|

Correlated Equilibrium

In game theory, a correlated equilibrium is a solution concept that is more general than the well known Nash equilibrium. It was first discussed by mathematician Robert Aumann in 1974. The idea is that each player chooses their action according to their private observation of the value of the same public signal. A strategy assigns an action to every possible observation a player can make. If no player would want to deviate from their strategy (assuming the others also don't deviate), the distribution from which the signals are drawn is called a correlated equilibrium. Formal definition An N-player strategic game \displaystyle (N,\,\) is characterized by an action set A_i and utility function u_i for each player When player i chooses strategy a_i \in A_i and the remaining players choose a strategy profile described by the a_, then player i's utility is \displaystyle u_i(a_i,a_). A ''strategy modification'' for player i is a function \phi_i\colon A_i \to A_i. That is, \phi_i te ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nash Equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed). The idea of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to his model of competition in an oligopoly. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep theirs unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and Bob has no other strategy available that does better than B at maximizing his payoff in response to Alice c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

√Čva Tardos

√Čva Tardos (born 1 October 1957) is a Hungarian mathematician and the Jacob Gould Schurman Professor of Computer Science at Cornell University. Tardos's research interest is algorithms. Her work focuses on the design and analysis of efficient methods for combinatorial optimization problems on graphs or networks. She has done some work on network flow algorithms like approximation algorithms for network flows, cut, and clustering problems. Her recent work focuses on algorithmic game theory and simple auctions. Education and career Tardos received her Dipl. Math in 1981 and her Ph.D. 1984 from the Faculty of Sciences of the E√∂tv√∂s Lor√°nd University under her advisor Andr√°s Frank. She was the Chair of the Department of Computer Science at Cornell from 2006 to 2010, and she is currently serving as the Associate Dean of the College of Computing and Information Science. She was editor-in-Chief of ''SIAM Journal on Computing'' from 2004 to 2009, and is currently the Economics a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge University Press

Cambridge University Press was the university press of the University of Cambridge. Granted a letters patent by King Henry VIII in 1534, it was the oldest university press in the world. Cambridge University Press merged with Cambridge Assessment to form Cambridge University Press and Assessment under Queen Elizabeth II's approval in August 2021. With a global sales presence, publishing hubs, and offices in more than 40 countries, it published over 50,000 titles by authors from over 100 countries. Its publications include more than 420 academic journals, monographs, reference works, school and university textbooks, and English language teaching and learning publications. It also published Bibles, runs a bookshop in Cambridge, sells through Amazon, and has a conference venues business in Cambridge at the Pitt Building and the Sir Geoffrey Cass Sports and Social Centre. It also served as the King's Printer. Cambridge University Press, as part of the University of Cambridge, was a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ariel Rubinstein

Ariel Rubinstein (Hebrew: ◊ź◊®◊ô◊ź◊ú ◊®◊ē◊Ď◊ô◊†◊©◊ė◊ô◊ô◊ü; born April 13, 1951) is an Israeli economist who works in economic theory, game theory and bounded rationality. Biography Ariel Rubinstein is a professor of economics at the School of Economics at Tel Aviv University and the Department of Economics at New York University. He studied mathematics and economics at the Hebrew University of Jerusalem, 1972‚Äď1979 (B.Sc. Mathematics, Economics and Statistics, 1974; M.A. Economics, 1975; M.Sc Mathematics, 1976; Ph.D. Economics, 1979). In 1982, he published "Perfect equilibrium in a bargaining model", an important contribution to the theory of bargaining. The model is known also as a Rubinstein bargaining model. It describes two-person bargaining as an extensive game with perfect information in which the players alternate offers. A key assumption is that the players are impatient. The main result gives conditions under which the game has a unique subgame perfect equilibrium ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MIT Press

The MIT Press is the university press of the Massachusetts Institute of Technology (MIT), a private research university in Cambridge, Massachusetts. The MIT Press publishes a number of academic journals and has been a pioneer in the Open Access movement in academic publishing. History MIT Press traces its origins back to 1926 when MIT published a lecture series entitled ''Problems of Atomic Dynamics'' given by the visiting German physicist and later Nobel Prize winner, Max Born. In 1932, MIT's publishing operations were first formally instituted by the creation of an imprint called Technology Press. This imprint was founded by James R. Killian, Jr., at the time editor of MIT's alumni magazine and later to become MIT president. Technology Press published eight titles independently, then in 1937 entered into an arrangement with John Wiley & Sons in which Wiley took over marketing and editorial responsibilities. In 1961, the centennial of MIT's founding charter, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jean Tirole

Jean Tirole (born 9 August 1953) is a French economist who is currently a professor of economics at Toulouse 1 Capitole University. He focuses on industrial organization, game theory, banking and finance, and psychology. In particular, he focuses on the regulation of economic activity in a way that does not hinder innovation while maintaining fair rules. Tirole's work is largely theoretical and explored in mathematical models, not empirical research. In 2014, he received the Nobel Memorial Prize in Economic Sciences for his analysis of market power and regulation. Education Tirole received engineering degrees from the √Čcole Polytechnique in 1976, and from the √Čcole nationale des ponts et chauss√©es in 1978. He was appointed a member of the elite Corps of Bridges, Waters and Forests, later completing graduate studies at Universit√© Paris Dauphine; he received a DEA degree in 1976, and a Doctorat de troisi√®me cycle in decision mathematics in 1978. He received a Ph.D ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Utility

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour. The expected utility hypothesis states an agent chooses between risky prospects by comparing expected utility values (i.e., the weighted sum of adding the respective utility values of payoffs multiplied by their probabilities). The summarised formula for expected utility is U(p)=\sum u(x_k)p_k where p_k is the probability that outcome indexed by k with payoff x_k is realized, and function ''u'' expresses the utility of each respective payoff. Graphically the curvature of the u function captures the agent's risk attitude. For example, imagine you’re offered a choice between receiving $50 for sure, or flipping a coin to win $100 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mixed Strategy

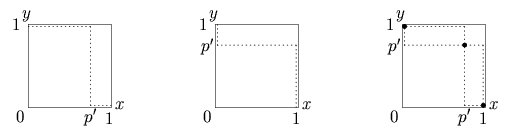

In game theory, a move, action, or play is any one of the options which a player can choose in a setting where the optimal outcome depends ''not only'' on their own actions ''but'' on the actions of others. The discipline mainly concerns the action of a player in a game affecting the behavior or actions of other players. Some examples of "games" include chess, bridge, poker, monopoly, diplomacy or battleship. The term strategy is typically used to mean a complete algorithm for playing a game, telling a player what to do for every possible situation. A player's strategy determines the action the player will take at any stage of the game. However, the idea of a strategy is often confused or conflated with that of a move or action, because of the correspondence between moves and pure strategies in most games: for any move ''X'', "always play move ''X''" is an example of a valid strategy, and as a result every move can also be considered to be a strategy. Other authors treat strate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Game Of Chicken

The game of chicken, also known as the hawk-dove game or snowdrift game, is a model of conflict for two players in game theory. The principle of the game is that while the ideal outcome is for one player to yield (to avoid the worst outcome if neither yields), individuals try to avoid it out of pride, not wanting to look like "chickens". Each player taunts the other to increase the risk of shame in yielding. However, when one player yields, the conflict is avoided, and the game essentially ends. The name "chicken" has its origins in a game in which two drivers drive toward each other on a collision course: one must swerve, or both may die in the crash, but if one driver swerves and the other does not, the one who swerved will be called a "chicken", meaning a coward; this terminology is most prevalent in political science and economics. The name "hawk‚Äďdove" refers to a situation in which there is a competition for a shared resource and the contestants can choose either conciliat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Aumann

Robert John Aumann (Yisrael Aumann, ; born June 8, 1930) is an Israeli-American mathematician, and a member of the United States National Academy of Sciences. He is a professor at the Center for the Study of Rationality in the Hebrew University of Jerusalem. He also holds a visiting position at Stony Brook University, and is one of the founding members of the Stony Brook Center for Game Theory. Aumann received the Nobel Memorial Prize in Economic Sciences in 2005 for his work on conflict and cooperation through game theory analysis. He shared the prize with Thomas Schelling. Early life and education Aumann was born in Frankfurt am Main, Germany, and fled to the United States with his family in 1938, two weeks before the Kristallnacht pogrom. He attended the Rabbi Jacob Joseph School, a yeshiva high school in New York City. Aumann graduated from the City College of New York in 1950 with a B.S. in mathematics. He received his M.S. in 1952, and his Ph.D. in Mathematics in 1955, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |