|

Commsec

CommSec is Australia's largest online stockbroking firm. It is a subsidiary of the Commonwealth Bank. Though its Internet trading platform constitutes the vast majority of its business, it also offers a telephone based brokerage service, and investment advisory services. In addition, CommSec also offers other peripherally related investment services, such as margin loan and cash accounts. History The brokerage arm started operations in 1995 and launched its share trading website in 1997. CommSec initially offered only Australian equities trades, but has since expanded into derivative products, international equities, managed funds, self-managed super fund (SMSF) administration, contracts-for-difference (CFDs), margin lending and short-term deposits. The firm's large retail customer base has also allowed it to successfully market a number of initial public offering (IPO) fund raisings. In 2008 CommSec became the first Australian brokerage firm to offer a brokerage website ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sydney

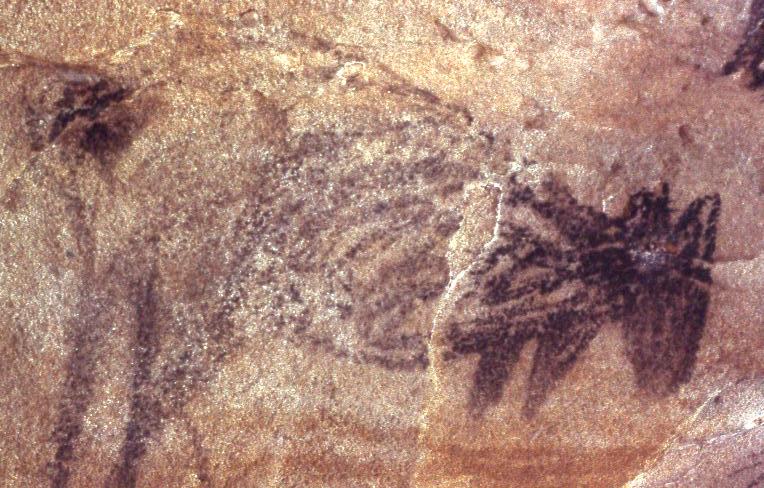

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Margin (finance)

In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty (most often their broker or an exchange) to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following: * Borrowed cash from the counterparty to buy financial instruments, * Borrowed financial instruments to sell them short, * Entered into a derivative contract. The collateral for a margin account can be the cash deposited in the account or securities provided, and represents the funds available to the account holder for further share trading. On United States futures exchanges, margins were formerly called performance bonds. Most of the exchanges today use SPAN ("Standard Portfolio Analysis of Risk") methodology, which was developed by the Chicago Mercantile Exchange in 1988, for calculating margins for options and futures. Margin account A margin account is a loan account with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collins Street, Melbourne

Collins Street is a major street in the central business district of Melbourne, Victoria, Australia. It was laid out in the first survey of Melbourne, the original 1837 Hoddle Grid, and soon became the most desired address in the city. Collins Street was named after Lieutenant-Governor of Tasmania David Collins who led a group of settlers in establishing a short-lived settlement at Sorrento in 1803.Judith Buckrich: ''Collins – The Story of Australia's Premier Street'', 2005, The eastern end of Collins Street has been known colloquially as the 'Paris End' since the 1950s due to its numerous heritage buildings, old street trees, high-end shopping boutiques, and as the location for the first footpath cafes in the city. As with all main streets in the Melbourne city centre, the Hoddle Grid is exactly 99 feet wide which would allow for the installation of trams in 1885. Blocks further west centred around Queen Street became the financial heart of Melbourne in the 19th century, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pitt Street

Pitt Street is a major street in the Sydney central business district in New South Wales, Australia. The street runs through the entire city centre from Circular Quay in the north to Waterloo, although today's street is in two disjointed sections after a substantial stretch of it was removed to make way for Sydney's Central railway station. Pitt Street is well known for the pedestrian only retail centre of Pitt Street Mall, a section of the street which runs from King Street to Market Street. Pitt Street is a one way (southbound only) from Circular Quay to Pitt Street Mall and (northbound only) from Pitt Street Mall to Goulburn Street, while Pitt Street Mall is for pedestrians only. It is dominated by retail and commercial office space. History Pitt Street was originally named Pitt Row, and is one of the earliest named streets in Sydney. Pitt Street is believed to have been named by Governor Arthur Phillip in honour of William Pitt the Younger, at the time, the Prime Min ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Apple Inc

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, United States. Apple is the largest technology company by revenue (totaling in 2021) and, as of June 2022, is the world's biggest company by market capitalization, the fourth-largest personal computer vendor by unit sales and second-largest mobile phone manufacturer. It is one of the Big Five American information technology companies, alongside Alphabet, Amazon, Meta, and Microsoft. Apple was founded as Apple Computer Company on April 1, 1976, by Steve Wozniak, Steve Jobs and Ronald Wayne to develop and sell Wozniak's Apple I personal computer. It was incorporated by Jobs and Wozniak as Apple Computer, Inc. in 1977 and the company's next computer, the Apple II, became a best seller and one of the first mass-produced microcomputers. Apple went public in 1980 to instant financial success. The company developed computers featuring innovative graphical user inter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Manager

A general manager (GM) is an executive who has overall responsibility for managing both the revenue and cost elements of a company's income statement, known as profit & loss (P&L) responsibility. A general manager usually oversees most or all of the firm's marketing and sales functions as well as the day-to-day operations of the business. Frequently, the general manager is responsible for effective planning, delegating, coordinating, staffing, organizing, and decision making to attain desirable profit making results for an organization (Sayles 1979). In many cases, the general manager of a business is given a different formal title or titles. Most corporate managers holding the titles of chief executive officer (CEO) or president, for example, are the general managers of their respective businesses. More rarely, the chief financial officer (CFO), chief operating officer (COO), or chief marketing officer (CMO) will act as the general manager of the business. Depending on t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Active Management

Active management (also called ''active investing'') is an approach to investing. In an actively managed portfolio of investments, the investor selects the investments that make up the portfolio. Active management is often compared to passive management or index investing. The average actively managed mutual fund in the US underperforms the average passive mutual fund. As a consequence, mainstream economic advice is to invest in passive mutual funds. Approach Active investors aim to generate additional returns by buying and selling investments advantageously. They look for investments where the market price differs from the underlying value and will buy investments when the market price is too low and sell investments when the market price is too high. Active investors use various techniques to identify mispriced investments. Two common techniques are: * Fundamental analysis. This approach analyzes the characteristics of individual investments to evaluate their risk and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements ( hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets. Some of the more common derivatives include forwards, futures, options, swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps. Most derivatives are traded over-the-counter (off-exchange) or on an exchange such as the Chicago Mercantile Exchange, while most insurance contracts have developed into a separate industry. In the United States, after the financial crisis of 2007–2009, there has been increased pressure to move derivatives to trade on exchanges. Derivatives are one of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |