|

Certified Funds

Certified funds are a form of payment that is guaranteed to clear or settle by a bank or other financial institution certifying the funds. The term is most commonly used in North America in the context of real estate transactions. When making certain types of transactions, such as purchasing real property, motor vehicles and other items that require title, the seller usually requires a guarantee that the payment method used will satisfy the obligations. To do this, the seller will require certified funds, usually in the form of: *Certified check *Cashier's check (known as a bank draft in Canada) *Money order * Manager's check *Wire transfer Specifically, personal checks are not allowed, as the account may not have sufficient funds, and credit cards are not allowed, as the transaction may later be disputed or reversed. Checks sent by a bank bill payment service can fall into an ambiguous state, since the funds are typically removed from the sender's account before the check is ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Checks

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or aro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

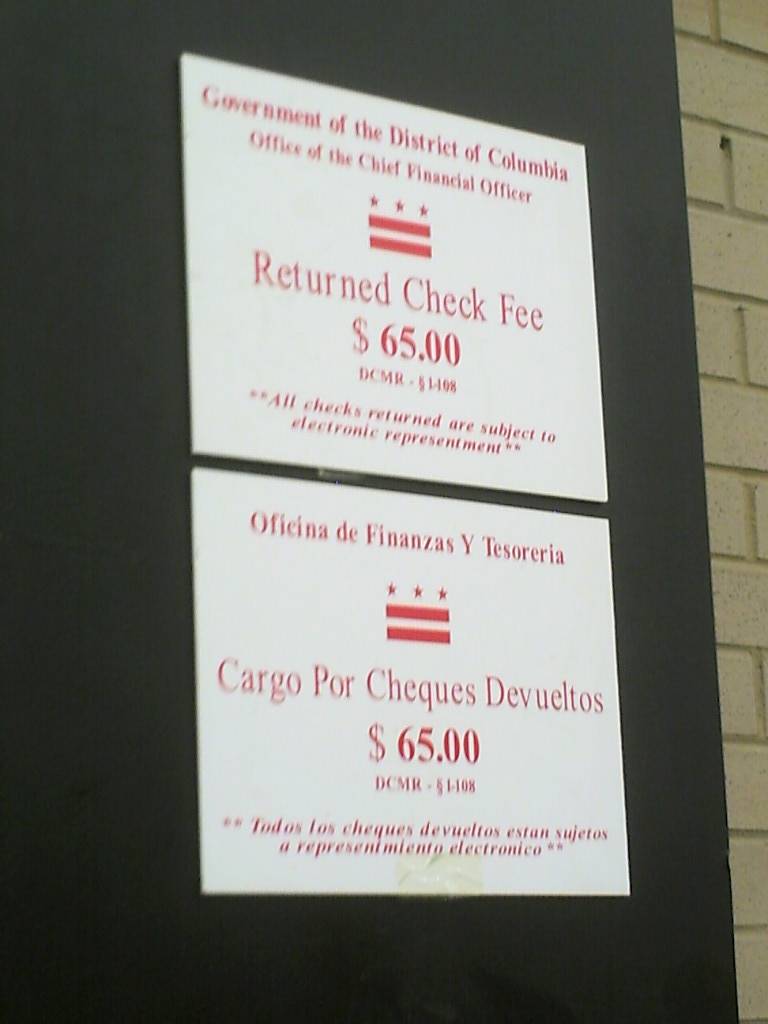

Dishonoured Cheque

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF cheque may be referred to as a bad cheque, dishonoured cheque, bounced cheque, cold cheque, rubber cheque, returned item, or hot cheque. Lost or bounced cheques result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed "Present again", by which time the funds should have cleared. When more than one cheque is presented fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real-time Gross Settlement

Real-time gross settlement (RTGS) systems are specialist funds transfer systems where the transfer of money or securities takes place from one bank to any other bank on a "real-time" and on a " gross" basis to avoid settlement risk. Settlement in "real time" means a payment transaction is not subjected to any waiting period, with transactions being settled as soon as they are processed. "Gross settlement" means the transaction is settled on a one-to-one basis, without bundling or netting with any other transaction. "Settlement" means that once processed, payments are final and irrevocable. History As of 1985, three central banks implemented RTGS systems, while by the end of 2005, RTGS systems had been implemented by 90 central banks. The first system that had the attributes of an RTGS system was the US Fedwire system which was launched in 1970. This was based on a previous method of transferring funds electronically between US federal reserve banks via telegraph. The United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Protectograph

A checkwriter may refer to: Occupation A person who physically writes a check or cheque. The check writer is also known as the "payor", "signer", "maker", the drawer, or the "account holder". The signer or presenter of the check, or person who prints and authorizes the check. Machine A check writer (also known as a "ribbon writer", "check signer", "check protector" or "check embosser"), is a physical device for protecting a check from unauthorized alteration of either the amount or the authorizing signature. Devices of this type that use various technologies are also known as check protectors, check punches, and check perforators. A check punch punches holes in the shapes of numerals. A check perforator punches small round holes that form numerals. A check writer, or ribbon writer, leaves a numerical or written value impression in the payment amount field of a check that is very difficult to alter. This is accomplished by the machine applying downward force on the check and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hole Puncher

A hole punch, also known as a hole puncher or paper puncher, is an office tool that is used to create holes in sheets of paper, often for the purpose of collecting the sheets in a binder or folder (such collected sheets are called loose leaves). A ''hole punch'' can also refer to similar tools for other materials, such as leather, cloth, or sheets of plastic or metal. Mechanism The essential parts of a hole punch are the ''handle'', the ''punch head'', and the ''die''. The punch head is typically a cylinder, with a flat end called the ''face''. The die is a flat plate, with a hole matching the head. The head can move, while the die is fixed in place. Both head and die are usually made of a hard metal, with precise tolerances. One or more sheets of paper are inserted between the head and the die, with the flat face of the head parallel to the surface of the sheets. Moving the handle pushes the head straight through the sheets of paper. The hard edge of the punch vs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seal (emblem)

A seal is a device for making an impression in Sealing wax, wax, clay, paper, or some other medium, including an Paper embossing, embossment on paper, and is also the impression thus made. The original purpose was to authenticate a document, or to prevent interference with a package or envelope by applying a seal which had to be broken to open the container (hence the modern English verb "to seal", which implies secure closing without an actual wax seal). The seal-making device is also referred to as the seal ''matrix'' or ''die''; the imprint it creates as the seal impression (or, more rarely, the ''sealing''). If the impression is made purely as a relief resulting from the greater pressure on the paper where the high parts of the matrix touch, the seal is known as a ''dry seal''; in other cases ink or another liquid or liquefied medium is used, in another color than the paper. In most traditional forms of dry seal the design on the seal matrix is in Intaglio (sculpture), intag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forgery

Forgery is a white-collar crime that generally consists of the false making or material alteration of a legal instrument with the specific mens rea, intent to wikt:defraud#English, defraud. Tampering with a certain legal instrument may be forbidden by law in some jurisdictions but such an offense is not related to forgery unless the tampered legal instrument was actually used in the course of the crime to defraud another person or entity. Copies, studio replicas, and reproductions are not considered forgeries, though they may later become forgeries through knowing and willful misrepresentations. Forging money or currency is more often called counterfeiting. But consumer goods may also be ''counterfeits'' if they are not manufactured or produced by the designated manufacturer or producer given on the label or flagged by the trademark symbol. When the object forged is a record or document it is often called a false document. This usage of "forgery" does not derive from Metalwo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-sufficient Funds

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF cheque may be referred to as a bad cheque, dishonoured cheque, bounced cheque, cold cheque, rubber cheque, returned item, or hot cheque. Lost or bounced cheques result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed "Present again", by which time the funds should have cleared. When more than one cheque is presented fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wire Transfer

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office. Different wire transfer systems and operators provide a variety of options relative to the immediacy and finality of settlement and the cost, value, and volume of transactions. Central bank wire transfer systems, such as the Federal Reserves Fedwire system in the United States, are more likely to be real-time gross settlement (RTGS) systems, as they provide the quickest availability of funds. This is because RTGS systems, such as Fedwire, post each transaction individually and immediately to the electronic accounts of participating banks maintained by the central bank. Other systems, such as the Clearing House Interbank Payments System (CHIPS), provide net settlement on a periodic basis. More immediate settlement systems te ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |