, the third party or buyer, and the option holder. In general, the owner must make the same offer to the option holder ''before'' making the offer to the buyer. The right of first refusal is similar in concept to a call option. A ROFR can cover almost any sort of asset, including real estate, personal property, a patent license, a screenplay, or an interest in a business. It might also cover business transactions that are not strictly assets, such as the right to enter a joint venture or distribution arrangement. In entertainment, a right of first refusal on a concept or a screenplay would give the holder the right to make that movie first while in rea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tag-along Right

Tag along rights (TARs) comprise a group of clauses in a contract which together have the effect of allowing the minority shareholder(s) in a corporation to also take part in a sale of shares by the majority shareholder to a third party under the same terms and conditions. Consider an example: A and B are both shareholders in a company, with A being the majority shareholder and B the minority shareholder. C, a third party, offers to buy A's shares at an attractive price, and A accepts. In this situation, tag-along rights would allow B to also participate in the sale under the same terms and conditions as A. As with other contractual provisions, tag-along rights originated from the doctrine of freedom of contract and is governed by contract law (in common law countries) or the law of obligations (in civil law countries). As tag-along rights are contractual terms between private parties, they are often found in venture capital and private equity firms but not public companies. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |