|

Bush Tax Cuts

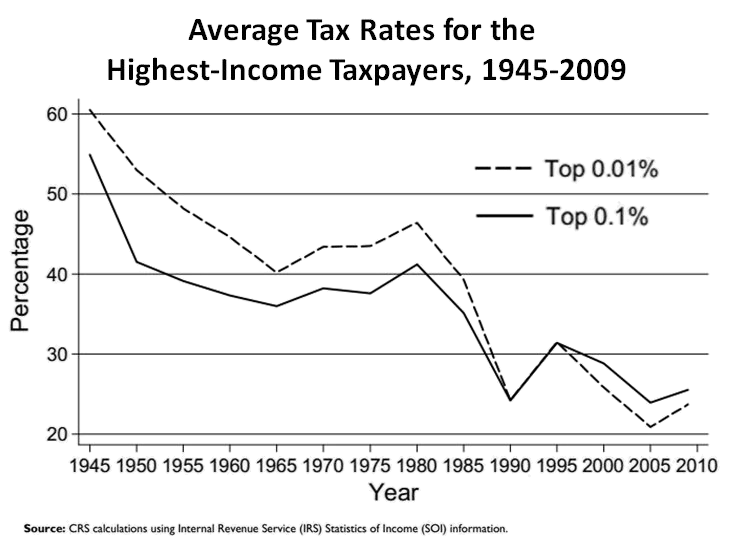

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through: * Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) * Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) * Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 * American Taxpayer Relief Act of 2012 (partial extension) While each act has its own legislative history and effect on the tax code, the JGTRRA amplified and accelerated aspects of the EGTRRA. Since 2003, the two acts have often been spoken of together, especially in terms of analyzing their effect on the U.S. economy and population and in discussing their political ramifications. Both laws were passed using controversial Congressional reconciliation (United States Congress), reconciliation procedures. The Bush tax cuts had sunset provisions that made them expire at the end o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Presidency Of George W

A presidency is an administration or the executive, the collective administrative and governmental entity that exists around an office of president of a state or nation. Although often the executive branch of government, and often personified by a single elected person who holds the office of "president", in practice, the presidency includes a much larger collective of people, such as chiefs of staff, advisers and other bureaucrats. Although often led by a single person, presidencies can also be of a collective nature, such as the presidency of the European Union is held on a rotating basis by the various national governments of the member states. Alternatively, the term presidency can also be applied to the governing authority of some churches, and may even refer to the holder of a non-governmental office of president in a corporation, business, charity, university, etc. or the institutional arrangement around them. For example, "the presidency of the Red Cross refused to suppo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Omnibus Budget Reconciliation Act Of 1990

The Omnibus Budget Reconciliation Act of 1990 (OBRA-90; ) is a United States statute enacted pursuant to the budget reconciliation process to reduce the United States federal budget deficit. The Act included the Budget Enforcement Act of 1990 which established the "pay-as-you-go" or "PAYGO" process for discretionary spending and taxes. The Act was signed into law by President George H. W. Bush on November 5, 1990, counter to his 1988 campaign promise not to raise taxes. This became an issue in the presidential election of 1992. Provisions The Act increased individual income tax rates. The top statutory tax rate increased from 28% to 31%, and the individual alternative minimum tax rate increased from 21% to 24%. The capital gains rate was capped at 28%. The value of high income itemized deductions was limited: reduced by 3% times the extent to which AGI exceeds $100,000. It temporarily created the personal exemption phase out applicable to the range of taxable income between $1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Reform Act Of 1986

The Tax Reform Act of 1986 (TRA) was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22, 1986. The Tax Reform Act of 1986 was the top domestic priority of President Reagan's second term. The act lowered federal income tax rates, decreasing the number of tax brackets and reducing the top tax rate from 50 percent to 28 percent. The act also expanded the earned income tax credit, the standard deduction, and the personal exemption, removing approximately six million lower-income Americans from the tax base. Offsetting these cuts, the act increased the alternative minimum tax and eliminated many tax deductions, including deductions for rental housing, individual retirement accounts, and depreciation. Although the tax reform was projected to be revenue-neutral, it was popularly referred to as the second round of Reagan tax cuts (following the Economic Recovery Tax Act of 1981). The bill passed with majority support in both the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Brackets

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Example Imagine that there are three tax brackets: 10%, 20%, and 30%. The 10% rate applies to income from $1 to $10,000; the 20% rate applies to income from $10,001 to $20,000; and the 30% rate applies to all income above $20,000. Under this system, someone earning $10,000 is taxed at 10%, paying a total of $1,000. Someone earning $5,000 pays $500, and so on. Meanwhile, someone who earns $25,000 faces a more complicated calculation. The rate on the first $10,000 is 10%, from $10,001 to $20,000 is 20%, and above that is 30%. Thus, they pay $1,000 for the first $10,000 of income (10%), $2,000 for the second $10,000 of income (20%), and $1,500 for the last $5,000 of income (30%), In total, they pay $4,500, or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William G

William is a male given name of Germanic origin.Hanks, Hardcastle and Hodges, ''Oxford Dictionary of First Names'', Oxford University Press, 2nd edition, , p. 276. It became very popular in the English language after the Norman conquest of England in 1066,All Things William"Meaning & Origin of the Name"/ref> and remained so throughout the Middle Ages and into the modern era. It is sometimes abbreviated "Wm." Shortened familiar versions in English include Will, Wills, Willy, Willie, Bill, and Billy. A common Irish form is Liam. Scottish diminutives include Wull, Willie or Wullie (as in Oor Wullie or the play ''Douglas''). Female forms are Willa, Willemina, Wilma and Wilhelmina. Etymology William is related to the given name ''Wilhelm'' (cf. Proto-Germanic ᚹᛁᛚᛃᚨᚺᛖᛚᛗᚨᛉ, ''*Wiljahelmaz'' > German '' Wilhelm'' and Old Norse ᚢᛁᛚᛋᛅᚼᛅᛚᛘᛅᛋ, ''Vilhjálmr''). By regular sound changes, the native, inherited English form of the name shoul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter Orszag

Peter Richard Orszag (born December 16, 1968) is the CEO of Financial Advisory at Lazard. Before June 2019, he was the firm's Head of North American M&A and Global Co-Head of Healthcare. Orszag previously served as a Vice Chairman of Corporate and Investment Banking and Chairman of the Financial Strategy and Solutions Group at Citigroup. Before joining Citigroup, he was a Distinguished Visiting Fellow at the Council on Foreign Relations and a contributing columnist for the ''New York Times'' op-ed page. Prior to that, he was the 37th Director of the Office of Management and Budget (OMB) under President Barack Obama and had also served as the Director of the Congressional Budget Office (CBO). Orszag is a member of the National Academy of Medicine of the National Academies of Sciences. He serves on the Boards of Directors of the Peterson Institute for International Economics, the Mount Sinai Hospital, and New Visions for Public Schools in New York. Early life Orszag grew up in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Inequality

There are wide varieties of economic inequality, most notably income inequality measured using the distribution of income (the amount of money people are paid) and wealth inequality measured using the distribution of wealth (the amount of wealth people own). Besides economic inequality between countries or states, there are important types of economic inequality between different groups of people. Important types of economic measurements focus on wealth, income, and consumption. There are many methods for measuring economic inequality, the Gini coefficient being a widely used one. Another type of measure is the Inequality-adjusted Human Development Index, which is a statistic composite index that takes inequality into account. Important concepts of equality include equity, equality of outcome, and equality of opportunity. Whereas globalization has reduced global inequality (between nations), it has increased inequality within nations. Income inequality between nations p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Effective Corporate Tax Rate 1947-2011 V2

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Ameri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |